This Stock Market is on Less Footing than in 2007

Stock-Markets / Stock Market Sentiment Dec 06, 2009 - 07:39 AM GMTBy: J_Derek_Blain

It seems that we have returned to the "olden days" of the bubble era. In fact, the words bubble, gold, bull market, and stocks seem to be popping up on finance web sites all over the virtual stratosphere.

It seems that we have returned to the "olden days" of the bubble era. In fact, the words bubble, gold, bull market, and stocks seem to be popping up on finance web sites all over the virtual stratosphere.

To make things worse, on-the-street retail investors and those that represent them (hedge fund and mutual fund managers as indicated by equities vs cash holdings - averaging about 4% cash currently!) appear to be eating it up. And we are at the point where we have discarded cutlery for the more subtle by-the-fistful type of gorging. Where everyone is out to make up the severe beating their portfolios took last year.

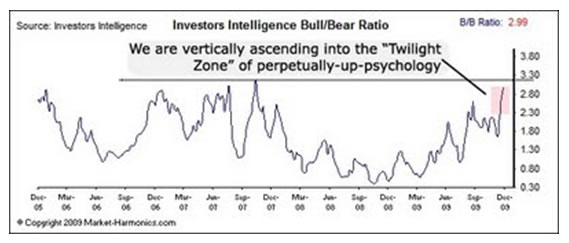

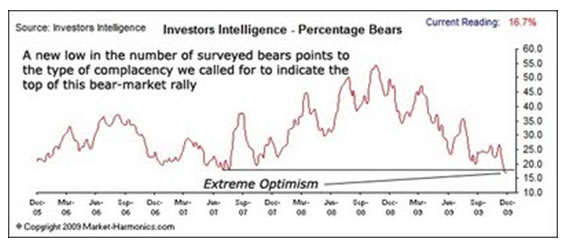

As demonstrated in the following charts, we have seen by far the worst level of complacency since this bear market started. This is highly indicative of a major turning point in equities price-movement and prime territory for a long-term shift in investor psychology and mood that will bring on the largest portion of this bear market. We anticipate an imminent turn in equities within weeks (if not days) which will herald the sharpest and deepest declines in their perceived values.

The ratio of bears to bulls is almost at its highest point on the chart and is sporting the same near-vertical price movement that it did as the market topped out in late 2007. From the market bottom, this ratio has gone up over 150% in quantitative terms indicating a massive shift in investor psychology. Since this positive sentiment is based on nothing more than "hope" at this point in the game, it may (and likely will) reverse just as swiftly as it ascended and should make a new low on the Investor Intelligence ratio.

To further demonstrate the "hope" mentality that permeates current market psychology, the percentage of bears surveyed is at its lowest point in a decade. This indicates both a complacency towards danger (for example, junk bond spreads have narrowed by over 50% relative to treasuries in the past 10 months while defaults are at their highest since the 1930's) , and a clinging to hope and extreme optimism.

Finally, we reiterate our advice. Liquidate stocks and corporate, territorial, and municipal bond holdings and conserve cash by either holding actual dollars or their safest short-term equivalents.

Have a wonderful weekend!

By: J. Derek Blain

© 2009 Copyright J. Derek Blain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.