Gold Beware Detour Dead Ahead

Commodities / Gold and Silver 2010 Dec 19, 2009 - 11:22 AM GMTBy: Ronald_Rosen

GOLD MONTHLY

GOLD MONTHLY

Click here for some of that….

V

Old Time Rock 'n' Roll

DOLLAR INDEX QUARTERLY

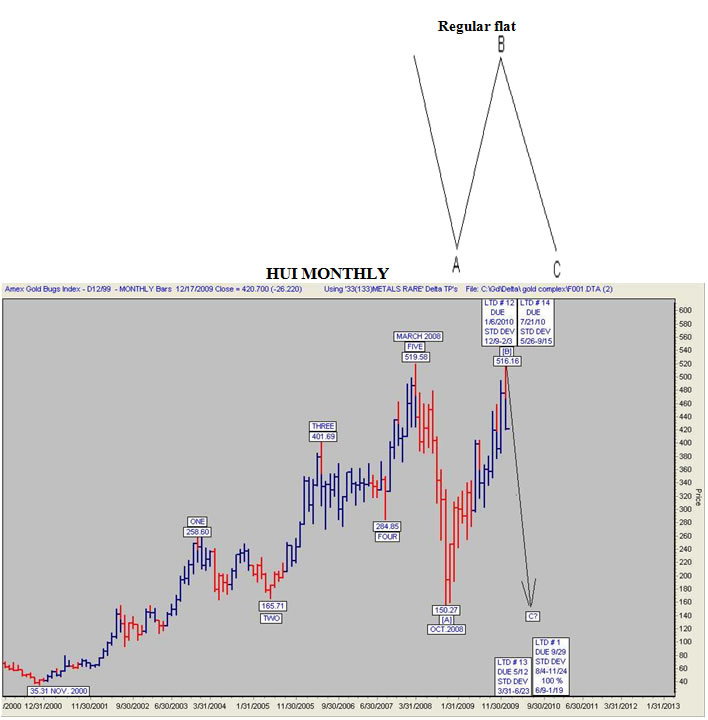

O. K., that’s enough of the Rosen Grand Musical Tour. We best enjoy this Dollar Index rally and gold [C] leg final corrective wave down while we can. I suspect that they will once again reverse course and resume their more familiar roles sometime in (for subscribers only). If so, that should be the month that we pounce on the gold and silver shares, scoop them up, and hang on for the ride of our lives! The HUI appears to be declining in a [C] wave of a regular flat correction. The bottom should occur at or slightly below the (for subscribers only). It would be normal if the HUI bottomed late in (for subscribers only). This would be several weeks before a probable bottom in gold. In a true bull move the shares do tend to lead the metal. An early bottom for the HUI will be an indication that the bottom in gold is close at hand.

“In a regular flat correction, wave B terminates about at the level of the beginning of wave A, and wave C terminates a slight bit past the end of wave A.” E. W. P.

Gold coins and bars should be considered an insurance policy. I do not believe that they should be sold regardless of a decline in their price. The percentage increase in the precious metal shares is a multiple of the rise in the price of gold. The percentage decrease in the precious metal shares is a multiple of the decline in the price of gold. The shares are obviously more volatile than the metal. There is more hope for riches placed in the shares than there is in the metal. That hope gets dashed easily on the way down. Speculators in gold and silver have their hopes for riches dashed on the way down but gold has a hard core of holders that refuse to have their holdings dislodged by fluctuations. Holding the metal gold as insurance is the way to proceed until the financial and economic mess that we are living with is resolved or at least mitigated.

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.