Stock Market Long, Immediate and Short-term Index Trading Trends

Stock-Markets / Stock Index Trading Nov 23, 2009 - 03:48 AM GMT Welcome to The J.E.D.I. Way.

Welcome to The J.E.D.I. Way.

LONG-TERM TREND (> 1YR) OF THE MARKETS: DOWN

(See Long-Term Chart of the Dow Jones Industrial Average since 1974 for further details)

THE J.E.D.I. WAY'S LONG-TERM (or POSITIONAL) HOLDINGS [> 1yr]:

ProShares Ultra Short Real Estate (Ticker Symbol: SRS)

ProShares Ultra Short Gold (Ticker Symbol: GLL)

ProShares Ultra Short QQQ (Ticker Symbol: QID)

ProShares Ultra Short Financials (Ticker Symbol: SKF)

ProShares Ultra Short Industrials (Ticker Symbol: SIJ)

Note: The above portfolio was selected based on my analysis of the MONTHLY CHART below of the Dow Jones Industrial Average.

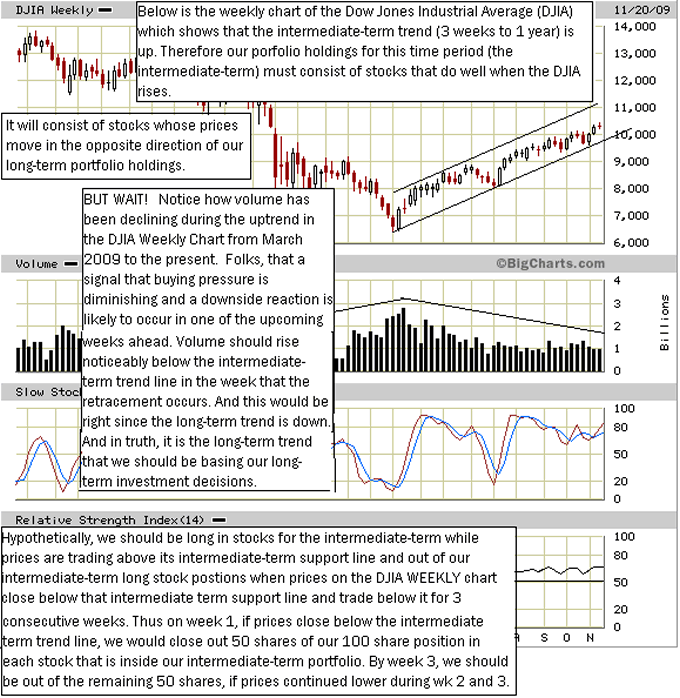

INTERMEDIATE TREND OF THE MARKET (Three weeks to 1 Year): UP

(See Weekly Chart of the Dow Jones Industrial Average for further details [below the long-term chart of the Dow Jones Industrial Average])

THE J.E.D.I. WAY'S INTERMEDIATE TERM HOLDINGS (3 weeks to 1 year):

NONE.

Note: This was based on my analysis of the WEEKLY CHART below of the Dow Jones Industrial Average.

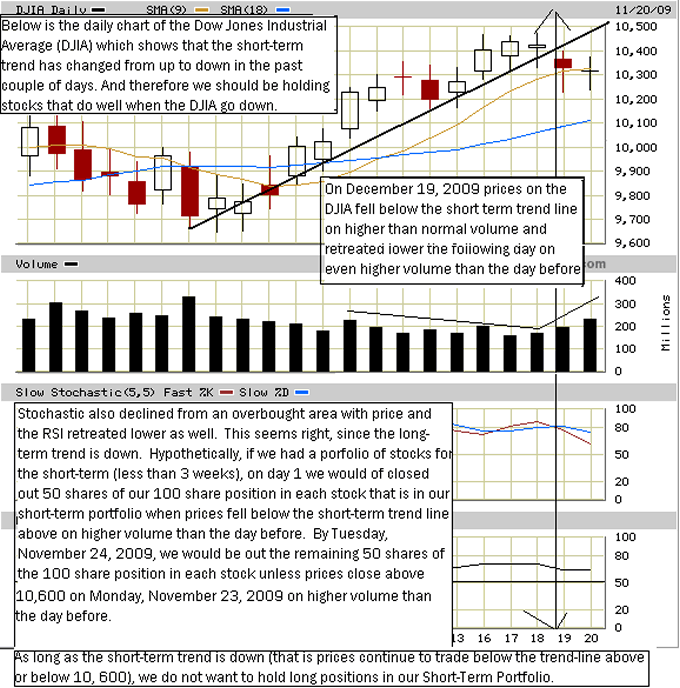

SHORT-TERM TREND OF THE MARKET (less than 3 weeks): DOWN

(See Daily Chart below of the Dow Jones Industrial Average for further details [below the Weekly Chart of the Dow Jones Industrial Average])

THE J.E.D.I. WAY'S SHORT-TERM HOLDINGS (less than 3 weeks):

NONE.

Note: This was based on my analysis of the DAILY CHART below of the Dow Jones Industrial Average.

LONG-TERM CHART OF THE DOW JONES INDUSTRIAL AVERAGE

INTERMEDIATE-TERM CHART OF THE DOW JONES INDUSTRIAL AVERAGE

SHORT-TERM CHART OF THE DOW JONES INDUSTRIAL AVERAGE

Until Next Time.

Thanks for listening.

Best Regards,

Patrice V. Johnson

E-mail : Patrice@stockbarometer.com if you have any questions about this trade or any other questions or comments.

If you are interested in continuing to receive our advice as your free trial, please click the following link to subscribe.

http://www.stockbarometer.com/pagesJEDI/learnmore.aspx

Important Disclosure

Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to buy/sell Futures, Options, Mutual Funds or Equities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this Web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

Performance results are hypothetical. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as a lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Investment Research Group and all individuals affiliated with Investment Research Group assume no responsibilities for your trading and investment results.

Investment Research Group (IRG), as a publisher of a financial newsletter of general and regular circulation, cannot tender individual investment advice. Only a registered broker or investment adviser may advise you individually on the suitability and performance of your portfolio or specific investments.

In making any investment decision, you will rely solely on your own review and examination of the fact and records relating to such investments. Past performance of our recommendations is not an indication of future performance. The publisher shall have no liability of whatever nature in respect of any claims, damages, loss, or expense arising out of or in connection with the reliance by you on the contents of our Web site, any promotion, published material, alert, or update.

For a complete understanding of the risks associated with trading, see our Risk Disclosure.

© 2009 Copyright Patrice V. Johnson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.