Stocks, Dollar or Bonds, Which Crisis Will be Next?

Stock-Markets / Credit Crisis 2009 Nov 09, 2009 - 11:40 AM GMTBy: Graham_Summers

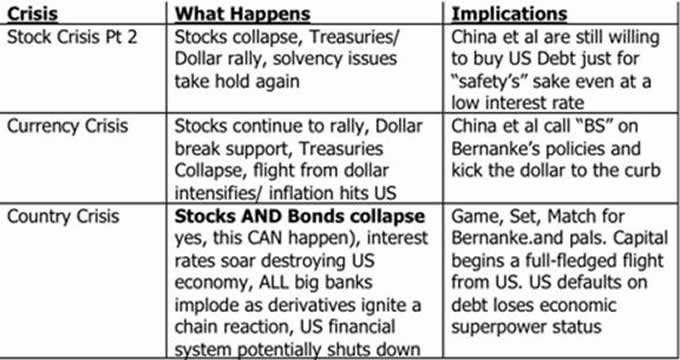

As I wrote earlier this year, the US’s monetary policy has already laid the seeds of the next Crisis. Is now no longer a question whether or not another Crisis is coming; instead, it’s a question of which Crisis and when. I’ve detailed what I think are the three general options below:

As I wrote earlier this year, the US’s monetary policy has already laid the seeds of the next Crisis. Is now no longer a question whether or not another Crisis is coming; instead, it’s a question of which Crisis and when. I’ve detailed what I think are the three general options below:

Quite a few people wrote in last week telling me I was insane for even claiming that the US Dollar could rally. But in reality, this is the outcome Americans should all be praying for given the alternatives: a Dollar rally would only damage stocks and commodities, whereas a Currency Crisis would effectively destroy the economy and a Country crisis… well, that one is obvious.

Stocks, generally get all the attention from the media, but in reality they are relatively small fries compared to the Bond and Currency markets. As of 2008, the world stock market was roughly $36 trillion in size. In contrast, bonds were $67 trillion and forex (currency) which TURNS OVER $3.2 trillion PER DAY: ten times the daily volume of EVERY stock market in the world.

Suffice to say, a Crisis in stocks would be the lesser of three Crises. And those of us in the US should be hoping it’s the Crisis we get as opposed to a Crisis for US debt or the Dollar.

The good news is that it seems this is what we’re heading for: in the last two weeks, the US Dollar broke its downtrend:

And stocks broke their uptrend:

I also want to point out that the Wilshire Index (the index containing every publicly traded US company) broke below its uptrend as opposed to the downtrend set by the beginning of this bear market (2007-present):

Looking at these, it seems that Crisis #1 (stocks collapse and the Dollar/ Treasuries) rally is the most likely candidate for the upcoming Crisis. However, to be sure of this, we need to see long-term Treasuries hold their 20+ year uptrend.

As I’ve written before, the Federal Reserve accounted for nearly half (49%) of ALL Treasury purchases in the second quarter. During the same time period, foreign investors (China, Japane, etc.) decreased their purchases of US debt by 40%.

In simple terms, foreign investors are not interested in buying US Treasuries at current yields (with the 30-year yielding 4.4% and the Dollar losing 15% in value this year alone, I can’t say I blame them).

Now, to get higher yields you need bond prices to fall. The Fed’s Quantitative Easing program (in which the Fed bought Treasuries to artificially create demand) just ended… so we’re about to find out what the bond market thinks of US debt without life support. If demand is so low that Treasuries break their 20+ year trend-line, then LOOK OUT, we may be heading for Crisis #2 or Crisis #3.

Looking at a close-up of the 30-year’s chart, it looks like we’ll know the deal (whether bonds will collapse along with stocks) sooner rather than later.

In conclusion, my main point is this: it’s now certain that A Crisis is coming… it’s now just a question of which one and when. So far it looks like it will be a Stock Crisis (a replay of last year in which the Dollar rallies and commodities and stocks fall). However, DON’T get too caught up watching stocks right now. The BOND market is larger and much more significant in terms of forecasting what’s to come. And with the Fed’s artificial support for Treasuries just ended, we may be about to find out.

Keep your eyes on the long end of the Treasury market and the Dollar. THEY (not stocks) will be dictating what’s to come.

The investments detailed within this report will not only protect your portfolio from the coming carnage, they’ll also show you enormous profits: they returned 12%, 42%, and 153% last time stocks collapsed.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.