Still Many Broken Charts Despite the Stock Index Rallies

Stock-Markets / Stock Index Trading Nov 04, 2009 - 12:31 PM GMTBy: Trader_Mark

Something that has been apparent lately is the weakness in small and mid caps, masked by the relative strength in large caps. We can see this in the indexes - while we've corrected some in both NASDAQ and S&P 500 it is nothing like what I am seeing on individual stocks.

Something that has been apparent lately is the weakness in small and mid caps, masked by the relative strength in large caps. We can see this in the indexes - while we've corrected some in both NASDAQ and S&P 500 it is nothing like what I am seeing on individual stocks.

I don't often post a chart of the Russell 2000 which is a much broader index, combining S&P 500 type of companies with a good selection of mid cap and the larger stocks in the small cap universe but you can see what I am talking about in a picture. We're not even close to the 50 day moving average in this index - unlike NASDAQ and S&P 500.

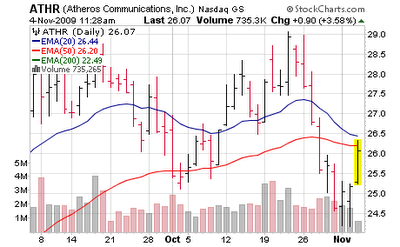

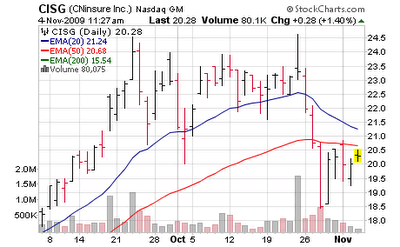

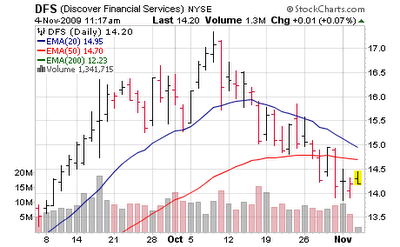

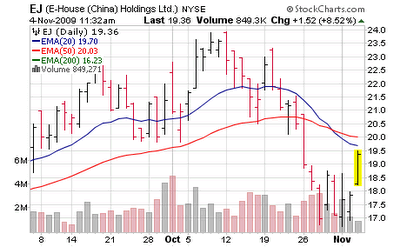

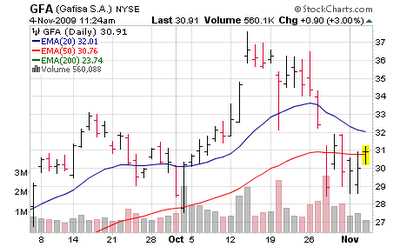

As I scan through names of names we own, or of interest I see the same pattern. Now of course in the "student body left" trading environment - all it takes is a bludgeoning of the US dollar, and we can rally every stock in the universe up in 1 huge correlation trade so this can change in a heartbeat. But thus far, it hasn't. In fact... with a tight stop... these are the type of charts I like to go short, rather than go long .(EJ and ATHR look very appealing)

Here are some example of what I am speaking of just from the portfolio holdings - many more in my watch lists all in exact same pattern. This shows me that breadth stinks and its a narrow rally led by the 'go to' names than institutions love to flood into to, along with oversold bounces in smaller names. The larger cap preference has been the case 2 weeks previous to today as well; only last week did the larger names finally get hit.

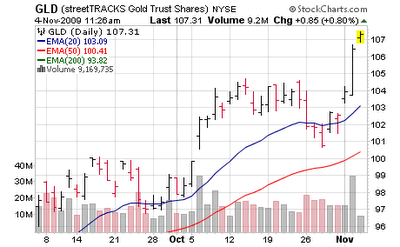

Instead of that sort of action, from the long side we'd much rather see this:

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2009 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.