Trading Commodities, Gold, Silver, Crude Oil and Natural Gas Using ETFs

Commodities / Commodities Trading Nov 12, 2009 - 01:25 PM GMTBy: Chris_Vermeulen

So far this week has been slow in regards to commodity etf funds. Gold continues to shine while silver refuses to make a move higher. Crude oil has a nice bull flag and we are waiting for a breakout and setup while natural gas continues to see selling pressure.

So far this week has been slow in regards to commodity etf funds. Gold continues to shine while silver refuses to make a move higher. Crude oil has a nice bull flag and we are waiting for a breakout and setup while natural gas continues to see selling pressure.

ETF Trading Tip: Waiting for these exchange traded funds to generate low risk setups and watching our current positions mature is the boring part of trading. It's these slow times when traders get bored and start taking more risk by entering positions that do not have clear entry and exit points. Not having clear entry and exit points will lead to traders holding on to losing trades and not taking profits on winning trades. Be sure you enter positions which you know where you should get out if the trade goes against you and where to take some money off the table if it rallies higher.

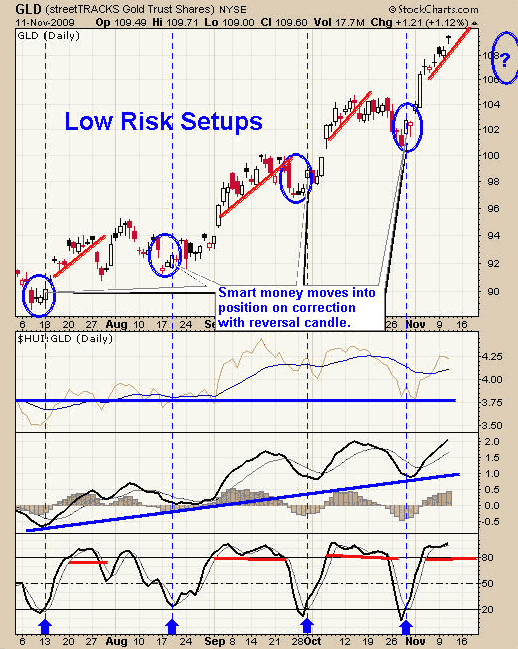

GLD ETF Trading - Daily ETF Chart

The gold etf fund looks to be in rally mode which means when traders start to take profits we should see a sharp reversal down.

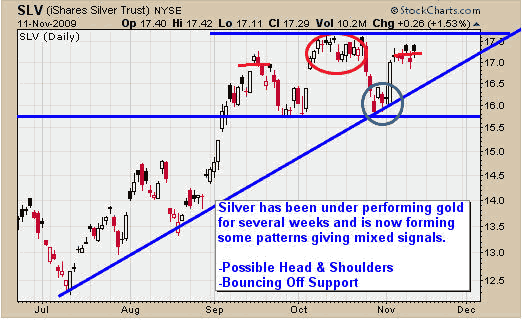

SLV ETF Trading - Daily ETF Chart

Silver has been under performing gold for several weeks now. I think this is because gold is the safe haven of choice be traders and investors. That being said silver generally leads gold so this is giving me a red flag. A larger correction in precious metal ETF prices could be just around the corner. But until we see a technical breakdown on the charts we are staying long.

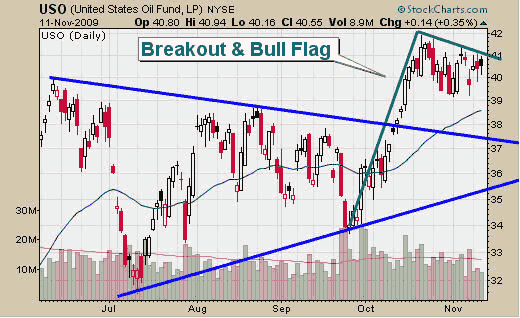

USO Fund Trading - Daily Fund Chart

The USO oil fund broke out a few weeks ago from the large pennant pattern. The price has been flagging for about 3 weeks now. It looks like we are getting close to a low risk setup so I am keeping a close eye on this fund.

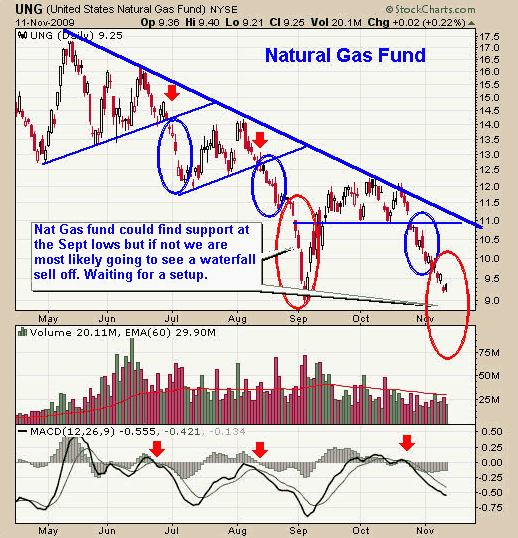

UNF Fund Trading - Daily Fund Chart

Natural gas continues to under perform the rest of our commodities. This fund is starting to look like another good by point but we need a few things to fall into place before that happens. Let's not jump the gun because this fund is still in a bear market. Waiting for a setup.

ETF Trading Conclusion:

We continue to wait for trading opportunities to unfold. We focus on taking advantage of low risk setups and avoiding times the market when things are choppy and unclear.

If you would like to receive my Free Weekly Trading Reports like this please visit my website: www.TheGoldAndOilGuy.com

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.