Natural Gas Vehicles vs Electric Vehicles

Companies / US Auto's Dec 02, 2009 - 07:38 AM GMTBy: Richard_Shaw

If we have more natural gas than we can currently use; if natural gas vehicles use a proven technology; and if we have developed natural gas pipelines that lose less energy than high tension electric transmission lines; why do we seek electric vehicles when the technology is not developed for distance travel, when electric power losses over long distance transmission are substantial, and when we do not have the electric production or transmission capacity to supply a major conversion from gasoline to electric vehicles?

If we have more natural gas than we can currently use; if natural gas vehicles use a proven technology; and if we have developed natural gas pipelines that lose less energy than high tension electric transmission lines; why do we seek electric vehicles when the technology is not developed for distance travel, when electric power losses over long distance transmission are substantial, and when we do not have the electric production or transmission capacity to supply a major conversion from gasoline to electric vehicles?

If we face brown outs and rolling managed electricity outages in summer months due to air conditioning, how do we expect to handle millions of automobiles plugging into electric sockets as they arrive home from work each day?

If we possess all of the necessary resources domestically in the U.S. to convert to a proven technology, natural gas based vehicle system, but must rely on batteries produced in China, Japan, Taiwan and Korea to power an underdeveloped and unproven technology electric vehicle system, why not natural gas instead of electricity?

Natural gas producers, storage and transmission companies are a more sensible system to rely upon than electric power plants, electric transmission lines and foreign produced electric batteries from both an economic and national security perspective.

If that logic stands up over time, and if the flaws in the wide scale adoption of the pure electric car concept are seen more broadly, then natural gas producers, storage and pipelines companies should outperform current expectations.

Such an investment approach would require a long patient wait, but if a reasonable dividend yield is available now for some natural gas related stocks, the long-term capital gain return could surprise on the upside.

We would tend to favor pipelines over producers at this point, because the oversupply of natural gas is still growing, while there is not a correspondingly large oversupply of transmission capacity.

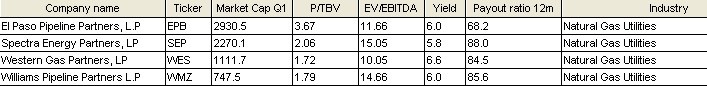

Here are four pipeline companies that may be interesting in terms of the natural gas versus electric vehicle argument (SEP, EPB, WES, WMZ).

The rating after each symbol is the Wright’s rating for liquidity, financial strength, profitability and growth (see the legend for Wright’s ratings).

- SEP: BANN rating

- EPB: BCNN rating

- WES: CBNN rating

- WMZ: CCNN rating.

None is a recommendation by us. All are suggested for further research and consideration.

Some Fundamental Data

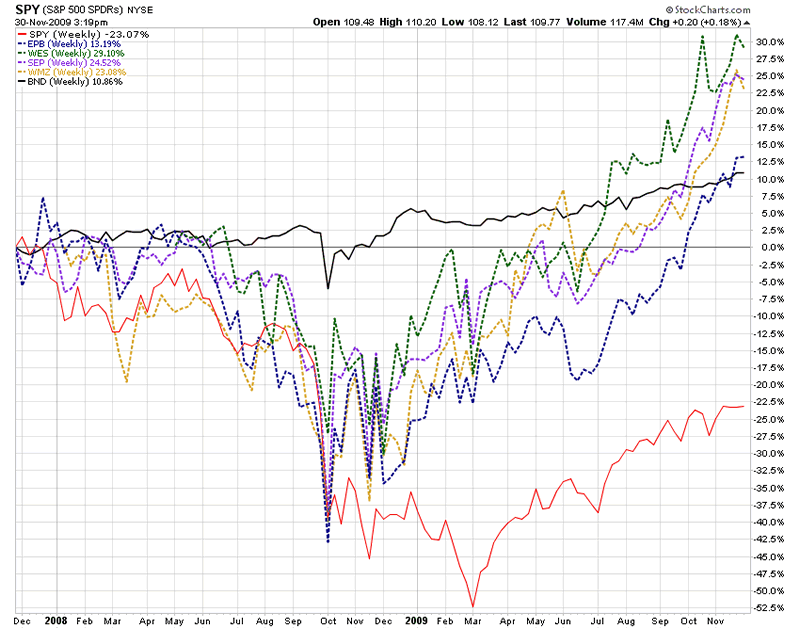

2-Year Performance Versus SPY and BND

Compliance Disclosure:

We own SPY and BND in some managed accounts. We do not own other mentioned securities. We are a fee-only investment advisor, and are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.