The Tentacles of the Housing Recession Are Beginning to Strangle the US Consumer

Economics / US Economy Jul 06, 2007 - 11:05 PM GMTBy: Paul_L_Kasriel

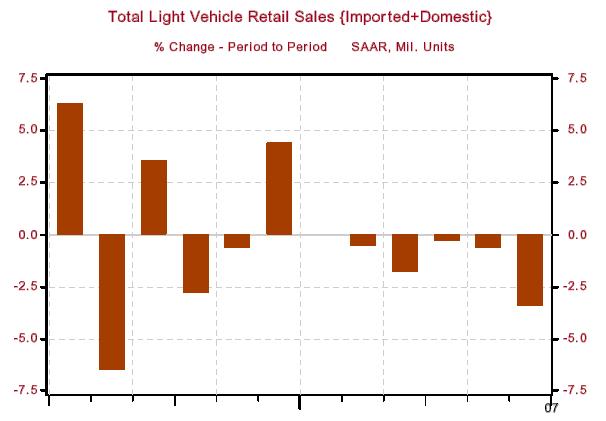

Light motor vehicle sales in the U.S. dropped 3.4% month-to-month in June to a seasonally adjusted rate of 15.6 million units. Excluding the Katrina-depressed sales of September 2005, the June 2007 sales rate was the slowest since September 2002. Light motor vehicle sales have declined sequentially for six consecutive months (see Chart 1). On a quarterly average basis, new light motor vehicle sales contracted at an annual rate of 12.7% in Q2 vs. a 6.2% increase in Q1.

Light motor vehicle sales in the U.S. dropped 3.4% month-to-month in June to a seasonally adjusted rate of 15.6 million units. Excluding the Katrina-depressed sales of September 2005, the June 2007 sales rate was the slowest since September 2002. Light motor vehicle sales have declined sequentially for six consecutive months (see Chart 1). On a quarterly average basis, new light motor vehicle sales contracted at an annual rate of 12.7% in Q2 vs. a 6.2% increase in Q1.

Chart 1

Although not all of the Q2 decrease will show up as a subtraction to consumer spending (some will subtract from business capex), there are other indications that consumer spending is flagging. As mentioned in our June 26 daily commentary, "So, the Housing Recession Is Contained?", a number of retailers in the discretionary consumer spending "space" have recently reported disappointing sales and have lowered sales guidance.

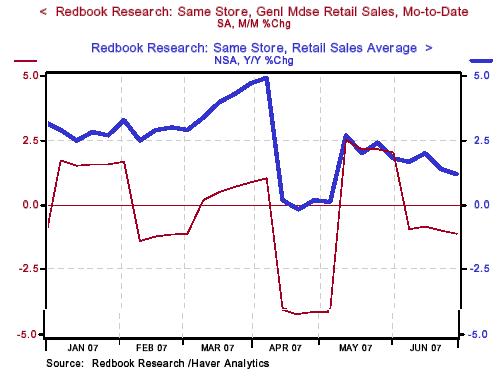

Corroborating these individual retailers' reports are the Johnson Redbook retail sales survey results for June. As shown in Chart 2, both in terms of year-over-year changes and seasonally-adjusted month-to-date terms, retailing activity tailed off significantly in June. The April-May average of real personal consumption expenditures was up only 1.3% at an annual rate vs. its Q1 average. The June data on light motor vehicle sales and chain store sales are not pointing to an acceleration. The question the markets and the Fed will be wresting with over the remainder of summer is whether the sharp deceleration in Q2 real consumer spending is a one-off event or something with more longevity. My bet is the latter.

Chart 2

The ongoing housing recession is sharply reducing one source of funding for household deficit spending - mortgage equity withdrawal (MEW). The continued decline in home prices and the tightening of mortgage underwriting standards will exacerbate the drying up of MEW. Job growth also is trending lower, which will restrain future consumer spending. Slowly but surely, the tentacles of the housing recession are strangling the consumer.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.