Easy Money Continues to Boost Risky Financial Asset Prices

Stock-Markets / Financial Markets 2009 Nov 08, 2009 - 11:02 AM GMT The Federal Open Market Committee (FOMC) maintained its extraordinarily accommodative monetary policy following its meeting on Wednesday. The communiqué had no surprises and said that the committee expected to keep the fed funds rate target in the 0-0.25% range “for an extended period”. As expected, the European Central Bank (ECB) and the Bank of England (BoE) also kept interest rates unchanged at 1% and 0.5% respectively.

The Federal Open Market Committee (FOMC) maintained its extraordinarily accommodative monetary policy following its meeting on Wednesday. The communiqué had no surprises and said that the committee expected to keep the fed funds rate target in the 0-0.25% range “for an extended period”. As expected, the European Central Bank (ECB) and the Bank of England (BoE) also kept interest rates unchanged at 1% and 0.5% respectively.

“A hesitant economic recovery, tame inflation and severe credit headwinds suggest that monetary policy will need to stay very easy for at least another year. Liquidity trends will not be a constraint on higher prices for risk assets for a while,” said BCA Research.

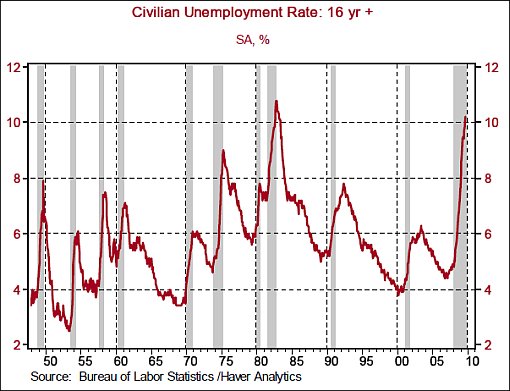

The jump in the unemployment rate to a 26-year high of 10.2% in October - an increase of 0.4 of a percentage point - reminded pundits of the challenges in the labor market and broader economy. While investors’ hopes of an economic recovery might have got ahead of reality, the cartoonists continually reminded us of worrisome issues …

Source: Stuart Carlson, Uclick.com

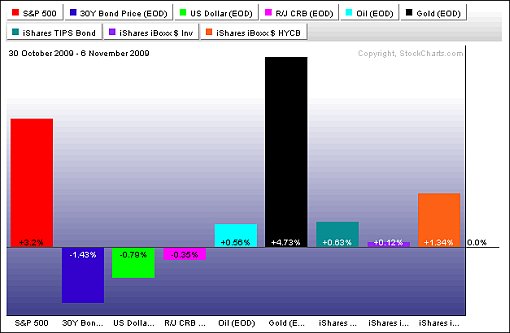

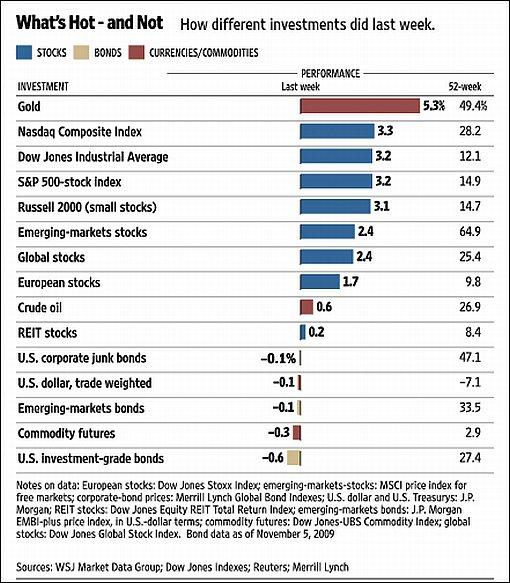

The past week’s performance of the major asset classes is summarized by the chart below. Gold bullion was the star of the week, especially subsequent to the purchase by India’s central bank of 200 metric tons of gold from the International Monetary Fund. The price jumped by 4.7%, recording an all-time high of just over $1,100, with platinum (+1.7%) and silver (+6.6%) also handsomely higher. (See my recent post “Gold bullion surging in all currencies“.)

Source: StockCharts.com

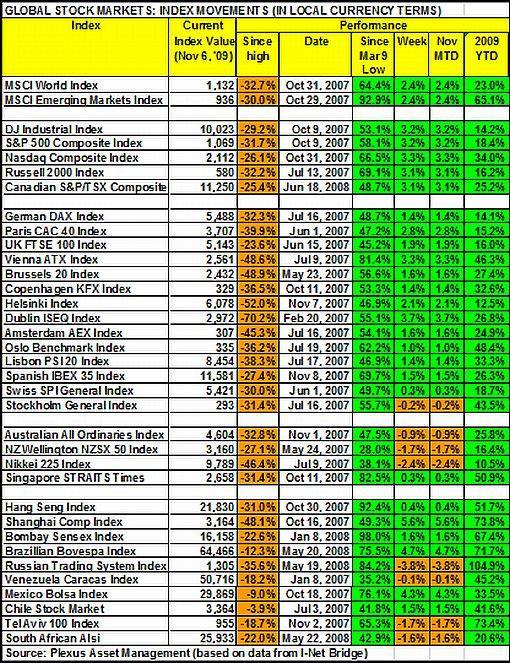

A summary of the movements of major global stock markets for the past week, as well as various other measurement periods, is given in the table below.

The MSCI World Index (+2.4%) and the MSCI Emerging Markets Index (+2.4%) both made headway last week to take the year-to-date gains to 23.0% and an impressive 65.1% respectively. Interestingly, Chile is now only 3.9% down from its July 2007 high and could be one of the first markets to wipe out all the financial crisis/recession losses.

The US indices reversed a two-week down-patch and all the major indices and economic sectors closed higher for the week. The S&P 500 scored a full house of gains and the Dow Jones Industrial Index reclaimed the 10,000 level, putting these indices within 2.7% and 0.7% respectively of their 2009 highs.

The year-to-date gains in the US remain firmly in positive territory and are as follows: Dow Jones Industrial Index 14.2%, S&P 500 Index 18.4%, Nasdaq Composite Index 34.0% and Russell 2000 Index 16.2%.

Click here or on the table below for a larger image.

Top performers among stock markets this week were China (+5.6%), Argentina (+5.1%), Brazil (+4.7%), Ukraine (+4.7%) and Slovakia (+4.7%). At the bottom end of the performance rankings countries included Egypt (‑6.6%), Vietnam (-5.5%), Iceland (-4.2%), United Arab Emirates (-3.4%) and Serbia (‑3.3%).

Of the 99 stock markets I keep on my radar screen, 52% recorded gains (last week 15%), 43% (84%) showed losses and 1% (5%) remained unchanged. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

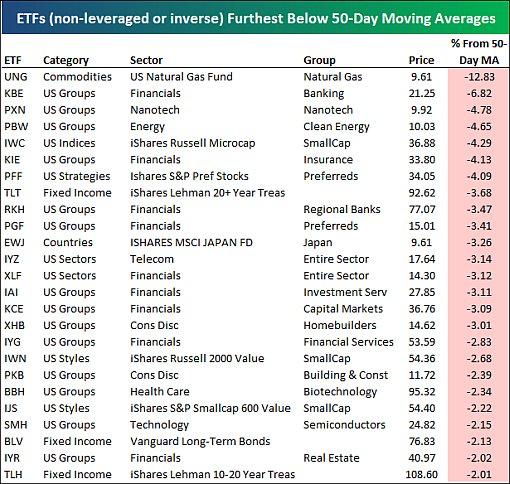

John Nyaradi (Wall Street Sector Selector) reports that, as far as exchange-traded funds (ETFs) are concerned, the winners for the week included Telebras HOLDRS (TBH) (+13.1%), Market Vectors Gold Miners (GDX) (+12.4%), PowerShares Global Gold & Precious Metals (PSAU) (+10.7%), Market Vectors Brazil Small Cap (BRF) (+9.2%) and Market Vectors Coal (KOL) (+8.1%).

At the bottom end of the performance rankings, ETFs included United States Natural Gas (UNG) (-7.2%), ProShares Short Emerging Markets (EUM) (‑5.5%), Vanguard Extended Duration Treasury (EDV) (-3.8%), ProShares Short QQQQ (PSQ) (-3.7%) and iShares Barclays 20+ Year Treasury Bond (TLT) (-2.2%).

Still on the topic of ETFs, Bespoke highlighted a list of the funds trading the furthest above (top table) and below (bottom table) their 50-day moving averages. The tables are posted with further comment.

Source: Bespoke, November 6, 2009.

Referring to the surge in the gold price, the quote du jour this week comes from long-timer Richard Russell, author of the Dow Theory Letters. He said: “An integral part of our prosperity since World War II has to do with the dollar as a reserve currency. As the world’s reserve currency, we could print our ‘wealth’ and the world would accept it. That ‘free lunch’ is now in the process of changing.

“The key to the whole picture is the acceptance of the dollar. The dollar is compared every minute with real Constitutional money - gold. As gold rises, the dollar’s future declines. At some point ahead, the world will refuse to accept dollars, which are really Federal Reserve notes. When that happens, the US’s great advantage will be over.

“The forces of real intrinsic money, gold, are now battering at the door of fiat money, which is money created at will out of nothing by the central banks. It’s a death-struggle between real intrinsic money against ‘counterfeit’ or play money created by bankers. Who will win? Reality will always triumph over fantasy.”

Other news is that the House, following the Senate, passed legislation that extended the $8,000 first-time homebuyers’ credit until April and unemployment insurance for an additional 20 weeks. Meanwhile, the Senate aims to publish a bill on regulatory overhaul next week.

Separately, regulators closed five more banks on Friday, bringing the tally of US bank failures in 2009 to 120. The latest round includes United Commercial Bank of South Francisco that reportedly received federal bailout funds in 2008.

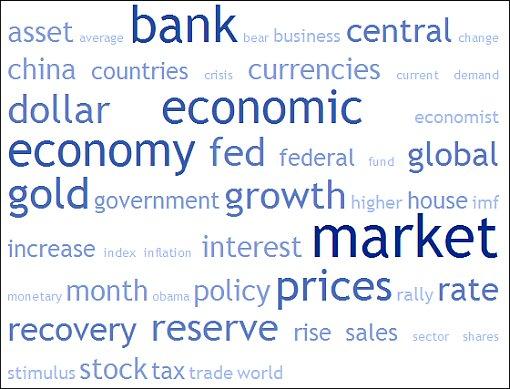

Next, a tag cloud of all the articles I read during the week. This is a way of visualizing word frequencies at a glance. Although “bank” still features prominently, the key words have started taking on a more normal pattern compared with the crisis-related words that have dominated the tag cloud for many months. Unsurprisingly, “gold” is moving up the ranks as the metal increasingly gains favor.

The major moving-average levels for the benchmark US indices, the BRIC countries and South Africa (where I am based in Cape Town) are given in the table below. With the exception of the Russell 2000 Index and the Bombay Sensex Index, most of the indices reclaimed their 50-day moving averages over the past few days, with all the indices still holding above their respective 200-day moving averages. The 50-day lines are also above the 200-day lines in all instances.

The October lows are also given in the table. A break below these levels would indicate a reversal of the uptrend since March, i.e. reversing the progression of higher reaction lows.

Eoin Treacy (Fullermoney) said: “Mean reversion [i.e. pulling back to the moving averages] within an overall bullish environment is the equivalent of taking a breather in a relatively long journey and is characterized by supply and demand coming back into balance for a time. As this is going on, bullish and bearish arguments increasingly compete for attention and sentiment is likely to begin to turn negative as the process unfolds. However, provided monetary conditions remain accommodative and markets find support in the region of their means [moving averages] we can continue to give the upside the benefit of the doubt over the medium to longer term.”

Moving on to government bonds for a moment, the ten-year US Treasury Notes yield has risen by 33 basis points since the October low as financial markets adopted a more upbeat outlook on the economy, while also grappling with concerns about massive issuance and inflationary pressures.

As highlighted in a post a few days ago, the chart below shows monthly data for the ten-year Treasury Note yield since 1998 and conveys an important message when considering the two momentum-type oscillators at the bottom (ROC and MACD). The ROC has just reversed course (crossing the zero line) for the first time since a buy signal was given at the beginning of 2007 and now indicates a primary sell signal. The MACD provided a similar indication six months ago.

Source: StockCharts.com

Nouriel Roubini (RGE Monitor) warned (via The Wall Street Journal) that markets, be they stocks, emerging markets or commodities, have rallied too far, too fast because the global economy will experience an anemic recovery rather than the hoped-for V-shaped recovery. He said that the current “party” can continue for another six months, but it will eventually end badly as much of the rise in asset prices since March is yet another bubble created by a huge pool of global liquidity.

As said last week, I will bide my time in the stock market while the fundamentals play catch-up. Meanwhile, caution remains the operative word.

For more discussion on the economy and financial markets, see my recent posts “Gold bullion surging in all currencies“, “Longer-term bond indicators flash ’sell’“, “Picture du Jour: Prepare for higher inflation“, “WealthTrack: Why Jim Grant is bullish“, “Unemployment rate troubling, but …” and “Credit woes continue“. (And do make a point of listening to Donald Coxe’s webcast of November 6, which can be accessed from the sidebar of the Investment Postcards site.)

Twitter and Facebook

I regularly post short comments (maximum 140 characters) on topical economic and market issues, web links and graphs on Twitter. For those not doing so already, you can follow my “tweets” by clicking here. You may also consider joining me as a friend on Facebook.

Economy

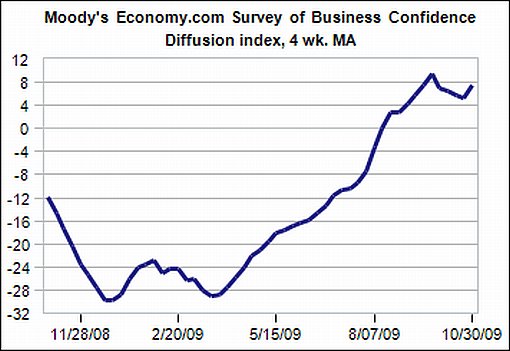

“Global business confidence has remained largely unchanged during the past two months through mid-October. Sentiment is consistent with a very tentative and fragile global economic recovery,” according to the results of the latest Survey of Business Confidence of the World by Moody’s Economy.com. “Businesses … are more upbeat about the outlook into next year … South Americans are the most positive, and North Americans generally the most negative.”

Source: Moody’s Economy.com

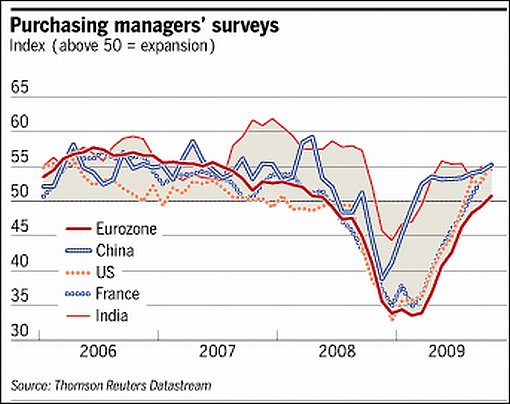

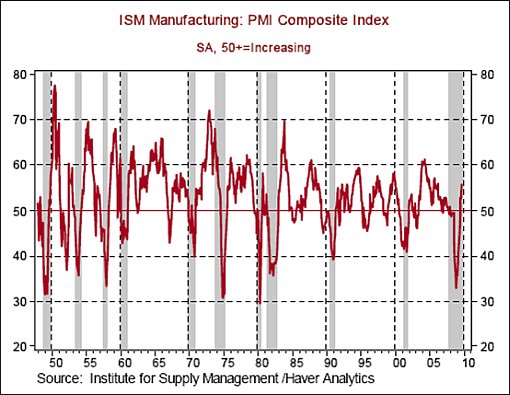

“Signs of recovery after a torrid year reverberated around the world on Monday as manufacturers reported rising output and improved employment prospects in the US, Europe and Asia,” reported the Financial Times. The JP Morgan global composite purchasing managers’ index (PMI) rose to 54.4, up from 53 in September, the highest value since July 2004. The recovery in manufacturing was strongest in Asia, where economists said the PMI figures were consistent with pre-crisis growth rates, but also reached multi-year highs in France, the UK and the US.

Source: Chris Giles, Financial Times, November 2, 2009.

A snapshot of the week’s US economic reports is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

November 6

• October employment report - headline jobless rate is troubling, but it is a lagging indicator

November 5

• November 4 FOMC policy statement revisited

• Total continuing claims post second weekly decline

• Productivity gains are noteworthy, but temporary jump

November 4

• Fed retains stance of September FOMC meeting

November 3

• Auto sales rebound in October

November 2

• Factory sector maintains expansionary trend

• Housing sector - positive signs in construction data and Pending Home Sales Index

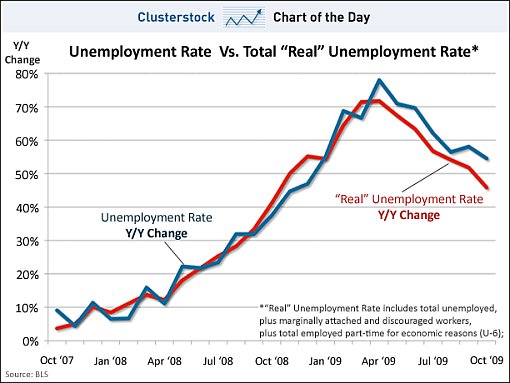

On the US unemployment rate hitting 10.2% in October, Clusterstock said: “Worse yet, the ‘real’ unemployment rate, which adds in things such as discouraged workers who have dropped out of the labor force, hit 17.5%. Ouch.

“Yet there’s some light at the end of the tunnel. While the unemployment rate and ‘real’ unemployment rate rose in October, the rate of deterioration (year-over-year change) for both measures kept falling, as shown below. Thus we’re still bleeding jobs and it hurts, but the blood loss is slowing rapidly and starting to come under control. Hopefully the patient still has a pulse by the time the blood stops,” said the report.

Source: Clusterstock - Business Insider, November 6, 2009.

Meanwhile, according to Financial Times, “the International Monetary Fund (IMF) projected that on current trends, even assuming some discretionary fiscal tightening next year, government debt in the advanced G20 economies would reach 118% of gross domestic product in 2014. Sweeping spending cuts and tax increases will be required across the industrialized world over the next decade to bring public finances under control following the economic crisis.” A decade of restraint looks like a likely scenario.

Week’s economic reports

Click here for a summary of Wells Fargo Securities’ weekly economic and financial commentary.

US economic data reports for the week include the following:

Thursday, November 12

• Initial jobless claims

• Treasury budget

Friday, November 13

• Trade balance

• Export and import prices

• Michigan sentiment

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, November 6, 2009.

“The conventional view serves to protect us from the painful job of thinking,” said John Kenneth Galbraith. Let’s hope the news items and quotes from market commentators included in the “Words from the Wise” review will assist readers of Investment Postcards with formulating the correct view in order to invest profitably.

That’s the way it looks from Cape Town (where I will shortly be making my way to the airport for a long-haul flight to Europe).

Source: Steve Kelly, Comics.com

Financial Times: Stronger signs of global recovery

“Signs of recovery after a torrid year reverberated around the world on Monday as manufacturers reported rising output and improved employment prospects in the US, Europe and Asia.

“From Seoul to San Francisco, manufacturing sentiment has recovered quickly from the sudden shock of the global recession last year, when world trade stopped dead and unsold stock piled up in warehouses across the world.

“A year on, manufacturers reported that in October, output around the world was rising at the fastest rate for five years. The JPMorgan global composite purchasing managers’ index (PMI) rose to 54.4, up from 53 in September, the highest value since July 2004.

“The biggest surprise came in the US, where the Institute for Supply Management’s factory index rose to 55.7 from 52.6 in September. The figure, well above market expectations, sent stocks in the US and Europe surging as it was seen as evidence that the recovery was more durable and entrenched than previously thought.

“Speaking at a White House meeting of his Economic Recovery Advisory Board, Barack Obama, the US president, said the US economy had recovered a lot of ground since January, but cautioned that there was still more pain ahead for US employees. ‘We anticipate that we are going to continue to see some job losses in the weeks and months to come,’ he said.

“Around the world, manufacturers reported rising output, falling stocks of finished goods and encouraging new orders as the recovery gained momentum. They were strongest in Asia, where economists said the PMI figures were consistent with pre-crisis growth rates, but also reached multi-year highs in France, the UK and the US.”

Source: Chris Giles, Financial Times, November 2, 2009.

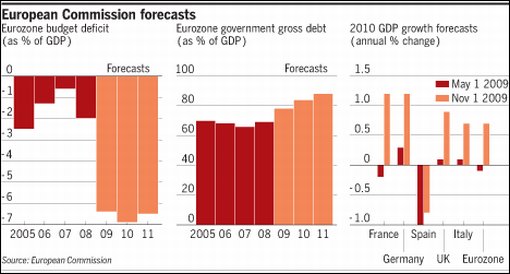

Financial Times: Commission raises EU growth forecasts

“The European Commission on Tuesday raised its forecast for European economic growth next year, but said the recovery from recession would come at the price of record-high budget deficits and public debt.

“In its six-monthly economic outlook, the Commission predicted that the 27-nation European Union would grow by 0.7% next year and 1.6% in 2011, after a slump of 4.1% in gross domestic product this year.

“The forecast for 2010 was significantly more positive than the Commission’s estimate in May of a 0.1% fall in GDP. It reflected the impact of multibillion-euro government deficit-spending programmes, emergency support measures for the financial sector and interest rates cut to almost zero.

“‘The EU economy is coming out of recession,’ Joaquín Almunia, the monetary affairs commissioner, said.

“‘This owes much to the ambitious measures taken by governments, central banks and the EU that have not only prevented a systemic meltdown but have kick-started the economy.’

“However, government borrowing to combat the financial crisis and recession has been on such a large scale that none of the eurozone’s 16 countries will have a budget deficit below 3% of GDP - the agreed ceiling in normal times - in either 2010 or 2011.

“The eurozone’s aggregate budget deficit was projected at 6.4% this year, 6.9% next year and 6.5% in 2011. By far the most seriously affected countries were Ireland, forecast to have a deficit of 14.7% in both 2010 and 2011, and Greece, whose deficit was estimated at 12.2% in 2010 and 12.8% in 2011.

“Aggregate public debt in the eurozone is forecast to rise to 84% of GDP next year and 88.2% in 2011 from 78.2% this year. The debt level stood at 66% in 2007.

“EU leaders agreed at a summit in Brussels last week that governments should concentrate on putting their public finances in order, but that the economic recovery was too fragile for the effort to start in earnest until 2011.”

Source: Tony Barber, Financial Times, November 3, 2009.

Financial Times: World Bank raises east Asia growth forecast

“The World Bank on Wednesday raised its forecast for economic growth in developing east Asia this year by 1.4 percentage points to 6.7%, but warned that the rebound from the global financial crisis had yet to turn into a recovery.

“The revised forecast compares with growth of 8% last year, and a fresh forecast of 7.8% for 2010 - a significant improvement on the development bank’s gloomier predictions in April that a world recovery might not materialise until late 2010.

“In an update to its East Asia and Pacific Outlook, published in April, the World Bank said the economies of developing east Asia had rebounded sharply from the steep drop in activity in early 2009 because of extraordinary fiscal and monetary measures, improved global financial conditions and an upturn in inventory cycles.

“The Bank said growth in the developed economies was projected to recover at a modest pace in 2010 as banks continued to reduce debt while high and rising unemployment subdued a recovery in private consumption.

“It warned that a premature withdrawal of the stimulus measures could damage the recovery, but also noted that the rebound in gross domestic product and emerging inflationary pressures could mean that monetary policy would have to be tightened ’sooner rather than later’.

“The Bank said that exchange-rate flexibility would be ‘critical’ in managing foreign-exchange inflows while keeping inflation and asset-price increases under control.

“It said many governments were worried that allowing exchange rates to appreciate would slow the recovery in exports and generate capital inflows that might cause financial instability.”

Source: Kevin Brown, Financial Times, November 4, 2009.

MoneyNews: Soros - China to be big winner from world crisis

“Billionaire investor and philanthropist George Soros said on Friday China will be the biggest winner of the global financial crisis while the United States stands to lose the most.

“‘There will be significant changes in the relative positions of other countries as well but from a global perspective, the one between the United States and China is the most significant,’ Soros told a lecture. ‘China is likely to emerge as the big winner.’

“Soros added the US banking system has to earn its way out of a hole while in commercial real estate and leverage buyouts, the ‘bloodletting is yet to come’.”

Source: MoneyNews, November 2, 2009.

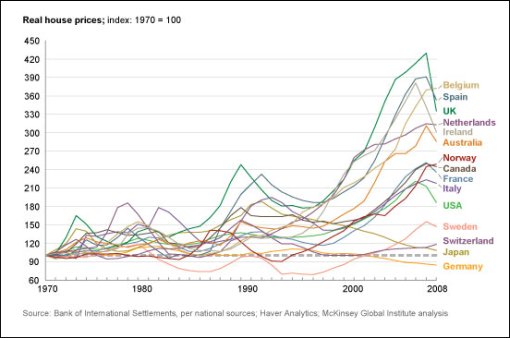

McKinsey Quarterly: A global view of the housing bubble

“Although the current crisis started with the bursting of the US housing bubble, other economies around the world are feeling the effects of their own real-estate booms and busts. From 2000 through 2007, a remarkable run-up in global home prices occurred. But that trend has reversed abruptly. In 2008, the value of US residential real estate fell 10%; the global average fared only somewhat better, declining by almost 4%. We estimate that falling home prices erased more than $3.4 trillion of household wealth in 2008. And because home prices are slow to correct, the current slide may persist for some time, which could depress global consumption.”

Source: McKinsey Quarterly, October, 2009.

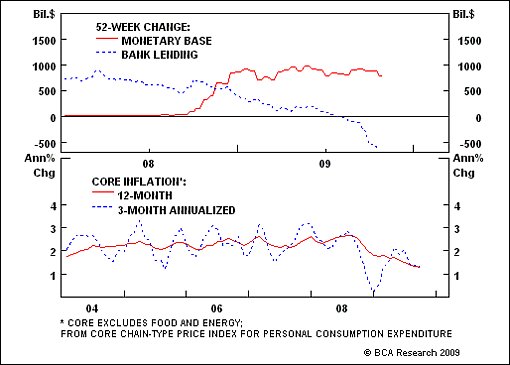

BCA Research: Fed policy - no exit in sight

“A hesitant economic recovery, tame inflation and severe credit headwinds suggest that monetary policy will need to stay very easy for at least another year.

“There were no surprises from the latest FOMC meeting, with the statement’s language on the economy and policy virtually unchanged from the September release. Fed policymakers no doubt had an in-depth discussion about exit strategies and how to communicate these to the public at large. However, in terms of near-term actions, there is no change in the picture: a highly accommodative stance is still needed.

“The Fed’s balance sheet is bloated, but liquidity injections into the banking system have still failed to trigger a self-feeding expansion in money and credit. The monetary base has expanded by $788 billion in the past year, while outstanding bank loans have contracted by $638 billion. Meanwhile, actual inflation and inflation expectations remain tame.

“Bottom line: Policy needs to stay very easy, and the first rate hike may not come till late-2010/early-2011. Liquidity trends will not be a constraint on higher prices for risk assets for a while.”

Source: BCA Research, November 6, 2009.

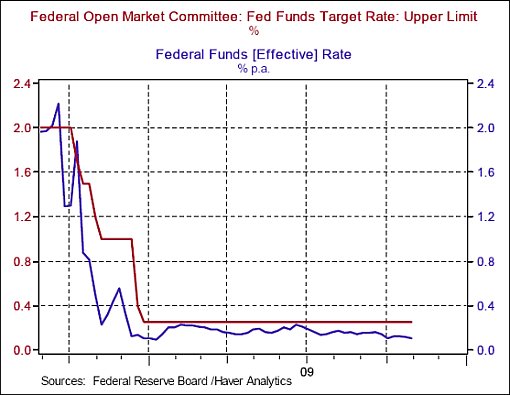

Asha Bangalore (Northern Trust): Fed retains stance of September FOMC meeting

“The FOMC policy statement following the meeting of November 3-4 retains roughly the stance that was conveyed in the September policy statement. In the November 4 policy statement, the Fed also left unchanged the much quoted phrase - “warrant exceptionally low levels of the federal funds rate for an extended period”. Essentially, the Fed is no rush to change its monetary policy stance. The financial media appears to have reacted prematurely after the 3.5% increase in third quarter real GDP. The effective federal funds rate continues to trade below the upper limit of the target federal funds rate.

“The modifications of today’s [Wednesday] policy statement are consistent with the nature of incoming economic reports and financial market conditions. The outlook for inflation was not modified. The reduction in the quantity of agency bonds the Fed plans to purchase (to $175 billion from $200 billion) is due to a limited availability of these bonds.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, November 4, 2009.

MoneyNews: Geithner - recovery is going to take awhile

“Treasury Secretary Timothy Geithner acknowledges the federal budget deficit is too high, but that the priorities now are economic growth and job creation.

“Asked repeatedly on NBC’s Meet the Press whether this means taxes will rise, Geithner avoided giving specifics. He did say President Obama is committed to dealing with deficit in a way that will not add to the tax burden of people making less than $250,000 a year.

“The White House has not decided how to reduce the red ink, Geithner said in an interview broadcast Sunday.

“‘Right now we’re focused on getting growth back on track,’ he said. ‘And we’re not at the point yet where we have to decide exactly what it’s going to take.’

“He acknowledged that the economic recovery, while showing positive movement, has been shaky and uneven.

“‘A lot of damage was caused by this crisis. It’s going to take some time for us to grow out of this. It could be a little choppy,’ he said. ‘It could be uneven. And it’s going to take awhile.’

“A bright spot in the recovery identified by Geithner is the banking system, which he said is ‘dramatically more stable’ because of the government bailout.

“But Geithner said more needs to be done to assist small businesses, adding that the administration is working to help open up credit to them. These businesses, he said, ‘face a really tough environment on the financing side’.

“After financial institutions were widely blamed for assuming too much risk and bringing the economy to the brink of collapse, Geithner said a concern now is that they might end up being too timid.

“‘The big risk we face now is that banks are going to overcorrect and not take enough risk,’ he said. ‘We need them to take a chance again on the American economy. That’s going to be important to recovery.’

“Geithner said it’s too early to decide if a second government stimulus package should be offered, though he acknowledged unemployment probably will rise even more before it starts to turn around. Economists expect to see job growth after the first of the year, probably in the first quarter, he said.

“Geithner also said the administration supports steps being considered by Congress like extending unemployment insurance and the homebuyer tax credit.”

Source: MoneyNews, November 2, 2009.

The Wall Street Journal: More relief for unemployed, home buyers

“The Senate has passed a bill extending unemployment benefits and the popular tax credit for homebuyers. It also includes proposed tax increases to offset the costs that may be hard for some businesses to swallow.”

SourceThe Wall Street Journal, November 4, 2009.

MoneyNews: Krugman - Huge new stimulus now

“The Obama administration’s stimulus plan is working, but the deficit spending was way too small to have a significant, long-term impact on the US economy, writes Nobel Prize winning economist Paul Krugman.

“‘The good news is that the American Recovery and Reinvestment Act, a.k.a the Obama stimulus plan, is working just about the way textbook macroeconomics said it would,’ writes Krugman in The New York Times.

“‘But that’s also the bad news - because the same textbook analysis says that the stimulus was far too small given the scale of our economic problems. Unless something changes drastically, we’re looking at many years of high unemployment.’

“Though the likelihood of long-term, high unemployment is acknowledged by policymakers in Washington D.C., it is not probable that they will spend another $1 trillion or so on a second stimulus any time soon. The political environment won’t allow it, as the urgency of the early days of the Obama administration has passed.

“‘The really bad news is that centrists in Congress aren’t able or willing to draw the obvious conclusion, which is that we need a lot more federal spending on job creation,’ writes Krugman.

“Though the US faces a bout of bad employment news, the ‘free fall’ of the economy has stopped, Krugman adds.

“‘The stimulus didn’t completely eliminate these effects, but it was enough to break the vicious circle of economic decline,” Krugman writes.”

Source: Gene Koprowski, MoneyNews, November 3, 2009.

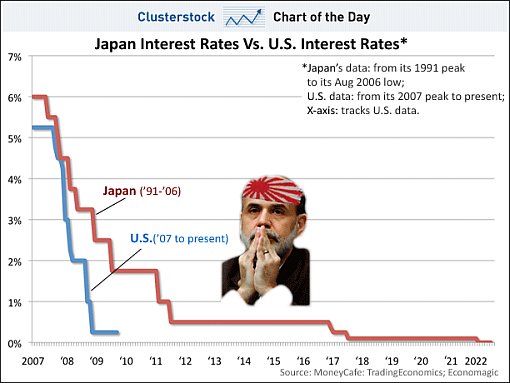

Clusterstock: Bernanke rips a page from Japan’s suicidal playbook

“Let’s hope that Bernanke doesn’t keep playing by Japan’s suicidal 1991 interest rate playbook for too much longer.

“The chart below shows Japan’s 1991-2006 interest rates on top of our current US interest rate cycle.

“While Mr. Bernanke is trying to temporarily fight deflationary forces in the economy after the massive housing bust, don’t forget that Japan’s low interest rate policy lasted far longer than they had initially expected. And they lost a decade of economic growth by not allowing prices to fall when they should have. If we follow Japan, our rates would stay low until 2022.

“Sure, the US dynamics are different. Yet if Bernanke follows the Japan model for just a quarter as long as Japan did, while we might not lose a decade of growth, we might set off a decade of dollar-destroying inflation.”

Source: Vincent Fernando and Kamelia Angelova, Clusterstock - Business Insider, November 4, 2009.

MoneyNews: Volcker - no more reliance on consumer spending

“White House economic adviser Paul Volcker said his meeting on Monday with President Barack Obama focused in part on reducing US economic reliance on consumer spending.

“The alternatives to help bolster future economic growth include boosting exports, applying innovative technology to green issues and improving the nation’s infrastructure, Volcker said.

“The former Federal Reserve chairman, who now heads the White House Economic Recovery Advisory Board, said Obama understands that ‘we cannot have so much consumption’.

“Consumer spending accounted for 70% of the US economy before last year’s economic meltdown, a level that Volcker said was sustained only by ‘the magic of financial engineering’.

“‘We cannot rebuild the economy to the tune of 70% consumption or housing booms. It will just break down again,’ Volcker said.

“Obama has been accused recently of ignoring Volcker’s advice to do more to separate commercial banking from risky securities trading.”

Source: MoneyNews, November 3, 2009.

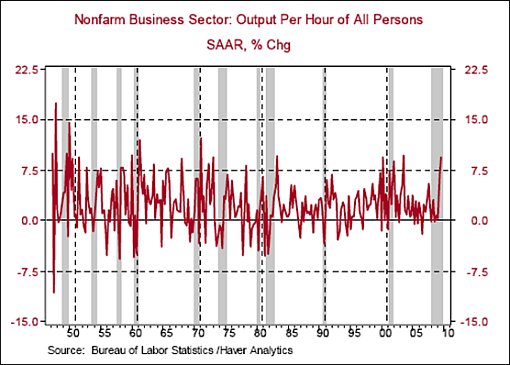

Asha Bangalore (Northern Trust): Productivity gains are noteworthy, but temporary jump

“Productivity of the US economy increased 9.5% in the third quarter of 2009 vs. 6.9% gain in the second quarter. Unit labor costs fell 5.2%, after a 6.1% drop in the prior quarter. Hourly compensation moved up 3.8% in the third quarter vs. a 0.3% increase in the second quarter. Productivity gains are impressive at the early stages of a recovery as output is raised without expanding payrolls. Putting things in perspective, the underlying productivity trend of the US economy is little over 2.0%.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, November 5, 2009.

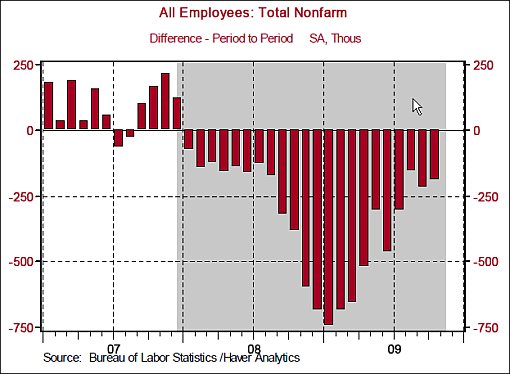

Asha Bangalore (Northern Trust): October employment report - headline jobless rate is troubling, but it is a lagging indicator

“The significant increase in the unemployment rate to 10.2% in October from 9.8% in September is a shocking headline. At the first blush, the 3.5% increase in third quarter real GDP and the weak employment report are puzzling but closer scrutiny indicates that the unemployment rate is a lagging indicator (always peaks at the end of a recession or after a recovery has commenced). There is an important difference to note in the timing of the peak of the jobless rate in the post-war period. The unemployment rate took longer to peak after a recovery was underway in the 1990-91 and 2001 recessions. In other words, real GDP was advancing for several quarters before the unemployment rate peaked. A similar case is projected for the current recovery. Our current forecast is for the unemployment rate to peak in mid-2010. At the same time, real GDP should continue to advance during the final months of 2009 and all of 2010.

“Nonfarm payrolls fell 190,000 in October, following upward revisions of August and September estimates which led to net addition of 91,000 jobs over the two-month period. The trough of the year-to-year change in payroll employment appears to be August 2009. About 7.3 million people have lost jobs since the recession began in December 2007.

“In sum, the grim October employment report supports expectations of a Fed on hold for several months. As The Economist magazine puts it, there are aspects of both ‘gloom and glimmer’ in the October employment report.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, November 6, 2009.

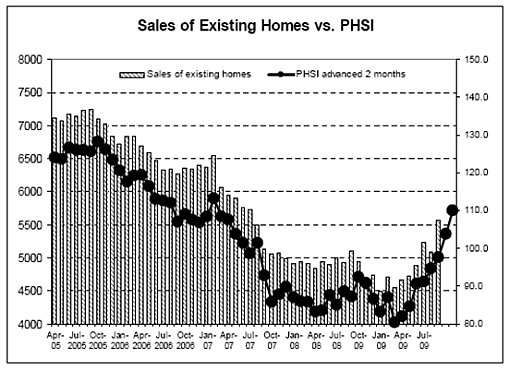

Asha Bangalore (NorthernTrust): Housing sector - positive news

“The positive news from the housing sector is noteworthy. Total construction spending rose 0.8% in September, with the gain in residential sector spending (+3.9%) and 1.3% increase of publicsector outlays accounting for the overall gain. Residential construction spending has posted strong growth in the August-September months. Non-residential construction spending fell 1.8% in September.

“The Pending Home Sales Index (PHSI) of the National Association Realtors increased to 110.1 in September from 103.8 in August. This gain bodes positively for sales of existing homes in the October/November period. The PHSI has risen each month since February. The existing home sales data for October are scheduled for publication on November 23.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, November 2, 2009.

Asha Bangalore (Northern Trust): Factory sector maintains expansionary trend

“The ISM manufacturing composite index rose to 55.7 in October, marking the third consecutive monthly reading that exceeds 50.0. Readings in excess of 50 denote an expanding factory sector. The new orders index (58.5 vs. 60.8 in September) edged down slightly in October implying that orders are growing but at a slower pace compared with the prior month. The sharp increase of the production index (+7.6 to 63.3) puts it at the highest in nearly five years. The main message is that the factory sector continued to grow and registered a more rapid pace in October compared with September.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, November 2, 2009.

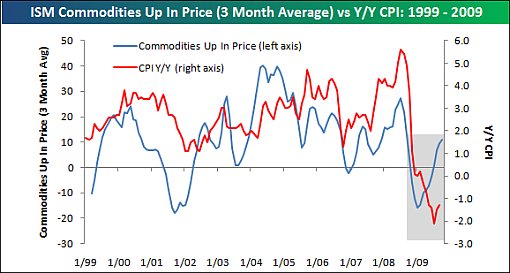

Bespoke: Was yesterday’s ISM an early warning for more inflation down the road?

“In addition to the Indian Central Bank’s purchase of 200 tons of gold from the IMF, one reason for gold’s strong rally today can be found in yesterday’s ISM. In each month’s Report on Business, ISM publishes the results of its monthly commodities survey where it asks respondents which commodities are rising in price and which are declining. In this month’s survey, respondents saw price increases in eleven commodities and decreases in only one. This month’s net reading of +10 brought the three month moving average to eleven and is the highest level since September 2008.

“The chart below compares the three month average net reading in the ISM Commodities Survey (CS) with the year over year change in CPI. Over the last ten years, trends in the CS have often preceded moves in the CPI. So when the net reading in the CS rises, increases in the CPI are typically not far off. Therefore, given that the net number of commodities rising in price is currently at +10 from a low of -15 in February, don’t be surprised if upcoming inflation reports come in on the high side of expectations.”

Source: Bespoke, November 3, 2009.

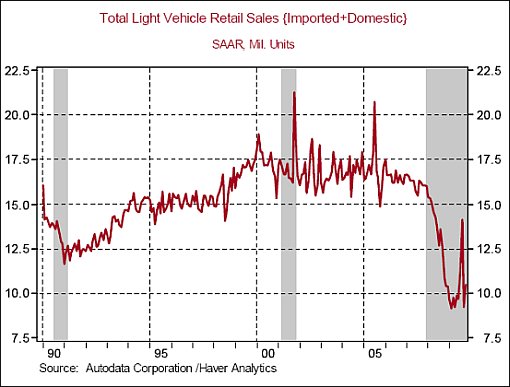

Asha Bangalore (Northern Trust): Auto sales rebound in October

“Sales of autos rose to an annual rate of 10.2 million units in October from 9.2 million in September. Attractive incentives helped to push sales in October. Consumer spending is most likely to make a positive contribution to real GDP in the fourth quarter, but a relatively smaller gain compared with the 3.4% annualized increase during the third quarter. Auto sales ranged between 16.2 million - 17.4 million units during 1999-2007. In the first three quarters of 2009, sales of autos have averaged 10.2 million units. Effectively, auto sales have dropped a little over a third of the pace seen in the eight years ended 2007.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, November 3, 2009.

The Wall Street Journal: Business bankruptcy filings increased 7% in October

“Business bankruptcy filings jumped in October, reversing two consecutive months of declining commercial filings and indicating that bankruptcies could continue to rise as the economy struggles to stabilize.

“Last month, 7,771 businesses filed for bankruptcy protection, compared to 7,271 that sought shelter from creditors in September, according to new data from Automated Access to Court Electronic Records, or AACER, a private firm that tracks bankruptcy filings.

“After two months of decline, the 7% rise in commercial filings shows that businesses are still struggling to access financing and are facing weak demand for their products.

“‘The margin for success is so thin that any financial hiccup’ could cause a business to file for bankruptcy, said Jack Williams, a bankruptcy professor at the Georgia State University College of Law.

“The tight credit markets since 2008 ‘will only be exacerbated’ with small-business lender CIT Group Inc.’s (CIT) Chapter 11 filing Sunday, he said.

“The hardest-hit industries continue to be real estate and retail, but weakness in those sectors trickles down to a number of other areas, including home building and manufacturing, Mr. Williams said.

“On a year-to-year basis, business bankruptcies shot up 24% in October compared with the same month in 2008. Mr. Williams called that increase ’substantial’ and said it is a bad omen for the final months of 2009 and the first quarter of 2010.”

Source: Eric Morath, The Wall Street Journal, November 3, 2009.

Financial Times: Obama signals rethink on bank oversight reform

“The Obama administration could support a bolder consolidation of bank regulators, an official said on Tuesday, as the US Senate prepared legislation to streamline financial supervision.

“Chris Dodd, chairman of the Senate banking committee, could unveil a draft bill next week that reduces the country’s bank regulators from four to one, retaining a separate division for smaller banks.

“An administration official said there could be a way to support a more drastic consolidation than that outlined by the Treasury in June, which proposed merging the Office of Thrift Supervision into the Office of the Comptroller of the Currency.

“Barney Frank, chairman of the House financial services committee, has said that further consolidation is a non-starter, with regulators protecting their turf. The Federal Reserve and Federal Deposit Insurance Corporation are the other two national bank regulators.

“Others in Congress have questioned whether a streamlined system, such as the UK, has proven any better during the financial crisis.

“‘The only argument Dodd seems to hear against a single bank regulator is that it is a politically difficult move, not that it is a bad idea,’ said Kirstin Brost, spokeswoman for the Senate banking committee.

“As the Senate aims to publish its bill soon, Mr Frank was on Tuesday proposing changes to his version of the regulatory overhaul as he and the administration try to put the legislation back on track.”

Source: Tom Braithwaite, Financial Times, November 4, 2009.

The Wall Street Journal: Geithner testifies on regulation

“The Federal Reserve should lose its authority to bail out big, failing financial firms like AIG and Bear Stearns under proposed reforms aimed at limiting the collateral damage from such failures, US Treasury Secretary Timothy Geithner said.”

Source: The Wall Street Journal, October 29, 2009.

Financial Times: Buffett bets $27 billion on US

“Warren Buffett on Tuesday struck the biggest deal of his life with the $26.6 billion purchase of Burlington Northern Santa Fe, one of the largest US railroad operators, in what the billionaire investor called an ‘all-in wager’ on America’s economic future.

“The cash-and-shares deal by Mr Buffett’s Berkshire Hathaway, which already has a 22.6% stake in BNSF, caps a long search by the legendary investor for an ‘elephant’ deal to deploy his vast cash pile.

“The takeover deepens Mr Buffett’s exposure to the US-focused old-economy sectors that have long been the backbone of his empire alongside financial services, and underlines his confidence in a rebound in domestic growth. ‘It is a very solid business … that will do well if the economy does well and I believe the economy will do well,’ Mr Buffett told the Financial Times.

“After a few overseas purchases prior to the crisis, Mr Buffett refocused on the US during the turmoil, buying into then-ailing corporate icons like General Electric and Goldman Sachs and urging Americans to purchase shares.

“Doug Kass, general partner at the hedge fund Seabreeze Partners Management and a former Berkshire shareholder, said the BNSF takeover could be a defining moment for the 79-year-old investor. ‘Considering the size, this could be Mr Buffett’s coup de grâce on the deal world. And it’s going to take a while to absorb it. I think it’s his last meaningful deal,’ he said.”

Source: Francesco Guerrera, Justin Baer and Robert Wright, Financial Times, November 3, 2009.

Financial Times: JGB yields reach a three-month high

“Japanese government bond yields closed at their highest level in three months on Thursday as poor demand at a 10-year bond auction underscored concerns over rising issuance in the world’s largest bond market.

“The benchmark 10-year JGB yield rose 3 basis points to 1.44 per cent. At the Y2,100 billion auction, 37.6% was accepted at the lowest price, and that price was the lowest since February.

“Rising bond issuance is also alarming investors in other countries as governments issue record amounts of debt to finance stimulus programmes and, in some cases, bail out their banks.

“In Japan, investors are concerned because a tax shortfall is going to have to be covered by additional bond issuance, and poor demand from retail investors is going to force institutions to pick up the slack.

“That could result in an additional Y6,000 billion of Japanese sovereign bond issuance in the current financial year.

“Japan’s ministry of finance said earlier this year that it planned a record Y44,100 billion in new bond issuance in the fiscal year to March to pay for economic stimulus and offset falling tax revenue.

“Since then, concerns have grown over how the new government, led by the Democratic Party of Japan, will finance the promises made in its manifesto.

“Christian Carrillo, a senior strategist at Société Générale in Tokyo, said that although the Y44,000 billion was ‘quite do-able’, a figure of Y50,000 billion was a ‘bit more doubtful’.

“‘[This] is the reason why you see the market so tense right now,’ Mr Carrillo said. ‘The basic issue is: how is the market going to be able to digest the increase in supply.’

“But Mr Carrillo said it was important to remember that the vast majority of Japan’s debt was held internally, so it was less vulnerable than countries where significant amounts of debt were held in foreign currency and by overseas investors.

“Japan’s huge issuance this fiscal year is likely to take the country’s debt to gross domestic product ratio close to 200%, making it one of the most indebted governments.”

Source: Lindsay Whipp, Financial Times, November 5, 2009.

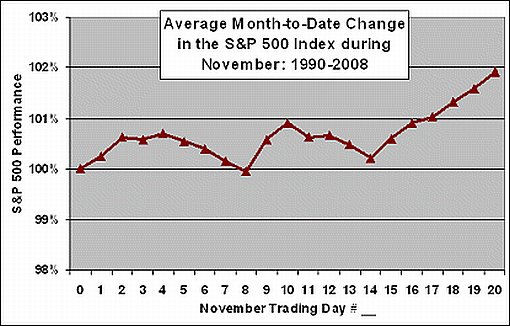

Charles Kirk (The Kirk Report): November trends

“Historical trends have not been particularly useful this year, but I know many of you like for me to pass this kind of information on so I’m more than happy to do so.

“A few things that you may want to know include:

“The Dow has been down only three Novembers in the last 14 post-election years

“Today [Monday] starts of the ‘Best Six Months’ of the year. Investing in the Dow Jones Industrial Average between November 1 and April 30 and then switching into fixed income for the other six months has produced a +7.6% gain versus the +0.6% gain since 1950.

“Historically, November is the number one best performance month for the S&P 500. It is also the number two best performance month historically for the Nasdaq since 1971.

“As you can see from CXO Advisory’s trading calendar, November tends to start off strong, pull back, and then close with a nice gain.”

Source: Charles Kirk, The Kirk Report, November 2, 2009.

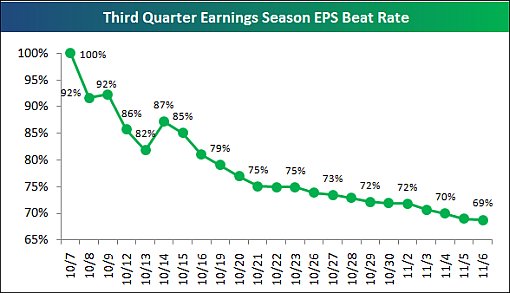

Bespoke: Another dip in the earnings beat rate

“More than 1,800 US companies have now reported third quarter numbers, and as shown below, the percentage of them that beat earnings estimates has dropped below 70% to 69%. Based on the first half of earnings season, it looked like this quarter might register the highest ‘beat’ rate in at least a decade, but if the trend continues, this quarter might not even beat the 68% reading seen in Q2 ‘09. Earnings season ends next Thursday when Wal-Mart reports.”

Source: Bespoke, November 6, 2009.

Patrick Moonen (ING Investment Management): Dividend growth in 2010

“Global earnings per share growth should see a strong rebound next year - paving the way for a recovery in dividends, says Patrick Moonen, senior equity strategist at ING Investment Management.

“‘During the current recession, corporates have seen the biggest earnings decline in at least three decades,’ he says. ‘One of the big differences compared to previous recessions was that this time round, dividends were also dramatically cut.’

“Mr Moonen says a lack of easy finance and the subsequent rise in corporate bond yields made companies reluctant to distribute their cash flow.

“As a consequence, the payout ratio, which historically jumps during profits recessions as companies prove reluctant to cut dividends, remained near the long-term average.

“But he argues that a swift turnaround in profits means dividends now have room to grow above their long-term average.

“‘Corporate earnings have passed the low point of the cycle. This happened very quickly due to aggressive cost-cutting, lower capital expenditures and a steep downturn in inventories.

“‘A direct consequence was that operating margins troughed well above previous recessions and above analysts’ forecasts.

“‘We currently prefer European to US equities due to their more favourable valuations. We also like emerging markets, as they offer superior fundamentals and earnings growth at similar valuations.’”

Source: Patrick Moonen, ING Investment Management (via Financial Times), November 2, 2009.

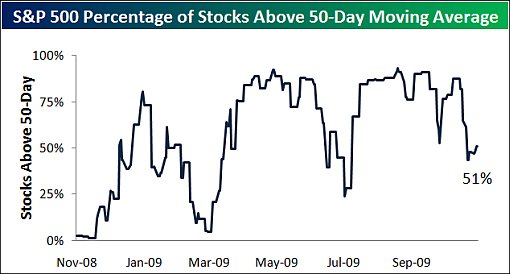

Bespoke: Percentage of stocks above 50-day moving averages

“With the S&P 500 moving back above its 50-day moving average, the percentage of stocks in the index above their 50-days is unsurprisingly back above 50% - 51% to be exact.

“But there are still a few sectors that have failed to get this 50-day indicator back above 50%. The Financial sector ranks the worst with just 29% of stocks above their 50-days. Technology, Materials, Utilities, and Telecom are the other four sectors that still have less than 50% of stocks above their 50-days.

“On the positive side, Energy and Consumer Staples rank the best with a reading of 73%, followed by Industrials and Health Care at 63%. For this market to break to new highs once again, we’ll need to see the Financial and Technology sectors rally back more than they have over the past couple of days.”

Source: Bespoke, November 5, 2009.

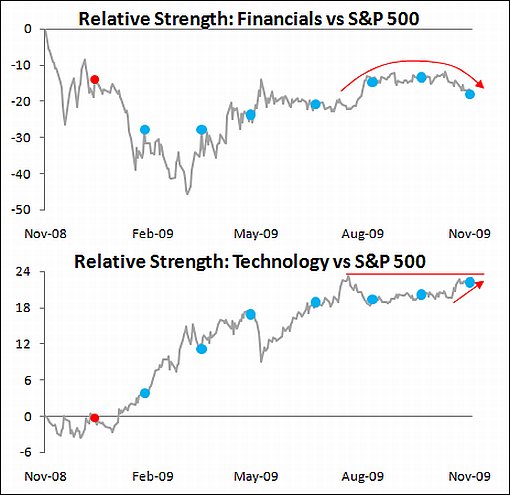

Bespoke: Sector relative strength - technology and financials

“The charts below show the relative strength of the Financial and Technology sectors versus the S&P 500. In each chart, a rising line indicates that the sector is outperforming the S&P 500 while a declining line indicates underperformance. We have also included dots showing each time the Fed has recently cut rates (red) or left them unchanged (blue dots). Given the fact that the two sectors are the most widely followed sectors in the market, any meaningful rally in equities will need to see both sectors participating.

“With the overall market correcting, it is not surprising to see that Financials have been weak. In the days and weeks ahead, it will be important for this sector to stabilize or pick up now that it has moved back down to the range it was in for much of the Summer.

“While the Financial sector is lagging, the Technology sector is improving. After peaking back in July on a relative basis, the Technology sector has stabilized and has been improving over the last two to three weeks. If the sector can break above its prior peak, it should set the stage for an end of year rally. Otherwise, the market will be in for more of the recent lackluster action.”

Source: Bespoke, November 5, 2009.

Richard Russell (Dow Theory Letters): Stocks could decline rapidly

“I don’t believe most investors understand the significance of the possibility that the March to October rally was an upward correction in a bear market. The majority of analysts believe that the advance that started from the March lows represented the beginning of a new bull market. I disagree, and do not believe March marked the start of a new bull market.

“For the sake of argument, let’s just assume that I’m right and that what we’ve seen since March was a bear market rally. If that’s true, we’re in a very dangerous situation. It appears to me that the rally is in the process of topping out. Again, let’s assume that we’ve been in a bear market rally. If the rally is indeed topping out, then the stock market will soon be again in the grip of the bear.

“The rally ran from March to October, a period of seven months. In other words, the bear market has been ‘held back’ for a period of over half a year. My thinking is that the bear is ‘angry’ at being held back, and it will probably want to make up for lost time in the period ahead. From everything I see, hear or read, I gather that almost everybody believes the March lows are safe, that they will not be violated, no matter what.

“However, if the bear market rally is now in the process of breaking up, my thought is that stocks could decline very rapidly, much faster than most people are prepared for. If late-coming traders suspect that the rally is over, we could see a frenzy to get out of this market. This along with a panic from pros who want to get out with what profits are left.”

Source: Richard Russell, Dow Theory Letters, November 3, 2009.

David Fuller (Fullermoney): Modest US recovery best recipe for stocks

“For equity investors, and not just in the West, a distinctly modest US economic recovery could be the best recipe for further stock market gains. While this may sound counter intuitive, equities often do well in a slow growth environment because monetary policy remains accommodative, enabling efficient companies to prosper. Conversely, strong growth forewarns of tighter monetary conditions which eventually choke-off bull markets.

“Surprisingly, this point is often lost on economists and fundamental analysts who constantly fret over the lack of strong growth to validate stock price appreciation. Investor sentiment will remain net favourable provided that equity indices are trending higher, with the help of accommodative monetary policy, and the economy appears to be heading in the right direction, however gradually.

“Meanwhile, there is little doubt, in my view, that stock markets and commodity markets continue to lead asset price inflation, reactions and the occasional correction aside, fuelled in no small part by expansionary monetary policies. The higher these markets go, the more likely it is that the Fed will become less accommodative. However not all markets are equal and I believe it is an eventual spike in crude oil prices that central banks and therefore investors will fear most.

“Recently, a corrective phase has been evident for stock markets and many commodities. This is removing some of the froth from asset price appreciation and a further pause would reduce calls for central banks to ‘do something’.”

Source: David Fuller, Fullermoney, November 2, 2009.

The Wall Street Journal: Equity investors should be careful what they wish

“Equities seem to be pricing in a normal recovery. But normal recoveries tend to be accompanied by much stronger GDP growth than economists are expecting for the coming year. A normal recovery growth rate could see a sharp unwind of central bank policy, which would do some serious damage to both stocks and bonds.”

Source: The Wall Street Journal, November 4, 2009.

Simona Paravani (HSBC Global Asset Management): Get the Latin feeling

“Investors looking at emerging markets should favour Latin America over Asia in the near-term - in spite of Brazil’s imposition of a tax on foreign stock purchases, says Simona Paravani, global investment strategist at HSBC Global Asset Management.

“She points out that LatAm equities are trading at a more than a 40% discount to emerging Asian equities, versus a five-year average discount of just 5%, based on 12-month trailing price to earnings ratio.

“Ms Paravani argues that the valuation case is further supported by a buoyant macroeconomic picture. HSBC’s central scenario is for Brazilian growth to be 5.3% in 2010 - which will in part be driven by strong Asian demand for commodities.

“She does note some hesitation among investors about LatAm equities after Brazil’s recent move to levy a 2% tax on foreign purchases of real-denominated shares and fixed-income securities.

“‘This has raised worries there will be ramifications for the whole region, not only because Brazil accounts for 70% of the MSCI Latin America index, but also because similar policies are being adopted or considered by other LatAm countries.

“‘This measure is clearly not market-friendly and should create volatility in the short-term. But it is unlikely to have a major impact as the fundamentals of the Brazilian economy and corporates are very sound and should continue to attract inflows.’”

Source: Simona Paravani, HSBC Global Asset Management (via Financial Times), November 3, 2009.

Reuters: PIMCO’s El-Erian says Fed fuels dollar carry trade

“The Federal Reserve will continue to foster a US dollar-funded carry trade with its near-zero interest rate policy, Mohamed El-Erian, chief executive of Pacific Investment Management Inc., said on Wednesday.

“The so-called carry trade refers to borrowing at low short-term rates - in this case, in the US dollar - to buy high-yielding,

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.