The U.S. Recession Jobless Interest Rate Conundrum

Economics / Recession 2008 - 2010 Nov 20, 2009 - 02:46 AM GMTBy: Tim_Iacono

Just about everywhere you look these days in the financial media, when the topic of discussion turns to the plunging U.S. dollar, you'll hear someone saying something like, "Unless the Fed raises interest rates, the dollar's got nowhere to go but down".

Just about everywhere you look these days in the financial media, when the topic of discussion turns to the plunging U.S. dollar, you'll hear someone saying something like, "Unless the Fed raises interest rates, the dollar's got nowhere to go but down".

And then someone invariably says, "But the central bank can't raise interest rates. Not with the unemployment rate at over ten percent!"

What's a central banker to do?

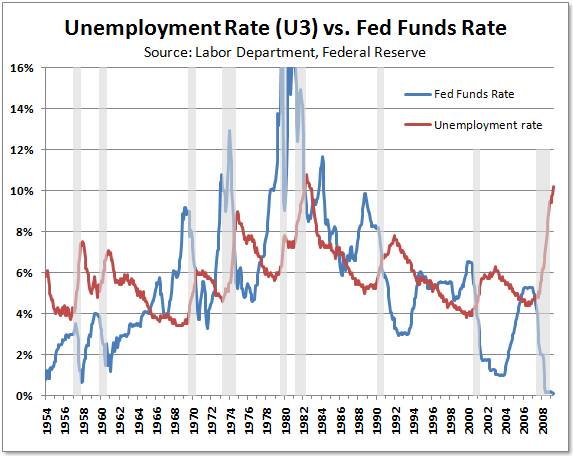

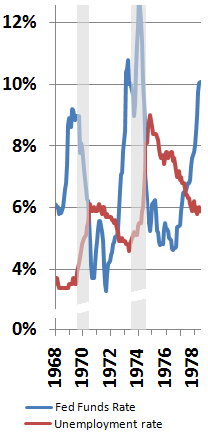

A look at history with the help of the chart below sheds some light on the current jobless rate-interest rate conundrum and, as you might expect, things don't look good for Fed chief Ben Bernanke if he's at all concerned about the value of the nation's currency.

Obviously, this graphic is too chock full of information to be addressed as a whole so it will be broken down in detail below, however, it is interesting to note that the 55-year time span above with just these two curves - U3 unemployment and the Fed funds rates - has two very distinct features.

First, current short term interest rates of around 0.15 percent are without precedent and, based on all but the most optimistic forecasts for the labor market, the jobless rate will soon share that attribute. In fact, if you were to simply subtract today's Fed funds rate from the unemployment rate you'd get 10.1 percentage points, an all-time high. Prior to 2009, over a period of almost six decades, this measure had exceeded six percentage points during only four months, back in 1958 when unemployment was around 7 percent and the Fed funds rate was just under 1 percent.

Second, "jobless recoveries" are a relatively new development. It's clear to see that, as you move from left to right in the chart, the unemployment rate falls at a slower and slower pace during economic recoveries. When weighed against economic cycles that have grown longer and longer, part of what was once affectionately known as The Great Moderation, this may not have seemed like such a bad trade off, however, the Great Moderation is not likely to fare well in history books now that the jobless rate has risen so sharply over the last year with little hope of "full employment" returning in the U.S. anytime soon.

A look back at the historical relationship between jobless rates and interest rates will help to understand the difficulty ahead for the Federal Reserve in formulating monetary policy.

The 2001 Recession

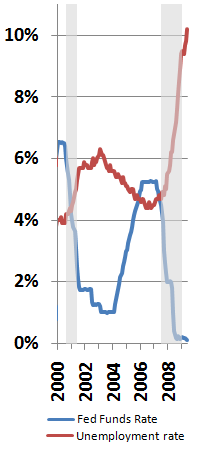

The first thing you are likely to notice about the recovery from the 2001 recession is the trademark "baby-steps" campaign of former Federal Reserve chairman Alan Greenspan in which short-term interest rates were raised in 0.25 percentage point increments at 17 consecutive Fed meetings, the last three quarter-point hikes being accomplished by current Fed chief Ben Bernanke in early-2006.

The first thing you are likely to notice about the recovery from the 2001 recession is the trademark "baby-steps" campaign of former Federal Reserve chairman Alan Greenspan in which short-term interest rates were raised in 0.25 percentage point increments at 17 consecutive Fed meetings, the last three quarter-point hikes being accomplished by current Fed chief Ben Bernanke in early-2006.

From the time that unemployment peaked during the summer of 2003 at 6.3 percent (a jobless rate that appears "quaint" as compared to the reality on the ground today), it was a full year before the first "baby-step" was taken in 2004.

Of course, years later, this is one of the most widely heard criticisms of Greenspan's final years at the Fed as even shoe shine boys know now, in the wake of the bursting housing bubble, that the former Fed chairman left interest rates "too low for too long".

While soaring home prices were clear to see in 2003, the peak in unemployment was only visible in hindsight, so, for future reference, note that when the rate increases didbegin in mid-2004, unemployment had dipped almost a full percentage point, from 6.3 percent to 5.5 percent.

If memory serves, there was also an election in 2004 but, since the central bank is purportedly independent of the U.S. government (a point they make regularly now that some in Congress want to audit them or dismantle them), surely politics played no role in the "too low for too long"monetary policy or the massive credit bubble that followed it a few years later.

If this is the model that Ben Bernanke follows for the current recession, look for interest rates to start to rise no sooner than mid-2011 and don't be surprised if the Mexican peso looks pretty good relative to the U.S. dollar at that time.

The 1990-1991 Recession

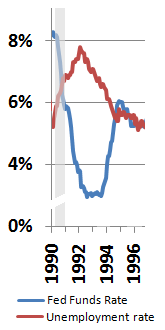

The last "consumer-led" recession occurred in the early 1990s following the melt-down in the Savings and Loan industry and a housing boom that went bust, though this boom-bust was largely confined to California and parts of the Northeast.

The last "consumer-led" recession occurred in the early 1990s following the melt-down in the Savings and Loan industry and a housing boom that went bust, though this boom-bust was largely confined to California and parts of the Northeast.

In this case, the recession officially ended in March of 1991, however, unemployment continued to rise until June of 1992, coming down very slowly during the first major "jobless recovery" in America.

Short term interest rates continued to decline for a few months after the jobless rate peaked and then stayed at 3.0 percent for over a year before rate hikes began in February of 1994.

In this case, it was a full 20 months from the peak in unemployment until the Fed moved, the unemployment rate having moved downward more than a full percentage point from the peak of 7.8 percent in mid-1992 to 6.5 percent in early-1994.

This was the first economic recovery under the guidance of Alan Greenspan and, given how well the U.S. economy fared later on in the 1990s as his first monstrous asset bubble was inflating, it's easy to see why the same script was followed a decade later.

At this point in our look back, there are two data points for Ben Bernanke's latest conundrum - 12 months and 20 months from the peak in unemployment to the first rate hike - and those short the U.S. dollar at the present time would be advised to maintain those positions if the Fed chairman looks back no further.

If he does, the picture becomes much more confusing.

The 1980s Recessions

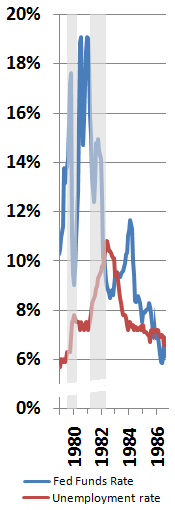

The Paul Volcker era at the Fed in the 1980s was characterized by penal interest rates early on to squash inflation that had run wild in the 1970s. His term was highlighted by the "Saturday Night Massacre", where he raised the overnight lending rate from 11 percent to 12 percent on a Saturday night shortly after taking charge, and a Fed funds rate that peaked at almost 20 percent in 1981.

The Paul Volcker era at the Fed in the 1980s was characterized by penal interest rates early on to squash inflation that had run wild in the 1970s. His term was highlighted by the "Saturday Night Massacre", where he raised the overnight lending rate from 11 percent to 12 percent on a Saturday night shortly after taking charge, and a Fed funds rate that peaked at almost 20 percent in 1981.

During Volcker's early years there were two recessions, both brought on by the Fed chairman himself during a successful two-year campaign against a wage-price spiral that had been fostered by his predecessors.

Since the Fed funds rate moved up and down so dramatically during this period - a time when the official Fed funds target had to be inferred by the bond market as it was not announced to the public - it's hard to draw conclusions about the relationship between unemployment and short-term rates.

For example, the 1980 recession lasted from January to July, during which time unemployment went from 6.3 percent to 7.8 percent, however, over this same span, the Fed funds rate moved from 14 percent down to 9 percent, moving back up to over 19 percent by the end of the year.

In this case, the peak in unemployment and the low in the Fed funds rate occurred during the very same month, the jobless rate obviously not being the key factor in Volcker's decision.

The next recession was a bit more typical, the downturn being declared over in November of 1982, just two months before the peak in unemployment, and short-term interest rates hit bottom six months later.

It's hard to draw too many parallels from the early 1980s recessions to the present one - just the fact that interest rates are zero today versus ten or twenty percent during Volcker's term likely negates anything useful being available here for Ben Bernanke.

But, for those of you keeping score at home, there are now four data points - in reverse chronological order they are 12 months, 20 months, 6 months and 0 months.

The 1970s Recessions

For most of the 1970s, the Federal Reserve was run by Arthur Burns who presided over two recessions, one already underway when he took office in February of 1970. By all accounts, his term as Federal Reserve chief is not one that should be emulated, bending early on to powerful political pressure from the Nixon administration and blazing the monetary policy trail of "too low for too long" that, somehow, always seems to end up badly.

For most of the 1970s, the Federal Reserve was run by Arthur Burns who presided over two recessions, one already underway when he took office in February of 1970. By all accounts, his term as Federal Reserve chief is not one that should be emulated, bending early on to powerful political pressure from the Nixon administration and blazing the monetary policy trail of "too low for too long" that, somehow, always seems to end up badly.

That was certainly the case during Burns' eight year tenure as inflation soared to over 12 percent by the middle of the decade only to surge again as he was on his way out a few years later.

After the December 1970 peak in unemployment, short-term rates fell and rose and then fell again reaching a low for the cycle early in 1972 at just over three percent - a full 14 months later.

A period of calm followed but then in late-1973 an oil crisis erupted in the Middle East and inflation began to rise, followed shortly thereafter by the Fed funds rate, and then unemployment.

From the peak rate of 9.0 percent unemployment in May 1975, just two months after the recession was declared over, it was 20 months before interest rates began to rise from the eventual low of 4.6 percent in January of 1977.

Of course, the rest of the 1970s was a virtual inflation free-for-all as consumer prices rose seven percent in 1977, after which Burns was relieved as Fed chairman in favor of William Miller who then watched the inflation rate reach nine percent in 1978 and 13 percent in 1979 when Volcker was summoned.

You don't hear too much these days about parallels between the Burns-Miller era and the current one but there are more than a few similarities - soaring prices for commodities and multiple periods of "too low for too long" for interest rates.

Now having worked back through the last six recessions, adding periods of 14 months and 20 months to the data set above, we now have an average span of 12 months from the time that unemployment peaked until interest rates began to rise. This is not good news for either Ben Bernanke or the U.S. dollar.

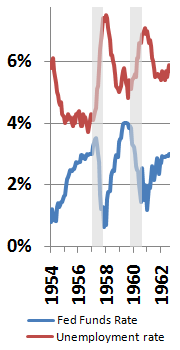

The 1957 and 1960 Recessions

It's not clear what, if anything, can be gleaned from looking at the recessions in 1958 and 1960 and the term of William McChesney Martin - he kind of made things look easy as Fed chairman. As shown below, these two downturns were relatively short and sweet - old style recessions, if you will - with the central bank raising interest rates over a period of a few years, more or less inducing a recession, causing the unemployment rate to quickly peak and then return to more normal levels.

It's not clear what, if anything, can be gleaned from looking at the recessions in 1958 and 1960 and the term of William McChesney Martin - he kind of made things look easy as Fed chairman. As shown below, these two downturns were relatively short and sweet - old style recessions, if you will - with the central bank raising interest rates over a period of a few years, more or less inducing a recession, causing the unemployment rate to quickly peak and then return to more normal levels.

What politicians and economists today wouldn't give to see a recovery in employment like either of these two...

For the record, the 1957 recession officially ended in April 1958 and, three months later in July, unemployment peaked and short-term interest rates hit their low in what appears to be near-perfect monetary policy in a near-perfect economy.

The 1960 recession had similar characteristics in that the unemployment rate reached a peak three months after the recession ended in February, however, Martin didn't start raising interest rates until two months after that.

All in all, a pretty impressive record for a pretty impressive Fed chairman who is best known as having served longest in that position and for saying that the job of the central bank is"to take away the punch bowl just as the party gets going," referring to the need to raise interest rates when economic activity is rising.

Of course, this occurred during an era that will probably go down in history as America's greatest, having helped vanquish both the Germans and the Japanese and emerging after World War II as one of two global military powers, but as the single economic superpower.

It sometimes makes you wonder how stupid economists could have been a few years back to even think that former Fed chief Alan Greenspan would go down as the greatest central banker of all time...

For those of you keeping track, the two recessions discussed above bring the average time from the peak in unemployment to a sustained rise in the Fed funds rate to just over nine months, not a good sign for the current Fed chairman or the greenback if the jobless rate doesn't peak until sometime next year.

What Does this Mean for the U.S. Dollar?

Given the historical relationship between unemployment and short-term interest rates, current Fed chairman Ben Bernanke certainly has his work cut out for him if he is at all concerned about the international value of the dollar.

Based on his speech on Monday, apparently he is a little worried about the currency, but maybe not concerned enough to do anything about it other than talk, which, in itself is quite unusual since that's normally the job of the Treasury Secretary.

With a mid-term election quickly approaching next year and a "best case scenario" of unemployment peaking during the first part of 2010, it seems inconceivable that we'll see any increase in short-term rates for at least another year.

Then again, if the gold price tops $1,700 an ounce and oil again soars toward $120 a barrel, one could envision a scenario where the Fed raises interest rates to one or two percent, just to make a point.

But, when considering what that might do to the nascent economic recovery and when combined with the inability of U.S. central bankers to spot anything resembling an asset bubble in real time, policymakers will probably think better of it and just keep talking about a strong dollar instead of actually doing anything to make it stronger.

St. Louis Fed President James Bullard said as much the other day citing the last two recessions as the likely model for the central bank this time around. In fact, Bullard thought it more likely that rates would begin to rise in 2012 rather than in 2011.

What this means for the U.S. dollar is that, about the only thing that will prevent its value from eroding much further in the year ahead - a development that could ignite a currency crisis of monumental proportions - is some sort of a non-currency financial crisis where investors and traders from all around the globe seek safety in the world's most deep and liquid capital markets that are only found in the U.S.

That seems to be about the only hope for the dollar.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.