Times, Bernanke Joins a Long List of Infamous Underachievers

Politics / Central Banks Dec 17, 2009 - 07:05 AM GMTBy: Money_Morning

Martin Hutchinson writes: There's a culture in our society that rewards bad behavior. Take the Fort Collins, Colo. couple that pretended to send their 6-year-old boy up in a homemade balloon so the family could star in a reality show?

Martin Hutchinson writes: There's a culture in our society that rewards bad behavior. Take the Fort Collins, Colo. couple that pretended to send their 6-year-old boy up in a homemade balloon so the family could star in a reality show?

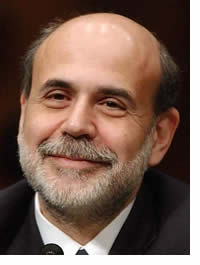

Well, Time magazine's anointment of U.S. Federal Reserve Chairman Ben S. Bernanke as its "Person of the Year 2009" is an example of the same thing.

Well, Time magazine's anointment of U.S. Federal Reserve Chairman Ben S. Bernanke as its "Person of the Year 2009" is an example of the same thing. For starters, no other U.S. central bank head has been a "Person of the Year." Not William McChesney Martin Jr. (Fed chairman, 1951-70) who defined monetary policy accurately, saying the Fed's job was "to take away the punchbowl just as the party gets going." Not even Paul A. Volcker (Fed chairman, 1979-87), who bravely pursued a tight-money policy that broke the back of inflation.

But cause a major global financial disaster, as Bernanke did by first supporting and then implementing policies that inflated the largest housing bubble in U.S. history? Then you get Time's nomination...

Anti-Heroes...Several Real Zeroes

Not that all Time's nominees have been heroes. Adolf Hitler got the nod - back in 1938. Joseph Stalin got it twice, in 1939 and 1942. Ayatollah Khomeini of Iran got it in 1979.Let's face it, all three of those were essentially rewards for bad behavior: Hitler seized Austria and Czechoslovakia; Stalin conspired with Hitler to seize Poland; and Khomeini imprisoned 52 U.S. diplomats.

Russian leader Vladimir Putin, another of nature's reality show contestants, was honored by Time in 2007. A year later he invaded Georgia - perhaps he was going for a repeat win?

Some of Time's winners have later turned out to be losers. Mikhail Gorbachev was honored twice, in 1987 and 1989, as he presided over the collapse of the Soviet empire. Indeed, the second time he was even named the "Man of the Decade," ignoring the achievements of former U.S. President Ronald W. Reagan, the actual winner in the Cold War contest between the two.

U.S. Army General William Westmoreland (1965), who lost the Vietnam War, and Chiang Kai-Shek (1937) who lost China to the Communists, were other members of the eventual-losers club. Wallis Warfield Simpson (1936) was also something of a loser. Although the twice-divorced American socialite was Time's first "Woman of the Year," she never became Queen of England, and she had to live with the former Edward VIII for the rest of her life.

Dot-Com Thunder and One-Shot Wonders

To be fair, Time occasionally gets it right - though not very often, unless the winner is blindingly obvious. Jeffrey P. Bezos, for example, founder and chairman of Amazon.com Inc. (Nasdaq: AMZN), drew criticism when he won in 1999. However, Time was surely prescient (or lucky): In Amazon, out of all the hundreds of questionable dot-com companies, Time not only spotted a winner; it actually chose the company that would genuinely revolutionize our lives by enabling us to escape the horrors of Christmas shopping.Then there are the one-shot wonders - winners at the time, and totally obscure decades later.

Pierre Laval, France's foreign minister, was marginally famous as a Nazi collaborator shot by his countrymen after World War II, but what did he achieve in 1931 that made him Time's wonder-boy? Beats me.

Peter Ueberroth (1984) did a competent job running the Los Angeles Olympics, though he did rather less of one as the commissioner of Major League Baseball. But Man of the Year?

Bernanke is thus in a long tradition. Neither a one-shot wonder nor truly evil, he fits best into the category of losers, people whose achievements seem plausible at the time, but over the long term come to be recognized as spurious, causing more harm than good. He is currently feted as the victor over the 2008 financial crash, although the Fed's failure to adequately supervise the nation's banks is also cited as a cause.

However, by accepting re-nomination for a second Fed term to start next month, he will be universally blamed when the current commodities bubble bursts, as it surely will, causing yet another deep recession.

Bernanke will be remembered by the next generation as a man mesmerized by the memory of the Fed's mistakes at a single point in history - 1930-32 - for whom printing more money was the right answer in every economic situation.

Even if vast new economies in India and China continue their emergence, competing with their U.S. counterpart to produce ever-cheaper goods and services, at some point their ability to dampen general inflation ends, and inflation reappears. When that happens, it will do so suddenly and destructively, as the pent-up force of a decade of excessive monetary creation sweeps away all that's in its path.

It's unlikely that Bernanke will win the Time award again - not even next year. But as others that came before him have found, the magazine never takes the honor away, either.

[ Editor's Note : Martin Hutchinson scours the globe for the "hyper-profitable" investment plays that he recommends for his Permanent Wealth Investor trading service.

In a new report, in fact, Hutchinson not only uncovers the very best profit plays available today, he guarantees triple-digit gains. To check out this report - and these new profit plays - please click here.]

Source: http://moneymorning.com/2009/12/17/bernanke-person-of-the-year/

Money Morning/The Money Map Report

©2009 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.