Gold Stocks Bull Market - The Next Phase Has Begun

Commodities / Gold & Silver Stocks Jul 19, 2007 - 09:52 PM GMTBy: Jordan_Roy_Byrne

On Thursday gold stocks broke out from the consolidation that began in May 2006. The XAU closed at 158.25, exceeding its consolidation high of 153.15. The HUI closed at 371.88, exceeding its consolidation high of 369.69. If not for the recent slip in Eldorado Gold (EGO), the HUI would be at least a few points higher.

How do we know that this breakout is for real or confirmed?

Given the aforementioned case with Eldorado, I'm going to use the XAU here.

This chart shows the gold stocks breaking out against both gold and the stock market. As I have discussed quite a bit in my newsletter, the sector does best when it outperforms against the stock market. Refer back to this editorial where I discussed the importance of the gold stocks “breaking out” against the stock market. http://www.321gold.com/editorials/roy_byrne/roy_byrne030807.html

Gold stocks have staged a breakout against the S&P 500 during each impulse phase. That, as well as this most recent breakout, should put to rest the notion that gold stocks cannot rise without the stock market rising.

Now where do we go from here?

Let's take a look at some Monthly charts. First the XAU.

This current setting is very bullish. There is key long term resistance at 155-160. Going back the past 10 years we see a cup and handle pattern. Since 2006 the index has constructed the handle and now it appears that a major breakout is at hand. The target for this pattern would be 280. As far as immediate risk-reward, the current spot is one of the three best entry points since 2001. Each time the bollinger bands have pinched in, the XAU has risen significantly over the next few months.

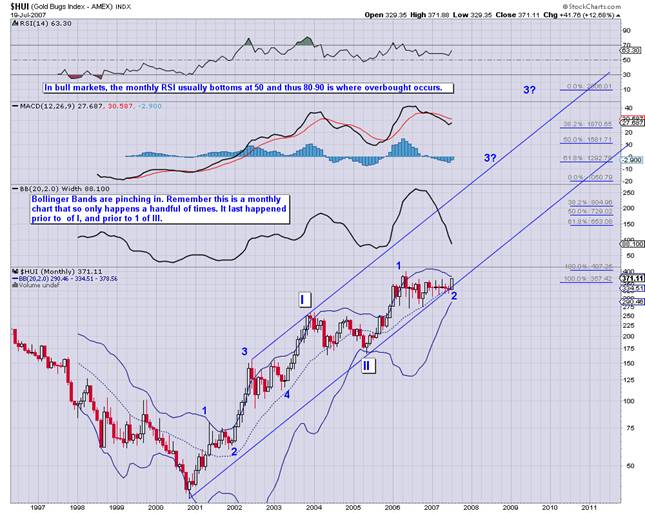

The mid-sized and junior stocks are the companies posting the best gains in this bull market. That is why I prefer to use the HUI. Here is my long term Elliot Wave Count on the HUI:

For those not familiar with Elliot Wave Theory, the third wave in a bull market tends to be the largest and the strongest. The “third of a third” or “3 of III” is called the point of recognition and is when most market participants realize the bull market at hand. It is the real sweet spot of a bull market. It is my humble belief that the point of recognition is now starting and will last into 2009 at the latest.

When the Dow finally broke 1000 for good in early 1983, it rose to 2700 before the 1987 crash. When oil finally broke 40, it moved up 100% in roughly two years. As I showed in my 2007 Market Outlook, new all-time highs often occur in wave 3 of III and they are the some of the most vertical and explosive moves you experience in a bull market. For these reasons (essentially market history and human psychology) it is easy to see why, once gold breaks its old intraday high of $888, it is quickly headed well above $1000.

For more fundamental and technical analysis and to see our top picks and model portfolio, sign up for our free email newsletter on this page of our website:http://trendsman.com/?page_id=17

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.