U.S. Treasury Bonds Spell Trouble for Bernanke Low Interest Rates

Interest-Rates / US Interest Rates Dec 22, 2009 - 10:51 AM GMTBy: Marty_Chenard

Bernanke is vowing to keep interest rates low ... but, can he?

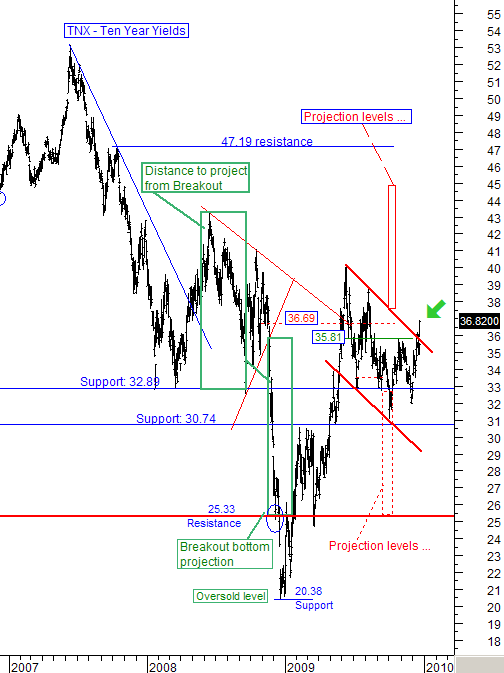

We say this because the market is not satisfied with receiving low yields when risk levels are perceived to be rising. That clearly showed up on the 10 year yields yesterday when the yield jumped up to 36.82.

It wasn't just any up move, it was an up move that passed through the resistance of our "flag pattern".

This "upside breakout" has an upside projection for this pattern at around 45, so there is still a way to go. I'm sure Bernanke will be trying to fight it all the way, because this now presents a major problem to his current strategy.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.