Bernanke is Not the Problem But the Rogue Fed Institution

Politics / Central Banks Dec 04, 2009 - 01:00 PM GMTBy: Andy_Sutton

Yesterday a poll was released that only 21% of Americans support giving Helicopter Ben Bernanke a second term as chairman of the US Fed. This compared to 41% thinking that someone else should be given the job. I must say this is quite an improvement. I wonder if Rasmussen would have been able to say 2 years ago that 21% of Americans even knew who Bernanke was? If nothing else, the financial crisis and economic debacle of the past two years have certainly shone some much-needed but unwanted light on the Fed and its clandestine activities. As much as I disapprove of Bernanke’s policies and his handling of virtually every aspect of what has gone on, I’ll be the first to admit that Big Ben isn’t the problem. No, it isn’t him or Greenspan, or Volcker. It’s the institution itself that is the problem.

Yesterday a poll was released that only 21% of Americans support giving Helicopter Ben Bernanke a second term as chairman of the US Fed. This compared to 41% thinking that someone else should be given the job. I must say this is quite an improvement. I wonder if Rasmussen would have been able to say 2 years ago that 21% of Americans even knew who Bernanke was? If nothing else, the financial crisis and economic debacle of the past two years have certainly shone some much-needed but unwanted light on the Fed and its clandestine activities. As much as I disapprove of Bernanke’s policies and his handling of virtually every aspect of what has gone on, I’ll be the first to admit that Big Ben isn’t the problem. No, it isn’t him or Greenspan, or Volcker. It’s the institution itself that is the problem.

Mandate #1 – Price Stability

Mandate #1 – Price Stability

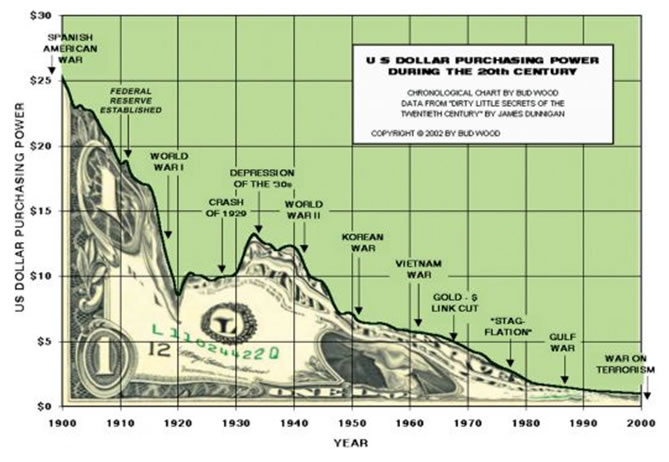

When the private Federal Reserve was chartered in 1913 by the unconstitutional Act of the same name, it stated two specific mandates: maximum employment and price stability. Those were to be the Fed’s areas of activity. However, with virtually no accountability to the American people (except vis a vis the President who appoints the Chairman and the Congress who invariably rubber-stamps such appointments), the Fed was turned loose on the undefended US Dollar.

For years, the American public has been duped into thinking that inflation is necessary for economic growth. This outright lie will likely compete for the title of biggest financial fraud in history. Aided by this unawareness, we have seen a fairly standard 5% rate of annual inflation institutionalized into our economic system. For quite a while, this inflation went virtually undetected as it feasted mainly on the prosperity America had achieved, particularly after the Great Depression. As a nation, we began to spend away our surpluses and attach claims on future economic activity through the great society programs of the 1960’s and the perpetuation of New Deal programs such as Social Security.

By the 1970s, however, we’d run short of real money and dealt the global financial system the shock of accepting paper dollars in settlement of our out of control deficit spending. This resulted in a period of increased instability in the 1970s and twin severe recessions. By this time, the devalued Dollar had destroyed enough of our purchasing power that it became necessary in many cases for a second breadwinner to work to maintain the standard of living. In the 1980s and 1990s, Americans began to rely increasingly on consumer credit to bridge the gap left by the waning dollar, and for much of the first decade of this new century, the house became the ATM as another gap filler.

It is no wonder that the recent contraction in consumer credit isn’t touched by the mainstream press; it is that critical to economic growth. This contraction is one of the biggest reasons the federal government has stepped in with record deficit spending. To keep the economic charade going, it has had to.

The above bevy of charts and data should make it perfectly clear that the Fed has failed in spectacular fashion in terms of price stability. The only thing it has been successful in is ensuring that the devaluation of the Dollar occurred gradually, over time, so as not to alarm Main Street.

Mandate #2 - Maximum Employment

The second part of the dual mandate was maximum employment. In this regard, the central bank has done only a slightly better job. America in general has ranked fairly high globally in terms of low unemployment. However, one thing that must be noted is the Fed’s role in assisting with the exportation of American industry and the high paying manufacturing jobs that went with it. How did the Fed do this? Conventional wisdom would assert that it was solely government trade policies and agreements such as GATT and NAFTA that ruined our manufacturing base. That is certainly true, but these government policies had plenty of help.

A consistently weaker dollar means export advantages. However, there was (and still is, albeit a smaller one) a significant gap between labor costs in foreign countries like much of Asia and the US. So US-based companies could export their manufacturing activities abroad to take advantage of the cheap labor while having export advantages over their foreign competitors because of the weak dollar.

While the bottom line was certainly money and power, it is debatable whether the de-industrialization was done to flood America with cheap imported goods to mask the loss of the Dollar’s purchasing power or if it was done merely to consolidate global power by knocking down the standard of living of the first world. I realize this is going to be a difficult point to argue when one can walk into a store almost anywhere in the country and purchase a myriad of items at ‘Rollback’ prices. However, if you take a look around you and imagine what would be there if it weren’t for the debt load, I think you’ll get a pretty good picture of what is going on here.

What is undeniable is the transition from a goods-producing economy to a service-oriented one. The biggest problem with a country full of employees performing services is that many of these services cannot be exported to pay for the goods we now must import. Despite the technological developments of the past 10 years, a haircut still cannot be exported to China. To be honest, the Fed’s direct impact on the job market has traditionally been much less than its impact on price stability. However, the fact that there has been a covert move to de-industrialize the first world cannot be denied. The fact that much of the impetus for this move came from the policies of the IMF and World Bank with assistance from regional central banks is equally real. A good take home message from this is that central planning almost always works against personal liberty and human rights.

Ramifications

Unfortunately, what has taken place over the years is that the Fed has used these two broad mandates to create for itself a battalion of illicit activities, to the point where mere disclosure of what these activities are would cause an instant depression if you listen to Ben Bernanke, Frederic Mishkin, and others. Attempts to shine the light of day on the Fed’s activities are painted as being ‘dangerous’. I’m sure they are dangerous – to the status quo. Even more disturbing is the Fed’s ability to buy out the entire country while Congress worries about state dinner party crashers and how many subpoenas should be issued. Few commentators have bothered to mention that when the Fed buys $852 Billion in mortgage bonds, it is buying the mortgages of American homes. Maybe your mortgage is now held by an offshore banking cartel even though your mortgage contract was with Countrywide, BAC or any of a thousand originators. Does that bother you? It should.

No, this is not a problem of a single rogue Fed Chairman. It is a problem of a rogue institution, which has stretched way beyond its original charter – and an unconstitutional charter at that. Recent moves to audit the Fed, while noble, will only go so far. I had the opportunity to chat with G. Edward Griffin about this very topic and share his concern that the audit movement will act as a lightning rod for public outrage while allowing the institution itself to continue in a business as usual manner. Congress has the power to yank the Federal Reserve’s ticket; it is about time they used it to give the Fed a 100th birthday present - a pink slip.

Addendum- It should come as little surprise to anyone that a truly out of nowhere jobs report comes out just as Bernanke is ‘under fire’ on Capitol Hill. It would be nearly impossible to count all the times this has happened over the past year or so when either the stock market or some political figure has needed a boost. What must be noted is that goods-producing jobs continue to disappear, and that much of the ‘good news’ in the jobs report comes from the fact that temp agencies signed on 52,000 workers in November. Much ballyhooed about this trend is the fact that temp agencies have been adding staff for the last 4 months now. What should be of concern is that there appears to be almost no conversion of those temp jobs into permanent positions at this point in time.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.