If the Gold Price Explodes, Silver Will go SuperNova!

Commodities / Gold & Silver 2009 Nov 11, 2009 - 04:36 PM GMTBy: Jeff_Clark

How Will Niagara Falls Fit Through a Garden Hose?

How Will Niagara Falls Fit Through a Garden Hose?

“There’s no doubt in my mind that we’ll have a mania in gold. And because the gold and especially silver markets are so tiny, the rush into them will be like trying to push the contents of Hoover Dam through a garden hose. Our positions will go absolutely ballistic.” –Doug

Dear Readers,

Dear Readers,

Elmer Sutton’s eyebrows shot up when he saw the ad proclaiming gold stocks might make you wealthy.

It sounded like the perfect solution for his stock portfolio, loaded with investments going nowhere. He vaguely recalled hearing a little about gold, but if what the ad said was true, he thought he could make a killing.

So he called the broker and made an appointment for the next day. The broker seemed very knowledgeable and took the time to explain why he felt gold stocks were one of the best investments right now. He said this was not a get-rich-quick scheme, but that if you stuck with it, you could see potentially enormous profits. It sounded good. Elmer wrote a check for $2,500, and the broker bought three gold stocks for him.

The very next day, gold took a big drop and his spankin’ new gold stocks sold off hard. Not only that, there were riots in South Africa, where one of the companies was located. Elmer was instantly disgusted. He was losing money yet again. This time, however, he’d play it smart and get out before he lost it all – something his wife made sure he understood – so he hastily called the broker and told him he wanted his money back.

“Elmer, you can’t do that,” the broker told him. “This isn’t Woolworth’s.”

“I’m not buying them!” he yelled to the broker and slammed the phone down. Elmer wanted out, and that was that. He wasn’t about to lose any more money in the stock market.

Three years later, long after he’d forgotten about that broker, newspaper headlines were screaming about gold. Everyone at the party Elmer attended the night before was talking about how well their gold stocks were doing. His co-workers bragged about the good deals they were getting buying gold and silver coins. Everyone was talking about precious metals.

Elmer panicked; he didn’t want to be left behind. He scrounged around the house until he found the original confirmations of the trade he'd broken with “that broker”: 1,500 shares of Grootvlei at 35¢, 500 Anglo American at $2.50, and 1,000 Leslie at 50¢. He grabbed his newspaper and saw that Anglo was up 500% since then, and the others were paying dividends – this year alone – totaling more than he would have paid for his shares in 1976.

As the newspaper went limp in his hands, he had a vague recollection of the broker he met with and quickly tracked down the phone number. “I want to buy some gold stocks,” he breathlessly panted to the secretary answering the phone. She said the broker wasn’t in, and that while they would be happy to buy a stock for him, they were actually recommending investors sell their gold stocks.

Elmer couldn’t believe it. How ludicrous! Everyone he knew was buying, and he was personally acquainted with many people who were getting rich. He pushed on. “Look, everyone’s into gold right now. It’s on the front page of the paper, for crying out loud. So I want to buy some gold stocks right away.”

“That’s fine, sir, but I think you should talk to the broker first,” the secretary replied. “We really don’t recommend you do that.”

“I don’t care!” Elmer screamed, which he didn’t mean to do, but panic was setting in. “What’s this clown’s name anyway?”

“Doug Casey,” she replied.

Please Don’t Crowd the Emergency Exit

This true story explains how Doug Casey bought gold stocks at the very bottom of the market, as he took on those abandoned shares from Elmer. But today’s lesson underscores what Doug Casey saw back in the late 1970s: there’s certain to be a rush into gold and silver, and buying before Main Street catches gold fever is the only way to play this trend.

Because when Midas fever hits, prices will explode to the upside, for both the metals and the stocks. How do we know that?

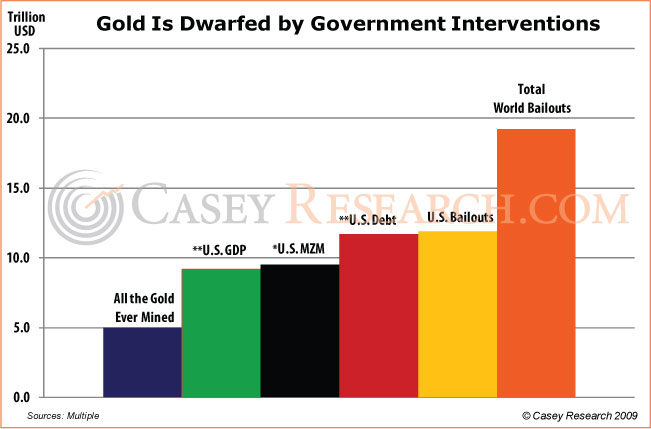

First, let’s look at gold. If we added up all the gold ever mined on the planet, its total value would equal no more than $5 trillion at today’s prices. Yet, look at how this compares to the debt and bailouts and other monetary mischief of current governments...

*MZM (Money of Zero Maturity) is a measure of the liquid money supply in the economy. It consists of coins and currency, checking accounts, savings deposits, and money market funds.

**Year to date figures.

Let’s make this chart very clear. Of the $5 trillion in gold ever mined...

- The U.S. government has thrown over twice as much at the economy in the past 12 months.

- The U.S. debt is more than double this amount so far this year.

- Total global government bailouts are almost four times larger (and this is a conservative figure; one estimate puts it at $24 trillion).

I intended to include annual gold production as one of the comparisons, but the chart isn’t big enough and neither is your monitor: 2008’s global gold production equaled about $73 billion, and to make that figure discernable on the chart would require the Global Bailouts bar to hit the ceiling above your head. That’s how small the gold market is.

The implications are undeniable: when the greater public rushes into gold – whether in response to inflation, dollar woes, war, whatever – the price will be forced up by an order of magnitude.

[For an elegant and profitable way to own bullion gold, check out this website.]

A Picture Is Worth a Thousand Dollars

While physical gold will protect our wealth, it’s the gold stocks that can potentially make us wealthy.

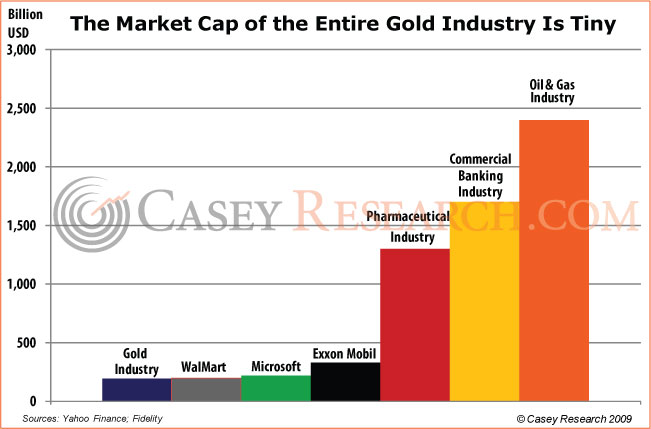

Once again, to get a sense of the Lilliputian size of the gold industry, I compared it to several other leading industries and stocks.

The value, as measured by market capitalization, of all gold producers around the world is less than Walmart’s. Every gold stock would need to nearly double just for the industry to match ExxonMobil. The oil and gas industry is about 12 times bigger.

When your neighbors and relatives and co-workers and friends all start clamoring to buy gold stocks, the pressure on prices will be enormous, rocketing our positions upwards.

Meanwhile – and admitting we’re first and foremost gold bugs – the picture for silver is even more dramatic. The potential for silver stocks is jaw-dropping.

|

|

|

If the gold industry is tiny, then silver’s $9 billion market cap makes it a nano industry. The entire silver industry is over 21 times smaller than gold’s! If gold explodes, silver will go supernova.

Consider these macro-facts about a micro-market and what they reveal about silver’s enormous potential:

- There are over 200 companies in the S&P 500 with a market cap larger than the entire market of silver producers

- There are five times more gold stocks than silver.

- Total silver production in 2008 was valued around $10.3 billion (at today’s prices). That represents just 1.5% of the $700 billion bailout last year, and 0.006% of the current U.S. monetary base.

- Of the 20 largest silver producers, only five actually call themselves a “silver” company, due to the fact that about 73% of all silver mined is a byproduct of other metals mining.

Any flood into the silver market would overwhelm it. In other words, the rise will be stunning. While it’s not going to happen tomorrow, I strongly suggest you get on board before that rocket ship takes off.

Just putting these charts together stirred my feelings of restlessness, making me anxious for the mania in precious metals to arrive. But the timing is not up to us. Be patient, because if you’re invested in gold and silver and the respective, high-quality stocks, you’re on the right side of this trend.

Had you bought gold, say, four years ago, when it was around $450/oz, you’d be sitting on a nearly 130% gain. But you could have made up to three times as much with even the most conservative precious metals investments – large- and medium-cap gold and silver producers. It’s not too late to jump on the bandwagon. Click here to find out more.

© 2009 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.