Recognising a Stock Market Top in the Making

Stock-Markets / Stocks Bear Market Nov 22, 2009 - 11:28 AM GMT John Whtehall writes: Risk Outweighing Reward for Financial Markets... Remember when the S&P was playing around 666-670? Remember that day? Of course we do. However, remembering how you felt on that day is far more important than glancing back at a date on a calendar. Most of the investing population remembers early March as if it were yesterday, but many investors are far too forgetful of the emotions elicited during that time.

John Whtehall writes: Risk Outweighing Reward for Financial Markets... Remember when the S&P was playing around 666-670? Remember that day? Of course we do. However, remembering how you felt on that day is far more important than glancing back at a date on a calendar. Most of the investing population remembers early March as if it were yesterday, but many investors are far too forgetful of the emotions elicited during that time.

I am not one of those investors. Presumably because I was long and loading up heavy from the mid- to low-700s and was literally sweating through my suit as we broke lower. The recent crisis and subsequent recovery has educated millions of investors, drawn in new ones, and has commanded more of the world's attention than ever to the markets. However, what gets lost in this education is the most important driver of the markets, and that is psychology.

How depressed we were at the bottom is roughly how happy we are right now.

An irresponsibly titled new book, Getting Back to Even, written by a nameless man who incorrectly associates the volume of one's voice with the accuracy of one's predictions, is a perfect symbol of investors' desperate desire to have their portfolios back and the incorrect assumption that the market somehow owes them something.

Friends, the market does not care whether you win or lose. Nor does it care to what extent.

Recognizing a market top in the making

Bears have been wrong since well, since March. At several points along the way, I have been one of them. However, I have to re-join the Meredith Whitney cause right about now.

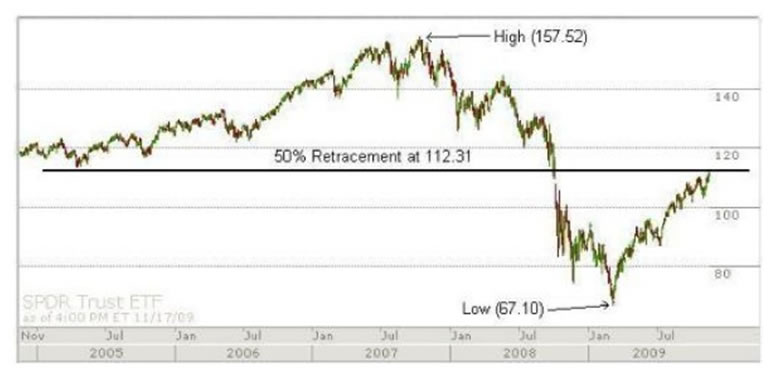

In the long run, I'm bullish. As in the watch-your-kids-grow-up long run. Not as in the next couple of weeks or months. I realize that I am writing for educated investors, so I feel no need to explain what typically happens at a 50% retracement level. Now please take a look (if you haven't already) at the multi-year chart of the S&P Spyders (essentially the same as the S&P 500 chart):

I wouldn't look for the markets to fall off a cliff back to April's levels, but I would certainly look for the S&P to fall back toward 1000. After all, that would only be about a 10% correction from where we are right now.

Don't ask why you should sell. Ask why you should buy.

Shorting stock is not for the faint of heart and truthfully is a practice that most investors shouldn't be involved in. Therefore, for all but the most sophisticated and well-capitalized investors, the thing to do right now is nothing at all.

The lack of excitement brought about by sitting on your hands is understandable, but sometimes it is the right play. After all, those who resisted the temptation to buy two years ago look like geniuses now and those who sat on their hands for the last 11 years are about even. Sad.

It's not that another leg up from here is impossible, but you have to play the odds on this one. The real risk is to the downside, and I can all but guarantee that you will be able to get better prices in the next few weeks than you can today. I'm not saying sell everything in your portfolio, I'm saying don't look at this toppy market as a place to dive in head-first.

Especially into financial stocks.

Bank on uncertainty for banks.

Look to the future. That's what stocks do. But how far into the future? Typically, we assume that the stock market looks about 6 months to 1 year into the future in terms of earnings and expectations. However, this has recently created quite a paradox.

If stocks are forward looking, and the future is more uncertain than ever in terms of healthcare, repaying our massive stimulus bill, the inevitable increase of interest rates, a rollercoaster currency, and a housing market that is questionable at best, why in the world aren't stocks looking there? Well, they might be about to.

The investment world, on television, in newspapers, on the internet, and on the trading floor, is abuzz with experts not analyzing, but rather rationalizing the past 8 months of market happiness.

However, the only concrete reasons anyone can provide for the market's climb are that things "weren't as bad as we thought" and/or the dollar's decline has benefited every company that earns money in other currencies.

But banks are not really doing well. They only appear to be because they are improving their balance sheets by borrowing money at 0%, and government bailouts have made us feel like teenagers with our mom's credit card. It's absurd to assume that will last more than another year, much less any long-term period of time and talk about a business sector with a low profit margin. If the Fed raises rates by 1% in the next year, profits are squeezed tightly, and earnings aren't so rosy. Mortgage rates would rise, which causes mortgage demand and housing prices to decline even further. But, if this country has any interest in keeping a currency that's worth more than Monopoly money, we may have to do just that.

Things might not be abysmal, but they are uncertain. Stock prices and uncertainty do not get along.

The bull market case is getting tired

Speaking of board games, anyone who is pointing to revenue growth is living in Candyland. Year-over-year increases in revenue are absolute garbage. Think about where we were 1 year ago. Beating those revenue numbers can be done by adding a lemonade stand to any company's parking lot. Forecasts have increased as if we're going to be borrowing free, never-to-be-repaid capital forever.

Just because people are buying iPhones and Wiis in larger quantities than expected doesn't mean that the consumer is "back", rich and ready to spend. People are still cutting back in a major fashion, it's just that they've cut back to the things that they really, really want.

I know people who have bought a Wii as a means of entertainment – not children looking for activities on rainy days, but instead thirty-somethings who have made the purchase as an alternative to going out on a Saturday night. I'm not making this up. It's fun, and it's money they aren't spending at restaurants, bars, shows, and other less thrifty endeavors. While it may appear better for Nintendo, it's broadly worse for the economy.

And yet, plenty of people are looking at this runup as "climbing a wall of worry". In my opinion, it is actually a mountain of worry. And mountains have another side. As Willi Unsoeld said after climbing Mt. Everest, "You've climbed the highest mountain in the world. What's left? It's all downhill from there."

I'm not that pessimistic, I'm just not hitting the buy button just yet.

Good investing,

John Whitehall

Analyst, Oxbury Research

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.