U.S. Dollar Fiat Reserve Currency Root of the Global Financial Crisis

Stock-Markets / Credit Crisis 2009 Oct 31, 2009 - 04:06 PM GMTBy: Richard_Karn

Chapter 4: “James Ross Clemens, a cousin of mine, was seriously ill two or three weeks ago in London, but is well now. The report of my illness grew out of his illness, the report of my death was an exaggeration.”1

Chapter 4: “James Ross Clemens, a cousin of mine, was seriously ill two or three weeks ago in London, but is well now. The report of my illness grew out of his illness, the report of my death was an exaggeration.”1

The matters discussed thus far in the first three chapters of our report, Credit and Credibility, may be summarized as follows:

- the global financial crisis stems from the abuse engendered by the universal use of fiat currencies, with the US dollar as the world’s reserve currency being the root of the problem;

- global efforts to treat a monetary problem with macroeconomic stimuli are designed to fail, i.e. the primary goal is to maintain the fiat currency regime, not to cure the problem by ending it, and the best conceivable outcome of interventionist policy is the creation of a newer, larger, and invariably more catastrophic bubble;

- all central banks are complicit and have been either subverted or suborned, rendering all fiat currencies but derivatives of the dollar;

- the dollar will be defended by central banks worldwide either overtly by buying US Treasury debt or covertly by devaluing their currencies faster than the dollar to support its price;

- as the reserve currency, the dollar will be the last fiat currency to eventually fail, the system weakening from the periphery toward the center, its value declining during times of perceived global prosperity and increasing during panics as the effects of previous interventionist policies dissipate or fresh revelations of financial sector malfeasance emerge, necessitating fresh ministrations;

- EU and BRIC countries’ currency protestations are motivated not by altruism but by self-interest: they do not want to end fiat currency use but to negotiate a larger ‘piece of the action’ and more say in international monetary policy, preferably in the form of a new fiat currency regime;

- with US and European fundraising capabilities severely constrained by the global financial crisis, emerging market ‘decoupling’ will be increasingly difficult, slowing development to a more natural pace but not stopping it, and providing a wealth of opportunities for increased intra-governmental and mercantilist agreements tied to ideology, not commerce; and,

- China is the litmus test for both the ‘decoupling’ and the rapidly emerging market development theses but finds itself in a co-dependent relationship with the US in which it is rediscovering “the ancient truth that, when the debt is big enough, it’s the debtor who has the power, not the creditor."2

These matters, though patently contributory to the current global financial crisis and ultimately debilitating, operate in the background of the current crises, rather like the way a cancer consuming a body’s energy and resources weakens the immune system to the point it is increasingly susceptible to colds and influenzas—and interventionist policies are designed to treat a cold or flu, not the cancer. But armed with these insights, we may now proceed to the general effects we believe the credit crisis and climate change policy will have on the US economy and in turn on our investment universe; our nine original Emerging Trends Reports are each included in their entirety, then re-evaluated and updated within this context in subsequent chapters of this report.

As we go to press in late-June of 2009, various agencies well-positioned to comment on the status of the global financial crisis are at odds over its disposition. The IMF postulates one day that the worst is behind us and global growth will approach 2.4% in 20103but two days later announces at a conference in Kazakhstan that the worst part of the global financial crisis has yet to come4—this after stating in their Annual Outlook released in April that the recovery would be “sluggish” due to the financial sector origins and global nature of the crisis.5 Simultaneously, the World Bank states the recession in 2009 will be worse than expected, and the World Trade Organization (WTO) says that it has seen no signs of a recovery yet.6 On the other hand, America’s 21 largest banks issued a joint statement announcing that the recession would be over by the end of the summer.7

Although there is clearly an interruption in the economic downturn underway as a result of restocking the record inventory drawdown seen late last and early this year,8and despite equity markets globally pricing in a V-shaped recovery, we submit it is too early to declare an end to the financial crisis in the US or elsewhere. Quite simply, we believe the financial sector’s credibility is shot, and the full extent of financial sector malfeasance, corruption and off-balance sheet losses have yet to be exposed. Consequently, we find it disingenuous that the very banks that caused the global financial crisis but which did not see it coming are now declaring the end of the recession. After receiving untold billions in taxpayer largess, which in five of the last six months has not translated into increased lending on their part,9 these were the same banks that were still only able to pass the government “stressless tests”10 regarding their purported solvency by bringing political pressure to bear enabling them to return to the very creative accounting responsible for a large portion of their ‘success’ over the last decade.11 Now that the obstacle otherwise known as financial transparency has been removed, rendering their financial situation as clear as mud, these banks are understandably eager to repay the money lent to them because, as the CFO of Goldman Sachs candidly explained, “operating our business without the government capital would be an easier thing to do… we’d be under less scrutiny.”12

In other words, the US financial sector is unrepentant but eager to get back to business as usual, and the Fed, Treasury and Congress appear to be there solely to help. The Great Moderation, which was loudly touted as the issue of highly credible, transparent and efficient monetary policy,13proved to be the Great Lie. The financial sector’s longstanding ‘success’ was predicated on unprecedented volumes of lending combined with very low credit losses during the greatest expansion of credit in history, and both have now been reversed.14 Between the two, interventionist policymakers may be about to discover that putting the facilities in place to encourage a resumption of profligate behavior on the parts of banks and consumers alike does not necessarily mean it will eventuate, which would constitute a significant blow to long held, smug assumptions.

Financial sector dominoes are toppling. Consumers are trying to repair household balance sheets. Increased savings means less borrowing. Foreign revulsion for US financial instruments other than Treasury debt15will compel a domestic focus, increasing competition and reducing profits. Less fee and commission income coupled with less trading income leaves net interest income as the banking sector’s primary income driver, but bank lending is down. All of which suggests that record financial sector profit margins should be due for a long period of contraction, not least because as Jeremy Grantham reminds us profit margins are the most mean-reverting data series in economics.16 Although there are expected to be fewer bank failures, loan quality today is inferior to that of the 1930’s, suggesting a larger volume of non-performing loans will result in net charge-offs at least approaching Depression Era levels:

Chart 1: The State of American Banking

The financial crisis has brought the debt-driven, service-oriented US economy to a comparative standstill. The reduced lending capacity, not to mention flagging inclination, on the part of banks appears to be signaling if not the end of the secular expansion of private sector credit, a severe reduction of it. Industry consolidation has resulted in five banks now holding 67% of all mortgages and 68% of all credit card debt in the US—and they are in the process of reducing the amount of credit available to card holders by $2 trillion over the next 14 months,18which foretells of at best subdued growth because credit is a leading indicator.19 Since many consumers use revolving credit in lieu of savings to help them through rough patches, this cut back in credit availability will serve to reinforce frugality and the urge to save.

Don Coxe reported that at the height of their glory in 2007, financial companies were reporting 41% of total US corporate earnings.20 But with debt levels assuming a far more onerous character as GDP slows, the contraction is undermining the fundamental stability of the entire economic edifice: unable to generate the more than $6 of credit expansion necessary to produce $1 of GDP growth, what we are witnessing today is the long overdue rebalancing of the US economy, which in our view will entail a protracted slowdown affecting every sector of our economy in the near to intermediate term, but especially the service sectors over the long term.

As would be expected when confronted with an evolutionary dead-end, the financial industry, which is unequivocally integral to market operations, must now retrace its steps, regroup, and start again from a subordinate rather than pre-eminent role in both the US and the global economy. Generalizing for the sake of brevity, the arbitrage-type business model exceeded the limits of its transactive capabilities. Ironically, the financial sector became so efficient at identifying, profiting from, and thereby eliminating price distortions in the market that in order to maintain its all-consuming focus on earnings growth, it resorted to producing ever more complex derivative instruments that were leveraged to an ever larger degree to an ever-shrinking profit potential.21 Excluding three Chinese banks which now hold the top rankings globally, the pandemonium associated with the collapse of this model has seen a roughly 50% reduction in the market capitalizations of the remaining 17 largest banks in the world from $2.2 trillion to $1.1 trillion.22 In place of the arbitrage model, a ‘value-added’ model must be adopted in which the financial industry returns to its traditional role of offering a combination of prudent lending, experience, and innovation in the service of its clients’ interests and the furtherance of the real economy, i.e. making stuff instead of pedaling financial innovation. The “Masters of the Universe” conceit has been proven to be exactly that: the problem is that in their hubris neither the financial industry nor the Fed has experienced this epiphany, and until they do the US recovery will be at best erratic.

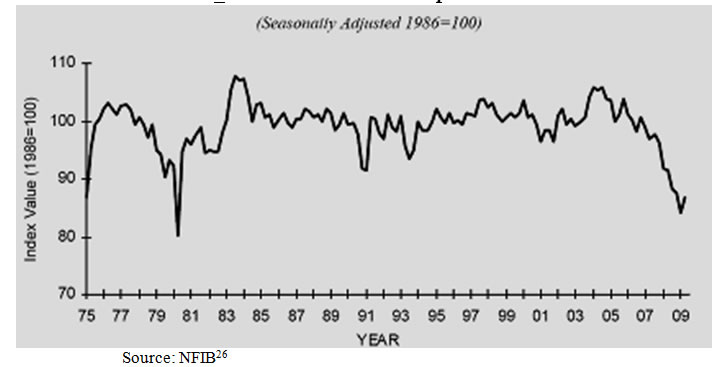

For their part, the Fed and Treasury are employing what can only be described as an ad hoc shotgun approach to policymaking that is also failing to inspire confidence virtually anywhere except in the financial sector and media. Though commercial paper has been recovering from the credit freeze, small- and medium-sized businesses, which generally have smaller margins for error in dealing with catastrophe, are performing well below levels historically consistent with a recovery in the broad economy, and expectations remain cautious going out six months.23 In its most recent release, the National Federation of Independent Business (NFIB) reports that although conditions are improving, which they see being driven by “pent up demand” within the overall economy, capital expenditures, plans to expand such spending, and inventory investment are all at record low levels; further, the employment cutbacks by its member businesses were unprecedented, and ongoing price reductions implemented to move inventory have been so severe as to be “unsustainable.”24

This makes extending the uptick in confidence portrayed on the following chart vital. Until small business uncertainty regarding government policies pertaining to new regulations, ‘nationalizations,’ increased taxes, and the extent to which the diversion of private funds for public use reduces funds available for private investment are alleviated the bounce will be fragile25:

Chart 2: NFIB Small Business Optimism Index

As both the largest cumulative employer and largest source of tax revenues, the Fed and Treasury simply must find a way to get money into the hands of these employers, or despite the recent, tentative improvements in unemployment figures, the economy will return to hemorrhaging jobs. In addition to the tight credit conditions and high number of ‘non-performing’ loans discussed earlier, due to the extent of the housing slowdown, increasing re-default and foreclosure rates, and the pending onslaught of option-ARM and Alt-A resets that will run for two more years, numerous commentators make the argument that unemployment now constitutes a leading indicator for the economy in that it foretells of further delinquencies and foreclosures. Highlighting this vulnerability, Fitch Ratings noted in June of 2009 that of the 543 mortgage-backed securities of the 2005-07 vintage that it was downgrading, 50% of the remaining performing loans were experiencing negative equity. They also projected a further 12.5% decline in home prices nationally, with California expected to see an additional 36% decline, and prices not stabilizing until the second half of 2010.27 A fresh wave of unemployment would certainly exacerbate the debt situation, not to mention further undermining shaky municipal and state finances that depend on property taxes for revenue.

Even before President Obama took office, a group of 43 states had lined up to petition the federal government for assistance to the tune of $1 trillion,28and for many states, such as California (see below), their situation has deteriorated markedly since then. According to the Philadelphia Fed, in February, for the first time in American history, all 50 of the United States were concurrently experiencing an economic contraction.29 In April, for the first time in its history, Moody’s issued a blanket downgrade of the creditworthiness of all local governments in the United States.30 But in a clear indication that fiscal profligacy is to remain the widespread norm, instead of privatizing services or selling assets or reducing payrolls, states and cities have chosen to follow the federal government’s lead and to borrow heavily to finance further spending: far from being discouraged by the Moody assessment of cities and states’ abilities to repay their debts, during the first quarter of 2009 speculators bought the second largest amount of debt ever issued.31

California, which has long been perceived as the trendsetter for much of the nation, is proving to be a socio-economic model best avoided like the proverbial plague. Californians individually pay the sixth highest state taxes in the country, with 1% of the population paying 50% of the taxes; it is now the costliest place in America to do business, not least due to climate change-driven zealotry that has resulted in energy costs 35% higher than the national average.32 Manufacturers ranging from Toyota to Tesla Motors have left; Silicon Valley scion Intel no longer makes anything in the state. The west coast locus of the property boom combined with the economic downturn saw state revenues in May decline 39.3% year-over-year in personal income taxes, 52.1% in corporate taxes, and 7.6% in sales taxes.33 Bad management exacerbated by plunging revenues has bankrupted at least one city.34 The state’s debt is only one level above the lowest credit rating money-market funds are allowed to hold.35

Unfortunately though, it appears that interventionist policymakers are about to Californicate the entire country. Burdened by the “secondary earner’s bias,” which effectively sees the second income in a dual income family taxed at a much higher marginal rate, a dual-income family today sees less actual discretionary income than a single-earner family in the 1970’s with an equivalent inflation-adjusted income (please refer to Chapter 1 regarding how this mechanism works).36 Individual income taxes relative to GDP are at or near the highest point in history37and appear set to head higher still one way or the other under the Obama administration. American corporate taxes are the second highest in the OECD at 39.25%, a scant .29% less than No. 1 Japan,38which combined with an increasingly antagonistic business environment fostered by Congress and the new administration is driving US corporations abroad, notable recent examples including Foster Wheeler, Tyco, Transocean International and Weatherford International. Federal revenues are falling at the fastest rate since 1981 and while the Congressional Budget Office projects a $1.7 trillion deficit for fiscal 2009, the Obama administration predicts a doubling of the national debt held by taxpayers over the next decade.39 Most recent data from U.S. Courts indicate personal bankruptcy filings were up 33% and business filings were up 59.7% year-over-year for the period ending March 31, 2009.40 Such distress may have contributed to the Fed deciding to broaden its Term Asset-Backed Securities Loan Facility (TALF) to encompass all manner of loans, including Small Business Association loans, which means the Fed may soon find itself financing loans slightly outside its purview, such as those for recreational vehicles, boats, snowmobiles, motorcycles and campers41—summoning an image of a smarmy used car salesman offering E-Z terms.

It is, however, consistent with interventionist doctrine that insists no thought needs to be given to value, efficiency or consequence, just to thrusting government largesse with taxpayer money into the economy. The approach may be best summed up as, ‘make money available, and they will spend.’ Although epitomized by the 2005 Bush energy policy which was widely dubbed the ‘no lobbyist left behind’ bill, the Obama administration appears set to scale new heights of pork-belly politics. More than 1400 pages of stimulus constituting what House Appropriations Committee Chairman David Obey termed “the largest change in domestic policy since the 1930s"42was pushed through Congress with barely enough time for anyone to read it, let alone to digest the details or to debate its merits. Demonstrative of the new administration’s approach, the US News & World Report claimed “lobbyists — not members of Congress — got the first shot at suggesting changes to the measure.”43

This naturally raises the question of how effective this first stimulus package will be. Lost in the clamor for President Obama to do something via FDR-styled work projects is consideration of those programs’ actual efficacy. In May of 1939, Treasury Secretary Henry Morgenthau summed up Depression era projects thus: "We are spending more money than we have ever spent before, and it does not work. After eight years we have just as much unemployment as when we started, and an enormous debt to boot."44 It is debatable whether this stimulus package has too much focus on social services and too little on economic growth, but history suggests the point may be moot because this clearly will not be the last stimulus package; perhaps, the second, or 32nd, will be more effective. All we can rely on is that there will be more programs in the offing because the government will stimulate the economy every which way it can until one of two things happens: either the economy responds to sufficient degree to claim victory, or it collapses.

At some point, interventionists will chance upon spending programs that actually have a positive effect on the economy long term. These will not center on projects like insulating schools or filling potholes or increasing our reliance on alternate energy sources, all of which have a place, however removed, in that they promote energy efficiency, but on sponsoring significant infrastructure projects that will serve to support, restore and expand our capacity for economic growth and increase our competitiveness. There is no end to the infrastructure work needing to be done in this regard: electrical transmission and base-load generation, water and wastewater treatment, rail expansion and electrification, light rail and public transport, ports and waterways, oil and gas pipelines and refining; after 30 years of neglect, the list seems endless.

Given the sheer size and scope of the stimulus, however, taxpayers would be wise to recall President Reagan’s famous quip that “(t-)he nine most terrifying words in the English language are, 'I'm from the government and I'm here to help.'”45 Government stimulus programs have historically been inefficient and rife with cronyism and corruption—so much of the latter, in fact, that in February the FBI announced it does not have the manpower to combat the anticipated fraud attendant to the new bailout and stimulus packages.46 In fact, by mid-April, the agency tasked with monitoring October’s bailout had twenty criminal investigations underway, ranging from securities fraud, tax fraud, and insider trading to the euphemistically titled “public corruption matters.”47

In attempting to revive the financial sector, the Fed and Treasury has extended an invitation for rampant moral hazard, otherwise known as cheating, in the various measures put in place since the crisis began, notably the purchase of banks’ toxic assets at full price, protecting politically-connected financial sector bondholders but not general public automotive bondholders, rescinding mark-to-market; and we can but conclude the aforementioned bank’s eagerness to return taxpayer money is indeed to free itself of government monitoring. We dwell on this uncharitable assessment because it would be consistent with a larger pattern of behavior that has become apparent in the aftermath of the financial crisis: there is a growing backlash to the amount of cheating and outright fraud that our elected officials’ lack of agency enforcement has been sanctioning.

There are sufficient parallels to put forth an argument that the Enron model, rather than being seen as a cautionary tale, became the template not just for the excesses seen throughout the financial sector but for a wide cross-section of the economy. We subscribe to the cockroach theory in this regard because money center banks with far too much influence in Washington marketed exactly the same financial instruments and derivatives they marketed to Enron to hide its wrong-doing48first in the US and then to the rest of the world to corporate officers concerned not with the health of their company or the welfare of their shareholders or the risks entailed in their dealings but with the performance bonuses they could arrange for themselves by employing such ‘financial innovation’—Enron writ large, if you will—and over time the fullness of the abuse will be revealed. We view the frantic efforts by the Fed and Treasury to revitalize the very sectors and business models that have failed so abysmally, and virtually guaranteeing their continued monopoly over opaque derivative trading, as an indication this cleansing is far from complete.49

Be that as it may, what is needed in the US is time—not the Wall Street, fast-talking, hot money predatory time that all too often starts a stampede over another proverbial cliff, but time for the economy to achieve a sustainable balance between sectors. Repairing household balance sheets, restoring business confidence, and realigning housing affordability with incomes takes the kind of time attendant to an economic bottoming process and then to a period of slow, steady growth, not the V-shaped recovery those still too liberally partaking in the interventionist Kool-Aid50believe is at hand and have priced into the market—and when the recovery does arrive it will bear scant resemblance to the US economy circa 2007.

The recent turmoil has taught us that the world has had its fill of ‘financial innovation’ and that Americans’ binge consuming has resulted in an epic hangover. People are realizing that consumerism alone can not be the engine of economic growth and has in fact undermined it by misrepresenting leveraged, debt-fueled nominal asset appreciation as ‘wealth creation,’ thereby encouraging a gross misallocation of capital. Capital investment in fixed assets that produce real goods is the actual driver of long term economic growth, and until slick financiers hijacked the country with ‘new economy’ mumbo-jumbo based on computer models and hype most Americans understood this. Only a government addled by special interest money could have overseen the development of an edifice as inherently unstable as that in the following Ecological Economist’s view of the US economy:

Chart 3: Percentage of 2007 GDP by Sector

Market forces are undermining the edifice. Sectors that have relied on financial engineering instead of real engineering are crumbling, led by the “Finance, Insurance, Real Estate and Leasing” and “Professional and Business Services” categories. As the rebalancing gathers momentum, it will lead to a substantial shift in emphasis from the ephemeral to the concrete. Opportunities within the economy, which may be visualized as a re-arranging and gradual broadening of the base of the structure, strengthening it, will entail a migration in employment from sectors dependent on discretionary consumption and services to those that rely on production, research and development, and capital investment. All are energy intensive.

We anticipate over the next decade the combined contributions from the “Manufacturing,” “Construction,” “Information (technology),” “Transportation & Warehousing,” “Utilities (infrastructure),” “Mining, Oil & Gas,” and “Agriculture & Forestry” sectors will increase from today’s roughly 38% to more than 60% of GDP. By way of general explanation, as seven of our nine reports deal with various aspects of this process and each is updated within this context in its own chapter, we offer the following.

Certainly, we have neglected the infrastructure that supports our economy, threatening our productive base, but we are convinced that in order for the US to regain its economic footing, we will have to turn to our aging but still formidable productive capacities. We are constantly bombarded with stories about imperial over-reach and the decline of the American Empire, how uncompetitive we are, and an endless litany of what is going wrong—and much has. Somehow though, Americans have been given to understand that our manufacturing sector has been gutted and shipped lock, stock and barrel to China, which much to financial sector lobbyists’ chagrin, is patently untrue.

It is true that American manufacturing has been in decline and that it is experiencing a precipitous slowdown consistent with the rest of the global economy, but let’s keep things in perspective. US GDP is estimated to have been $13.81 trillion in 2007,52which means the manufacturing sector’s 11.7% contribution amounted to $1.62 trillion dollars, making American manufacturing alone larger than the entire GDP of every country on the planet except for six: Japan, Germany, China, the United Kingdom, France and Italy.53

Craig Giffi, vice-chairman of consultancy Deloitte LLC, who wrote a book on the subject, told an economic summit in June that the US is “the most productive nation in the world when it comes to manufacturing.”54 And nothing threatens China’s success, or that of any exporting nation for that matter, like American manufacturing expertise, for we have a tremendous amount of unused capacity we can and will utilize. America possesses a unique geography that not only makes us the world’s largest producer of food but also provides us with some of the least expensive bulk transport on the planet55; American manufacturing has access to a competitive, educated workforce and sound basic infrastructure, albeit overdue for repair and expansion; there is an abundance of inexpensive electricity available to power industry; and we have local governments eager to offer favorable terms and concessions to attract new business to their area.

A case can be made that China’s central planners have reached this very same conclusion, which may explain why they flip-flopped from very publically denouncing the threat of ‘Buy American’ protectionism and repeatedly assuring global markets that their stimulus package would require no such codicil to mandating ‘Buy China’ requirements in their stimulus package to limit foreign competition. Perhaps they realized that American consumers will increasingly come to buy American products without legislative encouragement because we make better products for the money, and before long it will be widely understood that buying American products helps to employ Americans, not foreigners, and serves to keep American dollars circulating within the American economy, not lost to countries whose interests are not necessarily aligned with ours.

Interestingly, this rebalancing and strengthening of the US economy does not require the outlay of unfathomable amounts of money, such as that the government has committed to spending ‘on our behalf’ for various boondoggles like supporting their cronies in the financial sector. The credit crisis, which is really about debt, will likely afford myriad opportunities for well-managed companies to accumulate the manufacturing assets of those who were over-leveraged or imprudent and to put them to more productive use. It will not necessitate a full spectrum infrastructure rebuild and an expansion unlike anything since World War II as media pundits proclaim, for in the near term energy efficiency, and its attendant cost savings, coupled with the excess capacity in place and ready to be utilized will suffice. There need not be a delay while the infrastructure build-out comes on-line but a smooth incorporation of the new capacity to expand production further as it does. And the rebound leading the way will originate not in Silicon Valley or Manhattan, which will likely remain so self-absorbed as to miss the initial stages of the recovery, but in the American heartland, principally in the regions serviced by the Mississippi River and her tributaries, and will lead to new or reinvigorated roles for the cities along her banks. Sectors whose out-performance we expect to signal the eventual bottom will include the likes of machinery, electrical equipment, food producers, oil & gas extraction, chemicals and communications equipment, not service companies like brokers, bankers, apparel, printers and specialty retailers.

Given the opportunity, the US economy has the potential to begin the shift toward increasing productive output by a substantial margin today. Mostly what is needed is for the US government to stop treating American businesses like enemies of the state and to let them go about the job of putting people to work making things to sell to other people around the world that are eager to buy them. If the government cannot bring itself to help create a more friendly business environment, the least it could do is to get out of the way so American business can affect a recovery despite government involvement. Disaffection with the Obama administration preaching transparency and fiscal rectitude but practicing back-room deals and wanton profligacy is beginning to show up in sentiment surveys such as that of the University of Michigan: the category “opinions about government policy” saw a drop from 108 in May to 93 in June, tying the sharpest single drop on record.56

This is not the 1930’s, but the Obama administration has portrayed itself as the modern analog of the Roosevelt administration and has passed the first of what will likely be many 1930’s-style stimulus plans to rescue the economy—an economy most in need of being rescued from the nightmare of legislative excess and over-arching bureaucratic intrusion administrations just like this one has created in the service of interventionist policy.

And as is discussed in the next chapter, nowhere is this excess and antagonism toward American business more evident than in carbon policy. Ironically, as the administration rushes to pass carbon legislation before the growing opposition and the demands of the financial crisis postpone it indefinitely, Obama might discover that part of Roosevelt’s ‘success’ stemmed from the fact he did not have to contend with conflicting environmental agendas, the instantaneous public forum of the internet, battling bureaucracies, special interests groups gleefully running amok in the capital, and one of the most litigious societies in recorded history….

We believe it is critical to get the information contained in our eBook Credit and Credibility into your hands now, so in response to considerable feedback, which has perhaps been best summed up by a reader who wrote, “love your work, just can’t afford it,” we are making the following offer:

Market Oracle readers Buy CREDIT and CREDIBILITY for $99 and if you do not believe it has been money well spent, we will promptly issue you a refund.

We are confident this offer will not only help guide you through these troubled times but also help you prosper in the years ahead, rewarding us as well with your continued patronage.

This offer is valid for a limited time period. Please click here to take advantage of it.

As always, any questions, comments or suggestions you may have regarding our work are welcomed.

By Richard Karn/ETR

310 Arctic Boulevard #102

Anchorage, AK 99503

Phone: 510-962-5021

www.emergingtrendsreport.com

© 2009 Copyright Richard Karn / ETR - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Resources:

1Contents of the original note from Mark Twain, May 1897. http://www.twainquotes.com/Death.html

2Hogan, Michael: “Niall Ferguson: America Needs to Cancel Its Debt”; Vanity Fair: 20.01.2009. http://www.vanityfair.com/online/politics/2009/01/niall-ferguson-america-needs-to-cancel-its-debt.html

3Australian Associated Press (AAP: not attributed): “Recovery hopes dominate G8 finance talks”; AAP: 13.06.2009. http://au.biz.yahoo.com/090613/2/26vcm.html

4Berr, Jonathan: “IMF sees economic crisis getting worse, other expect recovery”; Daily Finance: 15.06.2009. http://www.dailyfinance.com/2009/06/15/imf-sees-economic-crisis-getting-worse-others-expect-recovery/

5International Monetary Fund (IMF): World Economic Outlook: Crisis and Recovery; IMF: April 2009. http://www.imf.org/external/pubs/ft/weo/2009/01/index.htm

6Australian Associated Press (AAP: not attributed): “Recovery hopes dominate G8 finance talks”; AAP: 13.06.2009. http://au.biz.yahoo.com/090613/2/26vcm.html

7Rugaber, Christopher R.: “Large banks see recession ending by late summer”; Associated Press: 16.06.2009. http://news.yahoo.com/s/ap/20090616/ap_on_bi_ge/us_banks_economic_outlook

8Benjamin, Matthew: “JPMorgan, Barclays Say Economy Will Grow in Last Half”; Bloomberg: 01.05.2009. http://www.bloomberg.com/apps/news?pid=20601087&sid=aKrcXN3PG_wQ&refer=home

9Rugaber, Christopher R.: “Large banks see recession ending by late summer”; Associated Press: 16.06.2009. http://news.yahoo.com/s/ap/20090616/ap_on_bi_ge/us_banks_economic_outlook

10Montier, James: “Mind Matters”; Cross Asset Research/Societe Generale: pp. 1, 20.04.2009. http://www.sgcib.com

11Katz, Ian: “FASB Eases Fair-Value Rules Amid Lawmaker Pressure”; Bloomberg: 02.04.2009. http://www.bloomberg.com/apps/news?pid=20601087&sid=agfrKseJ94jc

12Montier, James: “Mind Matters”; Cross Asset Research/Societe Generale: pp. 4, 20.04.2009. http://www.sgcib.com

13Vitner, Mark: “Past Recessions Suggest Sluggish Road Ahead”; Wachovia Economics Group: pp. 6, 04.06.2009. http://www.wachovia.com/economics

14Schildbach, Jan: “Global banking trends after the crisis”; Deutsche Bank Research: 15.06.2009. http://www.dbreserach.com

15Vitner, Mark: “Past Recessions Suggest Sluggish Road Ahead”; Wachovia Economics Group: pp. 7, 04.06.2009. http://www.wachovia.com/economics

16Grantham, Jeremy: GMO Quarterly Letter: pp.3, October 2008. http://www.gmo.com/

17Schildbach, Jan: “Global banking trends after the crisis”; Deutsche Bank Research: pp. 10 & 17, 15.06.2009. http://www.dbreserach.com

18Whitney, M., Mack, J., & Chung, K.: “Consolidated Lending Market Poses Risk to Overall Consumer Liquidity”; Oppenheimer: 30.11.2008. http://www.opco.com

19Strauss, Lawrence C.: “After the Bubble, How Capitalism Will Survive”; Barron’s: 29.09.2008. http://online.barrons.com/article/SB122246744271480397.html?mod=djemWR

20Coxe, Don: “Who Will Really Lead the Global Rescue?”; Basic Points/Coxe Advisors LLC/BMO Capital Markets: 08.06.2009. http://www.coxeadvisors.com

21Ikeo, Kazuhito: “Arbitrage-type biz model in decline”; Nikkei Weekly: 29.09.2008. (subscription required) http://www.nni.nikkei.co.jp

22Schildbach, Jan: “Global banking trends after the crisis”; Deutsche Bank Research: pp. 3, 15.06.2009. http://www.dbreserach.com

23DiClemente, Robert V.: “The Unsustainable Fire”; Comments on Credit/Citi: pp. 4, 12.06.2009. http://www.citi.com

24Dunkelberg, William C. & Wade, Holly: “NFIB Small Business Economic Trends Quarterly Report”; National Federation of Independent Business: pp. 3, May 2009. http://www.nfib.com/Portals/0/PDF/sbet/sbet200905.pdf

25Ibid.

26Ibid, pp. 4.

27Mauldin, John: “Outside the Box”; Millennium Wave Advisors, LLC: Volume 5, Issue 33, 15.06.2009. http://www.frontlinethoughts.com

28Hurdle, Jon: “U.S. Governors seek $1 trillion federal assistance”; Reuters: 02.01.2009. http://www.reuters.com/article/newsOne/idUSTRE5014F120090102

29Rosenberg, David A.: “North America: Morning Market Memo”; Bank of America/Merrill Lynch Research: pp. 4, 01.04.2009. http://www.ml.com

30Walsh, Mary Williams: “Muni Bonds May Face Downgrade”; The New York Times: 07.04.2009. http://www.nytimes.com/2009/04/08/business/economy/08muni.html?_r=1&emc=eta1

31Cauchon, Dennis: “States and cities borrow big”; USA Today: 03.05.2009. http://www.usatoday.com/news/nation/2009-05-03-borrowing_N.htm?csp=34

32Investor’s Business Daily (not attributed): “Fool’s Golden State”; Investor’s Business Daily: 19.02.2009. http://www.ibdeditorials.com/IBDArticles.aspx?id=319938451301950#

33Christie, Jim: “California nears financial ‘meltdown’ as revs tumble”; Reuters: 10.06.2009. http://news.yahoo.com/s/nm/20090610/pl_nm/us_economy_california_revenues_4

34Walsh, Mary Williams: “Muni Bonds May Face Downgrade”; The New York Times: 07.04.2009. http://www.nytimes.com/2009/04/08/business/economy/08muni.html?_r=1&emc=eta1

35Doherty, Jaqueline: “Help Me, Uncle Sam”; Barron’s: 11.04.2009. http://online.barrons.com/article/SB123941269948510457.html

36Zywicki, Todd J.: “The Two-Income Tax Trap”; The Wall Street Journal: 14.08.2007. http://online.wsj.com/article/SB118705537958296783.html

37Cogan, John F. & Hubbard, R. Glenn: “The Coming Tax Bomb”; The Wall Street Journal: 08.04.2008. http://online.wsj.com/public/article_print/SB120761416279896669.html

38Toscano, Paul: “The World’s Highest Corporate Tax Rates”; CNBC: 13.05.2009. http://www.cnbc.com/id/30727913/?slide=1

39Waggoner, John: “IRS tax revenue falls along with taxpayers’ income”; USA Today: 27.05.2009. http://www.usatoday.com/money/perfi/taxes/2009-05-26-irs-tax-revenue-down_N.htm

40Redmond, Karen: “Bankruptcy Filings Continue to Rise”; U.S. Courts: 08.06.2009. http://www.uscourts.gov/Press_Releases/2009/BankruptcyFilingsMar2009.cfm

41Andrews, Edmund L.: “Lender’s Role for Fed Makes Some Uneasy”; The New York Times: 12.06.2009. http://www.nytimes.com/2009/06/13/business/economy/13fed.html

42Cowan, Richard & Cornwell, Susan: “Congress sends $787 billion stimulus to Obama”; Reuters: 13.02.2009. http://news.yahoo.com/s/nm/20090214/bs_nm/us_usa_stimulus

43Investor’s Business Daily (not attributed): “No Way To Make Public Policy”; IBD: 13.02.2009. http://www.ibdeditorials.com/IBDArticles.aspx?id=319419724231321

44Hoye, Bob: “’Stimulus’ Has Never Worked”; Institutional Advisors: pp.1, 17.02.2009. (subscription required) http://www.institutionaladvisors.com

45Said during a microphone test in 1984: http://www.quotationspage.com/quotes/Ronald_Reagan

46Meyer, Josh: “FBI expects number of major financial bailout fraud cases to rise”; The Los Angeles Times: 11.02.2009. http://www.latimes.com/news/nationworld/nation/la-na-fraud12-2009feb12,0,3435565.story

47Liberto, Jennifer: “Bailout cop busy on the beat”; CNNMoney.com: 21.04.2009. http://money.cnn.com/2009/04/21/news/economy/tarp_cop_barofsky/?postversion=2009042103

48Thornton, Emily & France, Mike: “For Enron’s Bankers, a ‘Get out of Jail Free’ card”; BusinessWeek: 11.08.2008. http://www.businessweek.com/magazine/content/03_32/b3845036.htm

49We strongly recommend the statement by Christopher Whalen to the Senate Committee on Banking, Housing and Urban Affairs, Subcommittee on Securities, Insurance, and Investment: June 22, 2009. http://banking.senate.gov/public/index.cfm?FuseAction=Files.View&FileStore_id=1f354557-7b1f-4ffd-9014-e80435bc55b8

50ETR apologies to Tom Wolfe’s The Electric Kool Aid Acid Test; Farrar Straus Girous: 1968.

51Data updated and applied to visual representation adapted from Cobb, Kurt: “Upside down economics”; Resource Insights: 29.07.2007. http://www.energybulletin.net/newswire.php?id=32718

52World Bank: “Gross domestic product 2007”; World Development Indicators database/World Bank: 10.09.2008. http://siteresources.worldbank.org/DATASTATISTICS/Resources/GDP.pdf

53Ibid.

54Australian Financial Press (AFP: not attributed): “Manufacturing must drive US recovery, summit told”; AFP: 17.06.2009. http://au.biz.yahoo.com/090616/33/26x5p.html

55Zeihan, Peter: “The Geography of Recession”; Strafor: pp.4, 02.06.2009. http://www.stratfor.com

56Rosenberg, David A.: “Breakfast with Dave”; Gluskin Sheff: pp. 2, 15.06.2009. http://www.gluskinsheff.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.