The Global Gold Bull Market

Commodities / Gold & Silver 2009 Dec 02, 2009 - 01:44 AM GMTBy: Adam_Brochert

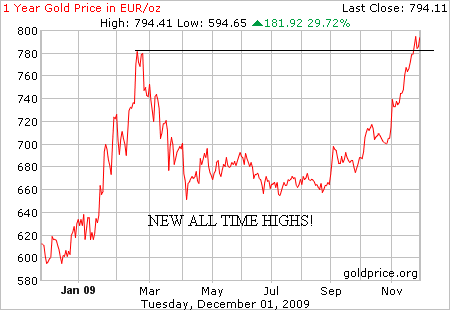

Does anyone remember how so called Gold experts (like Jon Nadler over at Kitco.com) were recently saying that the move in Gold wasn't meaningful because it was only making new highs in U.S. Dollar terms? Are all those experts currently publishing articles to admit how they were pretty far off base? Since I already know the answer to this question, here's a 1 year price of Gold priced in Euros (from goldprice.org):

Does anyone remember how so called Gold experts (like Jon Nadler over at Kitco.com) were recently saying that the move in Gold wasn't meaningful because it was only making new highs in U.S. Dollar terms? Are all those experts currently publishing articles to admit how they were pretty far off base? Since I already know the answer to this question, here's a 1 year price of Gold priced in Euros (from goldprice.org):

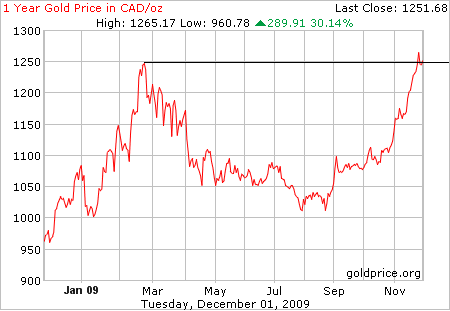

How about in loonies (Canadian Dollars, chart also stolen from goldprice.org):

And how about the currency that is so strong the government officials backing it are now having secret meetings trying to figure out how to destroy it (Japanese Yen, same source for the chart):

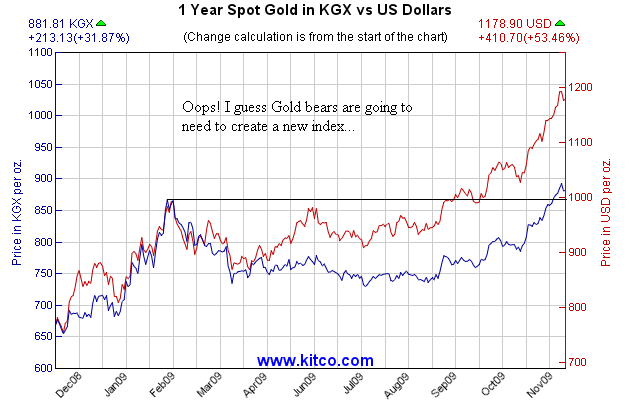

Finally, how about using Kitco's own index designed a few months ago to make the Gold bull market break out look like a phony (from kitco.com):

Gold has NOT made new highs in Australian Dollar terms on the current move (yet...), but it is at new highs in Swiss Franc terms. All fiat paper currencies are sinking relative to Gold. Confidence in paper is declining universally.

Another question: What happened to the "heavily short" commercial position that was going to squash the Gold bull break out like a roach?

What about the IMF sales being bearish?

The list goes on and on. There are a few take-away points from this exercise in antagonism.

First, a bull market does what it wants to do, which is go higher. It does this when it is overbought, oversold, when it's not supposed to, despite the daily news, and despite what any expert (or internet geek like yours truly) has to say.

Second, the wall of worry for Gold remains intact despite the short-term froth that needs to be corrected.

Third, all paper currencies are sinking relative to Gold. The U.S. Dollar Index is not a valid construct for Gold because it is simply a measure of the "worth" of paper federal reserve notes relative to other paper currency debt tickets.

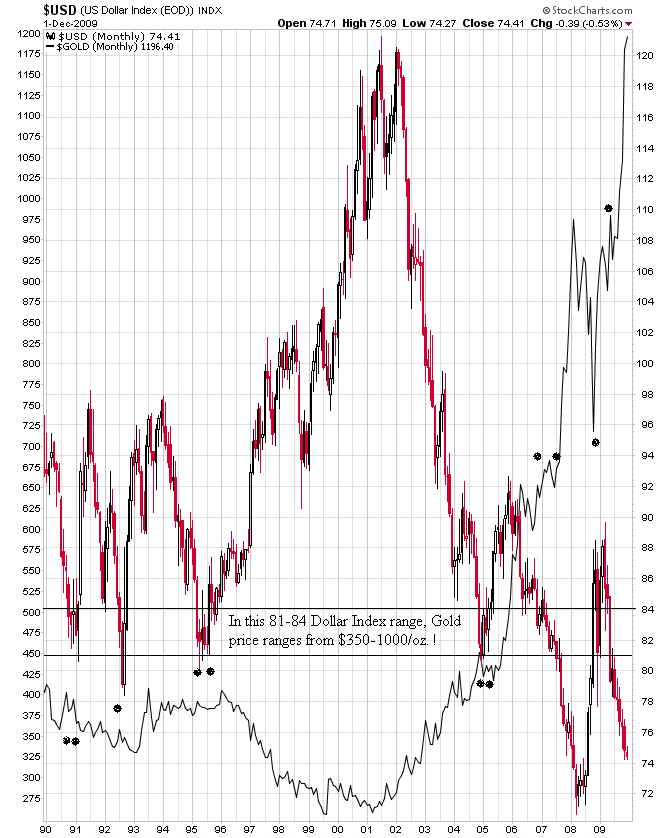

Don't believe me on this last point? Here's the proof: A 20 year monthly chart of the U.S. Dollar Index (candlestick plot) that also includes a background black linear plot of the U.S. price of Gold ($GOLD):

Since 1971, the monetary system has been anchorless. The U.S. Dollar Index is as useful a measure of the value of our paper currency as the interest rate is. In a vacuum, relative values are meaningless. Gold is rising in all currencies right now because they are all being debased. How can Gold be making new highs in terms of Japanese Yen when the Yen Index is skyrocketing higher right now?

The fiat masters/central bankstaz would prefer you keep watching the currency indices! When the U.S. Dollar finally has its long-overdue rally relative to other paper debt tickets, it doesn't mean the Dollar is really rising in value. It may or may not be rising in value - the U.S. Dollar Index doesn't supply such information! Of course, as hard core deflationists are quick to point out, the Dollar has outperformed the stock market over the past 10 years or more. Yeah, and so has a shiny piece of metal, only that piece of metal has performed much better than the Dollar!

I am not trying to be a cheerleader here. Gold is overbought and could easily plummet 10% from here very quickly (though not right this second, since Gold sliced through $1200/oz like a hot knife thru butter in Asian trading as I started typing this). Keep the bigger picture in mind, though. Gold consolidated at and below $1000 for 1.5 years before the breakout. A 20% move to $1200 over a 3 month period is not enough of a bull thrust to stop this move after such an important break-out. A mid-point consolidation is what's needed and that's all. We are already looking at $1400-1500/oz before the spring is over if recent history related to big breakouts in the Gold price are a reliable guide.

U.S. Dollar-centric deflationists (a la Prechter) are running out of explanations for why Gold is 20% above its all-time highs unless they finally concede that Gold is acting as a currency and a stronger one than the the U.S. Dollar in this secular asset deflation/credit contraction period. I think $1000/oz. is the new floor for the Gold price and $2000/oz. is now in the cards.

The U.S. Dollar-centric deflationary premise is reasonable as long as one ignores global capital flows and assumes that central banks and governments act within the bounds of reasonable behavior. The unconstitutional, non-federal, for-profit federal reserve corporation is now buying mortgage paper (over $1 trillion at last count but since they are above the law, who knows the true figure?) and bad debts of all kinds (the "fed" is now buying insurance companies, which is illegal but no apparatchiks seem interested in trying and/or able to stop them). Obama is expanding the War on Terror against the imaginary enemy in Afghanistan and trying to create a new health care entitlement despite the fact that we are desperately broke.

I believe the U.S. Dollar is due for a rally against other monopoly money, but is this really meaningful at this point in the cycle when every country is willing to counterfeit more debt and use the debt tickets to support other debt in an insane attempt to force further currency debasement? This is the new game of apparatchik chicken the current Gold price is reflecting. Gold is reflecting the loss of confidence in global leadership and loss of confidence in the stewardship of the confetti that serves as our transactional money world wide.

I personally think global leaders now wouldn't mind starting a bubble in the Gold price, since such a bubble would scare people back into spending again. They are desperate and willing to try anything at this point, despite their distaste for a rising Gold price. Don't think the central bankstaz won't profit from a Gold bubble - they will and their profits will be more than yours. India is not and never has been "dumb money" when it comes to Gold - so whey are they buying a big chunk of Gold at over $1000/oz? If we are in a Gold bubble right now, it is the first or second inning.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.