When Is It Time To "Worry" About Precious Metals?

Commodities / Gold & Silver Jul 12, 2007 - 08:45 AM GMT

Let us clarify that we do our best to take the emotional element out of our trading decisions and we do not "worry" about our investments. Instead we pay especially close attention to the markets and our investment decisions at critical junctures. But for expediency we will use the term "worry" in this article.

Let us clarify that we do our best to take the emotional element out of our trading decisions and we do not "worry" about our investments. Instead we pay especially close attention to the markets and our investment decisions at critical junctures. But for expediency we will use the term "worry" in this article.

So when is it time to worry? It is our opinion that an investor should pay close attention and possibly "worry" when truly unusual market behaviors, or "anomalies", take place.

For Example:

Imagine you are holding a coin in your open palm, with a straight arm at shoulder height. Now imagine turning your hand to the side to let the coin fall. Naturally the coin would drop to the ground as the laws of physics pull it towards the earth. Now on the other hand, how would you feel if you turned your hand and the coin went up? Sounds ridiculous doesn't it? The point of this analogy is that you would probably have very good reason to be concerned. It is our opinion that most people would probably really "freak out" and we think it would be fully justified.

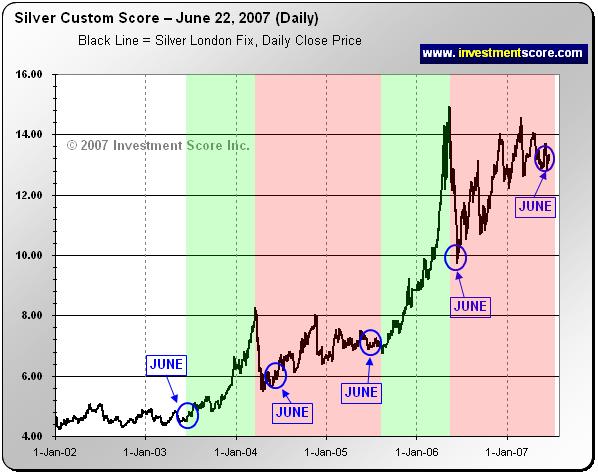

So how does this apply to the financial markets of today? Are we experiencing "unusual" or "normal" market behavior when it comes to precious metals such as silver. The following chart shows us what has happened to the price of silver, in US dollars, since the start of the bull market.

In the above chart you will notice a few things.

-

As with all markets you should note that the price does not move in a straight line. Although we are in a major bull market the price has times of bursting forward along with investor enthusiasm and falling back due to pessimisms. In our opinion this is normal market behavior and nothing to be alarmed about.

- Next you should note that so far in this bull market the price has had two very prominent advances. From June 2004 to nearly April 2004 silver surged from under five dollars per ounce to over eight dollars. From August 2005 the price moved from under nine dollars to over nearly fifteen dollars in May of 2006. We shaded these areas in green.

- Notice how the price of silver will pull back from a significant advance and then consolidate for a number of months. We shaded these areas in red. In a bull market this necessary price action is what causes investors to lose enthusiasm, give up hope, and sell out of positions. This is when negative commentary and analysis is prevalent and doubts abound that the bull market is ending.

- Finally, in the above chart, observe generally what has happened to the price of silver in the month of June. Notice how June has seasonally been a very weak month for the price of silver. However, investors sometimes forget that in a bull market weak prices usually mean a great buying opportunity. Notice what has happened to the price of silver following the seasonally weak late spring and summer months.

At this point we must remind you that just because the price has behaved one way in the past it does not necessarily mean it will do so in the future. The markets seem to have a funny way of changing right when an investor gets comfortable with a certain pattern. However, at this point we do not see reason for concern.

In 2006 silver and gold had a major advance followed by significant correction. In our opinion this healthy correction appears to be following a normal pattern. We are currently in late spring heading into summer, the months where the metals price seems to regularly soften. We are predictably hearing bearish commentary and news about how poorly silver and gold have been performing and why it may drastically fall. In our opinion all of these market observations are normal, healthy and bullish for the price of silver and gold.

So when should an investor worry? We can say that right now, we are not worried about our investment decisions. Please watch for part two of this commentary on this website. You may also visit our website www.investmentscore.com to subscribe to our free investment newsletter for notification of articles such as this one. At www.investmentscore.com you can also learn about our unique investing system and custom built timing charts. We hope to see you there.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.