Was March the True Stock Market Bottom? Here is How You Will Know Soon

Stock-Markets / Stock Index Trading Nov 28, 2009 - 05:39 PM GMTBy: Q1_Publishing

The Associated Press calls them “fully invested bears.”

The Associated Press calls them “fully invested bears.”

It’s the most unique phenomenon of this rally. They are the large and successful group of investors – both individual and institutional – who see the economic reality around them and are naturally bearish. However, they’re still fully invested.

That’s where we’ve all been in the past few months. We know the reality. We haven’t forgotten history will likely look back on this rally as a bear market rally. But we still have recommended buying stocks and continuing to do so until, there’s really no other way to put it, they start to go down.

Since the rally began, every week has been filled with reminders of the old trading adage – the tough trade to make (i.e. buying stocks when economy is down) is usually the better trade.

Still though, as the “fully invested bears” turn into “fully invested believers,” the most discerning investors are focusing on when this rally will end.

The Greatest Test of All

So far the rally has passed every “test” in the past few months.

Earnings seasons in the midst of a deep recession – no problem.

Bad news after bad news from the economy – no worries here.

Memories of the market decline from late 2007 through March of 2009 when the S&P 500 lost almost 68% of its value – totally forgotten.

Together they formed one of the greatest walls of worry in decades. The market has steadily climbed right over it in the past few months.

Now though, however, the markets are about to face the biggest test of all.

It’s a test that will likely determine the market’s next big move. It will signal where you’re going to need to have your money for maximum benefit. It will let us know whether the recovery is real or whether it’s the mirage we’ve expected in an otherwise desolate bear market.

The true test for this rally will be whether the market can hold on and add to its recent gains over the next few months. Here’s why.

Small Caps Lead Led the Way

Historically, small-caps lead the way when the markets recover from a cyclical bear market that coincides with a recession.

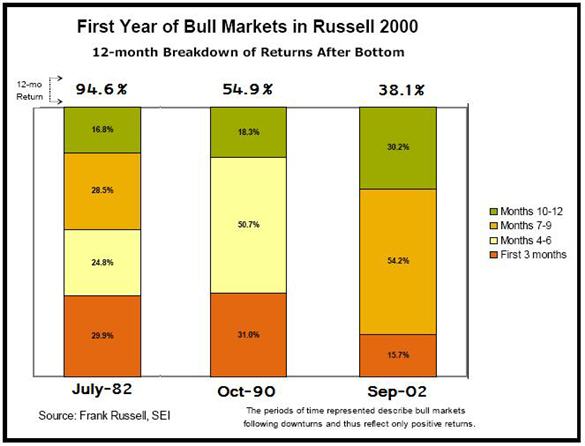

For example, small cap stocks (tracked by the Russell 2000 index) surged 95%, 55%, and 38% from the stock market bottoms in 1982, 1990, and 2002. In those rallies the Russell 2000 beat the Russell 1000, made up by the 1000 companies with the largest market cap, by 34%, 18%, and 14%.

The same has held true for this rally. Despite a recent pull back, the Russell 2000 is still up 73% from its March lows. Meanwhile the Russell 1000 is up only 53% for a difference of 20%.

The thing is though, as the chart below reveals, the past market rallies that coincided with genuine economic recoveries were spread out over time:

As you can see, small-caps continued to post solid gains in the 10th through 12th months following the start of the rally.

That’s why the big test will be what small-cap stocks will be able to do in the next few months. As they enter the final three of the 12 months following the rally’s start (which is just a couple weeks away), they’ll be signaling the economy’s – and eventually the stock market’s – next big move.

So far, the small cap stocks are signaling that our thesis that this rally is taking its last few breaths will be proven correct.

An Ominous Sign

Over the last few weeks the major indices have continued the uptrend. Lurking underneath the new highs for the Dow and S&P 500 though is a troubling sign in small-cap stocks. The Russell 2000 has declined from a high of 603 to a low of 586.

Although I wouldn’t call a 3% decline the end of the uptrend, the underlying catalyst for the downswing is signaling more trouble ahead for small-caps.

The problem is investors are pulling their money out of small-cap stocks.

Investors in the iShares Russell 2000 ETF (NYSE:IWM), which tracks the broad small-cap index, have pulled out more than $1 billion since the start of October. To put that in perspective, investors piled in more than $2.2 billion into the ETF between July and September.

If this trend continues, it would be a very bad sign for the continued strength of the rally. It signals investors are getting nervous and want the perceived safety (that’s a topic for another day) of large-cap stocks.

The Best Move to Make Right Now

Again, there’s no way to tell exactly when the rally will end. But history, however, will provide plenty of clues for the signs to watch.

In this case, the outperformance of small-caps in all past rallies, signal the market may be priced for an economic recovery, but it’s still not expecting it.

The next few months will be a big test for the markets. The recent weakness in small-caps, however, shows the markets may be ready to fail this test.

Still though, the best move to make is to continue to be part of the “fully invested bears.”

If you’re in, take what the market gives you and ride it for all it’s worth.

If you’re looking to get in, find the sectors showing some signs of strength and where the ratio of risk to reward is steeply tilted in your favor. That way if you’re right, you’ll do really well. If you’re wrong, you’ll take a very small loss and move on.

Opportunities like these still do exist. For example, in the next Prosperity Dispatch we’ll look at a group of overlooked and undervalued stocks which were one of the hardest hit when the markets came unglued last fall. Best of all, they have just started to recover. More to come soon.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.