U.S. Dollar is Going Up, Get Out of Gold!

Commodities / Gold & Silver 2009 Dec 21, 2009 - 01:39 AM GMTBy: Adam_Brochert

Certain old market adages just don't seem to go away and are perpetuated by novice investors who seek to find some meaning in markets and their interrelationships. Mainstream financial commentators are more than happy to repeat and regurgitate such claptrap endlessly, creating "rock solid" market wisdom.

Certain old market adages just don't seem to go away and are perpetuated by novice investors who seek to find some meaning in markets and their interrelationships. Mainstream financial commentators are more than happy to repeat and regurgitate such claptrap endlessly, creating "rock solid" market wisdom.

"Dollar Up, Gold Down" or "Dollar Down, Gold Up" is a common one in the Gold investing community. This works until it doesn't. The funny thing is that THE MOST IMPORTANT BULL RUN IN THE LAST CENTURY FOR GOLD PROVES THIS ISN'T A GOOD WAY TO LOOK AT GOLD! I am not making this up. This is actual market history there for anyone to examine. But most instead steadfastly stick to simple phrases that cannot possibly capture the nuances of the complex human psychology that backs market behaviors.

Here is a chart including the most important and legendary move in Gold that every Gold bug has seen a picture of (from chartsrus.com):

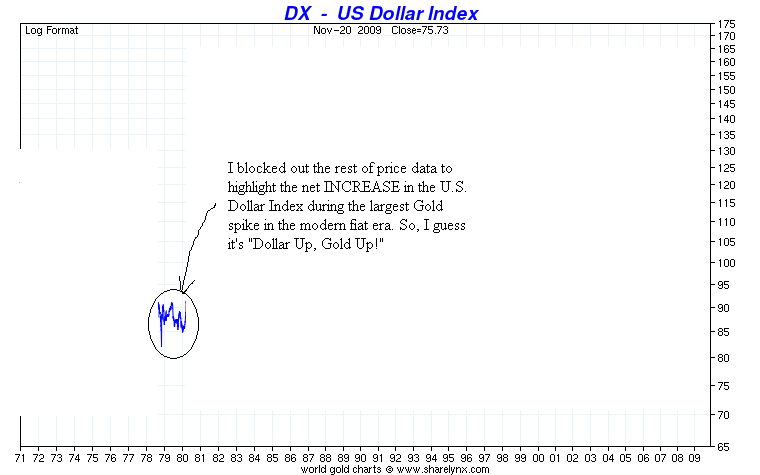

During the 1979 to 1980 parabolic run when Gold more than quadrupled in about a year, do you think the U.S. Dollar collapsed? Well, it obviously went down a lot, but we know it didn't collapse, right? Here's the chart of the rapid but not catastrophic collapse in the U.S. Dollar Index from 1978-1980 (again, from chartsrus.com):

If only markets were so simple that basic phrases describing intermarket relationships could make you rich. Ahhh, we can dream can't we? So if you really want to get rich in Gold, I guess you should buy Gold when the Dollar is rising.

Those thinking that a rally in the U.S. Dollar Index, which is an abstract index comparing anchorless paper to anchorless paper, can stop the secular Gold bull market don't understand Gold or secular bull markets. Secular bull markets become self-perpetuating momentum machines that shrug off "bad" news and power higher anyway.

The U.S. Dollar Index rose 50% between 1995 and 2000, but did that stop the secular general stock bull market or cause a collapse of the internet tulip mania? Absolutely not. The secular bull market in Gold will keep on going until we get to the public mania phase, after which it will collapse on its own weight, irrespective of the U.S. Dollar Index. I am betting this will happen after the Dow to Gold ratio gets to the 0.5 to 2 range.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.