Rydex Stock Market Timers Bailing Out

Stock-Markets / Stock Index Trading Oct 30, 2009 - 09:29 AM GMTBy: Guy_Lerner

Figure 1 is a daily chart of the S&P500 with the amount of assets in the Rydex Money Market Fund in the lower panel.

Figure 1. S&P500 v. Rydex Money Market/ daily

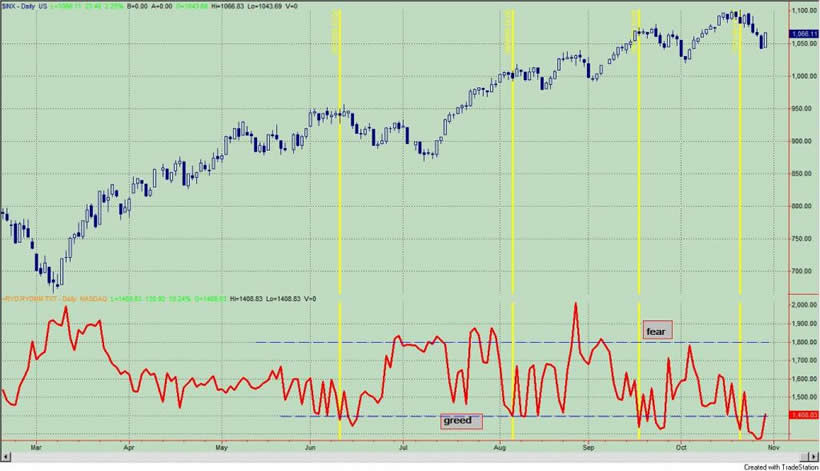

Figure 2 is a daily chart of the S&P500 with the amount of assets in the Rydex bullish and leveraged funds versus the amount of assets in the leveraged and bearish funds.

Figure 2. Rydex Bullish and Leveraged v. Bearish and Leveraged/ daily

Ok, this is my brief interpretation of yesterday's price action. The big GDP print was already priced into the market, and it should not have been a surprise. With the Dollar down and everything else up again, one would can say two things: 1) nothing has changed; 2) if things are so good why are rates so loose?

In any case, with respect to the Rydex market timer (which is only a representative sample of market participants), there is no doubt that many are feeling relieved having been relieved of their losing positions. Let's put it this way, if you put on a short term trade on Friday or Monday, you got your head handed to you, and I am sure you were heard muttering, "I will never do that again - just get me out." So we get a nice pop yesterday on old news, and you are gone - out of the markets and licking your wounds and maybe a little light in the pocketbook. You sold into this 2% lift. The Rydex numbers appear to support such a notion as the number of leveraged bulls decreased and the amount of assets in the Rydex Money Market Fund slightly increased.

In sum, the Rydex market timer has been bailed out and is bailing out!

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.