Healthcare Company Profits Sensitivity to Obamacare

Companies / Healthcare Sector Oct 31, 2009 - 02:17 PM GMTBy: Richard_Shaw

National healthcare wherever is implemented squeezes prices and profits of the private businesses involved in the system.

National healthcare wherever is implemented squeezes prices and profits of the private businesses involved in the system.

Obamacare in the U.S. will be no different. For investors in healthcare companies, it is a good idea to begin to think through which companies will be most severely negatively impacted or least impacted, to potentially make deletions or substitutions.

One dimension of healthcare companies is research and development, which has been an important driver of future growth and value for many companies in the biotech, pharmaceutical and medical devices industries.

One dimension of healthcare companies is research and development, which has been an important driver of future growth and value for many companies in the biotech, pharmaceutical and medical devices industries.

To the extent that the rewards of research and development are reduced by price pressures due to national healthcare, research and development will decrease, and therefore growth in sales, profits and value of those private companies will slow.

One way to begin the process of determining the sensitivity of biotech, pharmaceutical and medical device companies to a switch from a private to a public U.S. healthcare system is to identify what portion of their total revenue comes from the U.S. Those with a greater U.S. revenue exposure are more likely to be damaged by Obamacare than those with less U.S. revenue exposure.

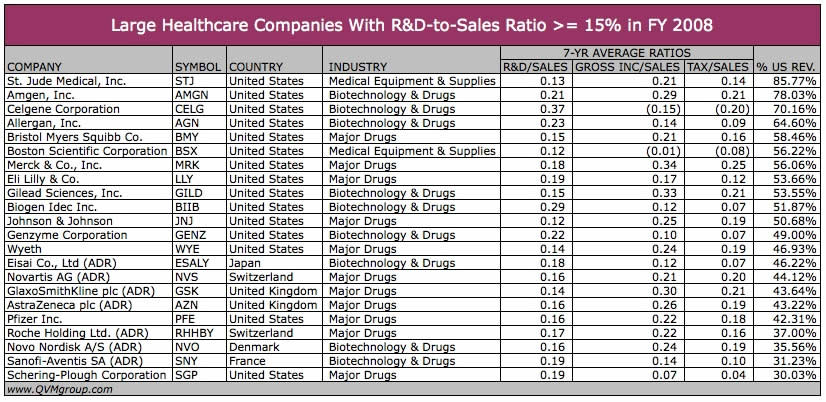

This chart identifies 21 healthcare companies that have expended for R&D on average for the past 7 years at 15% of sales or more, and that have a current market-cap of $10 billion or more.

Company symbols in the table image: STJ, AMGN, CELG, AGN, BMY, BSX, MRK, LLY, GILD, BIIB, JNJ, GENZ, WYE, ESALY, NVS, GSK, AZN, PFE, RHHBY, NVO, SNY, SGP.

While there are many other questions to ask about a company to judge its sensitivity to potential U.S. national healthcare, looking at geographic revenue segmentation is a good place to start.

Some, but not all, of the other factors, you will probably want to analyze as you do your investment research are:

- current profit margins on U.S. revenue versus non-U.S. revenue

- split of consumer products that are not covered by current insurance, nor likely to be covered by Obamacare (e.g. aspirin and cold remedies)

- sales and growth rate contribution from the U.S. versus other countries

- what they have already in late state development or clinical trials

- the duration of patents on their key drugs or devices

- the current degree of market adoption of their key drugs or devices

While the answers to the above questions could prove more important than geographic revenue segmentation, preliminary logic would say that large companies with lower U.S. revenue exposure are candidates as potential substitutes for large companies with higher U.S. revenue exposure.

Even though companies with less U.S. revenue may have substantial European revenue, the national healthcare impact from those countries is already a known.

One of our clients who is in the medical services business, told us that a national healthcare official there told him that European healthcare officials recognize that the profitable private market in the U.S. has enabled much of the research and development by healthcare companies around the world. He said the flow of new drugs, treatments and devices that they rely upon is dependent on companies being able to profitably develop them for the U.S. market. European officials are concerned that their national healthcare will consequently suffer a decreased flow of new drugs, treatments and devices if the U.S. eliminates its private healthcare system.

Whether that is correct, we don’t know, but it is an interesting issue from an investment perspective. It suggests that even though there are important European companies doing research and development, they may not do so much of that if they cannot sell new products into the United States at higher prices than they can at home.

The story points to the need for a large private healthcare market somewhere to make development of new medical technology economically attractive to private companies.

Without private research and development, we are left with politically directed research which is more likely to be incremental as opposed to breakthrough. There certainly are some examples of government directed and funded research creating breakthroughs, most notably in space exploration and in military technology. However, those types of programs were not characterized by cost containment as a key objective, but cost containment is one of the key goals in any national healthcare system.

All this leads us to think that healthcare investing would need to refocus on the “Walmarts” of healthcare (high volume, low margin); that biotech venture capital would have to be rethought; and that large pharma and device companies may need to merge to create larger more efficient, but less research oriented entities.

There will still be success stories and investment profits to be made, but not with the same old investment selection models.

We aren’t entirely sure what the new models would look like, but we do think a re-think of what a good healthcare investment would be is essential.

For starters, the U.S. versus non-U.S. revenue mix is a dimension to consider.

Approach healthcare providers, biotech companies, pharma companies, medical device companies, and medical or psychiatric REITS with an extra dose of investment research and caution until the U.S. sorts out its healthcare system plans.

Disclosure: We do not own any company identified in this article.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.