Gold Shines on Further Secular US Dollar Weakness

Commodities / Gold & Silver Jul 19, 2007 - 12:25 AM GMTBy: Ashraf_Laidi

The dollar resumes its broad sell-off as Chairman Bernanke's speech and the Fed's central tendency forecasts present no real deviation in the existing negative dollar flows, which have escalated in the Asian session following Bear Stearns' announcement on its sub-prime hedge funds. The secular deterioration in the US dollar is highlighted via the 5% increase in gold prices over the past 2 ½ weeks. Gold today is surging by $8 per ounce to $674 per ounce, its highest level in 2 months.

The dollar resumes its broad sell-off as Chairman Bernanke's speech and the Fed's central tendency forecasts present no real deviation in the existing negative dollar flows, which have escalated in the Asian session following Bear Stearns' announcement on its sub-prime hedge funds. The secular deterioration in the US dollar is highlighted via the 5% increase in gold prices over the past 2 ½ weeks. Gold today is surging by $8 per ounce to $674 per ounce, its highest level in 2 months.

Today's CPI report showing the annual headline rate unchanged at 2.7% and the highly scrutinized annual core CPI at remaining at 2.2%, supports the Fed's recent calls to draw attention to headline inflation. From a tactical perspective, however, the Fed has no choice but to emphasize the upside risks to inflation, at a time when a clear retreat in core inflation (and core PCE prices) is speeding up dollar selling, especially at a time when global central banks face no negative economic implications in their tightening campaigns.

The 2.3% increase in June housing starts gave a brief lift to the dollar, before traders realized that building permits (a longer-term indicator of future starts) fell 7.5%, posting their biggest monthly decrease since January 1995 . The year on year rate decline of building permits is at 25%. The intermittent monthly gains in housing starts will fail to reverse the current falling trends as long as the permits for these housing starts are on a sharp decline.

The Federal Reserve Board lowered its 2007 forecast for real GDP growth to 2.25%-2.50% from the February forecast of 2.50%-3.0%. The Board maintained its core PCE price index forecast unchanged at 2.00%-2.25%, with an expected slowdown in 2008 to 1.75%-2.00%. It also maintained its 2007 unemployment rate forecast at 4.50%-4.75%.

While the dollar's decline has remained largely unperturbed against most major currencies in recent weeks, the declines against the yen have been interrupted by mixed economic reports from the US and Japan. Nonetheless, the recent escalation in the frequency of sub-rime related news (from downgrades by credit rating agencies to earnings downgrades and pricing revelations) has systematically dragged the USD against the yen, even in cases where the Japanese currency did not particularly advance against other currencies.

Despite signs of improvements in US manufacturing indices and industrial production, markets remain skeptical due to the prolonged net losses in manufacturing payrolls (14 straight monthly losses).

The secular deterioration in the US dollar is highlighted via the 5% increase in gold prices over the past 2 ½ weeks. Gold today is surging by $8 per ounce to $674 per ounce, its highest level in 2 months.

Traders must take note of what could be the second phase of the 2007 rally, seen in a pick up in gold speculators' net longs from their 5 ½ month low (see chart below). The build up of net longs appears at its infancy, considering that gold is already 5% up from its late June lows. A situation where the net longs are relatively behind the price action in the asset is bullish for the price of the asset rather than the contrary case where a build up in speculators' longs is not reflected in an upward move in the price. Thus, considering that we are in early stages of an expected build-up in speculative net longs in gold, an extended price rally in the metal is deemed to follow.

Traders must take note of what could be the second phase of the 2007 rally, seen in a pick up in gold speculators' net longs from their 5 ½ month low. The build up of net longs appears at its infancy, considering that gold is already 5% up from its late June lows. A situation where the net longs are relatively behind the price action in the asset is bullish for the price of the asset rather than the contrary case where a build up in speculators' longs is not reflected in an upward move in the price. Thus, considering that we are in early stages of an expected build-up in speculative net longs in gold, an extended price rally in the metal is deemed to follow.

As for the fundamental driver for a prolonged rally in gold, it is already here. The aforementioned economic concerns weighing on the US dollar are especially being manifested in the dissipation of the yen-S&P relationship, which will likely help boost the secular nature of the gold bull. With prices currently at $666 per ounce and the average duration for net long accumulation lasting 6-7 weeks, we anticipate gold nearing the $700 mark by the end of Q3.

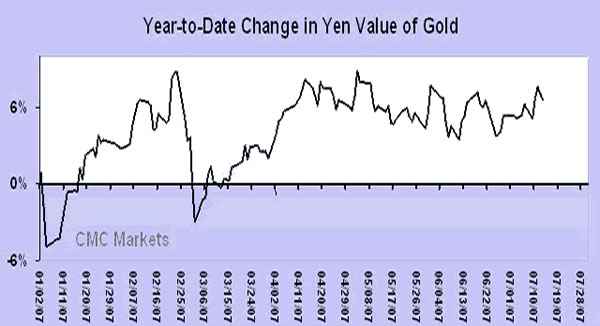

Watch the Yen value of gold

Traders can also use the yen value of gold for a clear perspective on the value of gold and on whether the price gold-yen relationship is impacted by carry trades into the metal or an unwinding into the currency. The chart below illustrates gold's 2007 year-to-date performance in yen terms, whereby a rising trend shows a decline in the value of gold against the yen. A falling gold/yen chart (yen per 1 value of gold) is a reflection of overall yen strength, or (and) a corresponding retreat in gold prices. In the event that a falling chart occurs during a period of stable gold prices (as measured against other currencies), one can deduce that a period of overall decline in the dollar is prevailing.

The fundamental drivers of G-10 currency markets have predominantly been 1-dimenstional throughout the year, based on carry flows, whereby their unwinding saw a rally in the dollar against Aussie, kiwi, sterling, euro, loonie and gold. But as the Federal Reserve increasingly proves to be in a policy straitjacket --facing upside inflation risks and downside risk to growth--at a time overseas central banks raise interest rates without any negative policy implications on their economies-- markets lose confidence in the dollar. Hence, the second dimensional aspect of FX market dynamics -- broad dollar weakness.

Our case for a 2007 interest rate cut throughout this year has been capital market-oriented as well as macro-oriented. The capital market rationale is highlighted by reduced risk appetite impacting liquidity in a highly leveraged financial landscape, which spells the probability of contagion.

The risk of such contagion could occur via the following:

1) A sharp rebound in the yen would jeopardize billions of dollars worth of what were initially low cost yen loans;

2) Higher interest rates on US mortgage owners after interest rate resets;

3) Deterioration in the values of sub-prime securities as these are unloaded from the portfolios of banks and hedge funds.

These are the avenues through which the dollar is expected to continue charting a broad but manageable decline, highlighted by a continued recovery in gold. As long as hopes of a US recovery remain dim, so will chances of a dollar recovery resulting on the back of carry trade unwinding. But with the Japanese currency acting as a determinant of pricing risk appetite, traders should also pay close watch to the gold-yen relationship for a benchmark of risk appetite and its opportunity cost.

By Ashraf Laidi

CMC Markets NA

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.