Stephen Roach Vs Mike Shedlock on Fed's Easy Money Exit Strategy

Economics / Quantitative Easing Dec 14, 2009 - 04:30 AM GMTBy: Mike_Shedlock

Former Fed economist and current Morgan Stanley Asia Chairman Stephen Roach Sees ‘Great Risk’ in Fed Exit Strategy.

Former Fed economist and current Morgan Stanley Asia Chairman Stephen Roach Sees ‘Great Risk’ in Fed Exit Strategy.

The Federal Reserve may cause another crisis by botching the withdrawal of liquidity from the U.S. economy, Morgan Stanley Asia Chairman Stephen Roach said.

The Fed is the “weak link” among central banks and may fail to tighten monetary policy in time to stop asset bubbles from forming, Roach said at a conference in Berlin today. The Fed helped trigger the boom and then bust of the subprime mortgage market by being “quick to slash, slow to normalize” interest rates, he said.

“There is a great risk in the coming exit strategy,” said Roach, a former Fed economist. “They are lacking primarily a political will to execute the exit in a timely and expeditious fashion that will avoid the mistakes of the last crisis.” The traditional view of central bankers that asset bubbles are hard to spot and deflate with rates is “ludicrous,” he said.

“This is a failed flaw in the intellectual construction of modern central banking that must be addressed,” said Roach. “If we don’t fix this problem we’re doomed to repeat the failed asymmetric policies of the past and set ourselves up” for another crisis.

Roach recommended the Fed be required to “hardwire” the goal of preserving financial stability into its mandate, alongside the pursuit of full employment and low inflation. Central banks should not be “allowed to outsource their responsibilities” to regulatory bodies, he said.

Fed Is Fatally Flawed

The Fed is fatally flawed in many ways. Stephen Roach (who I happen to like) misses a lot of them. For starters the only source of inflation is the Fed and fractional reserve lending.

The best policy would be to get rid of the Fed and fractional reserve lending entirely in favor of a stable money supply. That would fix the problem of inflation once and for all.

The Case Against the Fed and Fractional Reserve Lending is easily made. Please read Fractional Reserve Lending Constitutes Fraud for a brief overview.

More importantly please see

- Fractional Reserve Banking by Murray Rothbard.

- Case Against The Fed by Murray Rothbard

Please click on the second link above and read it. It is 162 pages long but very easy reading that anyone can understand if they just give it a chance.

Fed Uncertainty Principle

As noted in The Fed Uncertainty Principle the Fed distorts the economic picture by its very existence.

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg's Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

To measure the position and velocity of any particle, you would first shine a light on it, then detect the reflection. On a macroscopic scale, the effect of photons on an object is insignificant. Unfortunately, on subatomic scales, the photons that hit the subatomic particle will cause it to move significantly, so although the position has been measured accurately, the velocity of the particle will have been altered. By learning the position, you have rendered any information you previously had on the velocity useless. In other words, the observer affects the observed.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

Fed Uncertainty Principle:

The fed, by its very existence, has completely distorted the market via self reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed's actions. There would not be a Fed in a free market, and by implication there would not be observer/participant feedback loops either.

Corollary Number One:

The Fed has no idea where interest rates should be. Only a free market does. The Fed will be disingenuous about what it knows (nothing of use) and doesn't know (much more than it wants to admit), particularly in times of economic stress.

Corollary Number Two: The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Corollary Number Three:

Don't expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.

Corollary Number Four:

The Fed simply does not care whether its actions are illegal or not. The Fed is operating under the principle that it's easier to get forgiveness than permission. And forgiveness is just another means to the desired power grab it is seeking.

Fixing The Fed

Realistically the Fed cannot be properly fixed.

The Fed is a fatally flawed organization and it would be best to implement a plan to phase it out.

Can the Fed Be Improved?

Let's explore the idea of improving the Fed starting with its dual mandate.

Dual Mandate Issues

The Fed's dual mandate is fatally flawed in and of itself.

Roach recommended the Fed be required to “hardwire” the goal of preserving financial stability into its mandate, alongside the pursuit of full employment and low inflation.

I am surprised Roach would say that. It should not be the Fed's mission at all to pursue "full employment". It is not possible even in theory. The Fed is not in control of global wage arbitrage, tariffs, government mandates, taxes, work programs, minimum wage laws, or any of hundreds of things that affect the jobs picture.

Moreover, even if the Fed could take all of those into consideration, it would still be impossible for the Fed to succeed on a dual mandate with jobs or for that matter a dual mandate of any kind.

For example, the Fed can target money supply but it then must by definition give up control of interest rates. It can target interest rates, but then must give up control of money supply. I.e. the Fed has to supply enough money (or take it back) to hit its interest rate target.

The Fed can "control" using the word loosely, at most one factor at at time. It cannot control money supply and interest rates simultaneously. Therefore it certainly cannot control money supply, interest rates, full employment, and low inflation simultaneously as Roach implies.

Given that the only source of inflation is an increase in money supply and credit, why not simply have a stable money supply?

What Is The Proper Supply Of Money?

Those who suggest we need more money to function as the economy grows or as the population grows do not know what they are talking about.

An increase in money supply confers no overall economic benefit. Over time, money simply buys less and less.

At any point in time however, if demand for money increases (people want to hold money as opposed to buy goods and services) prices of goods and services will decline. This can happen even as money supply increases. It is happening now.

I invite you to read Rothbard's classic text: What Has Government Done to Our Money?

For some brief excerpts, please see What is Money and How Does One Measure It?

Why Should The Fed Control Money Supply?

Given that any amount of money that the free market would settle upon is sufficient, why should the Fed need to control money supply?

The Fed neither knows the proper amount of money, nor the proper interest rate and that certainly has been proven in spades.

Instead the Fed has spawned bubble after bubble of increasing amplitude, time after time after time.

Lack of Political Will vs. Plain Incompetence

Roach states “They are lacking primarily a political will to execute the exit in a timely and expeditious fashion that will avoid the mistakes of the last crisis.” The traditional view of central bankers that asset bubbles are hard to spot and deflate with rates is “ludicrous”.

Indeed! So why have a Fed? Moreover, the Fed's problem goes beyond political will, to plain out and out incompetence.

Bernanke trusts all his academic theories to the point of failing to use any common sense at all. Unfortunately his academic theories have failed in real world application.

For proof please see Bernanke's Deflation Preventing Scorecard

Moreover anyone in their right mind has to be asking ...

Bernanke: Why are we still listening to this guy?

The following video should make people think twice about listening to anything that Chairmen of the Fed Ben Bernanke says. It's a compilation of statements he made from 2005-2007 that will have your head spinning.

Measuring Consumer Prices

Can the Fed (or anyone) even measure consumer prices? I think not and a huge part of the problem is what constitutes consumer prices.

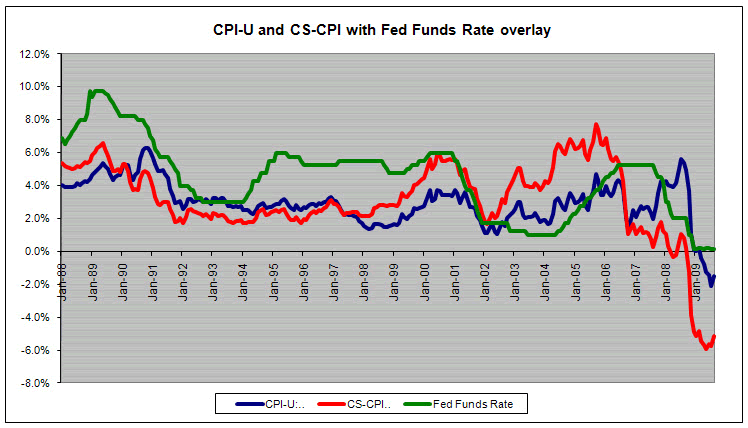

Inquiring minds are taking another look at Case Shiller CPI At Negative 5.1%

Case-Shiller CPI is formulated by substituting the Case-Shiller housing index for Owner's Equivalent Rent in the CPI. For a complete description of the reasons and methodology, please see What's the Real CPI?

CS-CPI continues to fall albeit at a less rapid pace and measures -5.1% YOY. Meanwhile the government’s CPI-U also continues to fall at a slower pace and measures -1.5% YOY. The divergence is to due to the government’s housing metric of Owners’ Equivalent Rent (OER) continuing to show price increases (+1.7% YOY) vs. Case-Shiller data showing price decreases (-13.3% YOY).

Since the Case Shiller housing market peak in June 2006, OER is up +7.7%, while the Case-Shiller index is down -30.9% - an amazing 3860 basis point divergence!

CS-CPI YOY has now fallen for 11 consecutive months and 14 of the past 18. Meanwhile the government's CPI-U YOY has fallen for 6 consecutive months.

I believe housing belongs in the CPI. Regardless, the Fed could have and should have taken housing prices into consideration instead of following a fatally flawed OER as its measure of housing prices.

Of course the Fed can vow to take housing prices into consideration "next time". However, "next time" the asset bubble will likely manifest itself in a completely different manner!

The Only Exit Strategy That Will Work

In light of the above, one should clearly be able to see that improving the Fed is damn near impossible. There are too many variables, and the Fed lacks both the knowledge and the willpower to do what is right.

Roach himself says "The Fed is the 'weak link' among central banks. They are lacking primarily a political will to execute the exit in a timely and expeditious fashion that will avoid the mistakes of the last crisis.”

Given that the next Fed chairman might even be worse than Bernanke, the only exit strategy that will work is to get rid of the Fed and fractional reserve lending along with it.

Call For Action

I do not think getting rid of the Fed can be done at once. Moreover, such an idea would need a good plan. So I call on Stephen Roach, Stephen Keen and any other economists who want to participate to come up with a 5 or 10-year plan (or whatever timeframe is appropriate), to get rid of the Fed, central bankers in general, and end their bubble blowing policies.

We need a plan and a timeline to put the world on a sound economic system because the current Bretton Woods II, fractional reserve, US dollar reserve currency hegemony is about to blow sky high.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.