Britain, the Canary down the Western Coal Mine

Economics /

Recession 2008 - 2010

Dec 04, 2009 - 08:06 PM GMT

By: Phill_Tomlinson

"We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step."

Jim Callaghan - Speech at the Labour Party Conference, 28 September 1976

Gold prices had been on the rise for weeks, then all of a sudden fell back with a thud as we were told that only 11,000 jobs were lost in the US during November. Another Brown bounce in the polls left Cameron backtracking, austerity is so last month, instead 'growth' by government spending is now acceptable as policy is dictated by focus groups. The Middle Easts version of Las Vegas got a helping hand which was good news for many UK banks, however only a mere $80 Billion would have been at stake. Years ago it would have meant something, not today with Trillion dollar bailouts. China's vice governor at the peoples bank declared 'We must watch out for bubbles forming on certain assets, and be careful in those areas' referring to golds recent upward trajectory. Nice try, that deceit may wash with CNBC but those of us in the loop know full well that China would love to transfer much of their paper assets into hard assets such as Gold.

It's sometimes easy to forget what the average person thinks in relation to financial matters. Articles posted here are certainly not consistent with mainstream thinking. People are still on the same broken record, 'Buy a house now while prices are cheap before you get priced out', 'We are past the worst now and good times are ahead', 'The government will make a good profit for the taxpayers with the bank bailouts'. Ask people who read the financial sections of broadsheet newspapers about gold and you get told 'The price can go up as well as down' as though this is a unique quality that does not apply to other assets such as bonds, real estate or stocks. Indeed it is important to remember just what people are thinking, because you don't want to be on the same page as them. 'Repeat after me, Gold is a bubble, Central Banks can 'tame' markets, the sustainable recovery is here and there is no inflation! There is no spoon!' There's no analysis of the thunderstorm that is brewing in the distance.

So what about this Gold bubble then? People are right, however they are 5, 10, 15 years too early in calling it. People are buying the stuff because one day it will be a bubble as the Worlds Central Banks are busy blowing the next bubbles as I write. The currency and Government Bond bubbles will eventually burst causing mass inflation and creating the next bubble, commodities and precious metals. As Bernanke and Company try to assess how best to deal with bubbles, they fool the public as though these events are some mystical force that no one can control. I have a simple solution, how about stop printing so much money. We instead move from bubble to bubble, the Centrals banks policy after one pops is to inject further easy money into the system. Like some drunk who throws up after a bottle of vodka, 'I best have another to sort myself out'.

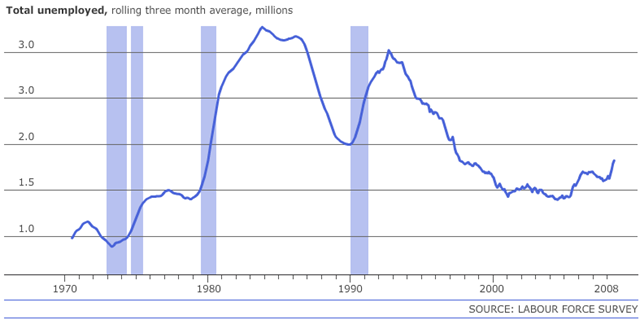

Could the US unemployment figures signal the turn with people getting back to work? Maybe in the short term, but I don't think this will be a long term trend. You have to remember governments everywhere are printing huge amounts of money and this is bound to give the so called 'prosperity' effect in the short term but it won't last, the free market hasn't healed. During the coming stagflation a lot of conventional indicators will seem to be healing when in fact the underlying fundamentals are deteriorating. For ten years after the credit crunch in 1973/74 the unemployment rate in the UK kept rising.

It didn't move up in a straight line, with periods of consolidation and even movements to the downside. When the correct path was taken it took years to fall. Numbered estimates in the news are useless, three million, four million, all have been given as figures for the short term, however no one can say for certain, all we do know is that history says it will keep rising over the long term.

For a developed country the British people sure do love their inflation. While many other nations inflation indices have plummeting like many a British Banks shares, the UK's inflation rate has remained remarkably 'sticky'. Whether its the appreciation of our assets, our rising incomes, our increased levels of debt or the fallacy that we believe the weak pound is good, we really do want to beat other nations in the race to the bottom. The yanks scream 'bloody murder' watching their beloved dollars debasement from the powers that be, not realising that one hundred years ago a British pound used to be worth $5. Anything you can do across the pond, we can do it much worse. Over the next decade I'm sure we will show the developed world what not to do. The problem I see is that British people want inflation. We want to see rising prices, we believe that this is a healthy state of affairs and will thus allow a greater level of leniency towards our policymakers compared with other nations when it comes to expansive monetary policy.

Will the BoE raise interest rates when the market forces their hand? Contrary to what people believe it is the market that controls long term interest rates. We may like to think of central banks under a paternalistic viewpoint, our saviours there to insulate us from financial destruction and chaos, to solve economic issues should they arise. Central bankers are just like their Communist Central Planning counterparts, eventually market forces get the better of them where eventually they follow the market, not set the tempo as they would have us all believe.

In order to understand how markets dictate prices such as interest rates its easier to compare the lowering of interest rates to say lowering the price of bread. If the government declared rather than liquidity not been easily accessible that the issue was now high bread prices, they therefore set forth a policy to fix the price lowering it below the market one. As suppliers begin making losses they shut down production, at the same time people consume more as they can purchase more of the product. Eventually the country runs out of bread with all stocks depleted. Rather than bite the bullet immediately the government would in all probability resort to rationing rather than admit the error of their ways with bread queues becoming a common occurrence. A black market may appear as people under their free will and against the governments law begin selling bread to one another for a price set by people, the marketplace. If however the government wishes to fix the state of affairs they must liberate the price once more, allowing the market to determine the price of production. As suppliers closed down long ago abandoning their supply networks it takes a short while for supply to meet demand once more. During this period the price of bread goes into the stratosphere as people bid up the cost of the present scarce bread. Eventually market forces will drive the cost down over time to a point of equilibrium.

How does bread relate to interest rates? Its the same principle. Governments can set the price low but eventually the market will force its hand to raise the price, with the price going into the stratosphere. This is why we had 18% interest rates when Thatcher tried to put things right, or when Paul Volker put US rates above 20%. The policy makers were just chasing the market, trying to reign in inflation which was driving the free markets interest rates haywire. During the 1973/74 credit crunch Central Banks had the same idea as now, that is they lowered interest rates in response to the recession, but the longer and lower you try to hold down these prices the higher and sharper they have to eventually rise as many an older reader will painfully remember.

The BoE could be forced to raise interest rates under a number of scenarios. They may have to raise rates if there is a currency crisis with the pound falling as investors flee. Like the bread situation above, they will put off the price liberation, instead they will put currency controls or limits on capital (like bread rationing) in order to try and provide a short term fix. Eventually the market beats them and they have to hike rates as over the long run a lack of foreign investment creates a less dynamic economy and higher inflation.

It could be forced to raise rates if inflation got out of hand with the free market demanding increased real rates of return to negate the depreciation of the currency. Even if central banks keep buying government debt at artificially low rates, private banks still lend to all of us, with this mortgage rates could rise for example. Its similar to what we see now, despite base rates at near zero average mortgage rates are far higher as the free market realises there are inflation risks over the medium to long term. They are also hedging against their potential losses as the government props them up.

However they could do none of the above. They could keep rates low, spurring on more inflation as the government can no longer afford increased rates on the ever expanding debt. They by pass the market and lend to individuals themselves at these rates. They print money directly to cover the shortfall in the various government payrolls. Currency collapse is ensured at this point as it becomes clear to all that its time to pack your suitcase. Marc Faber believes this is the conundrum America will face at some point in which its policymakers will not rise to challenge, instead they will shirk away from the correct action to take, opting for runaway inflation. At some point the stock market of such a country would be a screaming buy, just at the depths of the seemingly never ending hyperinflation when the average person has lost all confidence.

Could the UK be the Canary down the Western coal mine? There are many other nations with serious issues that have faced or will face issues sooner, but I wouldn't put them in the same tier as Britain, a nation who still has a recent innovative and industrious past. She could however, be the warning signal for many other Western nations that mass inflation and/or interest rate rises are just around the corner. Either option ain't pretty.

By Phill Tomlinson

http://theageofstupidity.blogspot.com

The Age of Stupidity "There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.", Ludwig Von Mises

© 2009 Copyright Phill Tomlinson - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

"We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step."

"We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step."