Does a Fall in Bank Credit Lead to Deflation?

Economics / Deflation Oct 29, 2009 - 01:51 PM GMTBy: Frank_Shostak

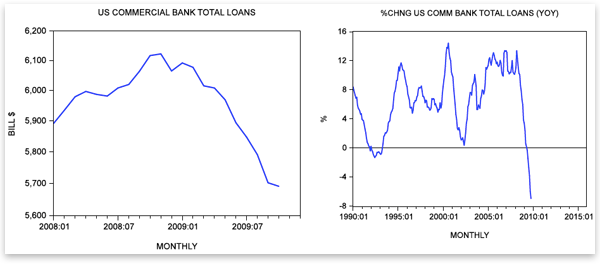

US credit is undergoing a major contraction. In the week ending October 14, US commercial-bank lending stood at $5,686.8 billion: a fall of 6.6% from the end of January.[1] Year on year, loans fell by 7% in October after declining by 5.8% in September. On the same basis of comparison, in October last year, loans increased by 6.6%.

US credit is undergoing a major contraction. In the week ending October 14, US commercial-bank lending stood at $5,686.8 billion: a fall of 6.6% from the end of January.[1] Year on year, loans fell by 7% in October after declining by 5.8% in September. On the same basis of comparison, in October last year, loans increased by 6.6%.

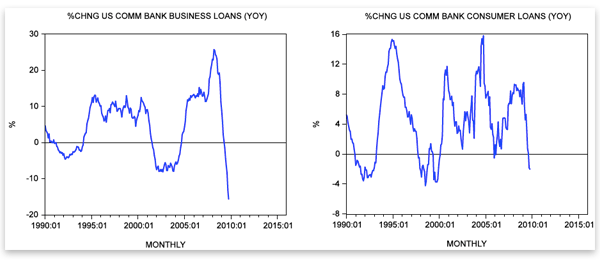

The growth momentum of commercial-bank business loans has also had a large decline so far this October. Year on year, these loans plunged by 15.9% after falling by 13% in September, and rising by 19.1% in October last year. Since the end of January, business loans fell by $215.7 billion.

The growth momentum of commercial-bank business loans has also had a large decline so far this October. Year on year, these loans plunged by 15.9% after falling by 13% in September, and rising by 19.1% in October last year. Since the end of January, business loans fell by $215.7 billion.

Year on year, consumer loans fell by 1.7% in October, after declining by 1.4% in September — this was the second consecutive monthly decline.

Commercial-bank real-estate loans also remain under pressure. Year on year, real-estate loans have fallen by 4.2% in October after declining by 3.7% in September.

Some commentators are of the view that because credit has acted increasingly as money, a collapse in credit has the same effect as a collapse in the money supply. Given the fact that credit by commercial banks displays a visible decline, it would follow that the United States is currently experiencing deflation.

But is it really valid to include credit as part of money supply? To provide an answer to this important question we have to define what money is.

The Definition of Money

Money is that for which all other goods and services are traded. Or we can say that the essence of money is that it provides the services of the medium of exchange.

Some commentators dispute that this is so. They maintain that money's main function is to act as a means of savings. Others argue that its main role is to provide services as a unit of account and to function as a store of value.

While these roles are important, they are not fundamental. The fundamental role of money is as the general medium of exchange.

It is because of this that all other functions emerge. The fact that an entity becomes the medium of exchange gives rise to these other functions.

According to Mises, money has evolved from the most marketable commodity.

There would be an inevitable tendency for the less marketable of the series of goods used as media of exchange to be one by one rejected until at last only a single commodity remained, which was universally employed as a medium of exchange; in a word, money.[2]

Through a progressive selection process, people settled on gold as money.

In today's monetary system, the money supply is no longer gold, but is instead coins and notes issued by the government and the central bank. Consequently, coins and notes ("cash") constitute the standard money that is employed in transactions. Goods and services are sold for cash.

At any point in time, part of the stock of cash is deposited in banks. Once an individual places his money in a bank's warehouse (making what is known as a "demand deposit") he is in fact engaging in a claim transaction. In depositing his money, he does not relinquish his ownership. No one else is expected to make use of it. Thus, when Joe stores $100 with a bank, he continues to have an unlimited claim on it and is entitled to take charge of it at any time.

Such deposits must be contrasted with credit transactions, in which the lender of money relinquishes his claim over the money for the duration of the loan. In this case, the lender is temporarily transferring his money to the borrower.

The distinction between a credit and a claim transaction is an important means of identifying the amount of money in an economy. Following this approach, one could easily note that, notwithstanding popular practice, money invested with money-market mutual funds (MMMF) should be excluded from the definition of the money supply. (Note that MMMF investments are included in M2.)

Investment in a money-market mutual fund is in fact an investment in various money-market instruments. The quantity of money is not altered as a result of this investment; only the ownership of money has changed. Including investments in MMMFs in the money definition only leads to a double counting thereof.

For example, if Joe invests $100 with a money-market mutual fund, the overall amount of money in the economy will not change as a result of this transaction. Money will move from Joe's demand-deposit account to the MMMF's demand-deposit account.

To incorporate the $100 invested with the MMMF (plus the original $100) into the definition of money would therefore amount to double counting.

The fact that mutual funds offer their clients check facilities has prompted some analysts to suggest that deposits with mutual funds are similar to bank demand deposits. However, when an individual writes a check against his account with the MMMF, he in fact instructs them to sell some of his money-market certificates for cash. The buyer of these certificates parts with his money, which is then transferred to the individual who wrote the check; money changes hands, but no new money is created.

Furthermore, the fact that MMMF checks are employed in payments does not mean that they are themselves money. Checks are merely a particular way of employing existing money in transactions.

The crux of identifying what must be included in the definition of the money supply is the distinction between claim transactions and credit transactions. Following this principle, it is questionable whether savings deposits should be part of the money supply.

According to popular thinking, the inclusion of savings deposits in the money supply definition (part of M2) is justified on the grounds that money deposited in savings accounts can always be withdrawn. But the same logic should also be applied here as to money placed with a MMMF.

The key is that savings deposits do not actually confer an unlimited claim. The bank can always insist on a waiting period of 30 days during which the deposited money could not be withdrawn. Savings deposits should therefore be considered credit transactions in which depositors relinquish ownership for at least 30 days.

This fact is not altered just because the depositor could withdraw his money. When the bank accommodates this demand, it sells other assets for cash. Buyers of assets part with their cash, which in turn is transferred to the holder of the savings deposit. The same logic is applicable to fixed-term deposits like Certificates of Deposit, which are credit transactions.

Though traveler's checks are considered an integral part of the money supply, they should not be. Traveler's checks are receipts for investment in the companies that issue them. As such, they result from a credit transaction, and therefore are not part of the money definition. Cashing a traveler's check means that AMEX or VISA will transfer money from their deposits to the holder of the check. Doing so does not change the amount of money in the economy.

The problem of double counting is also not resolved by the money of zero maturity (MZM) measure. MZM includes all types of financial instruments that can be easily converted into money without penalty or risk of capital loss.[3] Its definition excludes all securities, which are subject to the risk of capital loss, and time deposits, which carry penalties for early withdrawal. Included in MZM are currency, demand deposits, traveler's checks, savings deposits, and deposits with money market mutual funds.

This definition doesn't identify money but rather various assets that can be easily converted into money. It doesn't tell us what money actually is and where money is located — which is precisely what a definition of money ought to do.

Now, when a depositor places his money in a savings or fixed-term deposit, he temporarily relinquishes his ownership over money. This, however, is not the case with demand deposits. As long as the bank does not use the money in demand deposits, it is backed 100% by the deposited cash.

However, if banks lend part of the deposited money, they create new demand deposits that do not have any cash backing. Since the created deposits can masquerade as proper representatives of cash, they should be included as part of the money supply. Consequently, once banks use deposited money, they set in motion an expansion of money out of thin air.

Mainstream thinking currently excludes government deposits held in banks and the central bank from the money supply. If the government taxes people by one billion dollars, money is transferred from their deposits to the government's deposit. In the mainstream, this is viewed just as if the money supply fell by one billion dollars. In reality, however, the money is now available for government expenditure, meaning that money held in government deposits should remain part of the definition of the money supply.

Incorporating all the above arguments, I define the money supply to include cash, demand deposits with commercial banks, and government deposits with banks and the central bank.

Correlation and Money-Supply Definition

Most analysts use money M2, or MZM in their analysis. Does it matter which type of money one uses? A correct definition of money is a must if one wants to get the right information from monetary indicators.

Now, even if popular definitions were to produce good historical correlations with various economic data, one runs the risk that these monetary measures will lead to misleading analyses on account of the fact that these definitions are flawed. (M2 and MZM include credit-transaction items.) The only criterion for confidence in a money-supply definition is whether it correctly identifies what money is and where it resides.

Once it is established that the definition is sound, one must stick to it, regardless of whether it is well correlated with some other economic data or not.

The final judge regarding the validity of a money-supply definition should not be statistical correlations as such but the economic soundness of the definition. The soundness of a definition, however, cannot be established by means of a statistical analysis but only by means of its theoretical soundness.

Deflation and Fractional-Reserve Lending

Contrary to popular thinking, deflation is not a general decline in prices of goods and services but a decline in money supply.

Note that when Joe lends his $100 to Bob via the bank, this means that Joe (via the intermediary) lends his money to Bob. On the maturity date, Bob transfers the money back to the bank and the bank in turn (after charging a fee) transfers the $100 plus interest to Joe. Observe that here money never disappears or is created; the original $100 is paid back to Joe.

Things are, however, quite different when Joe keeps the $100 in the bank warehouse or demand deposit. Remember that by keeping the money in a demand deposit, Joe is ready to employ it at any time he likes.

Now, if the bank lends Bob $50 by taking it from Joe's demand deposit, the bank will have created $50 of unbacked credit, out of "thin air." By lending $50 to Bob, the bank creates $50 of extra demand deposits. Thus, there is now $150 in demand deposits that are backed by only $100.

So in this sense, the lending here is without a lender. The intermediary, i.e., the bank, has created a mirage transaction without any proper lender. On the maturity date, when Bob repays the money to the bank, that money disappears. The money supply falls back to $100, dropping by 33%.

Hence an increase in credit out of thin air, all other things being equal, gives rise to an expansion in the money supply. A fall in credit out of thin air, all other things being equal, results in a contraction of the money supply.

So in this sense it is valid to argue that a fall in bank lending out of thin air contributes to the decline in the rate of growth of the money supply and thus to deflation.

Note that what matters here is not credit as such but credit that was created out of nothing. A fall in normal credit (i.e., credit that has an original lender) doesn't alter the money supply and hence has nothing to do with deflation. For instance, if Joe directly lent Bob his $100, when Bob repays the money we will have a fall in credit with no change in money supply.

Given the currently observed decline in commercial-bank lending, it is quite likely that commercial bank lending out of thin air has also fallen. However, even if we accept that this is the case, the fact that the money supply's rate of growth is still a positive figure implies that we still have inflation and not deflation.

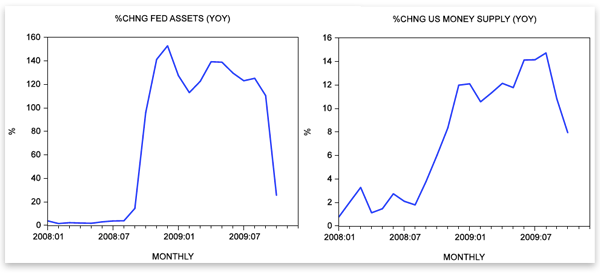

In fact, in August this year the yearly rate of growth of the money supply stood at 14.7% against 1.8% in August last year. The main reason for this increase in the money supply despite banks' curtailment of credit out of thin air is the massive pumping of money by the Fed.

The yearly rate of growth of the Fed's balance sheet jumped from 2.9% in June last year to 152.8% in December. Note that apart from pumping money directly to commercial banks, the Fed has also been pumping directly to nonbank entities in the economy ($408 billion last December alone). It is this that boosted the yearly rate of growth of the money supply despite commercial banks' curtailment of their lending out of thin air.

A visible fall in the yearly rate of growth of the Fed's balance sheet is currently instrumental in a visible fall in the growth momentum of the money supply. The yearly rate of growth of the Fed's balance sheet fell to 25.5% so far in October from 110.5% in September and 125.2% in August. As a result, the yearly rate of growth of the money supply fell to 7.9% in October from 10.8% in September and 14.7% in August.

If the pace of pumping by the Fed were to slow down further, the curtailment of commercial banks' credit out of thin air could become the dominant influence on money supply. If this happens, then we will have deflation.

Conclusion

Contrary to popular thinking, it is not a fall in credit as such that is the key to deflation, but a fall specifically in credit created out of thin air. It is this type of credit, which commercial banks have created through fractional-reserve lending, that causes the decline in money supply, i.e., deflation. A fall in normal credit (i.e., credit that has an original lender) doesn't alter the money supply, and hence has nothing to do with deflation.

Despite the likely current fall in commercial-bank lending out of thin air, as long as the rate of growth of the money supply remains positive, one should talk about inflation rather than deflation.

However, as the pace of monetary pumping by the US central bank is starting to fall sharply, there is a growing likelihood that the fall in commercial-bank lending out of thin air will cause actual deflation.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See his article archives. Comment on the blog.![]()

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.