Securitization and Fractional Reserve Banking

Economics / Economic Theory Nov 12, 2009 - 11:07 AM GMTBy: Nikolay_Gertchev

For good economists, the link between the operation of a fractional-reserve banking system and the recurrence of boom-bust cycles is of little doubt. One of the paramount figures who has contributed to the intellectual elaboration of this relationship and to its transmission to young economists, among which the present writer has had the pleasure to count himself, is Professor Hans-Hermann Hoppe.

For good economists, the link between the operation of a fractional-reserve banking system and the recurrence of boom-bust cycles is of little doubt. One of the paramount figures who has contributed to the intellectual elaboration of this relationship and to its transmission to young economists, among which the present writer has had the pleasure to count himself, is Professor Hans-Hermann Hoppe.

Professor Hoppe has embedded the economic analysis of banking within a fairly general and carefully constructed theory of property rights.[1] In this way, he has further substantiated the relationship between an inflating banking system and the growing, illegitimate government invasion of property rights that Ludwig von Mises and Murray Rothbard have exposed.[2] Furthermore, he has demonstrated the consequences of state monopolies of money production (fiat paper monies) on international politics.[3]

Professor Hoppe has embedded the economic analysis of banking within a fairly general and carefully constructed theory of property rights.[1] In this way, he has further substantiated the relationship between an inflating banking system and the growing, illegitimate government invasion of property rights that Ludwig von Mises and Murray Rothbard have exposed.[2] Furthermore, he has demonstrated the consequences of state monopolies of money production (fiat paper monies) on international politics.[3]

While central banks, which provide fractional-reserve banks (FRBs) and financial markets with liquidities created ex nihilo, have been systematically shown as the driver of inflation and of business cycles, other financial institutions have received significantly less attention in this respect. The purpose of this article is to investigate the extent to which securitization has played a role similar to that of central banks. Securitization has been growing for the last few decades and, like the use of derivatives, it has become a salient feature of present-day financial systems.[4] Despite lawyers', economists', and practitioners' analyses, and the renewed interest it has sparked since the 2007 subprime debt crisis, securitization's broad macroeconomic effects have not been fully expounded yet.[5]

The goal of this contribution to Professor Hoppe's Festschrift is to suggest an economic interpretation of securitization. The first section defines this financial technique, presents a short history thereof and broadly quantifies its significance. Section two details its operational aspects when used by FRBs. Section three systematizes the main economic features of securitization by banks and offers a broad assessment of the technique.

Definition, Rationale, and Score of Securitization

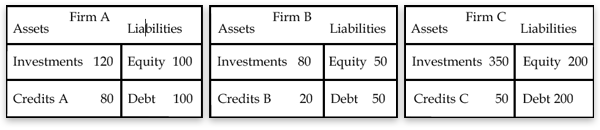

In the course of production for exchange, economic actors obtain rights to future payments of money. For instance, a car dealer that sells his cars on credit for five years gets a claim on future receivables in exchange of his cars. Such credits are relatively illiquid because their characteristics tend to be sector and client specific. In some cases, nonfinancial companies may want not to get involved in the business of making credit. For these, and other possible reasons, economic actors who own claims on future payments may prefer to exchange them for an amount of money that is available now.[6] Each of these claims can be individually passed to an economic actor that has just the opposite preferences. Or, relatively similar claims, possibly coming from different owners, could be grouped together within a single holding entity that could then create standardized claims on them to be sold to interested investors on the financial markets. This process of putting together relatively illiquid assets, of using them as collateral for backing new securities, and of using the proceeds from the sale of the securities to fund the owners of the illiquid assets is called securitization: "Securitization is the process of pooling and repacking loans into securities that are then sold to investors."[7] The general features of securitization can be presented by means of ordinary T-accounts (Table 1).[8]

Table 1: Synthetic Balance Sheets of Companies

In aggregate, firms A, B, and C have total liabilities of 700 (350 in owned capital and 350 in debts), out of which 550 are invested in production and 150 are lent to clients. In case all three firms securitize their credits to clients, economic relations can be summarized in the following way (after consolidation of A's, B's, and C's books):

Table 2: Entities Involved in the Process of Securitization

Firms sell their credits to a Special Purpose Vehicle (SPV) which makes the purchase with proceeds obtained through the issuance of securities bought by investors. The firms can use the reserves of 150 for consumption, investment or repayment of existing debts. The SPV is a separate legal structure, also referred to as a conduit, that issues asset-backed securities (ABSs). These securities can be structured in a variety of ways.[9] Some of them may be actual ownership titles in the SPV that give a pro rata property title on the credits held (pass-through ABSs). Others can be debentures that promise a rate of return that is only collateralized by the credits held (pay-through ABSs). Any of these types of ABSs can be issued in different tranches (three in our example), in which case the payment of income on a more junior tranche, i.e., with lower rating, is conditioned on the prior payment of income on the most senior tranches.[10] For investors, ABSs represent an additional opportunity for their savings.

On a technical level, other actors are involved also. The collection of the future receivables (repayment of the credits A, B, and C) may be fulfilled by a specialized servicer.[11] The servicer's activities may be monitored by a trust that defends investors' interests. More importantly, the very issuance of ABSs, especially when they are structured, requires the involvement of banks and rating agencies. Banks provide various degrees of liquidity facilities and credit-enhancement schemes that are crucial, together with tranching, for the evaluation of ABSs by rating agencies. In turn, this evaluation assesses the expected risk of investment in the ABSs, and determines the interest rate at which they could be issued. Analysts observe that securitization depends crucially on the rating process, "Rating agencies may be the single most important players in the securitization process."[12] However, to obtain a good rating seems to be a rather weak constraint for the success of an ABS issuance, "A securitization sponsor can theoretically structure the securitization to get any rating(s) it wants."[13]

From an economic point of view, securitization merely intermediates savings. One intuitive rationale for this rather roundabout technique is that competition between firms pushes them to accommodate clients with the financing of their purchases. Securitization then is the way to provide the funds, whose ultimate beneficiaries are the firms' clients. Clients, i.e., the ultimate debtors, may well appreciate and therefore remunerate that additional service enough for the ABSs to offer attractive yields to the investors. Firms may find this arrangement the best way to expand their turnover, rather than financing a more aggressive sales policy through additional fund raising that would become ever more expansive as it deteriorates their equity-to-debt ratio. There may be even a direct financial advantage for them, to the extent that market participants judge their activities riskier than the default risk of their clients. Under all circumstances, firms pass the credit risk of their assets to other market participants that are more willing to bear it.[14]

It is commonly admitted that securitization was created in 1970, when the Government National Mortgage Association (Ginnie Mae) issued a mortgage-backed security (MBS) in the form of a pass through.[15] If the contemporary rise of this technique is indeed rooted in mortgage loans, securitization first occurred in the eighteenth century as a means for financing the West Indies plantations. Deon Deutz, a Dutch businessman, issued bonds with the proceeds of which he financed mortgage loans to plantation owners in Suriname. The bonds' yield was dependent on the return of the plantation loans, themselves guaranteed by the plantations and crops. These plantation loans "can be viewed as the forerunners of modern mortgage-backed securities."[16] Present-day MBSs developed in the United States under the patronage of government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac that aim at creating a secondary market for home mortgage loans.[17] MBSs went through some innovations, such as the creation of collateralized mortgage obligations (CMOs) in 1983 and of Real Estate Mortgage Investment Conduits (REMICs) that facilitate the issuance of CMOs. CMOs are specifically designed to address the prepayment risk in the event of falling interest rate, through the cushion system of the tranches.[18] Based on the model of MBSs, banks started issuing ABSs in the 1980s. Besides mortgage loans, ABSs use automobile, credit card, and student loans as underlying assets. They are offered on the market either as long-term corporate bonds or as short-term commercial paper, better known as asset-backed commercial paper (ABCP).

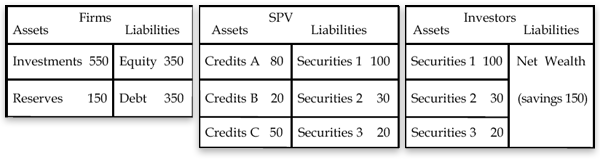

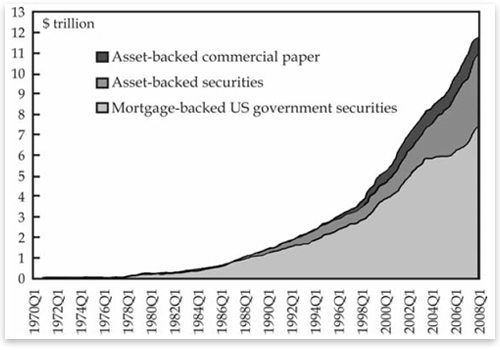

Securitization has had an exponential growth (Chart 1).[19] Securities issued by GSEs reached $7.5 trillion in the beginning of 2008, ABSs rose to $3.6 trillion, while the amount of ABCP stood at $0.8 trillion. If securitization represented only 2.5 percent of credit-market debt owed by all sectors in 1970, that ratio reached 24.0 percent in 2008. Home mortgages, which are almost the exclusive asset held by GSEs, have been in the portfolio of ABS issuers, varying from 35 percent of total assets in 2000 to 64 percent in 2006 (Chart 2).

Chart 1: Growth of Securitization (1970–2008)[20]

Chart 2: Structure of Assets Underlying ABSs (1984–2008) [21]

Evidence shows that securitization concerns mainly loans granted by banks, and not credits made by producers or distributors of commodities. The next question that needs to be addressed, therefore, is how the general principles of securitization change when this financial technique is carried out by modern banks.

Fractional-Reserve Banks and Securitization

Contemporary commercial banks combine two essentially different functions. First, they serve as intermediaries between saver-capitalists and investor-entrepreneurs. Banks issue a debt instrument (bonds or commercial paper) only in order to lend the funds thereby collected to economic agents that need financing. As financial intermediaries, banks transform the maturity, risk, and currency profile of existing savings.[22] This activity itself implies specific risks (credit, interest, currency, etc.) that banks may be willing to bear wholly, to manage partially or to hedge completely. Whatever their position toward these transformation-induced risks, their activity qua intermediaries consists in pooling and channeling existing savings. Because the loans that banks make come from actual wealth that is only transferred from one individual to another, one can speak of real credit. Real credit is the very foundation of capital accumulation and economic growth.

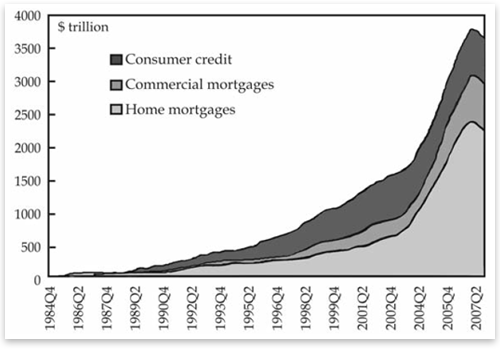

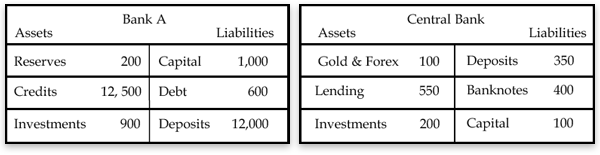

Second, banks act as fractional-reserve depository institutions. This means that they are legally obliged to keep in reserves only a (very small) fraction of any amount of money that is deposited with them. The part of the money in excess of that fraction can be used for granting credits, i.e., for creating an additional deposit that is made available to the receiver of the credit. It follows that contemporary banks, in addition to channeling existing savings, are also creating deposits that they lend out. Since such deposits are not brought about by existing savings, one can speak of bank (as opposed to real) credit.[23] It is precisely their ability to create bank credit through new deposits that makes banks specific and different from other companies, financial or not. The capacity to create deposits implies the capacity to increase the supply of media of exchange, for deposits are used as media of exchange. Since this is the particular feature of contemporary banks, we have to analyze securitization by banks especially in relation to its possible monetary impact. In order to do this, let us first briefly outline the operation of a fractional-reserve banking system. (Table 3)

Table 3: Synthetic Balance Sheet of a Fractional-Reserve Banking System

Bank A has to comply with two basic regulations. It must keep reserves equal to 2 percent of its overall deposits and its capital (equity) should represent at least 8 percent of its credits.[24] Bank A's total assets include its liquidity reserves in the form of a deposit at the central bank (200), its credits to economic agents (12,500) and its investments in real estate and securities (900). Bank A has obligations towards its creditors (600) and towards depositors (12,000). The net difference between assets and liabilities is equilibrated by A's capital (1,000). The typical central bank's balance sheet also reports some of these asset and liability elements. Deposits held at the central bank (350) contain A's reserves among deposits from other institutions (other banks and government). The central bank's lending (550) is partly reflected in A's debt (as well as in the debt of government and of other financial institutions). The central bank's investments (200) represent holdings of securities, some of which may have been issued by A, as part of its debt. The other figures have been adjusted in order to equilibrate the balance sheet.[25]

It appears that A does not respect the liquidity reserve requirement. Assuming that it does not want to lose its shares on the deposit market, it needs to increase its reserves by 40, i.e., to replenish its account at the central bank. One means to achieve this consists in obtaining a credit by the central bank through open-market operations. A cedes a total of 40 worth of assets to the central bank, which creates a corresponding liquidity that is credited to A's account.[26] The central bank's total liabilities increase by that same amount, while A's total assets remain constant, due to the substitution of reserves and other assets. An alternative means for A would be to obtain liquidity from economic agents that have excess liquidity. Securitizing 40 of its credits is the proper way to capture that liquidity. This would also improve the capital-adequacy ratio. There is a substitution between different assets on A's balance sheet, while the central bank's total liabilities remain unaffected. From the standpoint of an individual bank, securitization appears, therefore, tantamount to refinancing at the central bank, the difference being that it does not imply an increase of total liquidities in the economic system, but only redistribution thereof among banks. The question then arises as to how securitization functions from the standpoint of the entire banking system.

From a systemic viewpoint, we must reject the assumption of liquidity shortage or excess. Let us consider A's balance sheet from Table 3, after refinancing at the central bank for 40 in exchange for part of its investments, as the consolidated banking system balance sheet. The question now is to identify how securitization economically affects the banking system, and how this is translated in accounting terms. One bank's mortgages are used to pay house builders, who in turn pay workers, producers of building material, etc. The latter spend the new monetary units on consumption and investment goods. Among the variety of goods that the receivers of the new deposits purchase are securities, some of which are ABSs.[27] When ABSs are purchased, bank checks are written or money order payments are made that de facto transfer ownership of bank deposits to the issuing SPVs. The SPVs then pass the ownership of the deposits on to the banks, from which they acquire mortgage or other type loans. The credit-selling banks thereby obtain claims on customers' deposits held by themselves or by other banks. After compensation, the system's deposits decrease exactly by the amount of credits sold to the SPVs, i.e., purchased by banks' customers. From the standpoint of the entire banking system, securitization implies, therefore, a simultaneous reduction in credits and deposits. If we turn back to our numerical example now, if 10 percent of all credits are securitized, credits that remain on the banks' books amount now to 11,250, while their obligations to depositors decrease concomitantly to 10,750. At this stage, total deposits of 10,750 are backed by reserves of 240, while total equity of 1,000 guarantees credits of 11,250. The liquidity reserve ratio increases from 2 percent to 2.23 percent, while the capital adequacy ratio rises to 8.89 percent. Securitization leads to excess liquidity and to improved compliance with capital provision regulations despite the fact that the central bank has not increased its total liabilities and additional savings have not been channeled into the banking industry.

What will then be the next step of the banking system, given the excess liquidity? Banks will grant new credits until the existing excess reserves (25, i.e., the existing 240 minus 2 percent of 10,750 of deposits) are just enough to cover the new deposits created through bank credit. Ignoring liquidity outflows driven by a higher demand for banknotes and by purchases abroad, it is straightforward that banks can grant as much new loans as credits have been securitized. Then the process can be repeated again and again, as long as there is demand for asset-backed securities, without ever returning to the central bank for refinancing. Securitization allows fractional-reserve banks to grant more loans, while keeping total deposits, i.e., the money supply in the broad sense, constant in the economy. This is explained by the fact that the securitized credits are purchased by the SPVs by means of those same deposits that were created by banks in the very process of granting the credits. As a matter of fact, banks create both the object to be sold (credits) and the means by which it can be purchased (deposits). It is this aspect of FRBs that makes their use of securitization special.[28]

The operational aspects of securitization having been outlined, let us now address its economic characteristics.

The Illusion of Savings-Driven Growth and the Spread of Securitization

Securitization allows FRBs to withdraw from the market the liquidities they have created and lent out. It reduces the money supply by the amount of liquid assets used to purchase the asset-backed securities. Therefore, it hides the reverse side of bank credit—the increase in the money supply, i.e., inflation. It makes the economic environment appear less inflationary than it should be, given individuals' growing indebtedness to banks. Securitization portrays a bank-credit driven boom as noninflationary, savings driven growth. It contributes to the widespread illusion that more factors of production are available than in reality, and becomes thereby a factor in the generation of the error-induced boom-bust cycle.[29]

To a certain extent, economists have already recognized that securitization restrains the money-supply growth during a credit boom. From a different approach, central bank economists have come to the conclusion that securitization decreases the power of monetary policy: "securitization has likely weakened the impact of any policy move."[30] This, of course, means that securitization insulates banks' lending activity from the central bank's liquidity policy, which confirms our main conclusion and is even overtly stated by other economists, "Using a large sample of European banks, we find that the use of securitization appears to shelter banks' loan supply from the effects of monetary policy."[31] The central bankers' perspective is that of growing concern about loosening their grasp of the money supply. Such a concern implicitly admits that securitization disconnects the money-supply growth from bank-credit growth.[32]

To a certain extent, our analysis is in conformity with the increasingly common view among economists, at least as far as the outer description of the phenomenon is concerned. However, when it comes to understand what contributes to the spread of securitization, we must part with the traditional approach, which mentions three main factors. First, securitization is presented as a way to circumvent capital adequacy regulations, because it transfers the credit risk of the loans from banks' books to the investors in the asset-backed securities. Second, the "originate and distribute model," according to which credits are only originated by banks and then distributed to investors who fund them, appears more attractive than the "originate and hold model" because of higher frequency of banking fees. Third, asset-backed securities add to the choice of investment opportunities and contribute to the efficiency of financial markets.[33] While these assertions may be true in themselves, it is not true that they systematically render securitization the best solution for FRBs.

Indeed, securitization improves banks' capital-adequacy ratio, as shown in our numerical example. However, given that banks have to raise capital only up to 8 percent of their new credits, it is never too expensive for them to pay dividends to new capital in order to grant 12.5 times more loans. In addition, the interest on the securitized loans is lost for the banks. Securitization, therefore, is not really saving the cost of capital raising, for expenses on capital are not an obstacle to the expansion of banks' activity.[34] The "originate and distribute" model does have the advantage of increasing banks' fees, but it has also the inconvenience of depriving the originator of the credit of the interest yield, which is transferred to the buyers of the asset-backed securities. There is no guarantee that the accumulation of servicing fees from securitized loans would be higher than the interest rates received on even a smaller amount of credits kept on the balance sheets. Finally, the assets-backed securities allow investors to obtain the same risk-revenue exposure as the one they would have obtained if investing in the banks and if banks have kept the loans on their books. It is therefore not clear in what sense there are new investment opportunities offered on the market.

All three traditional explanations of securitization assume that origination and funding of the securitized loans are two unrelated processes.[35] Our analysis shows that, to the contrary, they are two analytically inseparable aspects of FRBs' operation. As a matter of fact, securitization is of interest for economists only insofar as it is used by FRBs to dissimulate the inflationary impact of credit expansion. From this perspective, a full assessment of securitization needs, indeed, to explain how it became a widely used technique. The crucial point, from bankers' points of view, is to create a demand for part of their loans, repackaged as structured securities. It follows that securitization relies critically on the ABSs' quality as perceived by investors. Securitization by FRBs can work only if securitized loans are presented to the public as actually different from what they are. Hence, factors that change investors' preferences favorably toward these financial assets are the real determinants of the success of this technique. In a sense, securitization is based on institutions that create and maintain an illusion.[36]

Three illusion-creating institutions can be identified: government, rating agencies, and credit default insurers. All three contribute, in different ways, to change investors' perceptions of the ABSs' risk-return profile. Government, which was historically related to the modern inception of securitization in the United States, was providing an implicit guarantee of refinancing Fannie Mae and Freddie Mac.[37] Rating agencies grant quality labels to privately issued ABSs. Credit insurers help enhance these labels through promises, namely to pay for defaulted creditors, that objectively cannot be carried out in the event of a systemic crisis.[38] All three contribute to an over-valuation of ABSs relatively to other financial assets.

Conclusion

Securitization is a financial technique that permits the exchange of relatively nonmarketable credit claims for liquidities. As such, it exploits an exchange opportunity between individuals with opposite liquidity valuations in their preference scales. Its modern usage by fractional-reserve banks has dissociated the growth of credit expansion from the growth of the money supply. Securitization has provided banks with an alternative source of liquidity, different from central banks' open-market operations, thereby weakening the latter's control of the total amount of credit in the economy. It has contributed to de-monetizing bank credits, thereby containing inflation under conditions of growing indebtedness. Securitization has therefore become a tool for spreading the illusion of savings-driven economic growth and for creating the economic cycle.

Nikolay Gertchev is an economist with the European Commission, Brussels, Belgium. The views expressed in this article are strictly personal and do not engage the responsibility of the European Commission. Send him mail. See Nikolay Gertchev's article archives. Comment on the blog. ![]()

Notes

[1] Hans-Hermann Hoppe, "Banking, Nation States and International Politics: A Sociological Reconstruction of the Present Economic Order," Review of Austrian Economics 4 (1990): 55–87; idem, "How is Fiat Money Possible?—or, The Devolution of Money and Credit," Review of Austrian Economics 7, no. 2 (1994): 49–74; Hans-Hermann Hoppe, Jörg Guido Hülsmann, and Walter Block, "Against Fiduciary Media," Quarterly Journal of Austrian Economics 1, no. 1 (1990): 19–50.

[2] Ludwig von Mises, Theory of Money and Credit (Indianapolis, Ind.: Liberty Fund, 1981 [1912]); idem, Human Action: A Treatise on Economics,Scholars ed. (Auburn, Ala.: Mises Institute, 1998 [1949]); Murray N. Rothbard, What Has Government Done to Our Money? (Auburn, Ala.: Mises Institute, 1990 [1963]). Even though Mises and Rothbard are not the first to have demonstrated how the monopoly of money production can be used as a means of expropriation, they are the closest, by intellectual affinity and scholarly heritage, to the essentialist and ethical flavor of Hoppe's particular analysis.

[3] Hans-Hermann Hoppe, "Government, Money, and International Politics," Etica & Politica/Ethics and Politics 5, no. 2 (2003).

[4] Two technical specialists of the field even advance that securitization is as crucial as capital markets: "Securitization is as necessary to any economy as organized financial markets." Frank Fabozzi and Vinod Kothari, "Securitization: The Tool of Financial Transformation," Yale International Center for Finance, Working Paper No. 07-07 (2007), p. 11.

[5] Since 1996, the area is the central topic of a journal of its own—The Journal of Structured Finance. References to the large variety of legal studies, as well as basic treatment of the fundamental legal issues raised by securitization, can be found in Claire Hill, "Securitization: A Low-cost Sweetener for Lemons," Washington University Law Quarterly (Winter 1996): 1061–1120 and Steven Schwarcz, "The Alchemy of Asset Securitization," Stanford Journal of Law, Business and Finance 1 (1994): 133–54. The following technical presentations were all published by the research departments of central banks: Randall Pozdena, "Securitization and Banking," Weekly Letter, Federal Reserve Bank of San Francisco (July 4, 1986); Charles Carlstrom and Katherine Samolyk, "Securitization: More than Just a Regulatory Artifact," Economic Commentary, Federal Reserve Bank of Cleveland (May 1, 1992); Christine Cumming, "The Economics of Securitization," Federal Reserve Bank of New York Quarterly Review (Autumn 1987): 11–22; Ronel Elul, "The Economics of Asset Securitization," Business Review, Federal Reserve Bank of Philadelphia (Q3 2005), pp. 16–25; Emre Ergungor, "Securitization," Economic Commentary, Federal Reserve Bank of Cleveland (August 15, 2003). Practical issues, such as the impact of securitization on interest rates and on monetary policy, have been developed by James Kolari, Donald Fraser and Ali Anari, "The Effects of Securitization on Mortgage Market Yields: A Cointegration Analysis," Real Estate Economics 26, no. 4 (1998): 677–93; Arturo Estrella, "Securitization and The Efficacy of Monetary Policy," FRBNY Economic Policy Review 8, no. 1 (2002): 242–56; Yener Altunbas, Leonardo Gambacorta & David Marquès, "Securitisation and the Bank Lending Channel," European Central Bank Working Paper Series no. 838 (2007); and ECB, "Securitisation in the Euro Area," Monthly Bulletin (February 2008): 81–94. A complete multidisciplinary study, meant also to be a practitioners' guide, is Vinod Kothardi, Securitisation—The Financial Instrument of the Future (Wiley Finance, 2006).

[6] The underlying ultimate cause of these exchanges is rooted in individuals' time preference rates that are higher than the current interest rate. On the importance of time preference for the process of civilization in general and for economic analysis in particular, see Hans-Hermann Hoppe, Democracy—The Gold that Failed: The Economics and Politics of Monarchy, Democracy, and Natural Order (New Brunswick, N.J.: Transaction Publishers, 2001), especially chap. 1.

[7] Ergungor, "Securitization," p. 1.

[8] All numbers, in tables and in the text, refer to a quantity of well-defined monetary units (dollars, euros, ounces of gold, etc.), which we will avoid to mention systematically in order to avoid redundancy.

[9] This explains why securitization is often considered as part of the broader area of structured finance, i.e., the engineering of structured financial products.

[10] Tranching is considered to be a form of insurance for the owners of the senior securities. Indeed, the junior securities act as cushions for losses on the credit portfolio of the SPV to the extent that these losses do not exceed the income payments on the junior securities.

[11] It is most common for the firms who made the credits, often referred to as originators of the credits, to play this role. Securitization then allows a new business model with regard to credits—"originate and distribute" as opposed to "originate and hold."

[12] Joel Telpner, "A Securitisation Primer for First Time Issuers," Global Securitisation and Structured Finance 2003 (Greenberg Traurig, 2003), p. 5. This is not an isolated opinion: "Rating agencies dictate a significant amount of the structure of securitization transactions. When the transactions were initially being structured, the rating agencies were heavily involved." Hill, "Securitization," p. 1071.

[13] Telpner, "A Securitisation Primer," p. 5.

[14] As noted by an analyst: "The securitization process allows the company to separate financial assets from credit, performance and other risks associated with the company itself." Telpner, "A Securitisation Primer," p. 1. For a detailed and still clear-cut explanation of the possible benefits of securitization for all parties involved, see Philip R. Wood, Title Finance, Derivatives, Securitisations, Set-off and Netting (London: Sweet & Maxwell, 1995), pp. 41–68.

[15] Carlstrom and Samolyk, "Securitization," p. 2.

[16] K. Geert Rouwenhorst, "The Origins of Mutual Funds," Yale International Center for Finance, Working Paper no. 04-48 (2004), p. 5.

[17] A general account of the activities of Fannie Mae and Freddie Mac can be found in Scott Frame and Lawrence White, "Fussing and Fuming over Fannie and Freddie: How Much Smoke, How Much Fire?," Journal of Economic Perspective 19, no. 2 (2005): 159–84 and Richard Green and Susan Wachter, "The American Mortgage in Historical and International Context," Journal of Economic Perspectives 19, no. 4 (2005): 93–114, while Gordin Sellon and Deana VanNahmen, "The Securitization of Housing Finance," Economic Review, Federal Reserve Bank of Kansas City (July/August 1988): 3–20 present an early synthesis on their more specific role in the spread of securitization.

[18] With falling interest rates, fixed-rate borrowers are inclined to refinance their mortgages, thereby letting the lender bear the interest rate risk. Early repayment also changes the duration of a lender's portfolio, which may compromise other aspects of his investment strategy. Let us note that long-term home loans with fixed interest rates and low loan-to-value ratio are the outgrowth of government intervention during the Great Depression that aimed at rescuing bankrupt banks. Prior to the creation of the Federal Housing Administration in 1936 and of Fannie Mae in 1938, a typical mortgage had flexible rates, a maturity of up to five years, and a loan-to-value ratio of 50 percent. Green and Wachter, "The American Mortgage in Historical and International Context," pp. 94–96.

[19] Source: Flow of Funds Accounts of the United States. Data for ABCP since 2006 has been extracted from the Ecowin Reuters database. Government securities, i.e., privately issued securities that are eligible for open-market operations, are not to be confused with Treasury securities.

[20] The securitization growth trend has been less pronounced in Europe, where, for instance, ABCP represents only 30 percent of the commercial paper market, to compare with 50 percent in the United States. FitchRatings, "The Importance of Liquidity Support in ABCP Conduits," ABCP/Global Special Report (October 25, 2007), p. 1. The total outstanding volume of ABSs in the European market was estimated at €1.3 trillion in September 2007, 60 percent of which was eligible as collateral for liquidity at the European Central Bank. ECB, "Securitisation in the Euro Area," p. 92.

[21] Source: Flow of Funds Accounts of the United States. Mortgage-backed securities pooled and issued by GSEs are not included.

[22] The relations involved by this intermediation could be represented by the last two balance sheets of Table 2, where the SPV is to be replaced by the financial intermediary. Thinking of the SPV as of a standard financial intermediary strengthens our view that the most plausible rationale for securitization on the free market is to provide convenience to customers. As a matter of fact, they do not have to deal with the financial intermediary, but only with the seller (firms A, B and C in our example) who is in charge of the financial arrangement, precisely through securitization.

[23] For a full-fledged theory of this important distinction, and a complete analysis of the legal and economic consequences of bank credit as opposed to real credit, see Jesus Huerta de Soto, Money, Bank Credit, and Economic Cycles (Auburn, Ala.: Mises Institute, 2006). Huerta de Soto convincingly shows, in line with findings by Chester Arthur Phillips and Milton Friedman, that from the standpoint of the entire banking sector, the limit on granting bank credit is a multiple of any initial monetary deposit, irrespective of which bank is the first to receive that money. The lower the required reserve ratio and individuals' demand for banknotes, the higher that multiple is.

[24] We borrow these numbers, for the sake of an example, from current practices in the euro area, according to which banks have to keep average reserves of 2 percent of their deposits, and from the Basle II capital requirements.

[25] Other figures are not commented upon insofar as they do not concern the issue of securitization. The discussion of issues such as international monetary arrangements, demand for banknotes and central banks' histories would, of course, require elaborating on these other elements.

[26] We speak of cession rather than of selling, because open-market operations may take a variety of legal forms: outright purchases of Treasury securities (as conducted by the FED), extendable repurchase agreements (also typical of the Fed), or simply renewable short-term collateralized loans (as carried out by the European Central Bank). The economically relevant fact is the creation of liquidity for Bank A, not the concrete legal form it takes. For details on open-market operations, see FED, The Federal Reserve System: Purposes and Functions <www.federalreserve.gov/pf/pdf/pf_complete.pdf> (June 2005 [1939]); ECB, The Implementation of Monetary Policy in the Euro Area: General Documentation on Eurosystem Monetary Policy Instruments and Procedures <http://www.ecb.int/pub/pdf/other/gendoc2008en.pdf> (November 2008).

[27] Our sequence of distributing new liquidity in the economic system starts with the construction sector, but it could start with any other economic sector, including the financial sector itself.

[28] Banks that keep total reserves can make only real credit, i.e., they can lend out only funds collected through the issuance of securities (shares and bonds). Consecutive waves of securitization would imply consecutive reductions in investors' money holdings, whether cash or deposits, that could not be countered by the banking system.

[29] Jörg Guido Hülsmann, "Toward a General Theory of Error Cycles," Quarterly Journal of Austrian Economics 1, no. 4 (1998): 1–23.

[30] Estrella, "Securitization and The Efficacy of Monetary Policy," p. 1.

[31] Altunbas et al., "Securitisation and the Bank Lending Channel," p. 4.

[32] Further evidence of the acceptance of this result by other economists is easy to find: "securitization provides an ever-growing funding source to banks and may well be the most important engine of growth in bank lending." Ergungor, "Securitization," p. 4.

[33] That third reason is presented sometimes as an overt syllogism: "For the issuer, the bottom line is to create a set of new securities that are worth more in aggregate than the value of the underlying assets." Lakshman Alles, "Asset Securitization and Structured Financing: Future Prospects and Challenges for Emerging Market Countries," IMF Working Paper WP/01/147 (2001), p. 5.

[34] If all outstanding asset-backed securities ($11.9 trillion at the beginning of 2008) were kept on US banks' balance sheets, this would have required, over the last 30 years, an additional capital injection of up to $ 952 billion. For comparison, at the beginning of 2008, the market value of all US corporate equities was $19.4 trillion, out of which $4.1 trillion were financial corporations' equities (Flow of Funds Accounts of the United States, Table L.213).

[35] Alles, "Asset Securitization and Structured Financing," p. 15.

[36] To a certain extent, the illusionary nature of securitization by banks has been well captured by a legal analyst: "Securitization, in short, brings to financial technology what the sought-after philosopher's stone promised to bring to base metals—the ability to turn them into gold!" Schwarcz, "The Alchemy of Asset Securitization," p. 154.

[37] That guarantee became explicit in September 2008, when both companies were nationalized.

[38] The very important question of whether "credit insurance" is an instance of insurance rests out of the scope of the present paper. Let us, however, note here that, following Mises and Hoppe, we may conclude that credits cannot be insured, as the events "going bankrupt" are not independent, uncorrelated elements with an identifiable class probability. See Mises, Human Action, pp. 105–19; Hans-Hermann Hoppe, "On Certainty and Uncertainty, Or: How Rational Can Our Expectations Be?," Review of Austrian Economics 10, no. 1 (1997): 49–78; idem., "The Limits of Numerical Probability: Frank H. Knight and Ludwig von Mises and The Frequency Interpretations," Quarterly Journal of Austrian Economics 10, no. 1 (2007): 3–21. This implies that the very notion of credit insurance contributes to the creation of an illusion.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.