Gold Near-Term Trend Analysis and Forecast

Commodities / Gold & Silver 2009 Dec 15, 2009 - 09:28 AM GMTBy: Jordan_Roy_Byrne

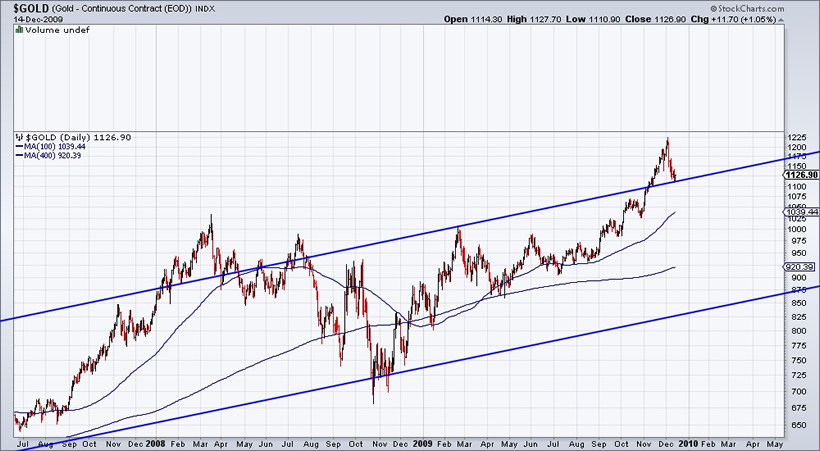

Can Gold hold the channel? What are we referring to? First, let us go back to the end of 2005. The chart shows how a parallel channel contained Gold’s move from 2001 to 2005. The first move above $500 reversed after hitting channel resistance. Yet, the market would immediately surge above the channel to $575. Then the market corrected for five weeks and two weeks later broke to a new high.

Can Gold hold the channel? What are we referring to? First, let us go back to the end of 2005. The chart shows how a parallel channel contained Gold’s move from 2001 to 2005. The first move above $500 reversed after hitting channel resistance. Yet, the market would immediately surge above the channel to $575. Then the market corrected for five weeks and two weeks later broke to a new high.

How is this relevant to today? Below we zoom in on the upper channel line, which connects the 1999 and 2006 high. Monday, the market rebounded from channel support. Pay attention to weekly closes. If the market can hold $1,115 on a weekly closing basis, it would imply an eventual strong

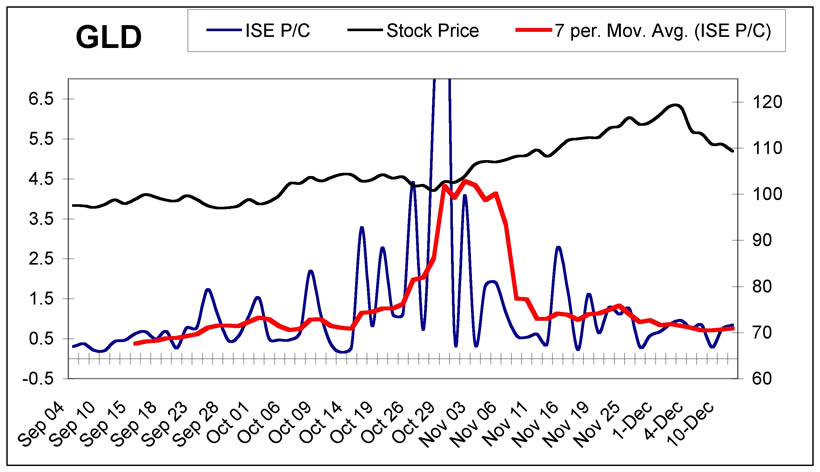

For immediate sentiment and market timing purposes we track the put-call data from the International Securities Exchange. This data, as a contrary indicator has provided strong signals and helped our market timing immensely. As you can see, the put-call on GLD was rising considerably into the end of October. The day it spiked to a new high was the day after GLD’s bottom. Since then the put-call has steadily declined. At present it looks close to increasing, but there is nothing to suggest an imminent reversal in GLD.

While options analysis portends to the immediate short-term, sentiment polls portend more to the medium or intermediate term. Below is the chart of public opinion, courtesy of sentimentrader.com. During the impulsive advances in 2005-2006 and 2007-2008, public opinion spent considerable time above 80% bulls. During the recent breakout, public opinion never exceeded 75% bulls.

Sentiment in the medium to intermediate term remains supportive for Gold. We suspect that after several more weeks of consolidation or weakness, the GLD put/call ratio will rise, thereby giving a bullish short-term signal. As always, we weigh sentiment along with the technicals.

Good Luck and Good Trading!

For more information on our Gold/Silver stock newsletter and examples of accurate real time sentiment analysis, please visit: http://www.trendsman.com/Newsletter/GSletter.htm

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.