Financial Markets Wedge Patterns Everywhere Means All Stocks May Sink

Stock-Markets / Financial Markets 2009 Oct 26, 2009 - 06:54 AM GMTBy: Garry_Abeshouse

This is a follow on to my October 13th 2009 posting , British Pound A Major Disaster Just Waiting to Happen? and my market update on October 19th, and deals with the markets as they stood as of last trade Friday October 23rd.

This is a follow on to my October 13th 2009 posting , British Pound A Major Disaster Just Waiting to Happen? and my market update on October 19th, and deals with the markets as they stood as of last trade Friday October 23rd.

USD – Cl 75.47 - Price moves on Friday suggest that the next couple of weeks will be important not only for the USD but for all markets. If the large downward wedges in the USD charts are indeed what they appear to be then we should soon see a sharp confirming break upside to at least 77 - 79 for the first move. Contrary to this, a break below the 75 support to say below 74 could change the whole scenario.

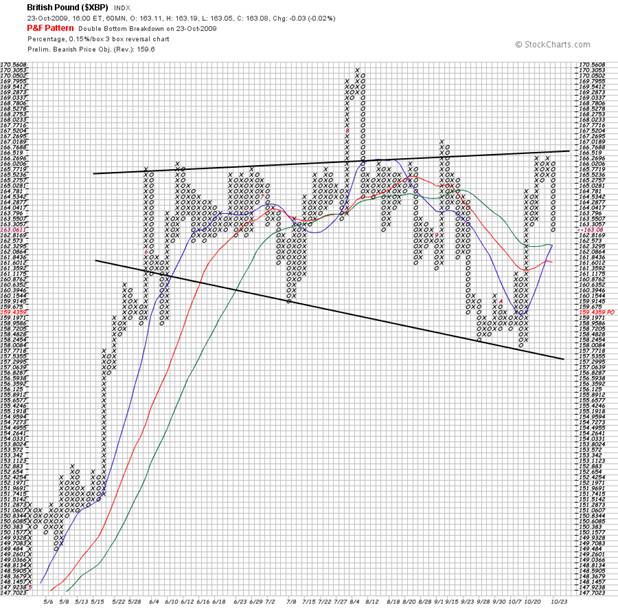

Watch the British Pound carefully, as I expect there will be a close inverse correlation between it and the USD, as discussed in my earlier posting. Below is an update of the USD daily chart shown against the Pound, the USD ETF as well as the P&F Chart on the Pound I posted earlier. Patterns on both charts suggests that if my suspicions are confirmed, the resultant moves in these markets will be sudden, swift and surprise many.

And as you can see from P&F chart on the Pound, resolution of its very well defined broadening pattern is likely to come fairly soon and be dramatic in its execution (the pun was intended). This pattern by the way is not so clear cut on other charts.

Gold – Cl 1055.20 – The continuous contract daily bar chart action on Friday (see chart below) does not look good for gold in the short term, suggesting that holding the 1050 support is now critical. A decent stab below this support would turn the small but critical consolidation area since October 6th into a distribution area making it much harder for gold to make its way into new highs in the short term. Should the conjunction of the three trend lines at Gold’s peak coincide with a fall in price, then this would further validate a longer term bearish view.

A fall below the pale blue support line below, drawn from the March 1033.90 high would also tend to validate a longer term bearish view.

Important support limits/lows below the 1050 are 986 and 906. I expect each break below these points to probably be accompanied by further falls in equities and the UK Pound, which would be associated with rises in the USD and US Treasury prices. Note that the 970/975 lows coincides with the support trend line from the February 2009 high at 1033.90. A break below this 18 month support for gold would signify longer term weakness and probably occur simultaneously with much stronger rally for the USD.

If and when gold really does want to head up into a new bull trend it will either show you its intent with dramatically increased volatility or just rocket off into the heavens overnight – either way you will know at that time that gold will be king again – but not before.

Yen/USD – Cl 1.0862 – The recent failure to penetrate the Dec/Feb highs below, significantly reduces the bullishness of the pair. As you can see the price is now testing the 50 day MA and would not have to fall much further to break the 200 day MA, which would also coincide with a break in the 14 month uptrend if I drew it in. As you can also see, the yen since April looks not dissimilar to the gold price and has, like the Euro, an inverse relationship now with the USD. These parameters are well defined and I expect will not take too long to be resolved, with the outlook looking more negative now than positive.

My longer term hand drawn charts will tolerate a move back to 1.04 to retain intact uptrends, which more or less coincides with a break in the 14 month trend on the daily chart.

It is easy to see the close inverse correlation since last March between the USD on one hand and the other currencies such as the Euro and the AUD, as well as silver, copper and equities on the other. The next few weeks should confirm whether these relationships will persevere into the future.

Equities - A brief word

Nasdaq 100 – Cl 1753.63 - The high volatility and triple testing of the area just below 1780 on Comex at the top of the recent rise this month, suggests a high degree of confusion. This is more apparent on the more sensitive Comex chart than the daily chart below. I would expect from what I have read, that this confusion and low volume volatility we are seeing in the market generally has more to do with the poor timing of shorting decisions, rather than any strong feeling that the market will go much higher. And despite the recent price rises experienced by Microsoft and Amazon, all long term resistance lines mentioned in my last posting on the main indexes remain intact, which leaves the market with little upward potential energy to force a way 2008 resistance areas.

S&P 500 – Cl 1079.60 - Comex charts suggest there could be some sort of attempt to rally on Monday, so this will be a good chance to see how much underlying strength the market really has - I suspect very little, even it if the market is somehow able to nudge into new highs. Ditto for the Dow. Should the market fall, there is little support between here and 1000/1020, the lower number being both an important uptrend and a testing of the early September lows (975 to 1000).

And as you can see below, the new equal weighted Dow Jones Global Dow Index of 180 of the worlds largest companies looks very similar to most of the other equity indexes. No further comment needed here.

Nasdaq Bank Index ($BANK) - Last 1649.67 – I consider the Nasdaq Bank Index a more conservative way of looking at the US Banks. And considering the way the major banks have rallied over the last seven and a half months, it’s quite surprising that this index has remained below the downtrend. This suggests that at this late stage in the bear market rally, the trend is most likely to stay intact, having reversed multiple times off it since early August 2009. It’s also surprising how little this index has risen since April compared to other sections of the market.

Any fall below 1600 would see a testing of the July 1500 lows, while a move below 1500 would probably confirm a major sell on the market. Not much leway here. A mere 150 points or just 9% between current prices and something I have no wish to contemplate. Watch this space.

The Philadelphia marine Shipping Index’s price action since March 2009 shares much in common in common with the Nasdaq Bank Index above.

Both underperformed during the rally and both peaked early during April/May, but the Shipping Index has a more pronounced upward wedge similar to other charts above. If this was truly the prelude to a new bull market you would expect the Shipping Index to be a leader rather than a lagger.

In September 2008, it was the sudden steep fall in the Dow Jones Corporate Bond Index that really confirmed that equity markets were in deep, very deep trouble. If or when a similar time comes again I expect the result to be the same. So watch this chart very carefully.

Australia

The three main Australian Indexes I follow (ASX 200, ASX Financial ex Property Trusts, ASX Metals and Minerals) have formed well defined upward wedges since June/July 2009.

The ASX 200 and the Finance index are both edging through a series of fanned out uptrends on my intraday charts and are looking very vulnerable to falls, much like USA equities..

The Mining index has hit (for the fourth time) and is working below, a well defined resistance line going back to before June 2009. Any weakness in the copper price will have an adverse affect on this index forcing it below its four month uptrend.

ASX - Woolworths (WOW) - Last $29.31 - Woolworths is the largest and most profitable supermarket chain in Australia. After peaking at $35 AUD in December 2008 it fell to a low of $23. Since then it has been trading roughly in the range $23 to $30. On my hand drawn chart it has formed a well defined upward wedge formation since June 2009, not unlike many of the US stocks. Over the last week though, after peaking at about $30.50 last week it has fallen to $29.20 - decisively breaking through the uptrend. Short term would test support and the next uptrend at $27 in any market weakness.

Summary

At the moment I see an overextended bear market rally hanging with great fragility onto its highs. In the nearish future I expect a tipping point will push or shove equities over the edge. It is possible that initially anyway, weakness in the British pound may be THE tipping point factor that destabilises the world’s rather fragile recovery - unchanged high world debt levels and already faltering regional US banks not withstanding. I would like to remind the reader of lessons probably not learned from the late but not forgotten economist Hyman Minsky. He suggested that once markets entered what he called the Ponzi phase of the market cycle, where we see ourselves in at the moment, it would tend to be dominated by the extreme and unsettling behaviours of its strongest constituents – namely this time, the cowboy traders of the large banks and hedge funds, who with their highly leveraged $US592 trillion time bomb of derivatives, are holding us all to ransom.

There needs to be a lot of tooing and froing in the market place before it is decided to what extent the USD permabears and the gold permabulls will be winners or losers. This could take weeks or months, so timing is going to be a day to day affair, assessing the variables as all the dirt unfolds – and it will be dirty and messy with more losers than winners, that you can be sure.

Till next time.

Garry Abeshouse

Technical Analyst.

Sydney

Australia

I have been practicing Technical Analysis since 1969, learning the hard way during the Australian Mining Boom. I was Head Chartist with Bain & Co, (now Deutsch Bank)in the mid 1970's and am now working freelance. I am currently writing a series of articles for the international "Your Trading Edge" magazine entitled "Market Cycles and Technical Analysis".

I have always specialised in medium to long term market strategies and after discovering the excellent Point & Figure Charts from Stockcharts.com in mid 2008, have concentrated on this style of charting ever since.

© Copyright Garry Abeshouse 2009

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.