Hedge Against Hyperinflation, Hard Assets Should Continue to Appreciate During 2010

Commodities / Investing 2010 Dec 08, 2009 - 06:29 PM GMTBy: The_Gold_Report

The devil will be in the details of the balance sheet when hyperinflation hits. And while lots of companies have been using leverage to drive their ROE (and their stock prices), the structure of their debt may spell the difference between prospering and perishing. Those with low-interest debt that's locked in for a long spell actually will be poised to retire their obligations with cheaper dollars. But woe betide those stuck with floating rates. That's how Sprott Asset Management senior portfolio managers Charles Oliver and Jamie Horvat see what's brewing beyond the horizon, when time comes to pay the price for running the money-printing presses too hot and too long. As Charles and Jamie suggest in this exclusive Gold Report interview, investors who base decisions on the strength and structure of the balance sheet may not do too badly. In fact, they explain how the stock market itself may serve as a hedge against hyperinflation.

The devil will be in the details of the balance sheet when hyperinflation hits. And while lots of companies have been using leverage to drive their ROE (and their stock prices), the structure of their debt may spell the difference between prospering and perishing. Those with low-interest debt that's locked in for a long spell actually will be poised to retire their obligations with cheaper dollars. But woe betide those stuck with floating rates. That's how Sprott Asset Management senior portfolio managers Charles Oliver and Jamie Horvat see what's brewing beyond the horizon, when time comes to pay the price for running the money-printing presses too hot and too long. As Charles and Jamie suggest in this exclusive Gold Report interview, investors who base decisions on the strength and structure of the balance sheet may not do too badly. In fact, they explain how the stock market itself may serve as a hedge against hyperinflation.

The Gold Report: A lot has happened to influence gold prices since the last time we spoke with you in June. India and Russia started buying bullion, which helped increase the prices. Now, the news from Dubai has put some downward pressure on prices. What does all of this mean for the gold sector?

The Gold Report: A lot has happened to influence gold prices since the last time we spoke with you in June. India and Russia started buying bullion, which helped increase the prices. Now, the news from Dubai has put some downward pressure on prices. What does all of this mean for the gold sector?Charles Oliver: In terms of central banks buying, it's very positive. You mentioned India, which just bought a couple hundred tons from the IMF. Sri Lanka also bought 10 tons, and Mauritius bought two tons. We've also seen the Russians buying and there's talk of China buying more—after the 400 tons they added in April.

So we're seeing some very positive fundamentals on the demand side of the equation. The last decade the central banks have been net sellers. It looks as if maybe over the next 12 months central banks will be net buyers, which is a completely turnaround.

I am not going to make too much out of Dubai and its implications for the gold price. We saw a small correction in every asset when the news came out. Everybody sold a bit of everything; I think that was just a knee-jerk reaction. If you look at the chaos in the financial markets, gold is actually a safe-haven area.

Jamie Horvat: The only thing I'll add is that it appears gold is reasserting itself as a currency, instead of being viewed solely as a commodity.

As far as Dubai goes, as Charles said, short-term it looks as if a lot of people got spooked in the market and started taking profits. Gold, obviously, has been pretty profitable year-to-date and we saw a couple of days of selling where people got nervous and wanted to lock in their returns. But that panic selling seems to have ceased.

TGR: Most people expect that all the money printing that's happened is going to lead to inflation—or worse. What's your view on that?

JH: Our view is moving more toward the probability of hyperinflation as governments have actually stepped up their stimulus programs and their deficit spending.

TGR: Let's define hyperinflation. Everyone knows it's big inflation, but what does that mean?

CO: The dictionary gives no fixed definition, but one of the best descriptions I have heard is that hyperinflation is an inflation in which the rate is measured in months or days rather than years. In my mind, if you're running at 50%, you're basically there. But again, there is no absolute number.

JH: One of the other things we've come across and talked about in the past is the aspect of monetary debasement or monetary inflation, where there's a definition for hyperinflation we came across stated as very high or out-of-control inflation due to currencies rapidly losing their value resulting in rapid price increases for all other goods.

TGR: So it's not necessarily the Zimbabwe type of hyperinflation, but something that certainly North America hasn't seen.

CO: Just after the Civil War, the U.S. did go through a period of hyperinflation. Everyone on the planet has at some point basically experienced hyperinflation. And that includes the Chinese; I believe it was around 1945 they went through a period of hyperinflation.

TGR: But this time you're looking at this potential hyperinflation as being a worldwide phenomenon—not one country at a time.

CO: It all depends on what the individual governments do. Right now, many of those countries are continuing to expand their monetary base. They're spending money left, right and center. Governments that continue to expand the monetary base at an increasing rate will share in the hyperinflationary phenomenon. Not every country's going to do that, and we ultimately don't know how it will unfold but as Jamie mentioned, we are seeing a lot of signs that governments are continuing to spend vast sums.

Just as an example, the U.S. is spending a huge amount this year. The healthcare program is going to cost them more money. The demographic story that's going on out there, as people retire, Social Security payments will increase while the tax revenues decrease. The Prime Minister of Japan and government bankers there are reportedly having discussions about quantitative easing, which, again, quantitative easing is printing money. The Bank of England has embarked upon a huge program of quantitative easing. Those governments that are going to ultimately pay the price.

TGR: In our last conversation, you mentioned that stock market studies suggest one of the best ways to protect your assets is investing in the market. Can you elaborate on why that works? And whether it would work in a hyperinflationary environment?

CO: If you go through a period of hyperinflation, the worst thing you can own is cash because it becomes worthless. You want to own assets that will protect you against inflation. Gold is one of the simplest things that we all talk about as protecting against inflation. But interestingly enough, if you go back to Weimar Republic, Germany and if you look at the Zimbabwe Stock Exchange a few years ago, the stock exchanges actually acted as an inflation hedge. That's because many of the companies on the exchanges actually pushed through price increases on their end products. Hence, during a hyperinflationary period, these companies were selling their products for much higher year after year after year and their prices went up to reflect that huge increase in earnings. The huge earnings increases were not the result of improvements in productivity or expanding and growing their companies. It was based purely upon the inflated prices they charged for the goods they were selling. So, yes, the stock market can be a very good hedge against hyperinflation as well as inflation.

JH: I'd argue that the stock market is potentially taking on this role already. It may be starting to act as an inflation hedge, as discussions have been coming out of China, Japan, Russia, and even the recent Fed minutes talking about the low interest rate policy in the U.S. and the U.S. dollar as potentially the new carry trade, resulting in this inflation of assets bubble globally. If you can borrow money at prime less 25 or 50 basis points, or essentially for free if you are one of the big U.S. banks that received a bailout, and can put that to work in the market to buy stocks and assets forcing prices up, or you can earn a yield spread, then under these circumstances, I would argue—as many central banks have stated—that this free money is causing the market to act as an inflation hedge.

CO: Just a small counterpoint to my partner in crime. . . . At the beginning of this year, we thought hyperinflation would happen several years out. With the market performing as well as it has, it's a bit of a conundrum with our belief of where we think the market should be valued. Jamie correctly points out that you can explain this by talking about it acting as a hedge against inflation or hyperinflation. But to some extent, my own personal view is that the big movement in stocks will be several years out, and that's contingent upon the governments continuing to expand and spend money at an increasing rate.

People always ask what the risk is to your expected outcome. And the risk is that at some point in time, some of these governments will start to get religion. If you go back to the 1970s, the U.S. was going through a period of huge stagflation. And then one man sort of stood out of the crowd—Paul Volcker. When he got religion and raised interest rates and did the right thing, people absolutely hated him. We look back now and say, "You know what? He stood up; he did the right thing. The U.S. was in a much better place and continued to be a very stable and good environment to invest in, to grow in." So that's the one risk, that there's another Paul Volcker out there who steps up to the plate.

JH: One counterpoint to my earlier argument about the market acting as a carry trade, as Charles said earlier, the thing you have to monitor when you look globally, is the U.K. still has a negative GDP number. The U.S. recently revised the third-quarter number down from 3.5% to 2.8%. Look at Canada. Look at Japan. There's no growth without government stimulus.

So if governments rein in or pull back the stimulus spending or someone gets religion and bumps interest rates 25 basis points, we could easily set up for a double-dip scenario or double-dip recession because the consumer is dead. And without the incentive to spend there is no consumer spending and growth.

TGR: If you're looking at investing in 2010, it sounds like the hyperinflation issues will happen several years out, and in the largest consuming nations we continue to have government expanding the M1 to provide stimulus, which will keep the market growing because the market is going to grow as a hedge. So should we take advantage of the market hedging potential inflation in 2010, and then bail out when we see hyperinflation on the horizon?

CO: We spend a lot of time trying to figure out how next year will unfold. It's a very tough call. Having said that, as long as Ben Bernanke says for the next 12 to18 months the Fed will keep rates low, you could see the stock market show some strength. I think as the market goes higher, the risk of a downturn increases because a lot of the growth in the stock market is people paying higher multiples for earnings.

If you look at the economy, we still have a very weak consumer and very weak earnings growth. A lot of it is a result of cost cutting, and there comes a point where you just can't cut any more costs out. Hence, you may see the stock market continue to go up, but I think the risk is significant that we see a double-dip recession, and as soon as the market catches a whiff that rates are going to start increasing, it probably will take a very big knock.

Again, we don't know exactly how and when that will happen, but we do see the market getting more and more expensive. So I think you'll want to tread very carefully, because there's a significant risk that at some time in 2010 the economy may go back into a double-dip recession.

TGR: Will it be as dramatic as the one that started in 2008?

CO: I don't think so, but it depends on how things play out. If you see the market get really, really expensive and continue upwards, it's going to have to come down further. My personal view is that it won't be as aggressive, but we will continue to monitor that and be ready to be wrong.

In 2008 the whole financial system looked like it was about to implode, and now we've seen if that happens, the government plans to take action. Unfortunately, the action is taking taxpayer dollars and giving them to the banks, but they are ready to act. In that case, the same degree of fear may not exist as it did in 2008 when people were fearful that the whole system would collapse.

JH: I agree with Charles as he hit it on the head. You have to question how forward-looking is the market? When does the market wake up and realize that the growth we had was all predicated on government spending and cost cuts? We can't cost-cut our way to prosperity. At some point the government stimulus and spending have to cease and we have to pay for all of this through future concessions, lowering the benefits that we were going to receive in the future and increases to our taxes.

Also we still need to repair our balance sheet. We haven't really solved the problem of all of those toxic assets and the quadrillion or $800 trillion of derivatives—whatever the number may be; it is still lingering out there.

So it's going to be an ongoing period of lower growth and balance sheet repair. When does the market correct? As Charles said, and I said earlier, that will happen as soon as we get a whiff that interest rates are going to go up.

TGR: Let's talk about some of those companies that have the model balance sheet—debt is low, they'll be able to service debt, and should a downturn happen either in the economy or in the market, they will be able to survive.

CO: Within every sector some companies have healthy balance sheets and surplus cash, and some have debt. Look at base metals, for example. Last year, HudBay Minerals Inc. (TSX:HBM) was trading at a discount to its net cash, and Teck Resources Ltd. (NYSE:TCK), which had an awful lot of debt because it had purchased its coal assets at the top of the market. Our preference is to take the one with the lower risk profile in terms of its potential to continue operating.

The picture also varies from sector to sector. In certain areas, generally speaking, you see a lot of companies with an awful lot of debt. For instance, there's lots of debt in the banking sector. So from a macro point of view, that would be something to avoid. On the other side, a lot of material stocks have very healthy balance sheets. They've been getting high commodity prices for the last several years; so unless they've been on spending sprees, for the most part they have been building up cash balance sheets.

JH: In consumer staples, a lot of the big conglomerates serve as a primary model of how they've been driving ROE through leverage. Their ability to continue to finance going forward is doubtful once rates increase substantially as overall the margins may be pretty slim. So you really have to pick and choose within each segment—the HudBays versus the Tecks, as Charles indicated.

TGR: As you said, material stocks have built up healthy balance sheets due to increase in prices of the underlying commodities. Why haven't gold stocks increased valuations to reflect the 35% increase we've seen in the price of gold?

CO: There has been a disconnect between the gold price and gold stocks certainly over the last year and a half. I think we can all agree that 2008 was really an anomalous year. A gold stock was a stock; the fact that it was in gold did not matter. So gold stocks just went down with the rest of the stock market, and this year we've been playing catch-up. The gold stocks have done very well.

Having said that, one sub-sector of the gold stocks has been the best. We've seen brilliant returns in some mid-cap gold producers, while at the same time some big-cap gold names and some early-stage names whose access to capital has been a bit of an issue have underperformed.

The S&P Global Gold Index is up around 10%, which really isn't a very good return; you would have done better than that if you held gold. But look at an index made up of mid-cap names or look at many of the gold funds in those mid-cap areas. Or look at our own fund—we're up over 100% year-to-date as we speak. There's been some very good performance from many of our peers as well.

TGR: So, is the reason some are outperforming the gold primarily back to that balance sheet issue and the debt?

CO: Except for some of the large caps, I think most gold companies generally have fairly strong balance sheets. A lot of them avoid too much debt because it's a very tough business, and they don't want to get themselves over-leveraged. For the most part, I think the dichotomy between the performance of the large and small caps relative to the mid-caps is just one of those things. Next year I wouldn't be surprised to see—in fact, I expect to see—large caps and small caps outperform the mid caps. They get out of whack sometimes, but eventually they tend to act as a group, so I expect that to become more normalized next year.

TGR: So if we want to look at companies with sound balance sheets in the group, which companies fall into those categories from your analysis—small caps, mid caps and big caps?

CO: The large caps—companies like Goldcorp (TSX:G) (NYSE:GG), Barrick Gold Corp. (NYSE:ABX), Newmont Mining Corp. (NYSE:NEM), AngloGold Ashanti (NYSE:AU, JSE:ANG, ASX:AGG, LSE:AGD), Gold Fields Ltd. (NYSE:GFI)(JSE:GFI), Randgold Resources Ltd. (NASDAQ:GOLD), Kinross Gold Corp. (K.TO; NYSE:KGC), IAMGOLD (TSX:IMG). Silver Wheaton Corp. (NYSE:SLW, TSX:SLW)—Silver Wheaton is actually on the verge of becoming a large cap; it probably is a large cap now.

JH: Red Back Mining Inc. (TSX-V:RBI) is probably considered a large cap now too.

CO: Among the mid-cap names, I think of companies such as Osisko Mining Corporation (TSX:OSK), Wesdome Gold Mines Ltd. (TSX:WDO) and San Gold Corporation (TSX-V:SGR).

JH: Also Lake Shore Gold Corp. (TSX:LSG) and Aurizon Mines Ltd. (NYSE/AMEX:AZK; TSX:ARZ) . And Romarco Minerals (TSX.V:R) have strong balance sheets.

CO: Romarco is sort of a small cap breaking into the mid-cap range. Generally speaking, the small caps tend to be more in exploration or development-stage projects. Some of the names may not be familiar. Within every country you can see a lot of small caps. One of our themes is monitoring the jurisdictions these companies operate in because governments sometimes change loyalties. We like stable areas. North America is a pretty good region to operate in. Companies like Rainy River Resources Ltd. (TSX-V:RR). What else do we have in North America, Jamie?

JH: Premier Gold Mines Limited (TSX:PG). Brett Resources Inc. (TSX-V:BBR)—the Hammond Reef project. International Tower Hill Mines Ltd. (NYSE/AMEX: THM; TSX-V:ITH).

CO: Let's pick some small-cap players in Brazil— Verena Minerals Corporation (TSX-V:VML.V). Amarillo Gold Corporation (TSX-V:AGC), Brazauro Resources (TSX-V:BZO), Magellan Minerals Ltd. (TSX.V:MNM). So that's just a smattering of names in the different groups.

TGR: Four companies made it into your top 10 for both the Sprott Gold Precious Metals Fund and the Sprott All Cap Fund— IAMGOLD, Kinross, Osisko and Silver Wheaton. Can you give us some more insight into how and why they achieved that ranking?

CO: I think of those as anchor names within the portfolio. It acts as a core. They're good, sound companies, well-diversified and with a number of different operations. The one that's a bit of an outlier among those you mentioned is Osisko. We've owned it for awhile, but increased our position over a year ago because we thought it was very cheap. Osisko has a very big, very promising deposit in Quebec. We felt that the market was undervaluing it dramatically. Great growth story, very cheap, strong balance sheet, fully cashed up.

JH: Another point about our top 10—many of them grow into those positions. Just over a year or even two years ago, people hated IAMGOLD and wouldn't give CEO Joe Conway any benefit of the doubt. It was a show-me story. Everyone saw a declining growth profile for the company for the next couple of years until a few other projects came on. But Joe was one of the few people out there willing to do something at one of the dour times in the market. He bought the Essakane Project in West Africa and advanced it forward, and now he's ahead of schedule and is showing a really good growth profile. People are willing to pay for that growth now, and you saw significant movement in the stock price.

Another example is Silver Wheaton. A year or so ago, people were dour in the market, silver was down and we had the financial collapse, but with Peñasquito coming on out of Goldcorp and the silver stream there along with a few other assets, investors became positive on the silver and gold price and the profile for the company. You can witness the movement in Silver Wheaton's stock price as a result.

So more often than not, these are companies that have grown into these positions over time.

CO: Jamie was quite right, and I think it's very important to know. We don't generally go in to a portfolio and say, "We're going to make this our largest position." It's usually growth from an initial position that gets larger through the performance of the stock that brings it to that magnitude. Our gold fund's top 10 is usually big, well-diversified producers or stocks that have run an awful lot. In the case of the first three, they are big, well-diversified producers, and as I said, Osisko's been a great performer. It's one of those mid-cap names that I mentioned that has had stunning performance.

One of things I can tell you is somewhere below that top 10 list there's another Osisko, which next year will probably break into the top 10. Again, it will be through the outperformance of the company and growing recognition by the investment community of the value of that company's projects and assets.

TGR: If investors are already well into their gold positions in their portfolio, what other sectors should they be looking at?

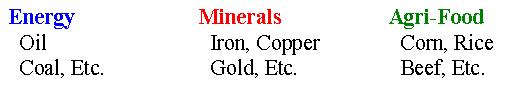

CO: Gold is our favorite sector. On a long-term basis, we're believers in peak oil, too, so we believe that energy should be part of an investor's outlook. In terms of mid-term themes, we think over the next decade there are some areas in which to have some exposure that maybe over the last two decades weren't so important. Agriculture is one example. A decade ago nobody talked about agriculture. I think now it's very important, and the macro themes are very compelling for why investors would want to get into agriculture.

TGR: Okay. Agriculture is one. Where else?

CO: We think infrastructure will be a good area. With all the government spending that's going on, there's going to be a lot of spending in infrastructure. We've gone through a year of talking about it. So far, the infrastructure companies haven't really benefited that much because it's been a time for signing contracts and getting everything put in place. The real spending comes on later down the line.

JH: We're looking at areas of the healthcare sector as well, but it's more on the productivity, technology and medical equipment side and not so much in biotech and pharmaceuticals. So the bread-and-butter supply types of companies look pretty good.

There's some appeal in the technology space as well, with developments that enhance productivity and make companies a little more efficient.

TGR: Anything else you'd like to tell our readers?

JH: Keep the faith. As long as governments continue to print money and debase fiat currencies, hard assets should continue to appreciate and do well as a store of value.

Bringing more than 21 years of experience in the investment industry, Charles Oliver joined Sprott Asset Management (SAM) in January 2008 as an Investment Strategist with focus on the Sprott Gold and Precious Minerals Fund. Prior to joining SAM, Charles was at AGF Management Limited, where he led the team that was awarded the Canadian Investment Awards Best Precious Metals Fund in 2004, 2006, 2007, and was a finalist for the best Canadian Small Cap fund in 2007. At the 2007 Canadian Lipper Fund awards, the AGF Precious Metals Fund was awarded the best 5-year return in the Precious Metals category, and the AGF Canadian Resources Fund was awarded the best 10-year return in the Natural Resources category.

Jamie Horvat joined SAM in January 2008. Jamie is co-manager of the Sprott All Cap Fund, the Sprott Gold and Precious Minerals Fund, the Sprott Opportunities Fund LP and the Sprott Global Equity Fund. Jamie has over 10 years of investment experience. Prior to joining SAM, he was co-manager of the Canadian Small Cap, Global Resources, Canadian Resources and Precious Metals funds at AGF Management Limited. He was also the Associate Portfolio Manager of the AGF Canadian Growth Equity Fund, as well as an instrumental contributor to a number of structured products and institutional mandates while at AGF. He joined AGF in 2004 as a Canadian Equity Analyst with a special focus on Canadian and Global resources, as well as Canadian small-cap companies. Prior to joining AGF he spent 5 years at another large Canadian mutual fund company as an Investment Analyst.

DISCLOSURE:

1) Karen Roche, of The Gold Report, conducted this interview. She personally and/or her family own none of the companies mentioned in this interview.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Romarco Minerals Inc., Aurizon Mines Ltd., San Gold, IAMGOLD, Goldcorp, Gold Fields

3) Charles Oliver: I personally and/or my family own none of the companies mentioned in this interview. I personally and/or my family am paid by none of the companies mentioned in this interview.

4) Jamie Horvat: I personally and/or my family own the following companies mentioned in this interview: Aurizon Mines I personally and/or my family am paid by the following companies mentioned in this interview: None.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

The GOLD Report is Copyright © 2009 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.