UK Interest Rates To Rise to 5.75 percent as a Consequence of Excessive Expansion of Money Supply

Interest-Rates / UK Interest Rates Jul 04, 2007 - 08:54 PM GMTBy: Nadeem_Walayat

The Bank of England is expected to raise UK interest rates tomorrow from 5.50% to 5.75%. This is inline with the Market Oracle two year forecast for UK interest rates to hit 5.75% by Sept 07.

The Money Markets are pricing in a rise in UK interest rates, with the Pound hitting a new 26 year high against the US Dollar trading towards $2.02, and the 3 month Inter bank rate rallying to a near 6 year high of 5.96%.

The key reason for the anticipated rise in rates is that the Bank of England is effectively losing the battle against inflation. The RPI inflation measure even after the recent dip is still way above the 3% comfort level and as long as it remains so upward pressure on interest rates remain. The banks preferred measure the CPI, stands at 2.5%, above the 2% target, however the real rate of inflation as experienced by most people is much higher than the CPI and RPI measures and is estimated to be running at 6% and most closely reflects the surge in money supply.

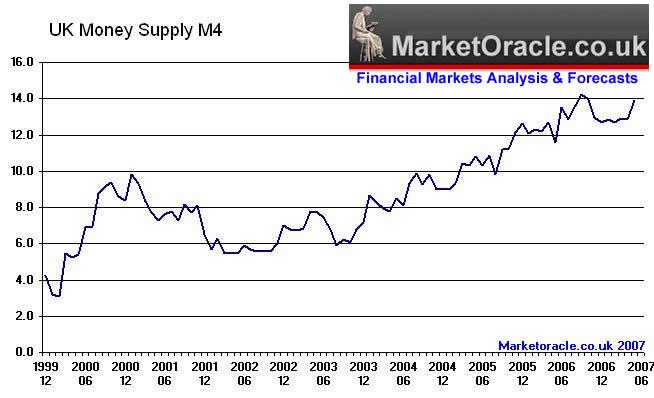

The thing that I find so surprising is why the Bank of England failed to comprehend that when the money supply is running along at well above 10% for the last two years, that this is not going to eventually lead to much higher inflation.

The latest figures for May 07 push the annual money supply expansion to 13.9%. This implies that the rate rises to date are not going to have much impact on future inflation, as the money supply suggests there is more inflation in the pipeline.

Perhaps the BOE as an institution is too bureaucratic to recognise the obvious, or perhaps the MPC Committee have too much data thrown at them that they again miss the obvious. But whatever the reason, the Bank of England is way behind the curve in its decision making process.

Given this track record, the implications are that the bank will make the mistake of over tightening rates too far, rather than signaling that the money supply should be reigned in by other means, but the problem there lies that those decisions fall into the realm of controlling excess government borrowing due to overspending on state budgets. Which is the primary purpose of the central bank, i.e. to lend to the UK government as much money as they request by increasing the money supply, rather than the government having to go to the British people and raising their taxes to fund spending programme's. So perhaps the Bank cannot control future inflation or the money supply due to the real power of controlling the supply of money being out of their hands. This increases the risks of some sort of stagflation occurring.

Related:

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

The Market Oracle is a FREE Daily Financial Markets Forecasting & Analysis online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Jen

05 Jul 07, 09:34 |

uk Interest rate

Good call ! Look forward to the next 2 year forecast, soon ? |