Dubai Property Crash Delivers Debt Black Swan to Deflationists

Stock-Markets / Financial Markets 2009 Nov 29, 2009 - 06:52 AM GMTBy: Nadeem_Walayat

This weeks major market event came late in the week whilst American's took the day off on Thursday for Thanksgiving, Dubai declared that it will be freezing repayments for at least 6 months on part of its approx $90 billion or so of visible debt at the state run Dubai World company ($20 billion). The ratings agencies responded by cutting the ratings on Dubai bonds to junk status.

This weeks major market event came late in the week whilst American's took the day off on Thursday for Thanksgiving, Dubai declared that it will be freezing repayments for at least 6 months on part of its approx $90 billion or so of visible debt at the state run Dubai World company ($20 billion). The ratings agencies responded by cutting the ratings on Dubai bonds to junk status.

Whilst the consequences of Dubai's debt fuelled real-estate boom and subsequent bust should not come as any surprise, however oil rich Abu Dhabi coming to its own inevitable shock realisation that it just cannot afford to keep footing bailout bill after bailout bill for the imbeciles just a few sand dunes away which triggered the market reaction as the consensus expectation had been that they would. However this is not September 2008 and Dubai Worlds debt freeze / default is not on anywhere near the scale to that of Lehman's bankruptcy so the perma-crash is coming NOW crowd will AGAIN be disappointed, just as they have been on EVERY stocks correction during the past 9 months!

Analysts for the more mainstream agencies such as Reuters called the news out of Dubai a black swan event (A black swan in the desert), well to the mainstream press these days virtually everything is now a black swan! I assume Nassim Taleb never meant for events such as Dubai's debt freeze to be termed as a Black Swan? After all the whole point of the black swan theory is to suggest that black swan's are rare and totally unexpected events, i.e. along the likes of Arch Duke Ferdinand's assassination triggering World War 1, and not one of the the dozen or so in-debted teetering on the brink economies eventually going pop !

I mean there is a long trail of suspect economies dating back to September 2008 when Iceland first went pop, with a dozen or so contenders other than Dubai including Ireland, Venezuela, Argentina, Greece, Portugal, Spain, the whole eastern block and not forgetting Britain! Its only a matter of time before another country goes pop, which one could be next ? Well going by the credit default swap risk prices on sovereign debt, Venezuela tops the list, though closer to home I would definitely be wary of Greek stocks and bonds! the safest in terms of default risk are France and Germany which by and large missed out in the debt fuelled boom.

I specifically warned about Dubai back in March 2009 that the 22% drop in property values at the time where not even half way there, that projected to something along the lines of an average drop of 50%. Where are we today ? You guessed it average property prices in Dubai are now 50% lower than the peak! Which says a lot for the so called Dubai property experts back in March who were calling a bottom for Dubai property prices, though if one took an look under the bonnet one would see that these 'experts' had a vested interest in rising prices! Much as we saw with our very own soon to be bailed out mortgage banks in the UK such as HBOS which pumped out soft landing propaganda during 2007 and first half of 2008, which I repeatedly ridiculed as utter gobbledygook.

March 2008 - UK House Prices Tumbling- Interest Rate Conundrum

Britains biggest mortgage bank also gave a positive spin on UK House prices in March 08, the Halifax's Chief Economist continued to suggest that there will be no fall in UK house prices this year. - "strong underlying fundamentals will continue to support the market throughout 2008". "Over the past year, the average price of a home in the UK has increased by £4,390 to £196,649," he commented. "Whilst the housing market has slowed over the past six months, it is supported by sound economic fundamentals. Interest rate cuts by the Bank of England are also helping to underpin house prices,".

My earlier analysis of February 2008 illustrated why it was impossible for UK house prices to avoid going negative in April 08, not only that but even if house prices stabilised and no longer fell, that the property market would still be heading for a sharp year on year fall for the quarter April to June 2008, which the media would eventually term as a mini-crash for the UK property market as the below table from the February article illustrates.

8th March 2009 - Dubai Property Market Crash

A warning to those investors being swayed, the Dubai property crash has only just begun which seeks to correct a 6 year property boom. The Dubai construction boom is expected to come to an imminent halt with many partially finished projects littering the landscape as investors walk away from the off plan deposits in the wake of the ongoing crash in property values. It remains to be seen how much of this excess supply will eventually be reclaimed by the desert as many foreign investors in off plan Spanish properties are painfully experiencing. My expectations are for an average 50% retracement in Dubai property prices from the peak, with many of the more over-leveraged high end properties possibly crashing by as much as 75%.

So where next for the Dubai property market? Well the crash is NOT over, we are in free fall territory towards a 75% drop! Maybe the worst case scenario may yet come true i.e of the desert reclaiming large chunks of abandoned developments?

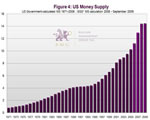

The Dubai debt crisis gave plenty of skin deep copy text for deflationists to continue betting on another imminent Market Collapse, that FAILED to materialise Friday! However to interpret what is probably likely to follow one needs to peel away several layers than opt for the obvious i.e. debt deleveraging deflation, as I continue to develop the inflationary mega-trend over the coming weeks as a consequence of ever greater money printing in the face of escalating debt burdens that ensure INFLATION. Your money will be worth significantly LESS as a consequence of Money Printing! The Deflationists Advocate the WORST solution of cash being King. Stocks are Up more than 50% since March, Gold is up more than 25% over the past year, does this sound like cash is king to you?

My good Deflationist buddy, Mike Shedlock questioned my inflationary logic earlier in the week to which I replied here - Mike Shedlock, a Deflationist Lashing Out at Nouveau Inflationists?

Don't get me wrong, to be of a deflationary mind set from mid 2008 and into March 2009 was correct, but being stuck there for the past 9 months is tantamount to giving up Most of not ALL of any gains for being right during the DEFLATIONARY downdraft, which my analysis has concluded was a temporary corrective wave in a ocean of inflation. Will we have more deflationary corrections ? Off course we will (great buying opportunities!), Will they be as severe as 2008/09? No! How will one protect ones wealth and make money ? By gearing towards accumulating towards higher overall inflation and its consequences which I will elaborate upon further in the coming weeks.

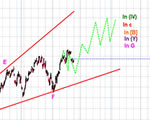

Back to the markets, the Dubai debt default fears hit the financial markets hard on Thursday which resulted in sharp drops in stock markets which saw the Dow trade 200 points lower in London to 10,260, commodities that eventually included Gold tanked towards 1,130 and the U.S. Dollar rallied back above 75 after its earlier slice through it, the dollar buy trigger remains at a distant 77.00, and yes the bull scenario has now been negated so I'll come back to it at a later date.

Stocks on achieving the target high of 10,425 continue to target a normal correction towards the previously stated target of Dow 9,900/50. Gold volatility is high so immediate term trends are not clear but it is VERY OVERBOUGHT, especially as both initial targets of $1,100 and $1,200 have been achieved in ultra quick time on news that central banks are now also starting to belatedly pile into gold, the next target of $1,350 was originally set for the second half of 2010 which now looks achievable during the first half, though as I voiced at the time I would not be surprised by Gold even hitting $2,000, so where's the deflation in that we keep hearing?, instead all we get is excuses as to WHY Gold has NOT DEFLATED YET?

Fibonacci Trading - Ebook costing $79 for Free! You have less than 4 days to download (until midnight 2nd December).

Our friends at EWI have presented our readership with a great opportunity to learn the role Fibonacci %'s can play in determining price targets with this great FREE resource worth $79. The ebook is a concise resource at just 42 pages and FREE to download, though only available until 2nd December. So grab it while you can!

Source: http://www.marketoracle.co.uk/Article15405.html

Your trend monetizing inflation mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Natural Gas Screaming Long-term Inflation Mega-trend Buy, But UNG... |

By: Nadeem_Walayat

This is the second in a series of analysis on the Inflationary Mega-trend that is anticipated to unfold over the next decade. The last article (Deflationists Are WRONG, Prepare for the INFLATION Mega-Trend) concluded that ever escalating debt fuelled stimulus coupled with never ending Quantitative Easing sows the seeds for a building inflationary outlook far beyond the deflationary impact of debt deleveraging as the DEFLATION of 2008 becomes increasingly old news which is evident in the reaction of near across the board asset and commodity prices during 2009 which WILL translate into higher consumer price inflation during 2010.

| 2. Investors Buy Gold As Central Banks on Course to Crash World Economy |

By: Bob_Chapman

Investors buy gold when there is inflation and when there is a flight to quality. They buy gold when they no longer trust currencies, due to government or central bank profligacy. Due to those and other reasons gold has broken out to new highs. It could well be that gold may never see $1,000 again. Long ago the world’s central banks set the course for a planned collapse of the world economy to implement world government and there is now no turning back. We have proof stretching back to 1965 that intervention by the Treasury and the Fed was taking place in the gold market.

| 3. Financial and Economic Situation Could Get Ugly Fast |

By: Mike_Whitney

Things could get ugly fast. With the Democrats backing-off on a second round of stimulus, the Fed signaling an end to quantitative easing, and Obama moaning about rising deficits; there's a good chance that the stumbling recovery could turn into another sharp plunge. Bank lending is shrinking, consumers spending is off, housing prices are falling, unemployment is soaring and the wholesale credit markets are in a shambles. This isn't the time to slash government support in the name of "fiscal responsibility". Obama needs to ignore the gloomsters and alarmists and pay attention to the Nobel laureates like Joe Stiglitz and Paul Krugman. They're the guys who know how to steer the ship to safe water.

| 4. The Day the U.S. Dollar Collapsed |

By: John_Galt

The following story is a potential fictional time line for the day the dollar died. I hope not to instill fear or loathing but to give everyone some perspective on a POSSIBLE outcome which does not really take much of a reach to come to any conclusion. Despite popular belief and promises from those who wish to rob you of your savings and investments, the collapse of the dollar might just be an event measured in hours, not days as their control is not what it seems….

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Gold Mount St Helens About to Explode Higher |

By: Jim_Willie_CB

Not in the last few years have conditions been aligned for a truly explosive upward move in the gold & silver prices. A confluence of factors simply could not be more bullish, promising, and powerful. The psychology has also been raised in awareness on a global basis, as financial centers, media networks, and common folks have coordinated their recognition of the gold bull. They comprehend perhaps two or three of the main factors why gold is rising, out my stated list in a recent article "13 Reasons For a Major Gold Breakout" in September (CLICK HERE). The trio of fundamentals, psychology, and technical chart constitute the trifecta that will push gold & silver to extreme heights, and crush the silly shorts with their myopic half-baked tactics that are certain to make them roadkill, then someone else's lunch.

| 6. Stock Market S&P 500 Trend Analysis and Forecast Update |

By: David_Petch

The following article was published for the benefit of subscribers on Saturday November 23rd 2009. All indices and commodities are trading inversely to the US dollar index at present, so as long as the defined trend of the USD remains intact, everything else should trade inversely. Gold is presently in a parabolic move, which has repercussions mentioned a few days earlier…on to analysis of the S&P 500 index:

| 7. Government Sovereign Debt Spirals |

By: John_Mauldin

I have been writing about sovereign debt risk for some time. Japan, Spain, Italy and Portugal are all facing serious fiscal deficits and funding problems within a few years. But Greece may be the first country to hit the wall. In today's Outside the Box, we look at a short column by Ambrose Evans-Pritchard of the London Telegraph on the problems facing Greece. Greece will soon be faced with deciding which bad choice to make among a very small set of really bad, difficult choices.

| 8. Marc Faber Sees Financial Crash and War Against an Invented Enemy |

By: Mike_Shedlock

Marc Faber, the Swiss fund manager and Gloom Boom & Doom editor, said eventually there will be a big bust and then the whole credit expansion will come to an end. Before that happens, governments will continue printing money which in time will lead to a very high inflation rate, and the economy will not respond to continued stimulus.

| Subscription |

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

John Bingham

01 Dec 09, 08:17 |

Market Calls

Nadeem I continue to read your posts and find them interesting but can you lay off calling everyone on their bad market calls. If you recall on 7th Oct 2007 pretty much the market high before stocks turned into a rout you said and I quote "In Conclusion - I would view any future sell offs as buying opportunities, this bull market is behaving as though it has just begun rather than having run for over 5 years! It may remind some of pre 1987, but to me it looks more like pre 1995. But do expect volatility in this Jackal and Hyde BULL market as the market moves between rate rising and cutting expectations within an overall up trending stocks bull market. My favorite sectors were mentioned in the article of 22nd August 07 UK Housing Market Crash of 2007 - 2008 and Steps to Protect Your Wealth , of which only the oil majors are so far failing to perform which implies lower oil prices.My only regret is that I had not bought more during the recent sell off." |

|

Nadeem_Walayat

01 Dec 09, 09:11 |

Market calls

Wow, you have to go back over 2 years to find a wrong call ? But you don't bet against a bull market until AFTER its peaked! Otherwise you would not have enjoyed the 2003-2007 bullrun, nor the current bull market from March ! Though AFTER the market started to show signs of peaking I did start to change my outlook just a few weeks later i.e.

I don't 99.9% of the time call others on their market calls, its just that the deflationsists by advocating cash is king are going to lose you ALL of your money ! |

|

David Lloyd

03 Dec 09, 06:10 |

Less Than 2 Years Ago

Your constant predictions of the pound marching towards its inevitable parity with the dollar was much less than 2 years ago. |

|

Nadeem_Walayat

03 Dec 09, 10:40 |

British Pound

The bear market target was £/$1.37 Original bear market call was on break below £/$1.98, Sterling would target parity on break below the £/$1.37 target, which has held. http://www.marketoracle.co.uk/Article7160.html Immediate short-term support levels are at £/$ 1.57 and £/$ 1.56. Immediate trend objectives are for a corrective rally to above £/$1.70 , to be followed by a downside test of £/$1.53 on break of which Sterling would target the longer term objective of £/$1.37

The next phase on GBP was dependant upon the dollar bull market scenerio which, yes has been negated on break below USD75. |

|

Nadeem_Walayat

04 Dec 09, 19:58 |

How to trade / invest

All forecasts / scenerios are best guesses. Actual entries / exists are on the basis of price triggers i.e. black or white decisions. In this regard I am plannign to write an ebook which will endeavour to explain how to trade / invest which I will give away for free, it is perhaps a couple of months away as my n1 priority is the inflationary mega-trend ebook which I am aimng to complete this month Best. |