Modified Faber Model Stock Market Sell Signal

Stock-Markets / Stock Index Trading Oct 29, 2009 - 02:26 PM GMTBy: Guy_Lerner

Back on June 29, 2009, I presented research that improved the efficiency of the Faber market timing model for the S&P500 by some 50%. By efficiency I meant that the new and improved model made more money with less time in the market and with less draw down. The research can be found in this article, "Inflationary Pressures Are A Legitimate Concern".

The gist of the research was that stocks tended to under perform during times when the trends in gold, commodities, and yields on the 10 year Treasury bond were strong. The Faber model is a simple moving average model, yet we can improve the model's efficiency (for the S&P500) by moving to cash when (real or perceived) inflation pressures are strong as measured by a composite indicator that assesses the trends in gold, commodities, and yields on the 10 year Treasury bond.

In other words, the modified model is only long the S&P500 when prices are above the simple 10 month moving average and when inflation pressures (as measured by the trends in gold, crude oil and yields on the 10 year Treasury bond) are not extreme. The original Faber model uses only the simple 10 month moving average to time its buy and sell signals.

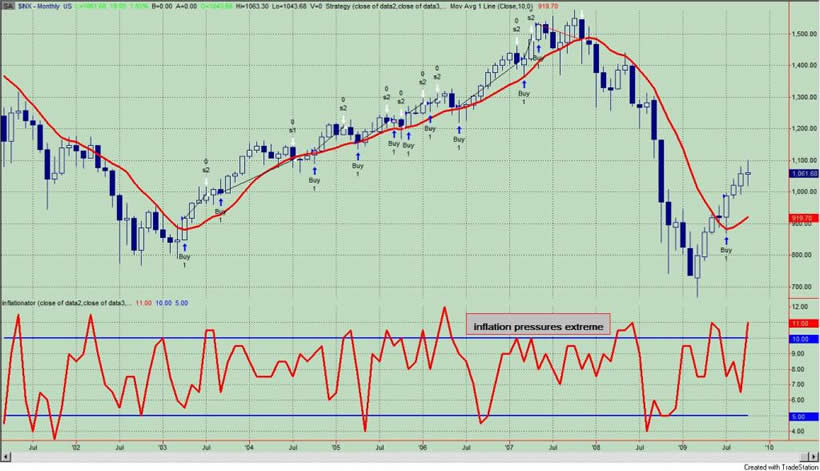

As we end October, the trends in gold, commodities, and yields on the 10 year Treasury bond have been surging . The composite indicator that measures these trends is shown in the lower panel of figure 1, a monthly chart of the S&P500. Therefore, this constitutes a sell signal for our modified Faber model. Referring back to figure 1, I placed the recent bull market (2002 to 2008) buy and sell points from this strategy on the price graph.

Figure 1. S&P500/ monthly

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.