Junior Gold Miner ETF GDXJ Welcomed to the Party

Commodities / Gold & Silver Stocks Nov 11, 2009 - 06:24 AM GMTBy: Adam_Brochert

The Junior Gold Miner ETF (ticker: GDXJ) from Van Eck Global is now in business. Though I have a problem with putting larger silver miners in this ETF as the heaviest-weighted holdings (get info from the Van Eck website here), I will be participating. This is a good vehicle for those looking to get into the more speculative side of the Gold patch without doing all the homework. It also provides a measure of international exposure.

The Junior Gold Miner ETF (ticker: GDXJ) from Van Eck Global is now in business. Though I have a problem with putting larger silver miners in this ETF as the heaviest-weighted holdings (get info from the Van Eck website here), I will be participating. This is a good vehicle for those looking to get into the more speculative side of the Gold patch without doing all the homework. It also provides a measure of international exposure.

As Gold continues to surprise to the upside, much to the paperbugs' dismay and astonishment, the Gold miners are likely to continue to play "catch up" to the Gold price. The all-time highs for many Gold stocks are now within reach (if they haven't been exceeded already). I can only hope that GDXJ will catch on rapidly so that long term LEAP options will become available soon.

Here's a link to a chart of this junior Gold mining index, which I can't seem to manage to steal/copy so that I can paste it into this rant. This ETF has a reasonable expense ratio of less than 1% and the chart is probably near the high end of its current upward trending channel, so I wouldn't be rushing into the frenzy buying this ETF today, as every uptrend has pullbacks and this one in junior Gold miners will be no exception. Remember that Gold and Gold stocks typically have a bullish run from fall to spring, so there's plenty of time.

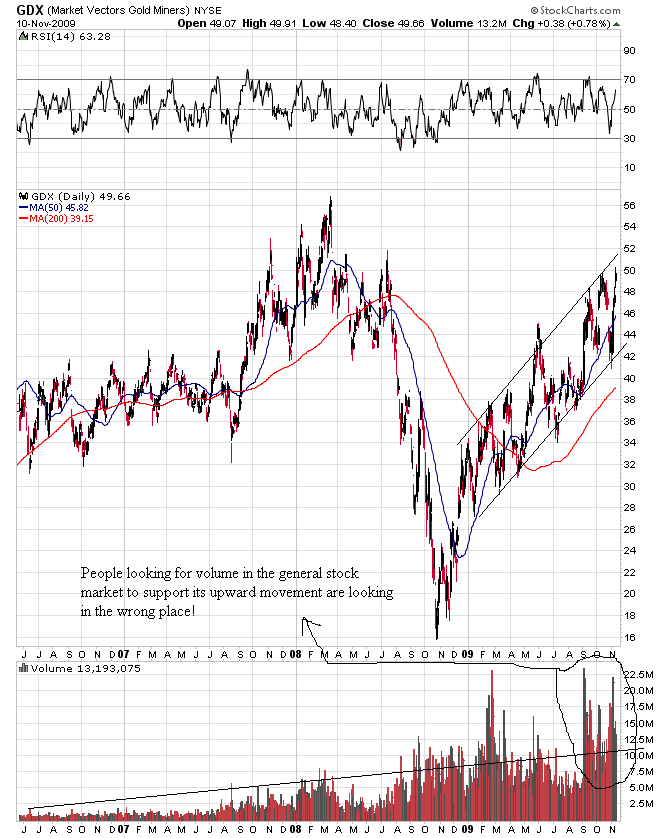

It is also important to recognize the liquidity (i.e. speculative money flow) this ETF will provide to the junior sector. Both retail and institutional investors will likely participate significantly in this ETF. While the Dow Jones Industrial Average continues to show anemic volume, the senior Gold mining ETF (ticker: GDX) shows continued bullish increase in volume. Gold investors know where the real bull market is (below is a 3.5 year chart of the GDX ETF since its inception to show this powerful secular volume trend):

As the Dow to Gold ratio continues to trend towards parity, more and more investors are jumping on the Gold ship. Though "contrarians" are now calling for a top based on this excessive bullishness, they did the same thing with oil at $40, $80 and then $100. We will absolutely have a parabolic bullish phase in Gold to match the one that previously occurred in oil (oil went up roughly 14 fold before its crash, which would translate into a Gold peak price of roughly $3500/oz.). Though I am in no position to say whether or not "the" parabolic move in Gold has already started, I do know that we are a long, long way from "the" secular top in the Gold market. Also, Gold stocks as a sector will likely peak months to a year or more AFTER the Dow to Gold ratio bottoms out. The timing of the release of the GDXJ ETF is impeccable. I predict major success for this new financial offering.

Disclosure: I have no relationship with Van Eck Global but I have invested in GDX and GDX options in the past and plan to invest in the GDXJ ETF soon.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.