Gold Price Collapse and Market Behaviourism

Commodities / Gold & Silver 2009 Nov 05, 2009 - 05:00 AM GMTBy: Ronald_Rosen

Behaviorism -From New World Encyclopedia

Behaviorism -From New World Encyclopedia

“Behaviorism is an approach within psychology based on the proposition that behavior, human as well as animal, can be researched scientifically and understood without recourse to inner mental states. Three major figures led to the development of this approach: Ivan Pavlov, John B. Watson, and B.F. Skinner. Their research produced theories of learning based entirely on reactions, or "responses," by the organism (human or animal), directly to stimuli in the environment through processes of conditioning.

This was a significant turning point in psychology as a scientific discipline, and led to extensive research in comparative psychology and experimental psychology, providing valuable data on how both animals and humans learn appropriate responses to their external environment. While such theories are no longer considered adequate to explain all forms of learning and behavior, nonetheless, methodologies developed through such studies continue to be utilized in numerous research programs that have greatly expanded understanding of human nature.”

Definition

“Behaviorism was developed with the mandate that only observations that satisfied the criteria of the scientific method, namely that they must be repeatable at different times and by independent observers, were to be admissible as evidence. This effectively dismissed introspection, the main technique of psychologists following Wilhelm Wundt's experimental psychology, the dominant paradigm in psychology in the early twentieth century. Thus, behaviorism can be seen as a form of materialism, denying any independent significance to processes of the mind. A similar approach may be found in political science, known as "Behavioralism."

The behaviorist school of thought ran concurrent with psychoanalytic movement, originated by the work of Sigmund Freud, who was also a proponent of a mechanistic view of human nature, but regarded the mind, particularly the unconscious, as the arena in which uniquely human activities occurred.

One of the assumptions many behaviorists hold is that free will is an illusion. As a result, behaviorism dictates that all behavior is determined by a combination of genetic factors and the environment, either through classical or operant conditioning. Its main instigators were Ivan Pavlov, who investigated classical conditioning, John B. Watson who coined the term "behaviorism," and sought to restrict psychology to experimental methods, and B.F. Skinner who sought to give grounding to behaviorism, conducting research on operant conditioning.”

-------------------------------------------------------------------------

The importance of the number 34

34 NUMBER – IN MATHEMATICS

Encyclopedia II – 34 number – In mathematics

“34 has four divisors, 1, 2, 17 and itself. Its neighbors, 33 and 35 also have four divisors each, and 34 is the smallest number to be surrounded by numbers with the same number of divisors as it has. It is the ninth Fibonacci number and a companion Pell number. Since it is an odd-indexed Fibonacci number, 34 is a Markov number, appearing in solutions with other Fibonacci numbers, such as

(1, 13, 34), (1, 34, 89), etc. This number is the magic constant of a 4 by 4 magic

square: This number is also the magic constant of n-Queens Problem for n =4” ...

See also 34 number, 34 number - In mathematics, 34 number - In science, 34 number - In other fields

“Behaviorism was developed with the mandate that only observations that satisfied the criteria of the scientific method, namely that they must be repeatable at different times and by independent observers, were to be admissible as evidence.”

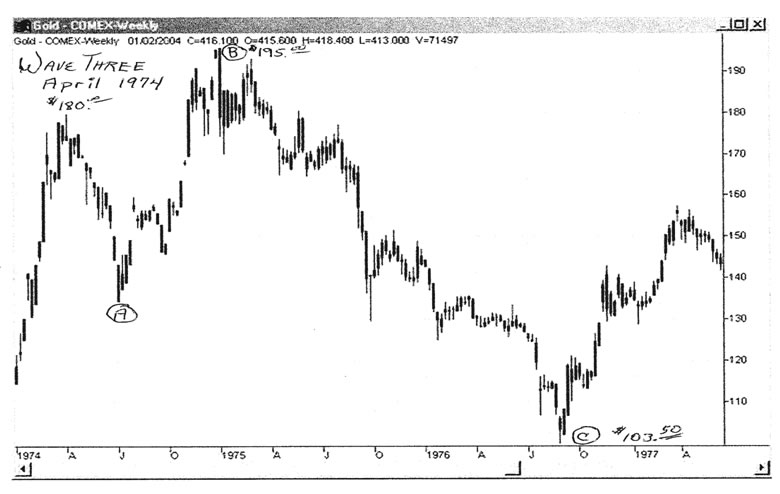

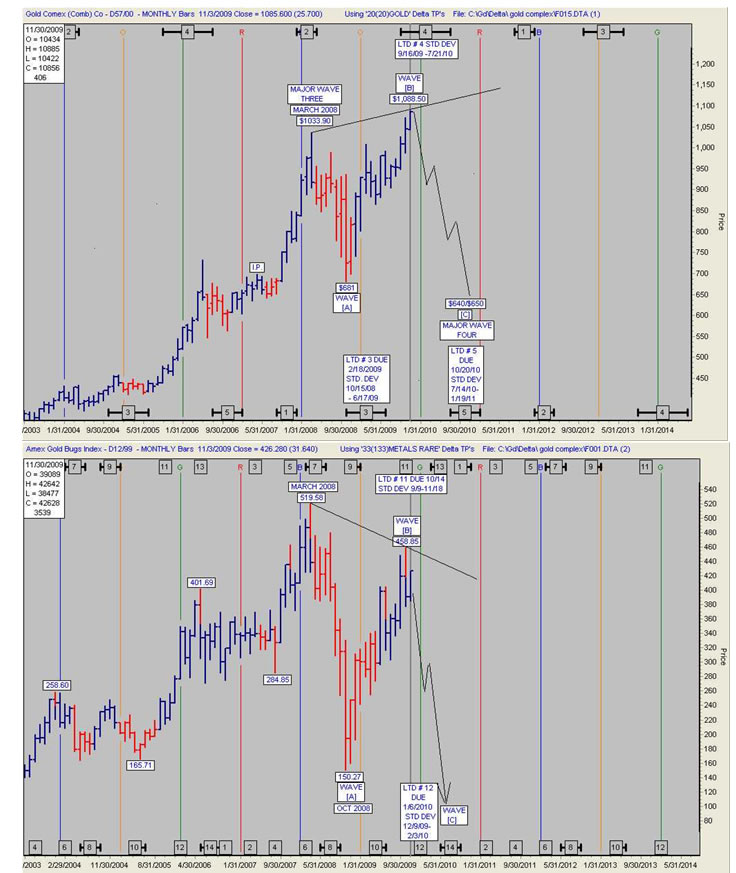

It appears to me that the participants in the gold market are repeating their patterns of behavior 34 years apart almost to the month. To make this repeat performance even more interesting is the fact that 34 is an important number from the Fibonacci sequence of numbers. If this pattern continues gold will be declining for many months. At the bottom it will be time to own gold shares, not now.

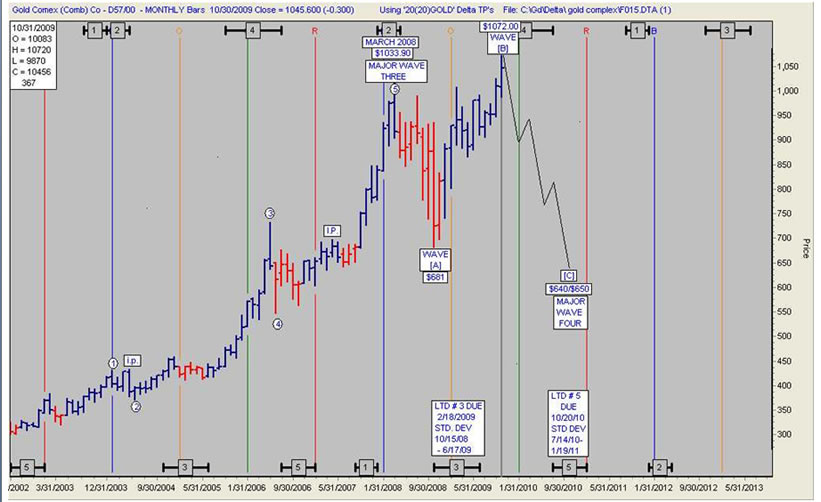

The [B] leg high of the 1974 to 1976 expanded flat correction for gold bullion gave way to a massive collapse in price. I believe that this is what will occur once the current top in gold is in. Now, as then, the precious metal shares refused to make new highs along with the gold price. In December 1974 the wave [B] high of $195 for gold was 1.085 times the Major Wave Three high of $180.00. I do not know if the same percentage increase for wave [B] this time around will be similar to what it was in December 1974. However if the current Wave [B] high is going to approximate the same percentage increase as 1974 the top may be in the vicinity of 1.085 times $1033.90 ($1121.7815).

APRIL 1974 TO AUGUST 1976

GOLD (A), (B), (C), EXPANDED FLAT CORRECTION

APRIL 1974 28 MONTHS FROM TOP TO BOTTOM AUGUST 1976

[--------------------------------------------------------------------------------]

34 years later a potential repeat expanded flat correction lasting 28 months.

However if the current Wave [B] high is going to approximate the same percentage increase as 1974 the top may be in the vicinity of 1.085 times $1033.90 ($1121.7815).

POTENTIAL

MARCH 2008 TO JULY 2010

GOLD (A), (B), (C), EXPANDED FLAT CORRECTION

28 months from top to bottom

[ ---------------------------------]

March 2008 July 2010

LTD # 5 low

If the current Wave [B] high is going to approximate the same percentage increase as the Wave [B] in1974 the top may be in the vicinity of $1,122.00.

GOLD MONTHLY

HUI MONTHLY

The S & P 500 cycle and the number 34

If we so choose we can ignore the theory of behaviorism. If we so choose, we can ignore the evidence of a 34 year cycle repeating in the gold market. If we so choose, we can ignore the evidence of a 34 year cycle repeating in the S & P 500.

However, if we choose not to ignore this evidence in the gold market we must put aside the many glowing reports that tell us gold is about to have a substantial rise in price. The thing to do is determine how low the price of gold may go if the 34 year cycle continues to repeat. If we use the percentages from the 1974 to 1976 expanded flat correction in gold we should expect the current gold market to decline to the $594.00 level.

The 1974 [B] leg high of the expanded flat correction was $195.00

The [C] leg declined to $103.00. (.53 X $195.00 = $103.35)

If the [B] leg high in 2009 reaches the $1122.00 level a similar percentage decline would bottom at $594.00. (.53 X $1122.00 = $594.66)

==============================================================

Should we ignore the Theory of Behaviorism?

Should we ignore the reality of the importance of the number 34?

Should we ignore the obvious repetitive 34 year cycle in the gold market?

Should we listen to the many glowing reports of how gold is in the process of having a substantial rise in price?

Perhaps one final chart will help us decide.

The [A], [B], [C] expanded flat correction in gold began in March 2008 at $1,033.90. The volume and momentum have been declining ever since then.

GOLD WEEKLY

If you choose to follow the numbers and the cycles and not the glowing reports, you may find courage by listening to this song.

Click here… v Where No One Stands Alone

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.