Goldman Sachs' and Warren Buffett's BRK Attempt Fannie Mae Tax Scam

Stock-Markets / Credit Crisis Bailouts Nov 08, 2009 - 02:56 PM GMTBy: Trader_Mark

Some great posts this weekend over at "The Big Picture" by Barry Ritholtz; Barry is essentially the "trailblazer" of financial blogging and many a blogger has followed in his footsteps. In my piece this past week on the Berkshire Hathaway (BRK.a) Burlington Northern (BNI) buyout I didn't have time to get into it but detail oriented readers might of noticed this seemingly throwaway line I tossed in:

Some great posts this weekend over at "The Big Picture" by Barry Ritholtz; Barry is essentially the "trailblazer" of financial blogging and many a blogger has followed in his footsteps. In my piece this past week on the Berkshire Hathaway (BRK.a) Burlington Northern (BNI) buyout I didn't have time to get into it but detail oriented readers might of noticed this seemingly throwaway line I tossed in:

.... of course Warren wraps himself in the US flag in his public reasoning for the purchase

.... of course Warren wraps himself in the US flag in his public reasoning for the purchase If there is one man who bests Cramer at self promotion it is Warren Buffet. Now let's be clear he is an investing genius... a marvel. But for anyone who thinks he is any different than "take your lunch money when your eyes are averted" top honchos at the investment banks, you have been duped. He is walking Capitalism 101 - the good, the bad, and the ugly. Carl Icahn with a far better publicity machine; operating in a corporate socialist state. I didn't post it on the blog but early in the week it came to light that Goldman Sachs (GS) was attempting to buy some tax loss credits from Fannie Mae. These credits are useless to Fannie because Fannie won't be making money anytime this decade... but they would of been a boon to Goldman since they would allow the firm to reduce their tax obligation to the US - need a way to shield those gains from the 98% winning percentage. My first thought was "have these guys no shame?" considering Goldman is only around due to the US taxpayer. Then within the time it takes a Wall Street high frequency trading computer to make 8000 trades (1/4000th of a second) I remember... no Goldman has no shame. Not in its current form anyhow. And as a pure capitalist - it's a brilliant move... why not try? Obviously this would of been a public relations nightmare for the government so other than a story in the Wall Street Journal I thought it was dead in the water. But lo and behold, midweek Warren Buffet (who is now a major stakeholder in Goldman) swoops in and puts his backing behind the Goldman bid. Oh that cute and cuddly "grandpa" guy from Omaha....it must be "ok" then!

Thankfully the Treasury saw this would STILL be a public relations nightmare even with good ole Warren giving his gold plated seal of approval. From there let's look at 2 posts from Ritholtz... gems. Note - if you are not familiar Buffet has been a huge backer of Moody's who is one of the many important pieces of the very broken puzzle that led us into this financial disaster [May 28, 2009: David Einhorn v Warren Buffet on Moody's] I have been struck that Buffet has not once come out and said (a) what Moody's pulled off was a massive scam and either (b) I know that being in an oligopoly type of business I was benefiting from this scam or (c) I was duped. And let's just be blunt and say the chances of Buffet being duped are between null and void.

#1 Treasury DK's Goldman/Fannie/Berkshire Tax Scam - here

Perhaps the Oracle of Omaha has been infected by a new flu variant, the H1N1 GS mutation. It is usually non fatal to the host, but destroys its reputation . . .

******************************

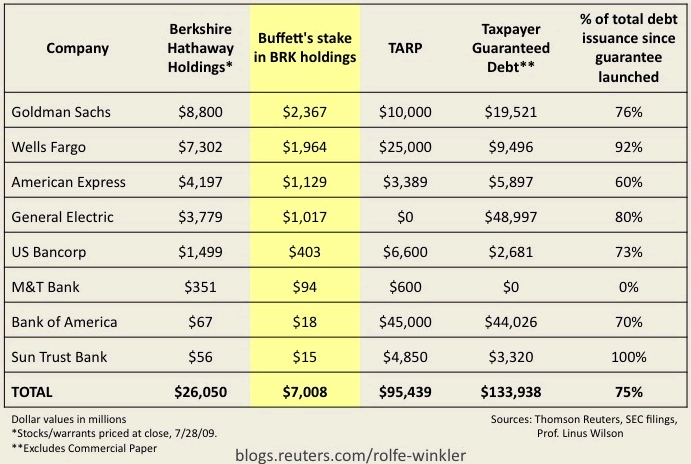

Back to my comment's here: Potentially even more eye opening is what I call the American system.... "corporate socialism". Remember socialism for the people is an evil thing and turns us into Europe. Socialism for the top flight of elite financiers and corporations? That's fine and dandy! Check out this data...

*******************************

#2 Buffet's Bailouts - here

#3 Rofle Winkler's original post - Buffet's Betrayal here

********************

Back to my comments

Summary: Is Warren B. genius? Absolutely. Does he know how to work the system like no other? Absolutely. Part of American free market capitalism corporate socialism? At the front of the line... with bells on. Soft and cuddly? Not so much.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2009 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.