Stock Market Money for Nothing and Chop for Free!

Stock-Markets / Stock Index Trading Nov 08, 2009 - 06:08 AM GMTBy: Piazzi

To the optimist, market held its own, looking to the future, and past the dismal job number.

To the optimist, market held its own, looking to the future, and past the dismal job number.

To the pessimist market is rigged, and money is printed by the bundle and delivered on the wire to buy ETFs and futures.

To the pragmatist, maybe this question: Where the hell is volume?

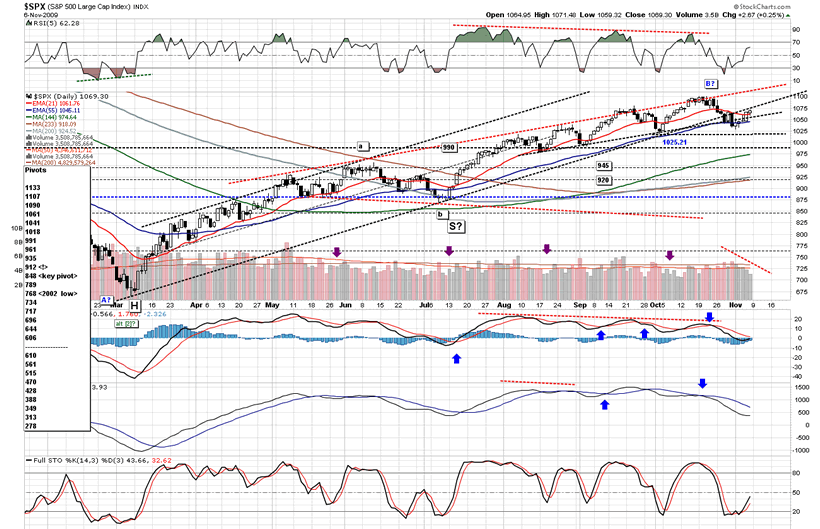

S&P has had 5 rising days on shrinking volume

Looking at each of the prior correction of the index since March, if the drop that started in October has ended, this is the first that the turn is shaping on 5 straight days of contracting volume.

The only other comparable daily volume pattern happened mid-June when index paused before making another leg down into July low.

Comparing some current oscillator readings with readings of the mid-way pause of June-July period, we see that MACD looks eerily similar. RSI and Stochastics went neutral in that period and turned over. RSI and Stochastics are neutral now and their behavior in coming days may tell us a thing or two about impending price action. If the drop is over, the oscillators should, ideally, rise towards overbought areas. Weak moves are often associated with a downshift in oscillators. So, even if we assume that price is going to zombie on without any real blood in it, and if we afford a 10% downshift for oscillators, Stochastics should still make it well past 50 and closer to 80.

There is another comparison I can make with June-July correction.

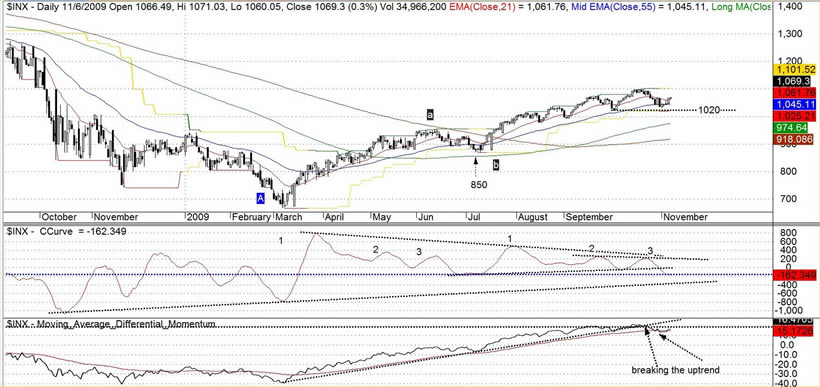

Some of you may remember this chart with the cyclical momentum of S&P (CCurve)

A study of CCurve helped me anticipate and act on October top. On November 4, I wrote

CCurve broke the uptrend line. Now the question is if it can turn around soon and start another momentum cycle as it did in July. As long as index stays above 1018 pivot, it has a good shot at consolidation and gathering energy to start another swing up. A break below 1018 gives bears a very objective level to play.

Well, index has stayed above 1018 – no kidding! And CCurve stopped right at the level it had stopped in July. Technically, to me, this is a picture in limbo.

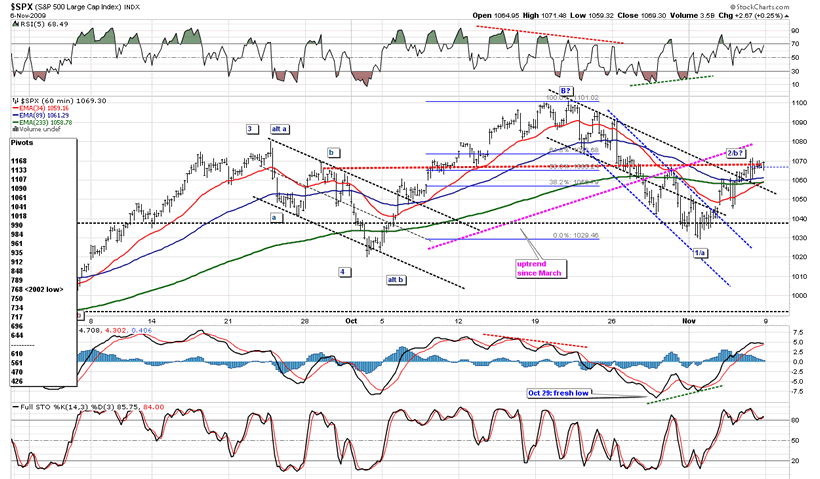

If we look closer

It’s been crawling towards the broken trend line. The move seems a bit lumbered. But a short term uptrend nonetheless.

For a possible bearish outcome, notice the possibility of a H&S formation with the potential right should under development.

Sometimes, if I wanna play a H&S, I play it on the price and not the pattern. I mean, I take a sell signal of my choice off the price action, and not wait for neckline break. That way, I am in early.

If H&S is successful, I have an advantage over many.

If the pattern fails, my losses will be minimal (The failed H&S of June-July did not hurt me at all. One reason was that I was into the pattern (OK, the failed pattern that never was) early.

I am not advocating this or anything else (I never advocate anything), just saying the way I sometimes play.

This is the potential H&S on the same chart

It’s a potential and not a certainty. And if one does not want to wait for the neckline break, one needs to decide in advance on both entry and exit strategies.

If successful, it targets 960, which is in line with the top side of my 850-950 potential drop target zone I discussed a few days ago.

Again, this is all theoretical, and price has to give me some sell signal to start even taking it seriously.

I also would like to remind you that what killed many a bear in July was a failed H&S. Since I am making comparisons to that period, I find the existence of a potential H&S an another interestingly similar, and want to warn myself against complacency. If a bearish pattern fails, one needs to entertain bullish outcomes.

The move since the recent low has been rather untidy and choppy

Speaking of H&S patterns, there is a potential small Inv. H&S. You know, if one squints hard and long enough, one can see H&S’s everywhere. Still the price is in a short term uptrend. There is an open gap around 1084, and all it takes is a spike to get there and have some fun putting pressures on some shaky shorts.

I thought the early morning drop on Friday was impulsive, and such a wave 1

But it may also be a wave A. It matters little. For the bears, as a start, the uptrend from November 2 has to break. And then the 1061 pivot should be taken, and held, or index either chops on (aka consolidation), or bears get bulldozed all over by the bulls

For the day, breadth was neutral. In fact, most of the day there were more decliners than advancers. But what does that tell me? If I am a staunch bull, I may argue that at the close true professional came in and bought. If I am a bear, I may say that the close was painted by GS or MM or whoever squeezing the shorts.

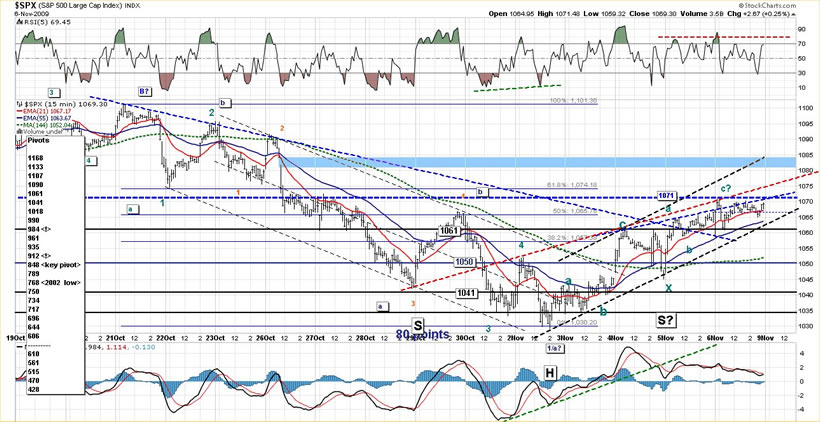

It may not matter that much what the breadth was on a low volume day. What I think truly matters is this chart

First off, notice the similarity of breadth oscillator patterns of the move from July to October with that of March to June. During the June-July period, there was a push to neutral, a setback, a lower low, and an advance that gave us the July to October rally in price.

Now, breadth oscillators are hitting neutral, and if my theory about the cyclical momentum of the two moves (March-June and July-October) holds, then we may see a similar behavior with breadth oscillators as well, implying that index should falter sometime soon and make a lower low than the low of November 2.

To back my argument, I know that some sectors, some indexes and some international markets are already in confirmed OEW downtrends.

That having been said, I also know that both major US indexes that I follow still enjoy an unbroken weekly picture

And

So, the longer term picture is still one of consolidation. The shorter term picture has a negative background, but that is not enough for an all out short position. The short term uptrend line and 1061 are must-break technical markers for the bears. If bears can’t press their case, other indexes and sectors that are in a mid-term downtrend may find enough time to turn and start another leg up.

------------------------------------------

I came across this post by Nadeem Walayat.

http://www.marketoracle.co.uk/Article14751.html

with this chart

Do your own analysis, learn from your own mistakes and not someone else’s, and, remember that economy and market may dance to different beats at times.

Thank you Nadeem!

Let‘s Wrap Up:

I am operating under the assumption that a top is in, expecting an OEW mid-term trend change.

So far, the advance from the low has been consistent in structure with a corrective move, and in price with my projected target of 1053-1069. It, however, it is pushing the top end of my range and as we have an open gap around 1084, caution is advised early next week

It seems like market has been trying to firm up its short term internals. It is important for bears to take the index below 1061 and, and, especially, break 1018

Last week, true to form, bears failed -- again -- to take the index lower when it mattered around 1020.

A move towards 1090 (and above) may positively change market dynamics

Support is 1061 and 1041. Resistance is 1090 and 1107.

Short term trend is up. Mid-term trend is up. Long term trend is down

Have a Nice Weekend!

By Piazzi

http://markettime.blogspot.com/

http://markettime.wordpress.com/

I am a self taught market participant with more than 12 years of managing my own money. My main approach is to study macro level conditions affecting the markets, and then use technical analysis to either find opportunities or stay out of trouble. Staying out of trouble (a.k.a Loss) is more important to me than making profits. In addition to my self studies of the markets, I have studied Objective Elliott Wave (OEW) under tutorship of Tony Caldaro.

© 2009 Copyright Piazzi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.