U.S. Healthcare Legislation Investment Impact

Companies / Healthcare Sector Nov 09, 2009 - 12:37 AM GMTBy: Richard_Shaw

Last night the U.S. House of Representatives brought us one large step closer to a national healthcare system. Investors should be cognizant of the financial effects that would follow.

Last night the U.S. House of Representatives brought us one large step closer to a national healthcare system. Investors should be cognizant of the financial effects that would follow.

In the extreme short-run, it would be reasonable to assume that the U.S. stock market would react negatively, although short-term price movements are often chaotic. In the intermediate-term, if the legislation goes forward, the healthcare sector should perform at a lower level than in periods prior to national healthcare.

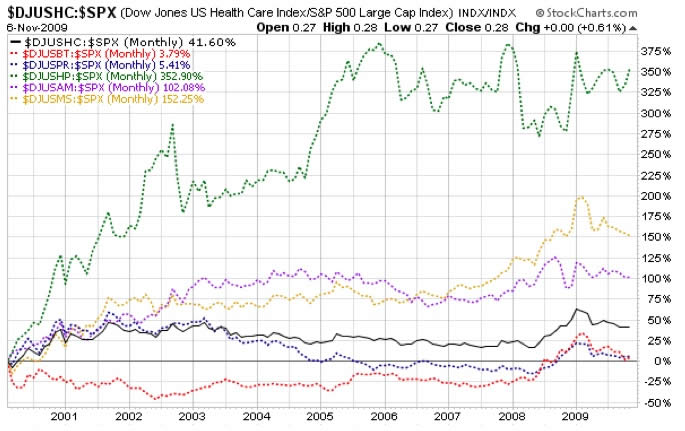

The chart below shows the historical relative price performance of several healthcare sectors versus the S&P 500. They are: biotech ($DJUSBT), pharmaceuticals ($DJUSPR), healthcare providers ($DJUSHP), medical equipment manufacturers ($DJUSAM) and medical supplies ($DJUSMS). The overall healthcare sector is represented by $DJUSHC.

Biotech and pharmaceuticals have underperformed. We expect that relationship to be accentuated. The other sectors are expected to have lower relative performance than before, particularly the healthcare providers, which include the health insurers.

Here are a few of the many specific negative profits factors in national healthcare:

- Drug patent protection will be shortened from 20 (+ up to 5 for approval) years to 12 years (? + up to 5 for approval), before generic competition will be possible. That reduces profitability of new drug research. Profits will be lower and fewer new drugs will be developed. That will reduce valuations on companies that develop new drugs. [In 1995, Congress increased to duration of drug patents from 17 to 20 years to encourage more development, but now in a reversal they cut from 20 to 12 to increase generic competition -- unfortunately at the cost of future medical advances].

- Annual fees to support the national healthcare budget will be assessed on insurers, drug companies, medical device companies, and clinical laboratories. That will reduce valuations of companies in those categories.

- Insurers may or may not be driven out of business (a major uncertainty that will reduce current valuations) and those that survive may effectively be converted to service utilities with regulated rates and profits (likely to reduce valuations below historic levels).

A small sampling of large companies in the healthcare field include:

- Biotech: AMGN, BIIB

- Pharmaceuticals: JNJ, PFE

- Medical Equipment and Supplies: MDT, BDX

- Clinical Labs: DGX

- Insurers: AET, UNH

- Hospitals: CYH, UHS

This list of companies is not a securities recommendation of any kind — just a representative sampling of the sector and its sub-sectors.

Disclosure: We do not own any named security.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.