Morgan Stanley Says Stock Market Rebound Rally in Last Stage; Prepare for Fallout from Tightening

Stock-Markets / Stocks Bear Market Oct 26, 2009 - 02:12 PM GMTBy: Trader_Mark

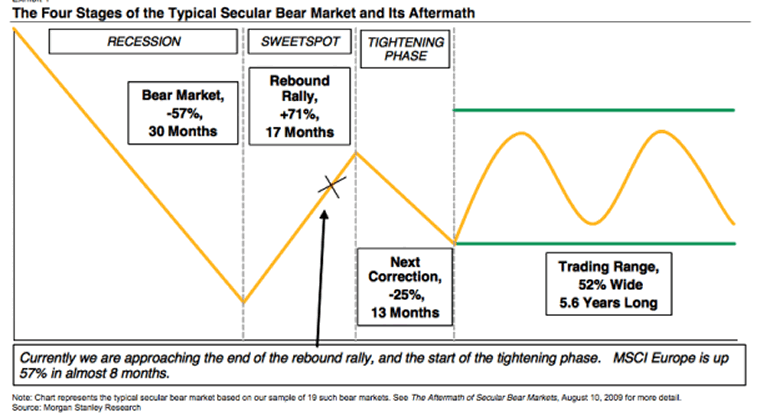

These words from Morgan Stanley's chief European equity analyst, Teun Draaisma are particularly interesting as we (the collective) sit awash in a world of government intervention and central bank liquidity, while ignoring the fact it is not endless. Fascinating chart below as well.

These words from Morgan Stanley's chief European equity analyst, Teun Draaisma are particularly interesting as we (the collective) sit awash in a world of government intervention and central bank liquidity, while ignoring the fact it is not endless. Fascinating chart below as well.

If you are not familiar with Draaisma, he made a well known call in summer 2007 to avoid equities. While he did get investors back in too early after the September/October 2008 crash - I would assume someone who followed his advice between summer 07 and November 08 would of saved themselves a lot of pain; and losses suffered in Jan/Feb 09 would of been made up by now.

His thoughts are below - please note: I think the US economy is so structurally damaged that I'll stick to my call for no rate increases until early 2011, but Draaisma believes it will happen mid 2010. Whatever the case, the market will start to price in tightening sometimes between "now" and "summer 2010"... which has the potential for destroying this simplistic "dollar sucks" trade.

That doesn't mean the dollar is not in a long term secular decline but this is a decades long situation based on the debt spiral the country is in; and as with any instrument, nothing goes straight up - or down. What I found interesting is in previous tightening periods materials and oil based stocks STILL were relative outpeformers... hmm... that seems a bit contrarian to me, but then again in the "old days" all commodities on Earth were not just an inverse trade to the US dollar.

First via Clusterstock

- Enjoy the bull while you can. According to Morgan Stanley euro analyst Teun Draaisma, we've got a little more rally left, and then a long, low multi-year grind as moneys starts to get tight.

- The tightening phase may start in the next quarter

or two. We believe investors need increasingly to

consider the implications of monetary and fiscal stimulus

withdrawal. We expect the first Fed rate hike in

mid-2010, but the tightening turning point could come

sooner, for instance through higher oil. Our portfolio is

already quite well positioned for this next phase, and we

provide a ‘tightening checklist’ to decide when to

position fully for it. The Fed language change ahead of

the first hike, or a market timing sell signal, would

indicate the start of that next phase, for us. - Lessons from past tightening cycles. The start of

tightening phases tends to lead to some indigestion and

a defensive rotation in equity markets, for two quarters

or more. The 1994 and 2004 episodes led to a 16% and

8% fall in MSCI Europe over eight and five months.

Sector performance was defensive, but Oil and

Materials outperformed, too. In the aftermath of secular

bear markets tightening phases have been more severe,

with equities falling on average 25% over 13 months.

Does history have to repeat? No. But it generally rhymes - a great chart below

To repeat what we (and many others) have said before, the rally is not remarkable in terms of % gains... it is simply the velocity of said rally - we've compressed time like never before.

*************************

Also, via FT Alphaville:

- The most oft repeated argument for why the current rally is built on sand is that money cannot remain loose forever. Yes, liquidity-drunk investors may be partying now, but they will suffer for this over indulgence when ultra-loose monetary policy is reversed. Mass panic will ensue in the markets. Squealing fund managers will be crushed like so many fat men simultaneously piling through a revolving hotel door, and cackling bears will revel in their own rightness.

- Analysts, clearly smelling the fear, have begun to look backwards for previous market reactions to sudden and sustained rate hikes. They need tips on how to survive THE TIGHTENING. So, do you keep skin in the game, or run screaming for the hills?

- Teun Draaisma and Morgan Stanley’s European strategy team have the following advice:

Is it worth trying to capture the upcoming last ~10% of a ~70% rally? We feel we are in the latter stages of this cyclical bull market, before the period of indigestion that typically occurs when the tightening phase starts. We recommend investors use significant further market strength to position for the next phase. In the aftermath of secular bear markets these tightening phases could last for four quarters, while markets fall by 25%; 2004 was a benign version of such a tightening period, and even then it lasted for two or three quarters while markets fell 8%.

Our best guess is that this tightening period will start before summer 2010. We keep in mind what Jonathan Bell Lovelace, founder of Capital, is quoted as saying: “When everyone wants to sell, you accommodate them and buy. When everyone wants to buy, you accommodate them and sell. Don’t try to get the last 5 percent. Don’t be greedy”.

Do you know anyone who wants to currently sell? People (i.e. myself) are smirked at when they sell positions... because stocks "can only go up"...

Greed and fear... how quickly things change. We said in late 2008, 2009 would be a year of ping pong between extremes. While accurate, we did not have a clue it would be to this degree.

By Trader Mark

http://www.fundmymutualfund.com

I have been in the market in some form since being a teenager, first with mutual funds, than onto to stocks. Now it is 20 years later. It has been a passion of mine, and as any investor, I've had my ups, downs, and tuition extracted from learning the ins and outs. "If I only knew then..." and I continue to learn each day. I have a BA in economics from the University of Michigan (Go Blue!), and work in finance (not related to Wall St).

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2009 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.