Are Biotechnology Stocks Heading for A Downturn?

Companies / Healthcare Sector Nov 04, 2009 - 02:35 AM GMT Science always looks to the future, and there's not much science that's more exciting than biotechnology.

Science always looks to the future, and there's not much science that's more exciting than biotechnology.

After all, this is the field with big promises for better and longer lives for all of us through applied biology in agriculture, food science, and medicine. But although the term 'biotechnology' is often refers to futuristic genetic engineering, the industry is far broader than genetics alone.

The promise is there. But the risks are too.

Biotech is quite risky since promising drugs or treatments can fail to get government approval and thus the associated large research & development budget is wasted. Companies can spend literally hundreds of millions of dollars devising products that they eventually can't even sell. And that's for the products that actually get that far – there are all kinds of failed research efforts that fizzle just after they get started.

But for the ones that make it, an approved drug, treatment, or piece of equipment is a gold mine.

Biotech Leaves the S&P In Its Dust

The main index used to track the major biotechnology companies is the Biotechnology Index (BTK), an equal dollar weighted index which measures the performance of 20 companies involved in recombinant DNA technology, molecular biology, genetic engineering, monoclonal antibody-based technology, lipid/liposome technology, and genomics.

So how have these 20 companies been doing?

Pretty well when compared to the S&P 500 with a 30%+ gain even after a recent fall from 52 week highs.

It's clear that even if most other industries are mired in the doldrums of earnings (and expectations) mediocrity, people are still seeing promise in biotech.

But is the biotech boom over? Let's take a closer look...

In this daily chart of BTK, we see that the MACD and RSI indicators are dropping fast and are close to (or already in) the 'buy zone'.

However, it looks like there might be a bit more of a drop to come. That's based on two things we can see in this chart:

- We aren't yet seeing a reversal candlestick that would indicate a bottom is in, and

- There's no obvious support at this price level.

We could see some support at 835, however as the market previously turned around at that level.

So if we're going to start positioning ourselves for a future buy at some point, what's the best way to do it?

Biotech ETFs For Diversity's Sake

Due to the extreme risks of holding single biotech stocks (the drops and rises can be truly heart-stopping – especially if you're caught on the wrong side of them!) it's better to hedge your risk with a good ETF (Exchange Traded Fund) instead.

The following chart compares 6 different biotech ETFs against the BTK index itself...

As you can see, there's only one fund (First Trust Amex Biotechnology Trust, symbol FBT) that's doing as well as BTK itself. In fact, it's mirroring BTK which isn't much of a surprise when you learn that it was designed to do so.

The other funds are not performing nearly as well despite their very different strategies.

The iShares Nasdaq Biotechnology Trust (IBB – the pink line shown in the comparison chart) holds the largest number of stocks (approximately 120+) of any of the ETFs and it's also the most actively traded. You're up about 12% over the year with their strategy.

That's still better than HOLDRS Biotech ETF (BBH – the black line) which is very unevenly balanced due to its "grantor trust" status and holds few stocks. This cripples its trading strategy as it can't alter its underlying holdings except as a result of corporate actions.

But the SPDR S&P Biotech (XBI – the purple line) holds up the bottom of the chart. How this fund could lose money when BTK is performing so well is stunning. Theoretically this fund follows a similar strategy as top performer FBT but clearly the managers have not been on the ball at all.

The others are the middle of the pack, and it seems that FBT is the vehicle of choice for trading (or investing in) the biotechnology sector.

Broaden Your Horizons For Less Risk

Biotech is frequently considered a subset of the larger healthcare sector.

So if you still think biotech is too risky, you could look at healthcare too. After all, people are still getting sick and injured (and getting old) no matter what the economy does.

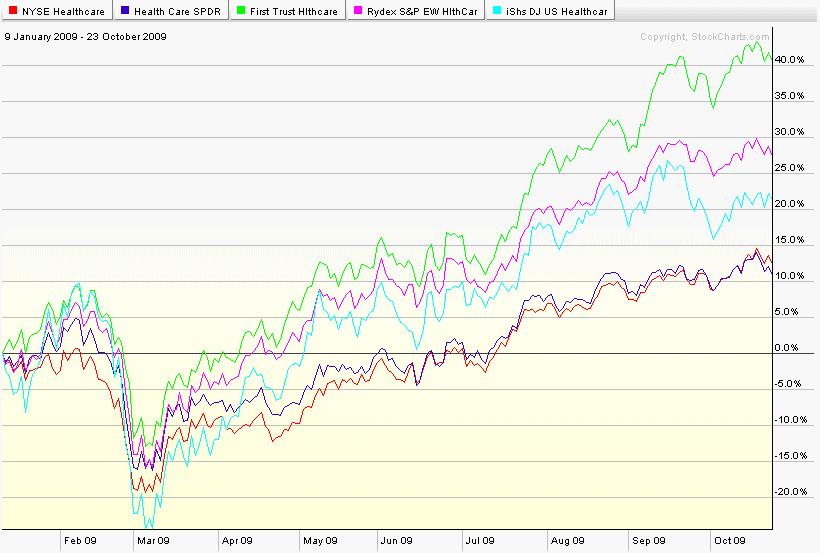

Here's the NYSE Healthcare Index (NYP), which is comprised of 108 different holdings as of this writing...

As you can see, this index is holding up even better than BTK, although it looks to also be ripe for a bit of a fall in the near future too.

If the bull trend remains intact, a logical buying point would be at the 50 day moving average.

So what's doing best in that sector?

Well, First Trust is again a clear winner with its FirstTrust AlphaDEX Healthcare fund (FXH). It's dramatically outperforming everything else in this comparison chart including the NYP index itself.

This ETF is designed to track the StrataQuant Health Care which employs the AlphaDEX stock selection methodology to select stocks from the Russell 1000 Index. This AlphaDEX strategy is based on a large number of fundamental factors, but whatever they're doing with that methodology, it's obviously working wonderfully well.

Meanwhile, the next closest contender is the Rydex S&P Equal Weight Health Care ETF (RYH) which seeks to replicate the performance of the S&P Equal Weight Index Health Care index (yet another lesser known but more impressive index than NYP).

So there you have it. The biotech (and healthcare) sectors look likely to drop a bit in the next few days or even weeks. But you now have some targeted 'buy' levels for the better-known benchmark indexes as well as the best performing ETF in each area.

Remember that science (and healthcare) is unlikely to take a backward step no matter how foolish the decisions coming from Washington. That makes these sectors relatively safe bets in an otherwise uncertain economy.

Good investing,

Nick Thomas

Analyst, Oxbury Research

Nick Thomas is a seasoned veteran of technical analysis and has mastered all intra-day trading in stocks, options, futures and forex. He prefers to scout investments as one asset class of many and shapes his investment strategies accordingly. He writes extensively about offshore banking and offshore tax havens and is active in the career development field of independent investment research.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.