US Bureau of Labor Statistics "Phantom" Workers Now Account for 56% of Payroll Increase

Economics / US Economy Jul 10, 2007 - 07:34 PM GMTBy: Paul_L_Kasriel

Each month the Bureau of Labor Statistics attempts to estimate how many jobs were created (or eliminated) by smaller businesses not yet included in its survey of employers. This estimate is referred to as the "birth/death" adjustment. In the 12 months ended June, total-not-seasonally-adjusted nonfarm payrolls increased by 1.982 million. During the same interval, the birth/death adjustment contributed 1.111 million jobs to the total. That is, in the 12 months ended June, the birth/death adjustment accounted for 56.0% of the 12-month increase in total nonfarm payrolls.

Each month the Bureau of Labor Statistics attempts to estimate how many jobs were created (or eliminated) by smaller businesses not yet included in its survey of employers. This estimate is referred to as the "birth/death" adjustment. In the 12 months ended June, total-not-seasonally-adjusted nonfarm payrolls increased by 1.982 million. During the same interval, the birth/death adjustment contributed 1.111 million jobs to the total. That is, in the 12 months ended June, the birth/death adjustment accounted for 56.0% of the 12-month increase in total nonfarm payrolls.

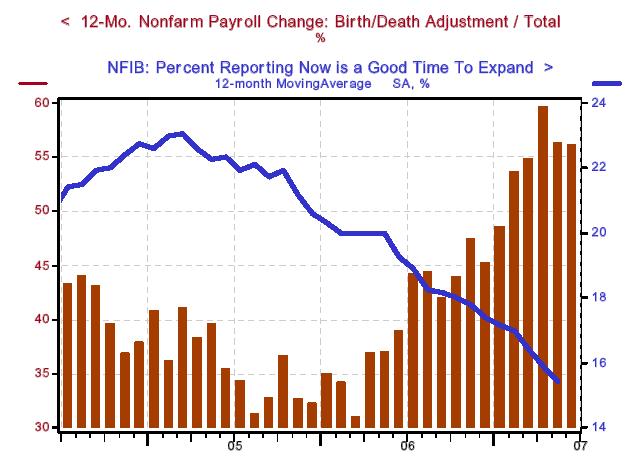

What has been happening to the relative contribution of birth/death estimates as the economy has slowed in the past year? The chart below shows that it has been rising. In the 12 months ended March 2006, the birth/death adjustment was contributing only 30.9% of the jobs to the change in nonfarm payrolls. The birth/death relative contribution has been trending higher since then.

Notice that as the birth/death contribution to nonfarm payrolls has been trending higher, the percentage of small businesses saying that now is a good time to expand their operations has been trending lower. If existing small business managers do not think now is a good time to expand their operations, does it make sense that there are a lot of new small businesses starting up and hiring?

Chart 1

Perhaps because the birth/death adjustment is not, itself, adjusted for the phase of the business cycle the economy is in, it is biasing upward the growth in nonfarm payrolls now. Perhaps the birth/death adjustment is the answer to the Fed's latest conundrum with regard to stronger-than-expected payroll growth given the sharp slowing in real GDP growth.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.