The Elements of Deflation and Surviving Today's Economic Depression

Economics / Great Depression II Oct 24, 2009 - 05:47 AM GMTBy: John_Mauldin

It's The Best of Times

It's The Best of Times

The Elements of Deflation

It's More Than Half Full

What's a Fed to do? We get talk about tightening and taking away the easy credit, but we got the fourth largest monetization on record last week. This week we examine the elements of deflation, look at some banking statistics that are not optimistic, and then I write a reply to my great friend Bill Bonner about why it's the best of times to be young. I think you will get a few thought-provoking ideas here and there.

But before we get to the main letter, I want to recommend a book to you. I am on a 17-day, 12-city speaking tour. It is rather brutal, but I did it to myself. However, one of the upsides of traveling is that I get quiet time on airplanes to read books. I am working my way through a very large stack of books on my desk. One that caught my eye - and I'm glad it did - is a book by Tom Hayes called Jump Point: How Network Culture is Revolutionizing Business. Hayes writes about how we are getting ready to experience a cultural change every bit as profound as the Industrial Revolution. He argues that as the 3 billionth person gets online sometime in 2011, it will shift the dynamic of how we interact as businesses and consumers. We get to 5 billion by 2015. The mind boggles.

Clearly, it is already changing things, and I am not sure if I buy Hayes' thesis that 3 billion is a magical number, though it is great marketing. That being said, I found something on almost every page that I underlined or highlighted. This book made me think about the future in ways that my kids already get but Dad doesn't.

I like to read books about "important stuff" by people who have done a lot of thinking about their subjects, and who can write easily and fluidly and communicate their thoughts without weighing me down with unnecessary verbiage. Hayes has done that. (I am sure some of you, my patient readers, wish I could be better at that!)

No long review here. Go to Amazon and read the reviews. One writer wrote: "I gave the book 5 stars not because it was perfect -- I think Hayes's enthusiasm sometimes makes him jump to conclusions - but because there are so many ideas and observations here that it would take ages to put something like this together from other sources."

I agree. If you are in business, any business, you need to read this. As an aside, I will insist that all my partners worldwide get this book and read it. You can go to Amazon.com and buy the book. And Tom, if you get this (and I bet one of your friends will forward it to you), call me.

The Elements of Deflation

One of the advantages of travel is that it gives you time away from the tyranny of the computer to think. (Am I the only one who feels like I am drinking information through a fire hose?) But getting the information is important too, as it gives you something to think about. And I have been thinking a lot lately about deflation.

I get asked at almost every venue where I stop, whether I think we will see inflation, or deflation. And I answer, "Yes." And I am not trying to be funny. I think the primary forces in the developed world now are deflationary. When asked if I don't think that the Fed monetizing debt of all kinds won't eventually be inflationary, I answer, "We better hope so!"

Let's quickly summarize some of the ideas from the last few months of this letter. Just as water is made up of two parts hydrogen to one part oxygen, so deflation has its own elemental structure.

The first element is Rising Unemployment. There has never been a sustained inflationary period without wage inflation. Wages are basically flat and falling. With 9.8% unemployment, 7% underemployed (temporary), and another 3-4% off the radar screen because they are so discouraged they are not even looking for jobs, and thus are not counted as unemployed (who made up these rules?), it is hard to see how wage inflation is in our near future.

Think about this. Only a few years ago, less than 1 in 16 Americans was unemployed or underemployed. Today it is 1 in 5. That is a staggering, overwhelming statistic. Mind-numbing.

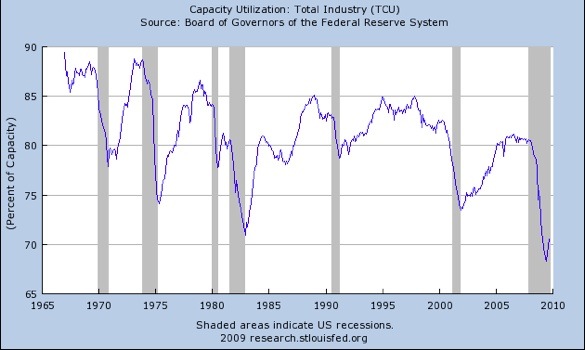

Keynes said that you should stimulate the economy in recessions in order to bring back consumer spending. That is not going to happen this time. As my friends at GaveKal point out, this time we will have to have an Austrian (economic) recovery, or a business-spending recovery. My argument will be, when I am with them in Dallas in December at their conference, "Where are we going to get business-investment spending when banks aren't lending and capacity utilization is at an all-time low?" This, of course, leads the Keynesians to jump in and say, "The government has to step up and jump-start consumption!" Which means more debt. Wash. Rinse. Repeat.

The next element of deflation is massive Wealth Destruction. Two bear markets and a housing market collapse have put the American consumer on the ropes. And the next bear market will bring him to the canvas.

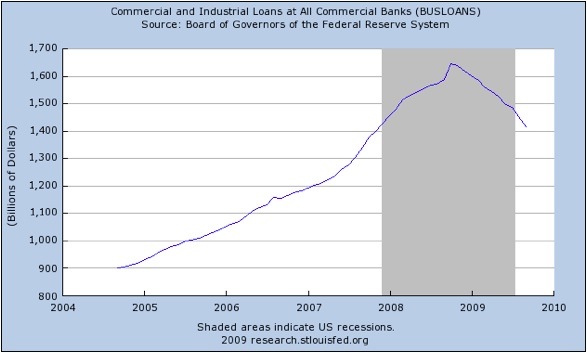

Then we have Reduced Borrowing and Lending, as consumers are paying down debt and banks are reducing their lending. Both are necessary in a credit crisis-caused recession. Bank lending is basically back to where it was two years ago, and shows no sign off rebounding. Banks, as I have written, are buying US government debt in an effort to shore up their balance sheets. Lending to small business, the real engine of job creation, is sadly decreasing each month. (See graph below.)

Next up in our elemental list we have Decreased Final Demand and its counterpart Increased Savings. Although the savings rate has come back down to 3% from 6% a few months ago, almost every expectation is that it will rise over the next 3-5 years back up to the 9% level where it was only 20 years ago. The psyche of the American consumer has been permanently seared. Consumption and savings habits are being changed as I write.

And of course we must address the element of Low Capacity Utilization. While capacity utilization is rebounding, it is still lower than at any time since the data has been collected, other than the last few months. It is hard to see where businesses are going to get pricing power, when not only US but world capacity utilization is still extremely low. The chart below is not the stuff that inflation is made of.

And let's just quickly throw in Massive Deleveraging and $2 trillion in Bank Losses and a Very Weak Housing Market. Which brings us to a Slowing Velocity of Money.

As I have written on several occasions, prices are a function of the amount of money times the velocity of money. If the velocity of money is slowing, the amount of money can rise without bringing about inflation. It is a delicate balance, but nonetheless the hyperventilation in some circles about the coming hyperinflation is, well, overinflated. Simplistic. Economically naive.

The Fed is going to do what it takes to bring about inflation (in my opinion). But they will not monetize US government debt beyond what they have already agreed to. If they need to "print money" to fight deflation, they can buy mortgage or credit-card or other forms of private debt, which have the convenience of being self-liquidating. Read the speeches of the Fed presidents and governors. I can't imagine these people will recklessly monetize US debt. You don't get to their level without having a stiff backbone. (Yes, I know the gold bugs will call me terminally naive. We will have to wait to see who is right. Peter Schiff, care to make a bet on this one?)

Bernanke warned Congress again last week about rising deficits. Watch the deficit rhetoric coming from the Fed after the next two governors are appointed next year, side by side with Bernanke's reappointment. There will be a line drawn in the sand. Some in Congress will not be happy, but my bet is that the Fed will maintain its independence. If they do not, then my recent letters will prove far too optimistic (and many of you protest my rather less-than-positive suggestion of a double-dip recession). But I must admit I cannot imagine that happening. And there are not enough votes in Congress to change that independent status. There is a day of reckoning coming with the US debt. And thank God for that.

Bottom line: The Fed will do what it takes to keep us from deflation. They will deal with the problems of the ensuing inflation. I wrote six years ago that the best outcome from all the easy monetary policy and budget deficits would be stagflation. I see no need to change that assessment. I am not happy with stagflation, but as I came into my young adult life in the '70s (see below), I know that we can deal with that. The far more worrisome prospect is continued trillion-dollar deficits.

It Is the Best of Times

Now let's change the topic. My friend Bill Bonner, of Daily Reckoning and Agora Publishing fame, recently wrote about his mother. Bill also turned 60 recently. I wrote to him about the similarities between our mothers. Both were born in hard circumstances, on farms that had no indoor plumbing. They joined the WACs and met their husbands. They struggled raising families. Bill and I both grew up in rather humble circumstances (to put a mild spin on it).

That exchange caused Bill to write about the future our kids face. He has six kids and I have seven. He has graciously allowed all my kids to invade his chateau in rural France (where they mingle with his kids), and has invited us back next summer. I think Bill is the best writer, the best "turner of a phrase," in the business. I often feel like a house painter standing in front of a Rembrandt when I read his work.

But Bill is a tad pessimistic. He makes me look like Larry Kudlow. He wrote (among other books) Financial Reckoning Day, which has just been updated and is now titled Financial Reckoning Day Fallout: Surviving Today's Global Depression. It makes for some interesting reading. Get it with Jump Point.

Now to the point. As I said, Bill wrote about the future our kids face. I will repeat what he said and then respond. Bill's thoughts:

"We sat in a cab yesterday, stuck in traffic in central London. We watched people walk by and wondered. What are they thinking about? What do they want out of life? What do they think of themselves?

"There were hundreds of them...different shapes...different sizes. A businessman in a pin-striped suit, briefcase in hand, concentrating on his sales report; he almost stepped in front of a motorcycle. A salesgirl, grotesquely overweight...yellow hair streaked with brown...wishing she hadn't had so much to drink the night before. A lawyer daydreaming about his secretary. A man who would have rather been fishing...still in his waxed coat. A woman annoyed about something. A heavy construction worker, his legs splayed outward as he walked. A tense young woman who dared not look up. A woman worrying about her son. A man thinking about buying a new car. One man trying to remember a line from a song he learned 30 years ago. Another talking to herself. One looked like a doctor taking an afternoon stroll. Another was stark raving mad.

"All of them walking along...from one place to another...shuffling along...the living towards the dead.

"We were thinking of our children. What a different world they grow up in. And yet, it is still the same too. A man might have been stuck on a London street 50 years ago...and hundreds of years ago he might have watched the same shopkeepers and carpenters walk by, each caught in his own thoughts like a fly in a spider's web.

"Our old friend John Mauldin wrote to say that his mother's experience was not much different than ours. She joined the WACs during the war...met John's father...and then nature took her course.

"But both John and your editor had a big advantage in life. We both caught the upswing.

"Not so with our children. They inherit a different world. America was the world's leading nation in the '50s and '60s. And it was growing in power and wealth - rapidly. We grew up with it. Things were getting better and better...we were sure we'd live much grander, richer, and more exciting lives than our parents. The sky was always the limit!

"Now, America is in decline. China's economy grows while hers declines. The Far East has savings, while she has none. The Asia nations are net exporters, making huge profits...while American industries are judged too old, too expensive, and too highly regulated to compete. Americans have debt up the kazoo, while their competitors have little. A young person in America has to look forward to supporting 70 million retired baby boomers...and paying for their drugs, their food, their wars, and their bailouts.

"For our children - ours and John's - the situation on a personal level is different too. Coming from poor families, we could look forward to much more wealth and material success than our parents ever knew.

"We came back to Ireland this week for a reason that our parents would never have dreamed of. Your editor has set up a family office. It is a very modest affair by family office standards. The typical family office manages a fortune of $100 million, according to The New York Times. We may not even be on the same planet with these rich families; but we are in the same universe. That is, we try to think about...and manage...our wealth as rich people do...as a family legacy or an endowment, not as a retirement fund.

"What wealth we have accumulated - even if it is paltry - will be held by a family-owned corporation. Then, the corporation, run largely by the adult children, manages the assets - from our base in Ireland.

"Your editor, freed from the responsibility of managing his own money, will be free to wander and think...like a vagabond, a gypsy, a refugee, an itinerant mendicant...forced to sup on whatever is at hand and take lodging wherever he can find it - but favoring the Four Seasons and Chateau Margot when they are available.

"Whatever else this does, it puts the children in a very different situation from their parents. Instead of starting out with nothing, they're starting out with something. While this would seem to be a big advantage to them, it has huge hidden disadvantages. Like America itself, they are in danger of finding themselves slipping downhill. Instead of expecting things to get better, they may find it hard even to hold onto what they've got. Instead of the "Morning in America" that Ronald Reagan promised, they may find that it seems more like evening, both in their personal as well as their national lives.

"'From shirtsleeves to shirtsleeves in three generations,' say the French. The grandfather begins without a coat. His grandson ends that way.

"But what to do? Spend it all now...so the children begin with the same clean slate we had? Move to Brazil or India - countries with more obvious upside?

"In the deep, cosmic end, it probably doesn't matter. The advantage to starting out on an upper rung of the ladder may be about equal to the disadvantage of having to worry about falling off. Who can know?

"Every man has to play the cards he's been dealt. What else can he do? He may have a humpback or a beautiful voice. He may have had a hard upbringing or a soft head. He may have a fortune worth of poetry in his soul but not a dime in his pocket. As far as we can tell, every young man starts out even. Each one begins life in the same place - where he is. And every generation takes what it is given, and makes the best of it.

"The real advantage in life is having the gumption to get on with it; no one knows where that comes from."

It's More Than Half Full

Ok, Bill, let's review those wonderful days from whence we sprang, so fraught with the advantages of having nothing. So potent with opportunity. It was the middle of the '70s when we started our careers. Inflation was high and rising. The Soviets were seen as a major threat. Japan was beating our brains out and buying everything, even if nailed down (like Pebble Beach and New York skyscrapers). I had to borrow money at 15% (or more) to buy paper in order to meet customer demands for printing. And guess what? The banks got into trouble and called loans willy-nilly. (My bank even called my mother and threatened her to pay off my loan - against written agreements - and she did. Evil sons of bitches. The more things change... And that bank did fail, I report delightedly! Not that I hold a grudge.)

There were multiple successive and ever-deeper recessions. Gold was rising and the dollar was seen as a joke. Howard Ruff (a good friend to both of us when we were starting out!) and almost every newsletter writer were telling people to buy gold and freeze-dried food to protect themselves against a near-certain economic, if not apocalyptic, catastrophe. Unemployment was high and rising for a decade.

The correct answer to the question, "Where will the jobs come from?" back then was, "I don't know, but they will." And that is the correct answer today.

In 20 years, no one will want to come back to the halcyon days of 2005. Our kids (all 13 of them) are getting ready to live through what will be the most exciting period in human history. There will be a century's worth of change, measured by the standard of the 20th century, just in the next ten years, and then we will double that pace in the next ten after that. Medical miracles will mean our kids and grandkids will live a lot longer than their dads, although I intend to be writing well into my 80s, like our mutual hero Richard Russell.

There will be whole new industries developed in the US. How do I know that? Follow the money. The rest of the world spends a fraction of what we do on research and development. Where do you go if you are looking for venture capital?

Do I care if the Chinese and the "developing" world are far better off, relatively speaking, than the US in 20 years? Not a whit. Good on them. I hope they make discoveries and inventions and grow new businesses that benefit us all. But we are not going into some long dark night. We, and our kids, get to choose how we respond to what is the reality of the day.

Our nation had to almost hit the wall in 1980 before a Volker could come along and force us to take the pain of recession to beat back inflation. And we will have to come perilously close to the wall this time before we take action as a nation. Way too close for comfort. Maybe you are right, and we have a soft depression. I hope not; but even so, the world will be better, far better, in 20 years, with far more opportunities than today.

It was not fun starting new businesses in the '70s and early '80s. But we did. I remember coming to Baltimore and being (literally) afraid to get out of the car to visit your offices in the slums. But that was what you could afford. A far cry from the chateau in Ouzilly.

I lived in a small mobile home. Tiffani was born there, and we converted part of the kitchen to be her bedroom. (Yes, I was white "trailer trash.") But I got up every morning just like you did and killed as many alligators as I could. The rest had to wait 'til the next day.

And that is the legacy our kids have. They know what it is to wade into the swamp every morning. Never quitting. In thinking about this, you may be the father I respect the most. You have raised your kids to be multilingual children of the world. What a work ethic. How did you get them to scrape window shutters at your chateaus? (I actually saw this, and my kids marveled. Thereafter I threatened to make them go live with you when they didn't behave!)

You have given your kids the opportunity to follow their dreams, even demanded that they do so. And such dreams they (and mine) have. Will they succeed? Who knows? But they will go at it with gusto, in a world with more opportunities than you and I ever imagined 40 years ago. And, oh boy, were we optimists back then. How else could we have done what we did? If we believed the rhetoric that the world was coming to an end, would we have dared to venture out?

You cannot have raised your kids to be such bold adventurers without instilling in them a certain high level of optimism. I am going to out you, Mr. Bonner. You present yourself to your readers as a bona fide end-of-the-world pessimist. But you are a really and truly a closet optimist. Your whole business empire (and what an empire it has become!) is based on finding people who are optimists, in the sense that they think they can actually get people to send them money for what they write. Which they do! Even if it is to read why the world will come to an end, which thankfully it never does.

You are right in this: it is personal gumption that makes or breaks us. There are those who started out with less than we did (hard to imagine but true) and made a lot more. And there are those who started out with far more and made less. But there are very few who are happier than either of us. Or luckier.

Our kids? It is not the times that dictate the man (or daughter!), but the response of the man which dictates his own time. Today promises a brighter future for someone young than any other time in history, whether they are in the US or Brazil or China. They just have to seize it.

And as our kids do just that, and as the millions of kids of those who read us do so, and the billions of kids who are just now getting ready to bust loose all work to achieve their dreams, the world is going to be a far more fantastic place. Smooth ride? Not a chance. We didn't get one; and in thinking through history, there have not been many smooth rides. Why should we think that will get any better? Our kids will just have to live with our generational (and individual) iniquities, government debt and all, and figure out how to master their own fates. But if I had a choice to take the '70s or today? In less than a heartbeat I would choose today. And I bet you would too!

(Side note: You can subscribe to the Daily Reckoning and read more of Bill's great prose. Warning: it is bearish, but lively and fun.)

Argentina, Brazil, and Uruguay

Tonight I am in Orlando, where I spoke at the Commonwealth national conference. I have been to a few conferences here and there, but I must admit to being impressed. A conference for brokers and advisors who are affiliated with them, it was exceptionally well done. And a very smart crowd. These guys have attracted some exceptional talent.

Tomorrow morning I fly back to Dallas, where I get to see my new grandson, Hayden, for the first time. Born this week a little early while I am on the road, I get a call at 3 am on Monday telling me the news and sending me a picture. Wow. The heck with deficits and deflation. How can you not be an optimist?

Then later in the afternoon I am off for Argentina, Brazil, and Uruguay, speaking in four cities and meeting with clients (and future clients) of my Latin American partner, Enrique Flynn. And then back to Philadelphia, again in Orlando, Scottsdale, and one trip to New York in early December. Then not much else is scheduled - but past performance says that will change.

There is a steak and a bottle of wine waiting for me down the hall, so it is time to hit the send button. Have a great week. I know I am. I love South America, and look forward to coming back to you with my impressions.

Your wondering who made up this schedule analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.