Unexpected Stock and Commodity Market Moves Should Not Be Ignored

Stock-Markets / Stocks Bear Market Oct 23, 2009 - 01:14 PM GMTBy: Chris_Ciovacco

In the last two weeks, in Reflation Supported By Stocks, Commodities, and Oil, and Gold, Recessions, Bonds, and 1987, we hypothesized that recent bullish moves in gold, oil, and the CRB Index were evidence of successful "reflation" of asset prices via monetary and fiscal policy. This week, we can add copper and emerging markets to the bullish evidence list. From a fundamental perspective, the desire to hold copper is based on economic need (you want to make a product), and inflation protection (you want to own hard assets rather than paper currencies).

In the last two weeks, in Reflation Supported By Stocks, Commodities, and Oil, and Gold, Recessions, Bonds, and 1987, we hypothesized that recent bullish moves in gold, oil, and the CRB Index were evidence of successful "reflation" of asset prices via monetary and fiscal policy. This week, we can add copper and emerging markets to the bullish evidence list. From a fundamental perspective, the desire to hold copper is based on economic need (you want to make a product), and inflation protection (you want to own hard assets rather than paper currencies).

Copper and Emerging Markets Are Worth Monitoring

When markets move in an unexpected manner, we should pay attention. In recent weeks, many market observers had noted the following:- Copper had failed to make a new high for over nine weeks.

- Many markets have a bearish formation known as a “rising wedge”.

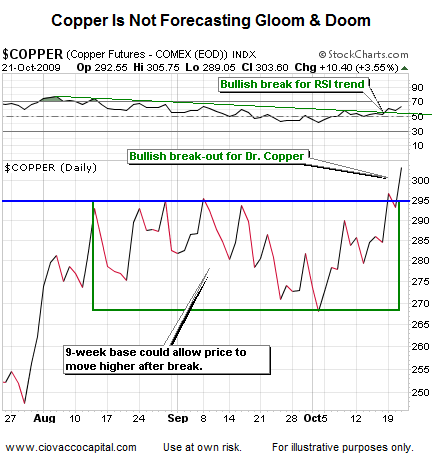

Using these accurate observations, a case was made by some that the "rally has come too far too fast", and that copper was indicating a weak recovery. From where we sit, those were legitimate concerns, and warranted close monitoring, while giving the bull market the benefit of the doubt. If you are bearish, you would expect copper to fail to make a new high for the remainder of 2009, and for "rising wedge" formations to conclude with bearish outcomes. In the case of the Emerging Markets Index and copper, the exact opposite has happened:

- Copper experienced an upside breakout and made new highs (bullish).

- Emerging Markets recently broke out from a "rising wedge" formation (bullish).

"Dr. Copper" Says Don’t Be Too Quick To Sell

If the current global rally was about to end, would we expect copper to be making new highs? On Wall Street, copper is often referred to as "Dr. Copper, who holds a Ph.D. in economics" based on the metal’s ability to forecast future economic activity. Copper recently made both a new closing high and new intraday high. Copper is bullish – we need to take that into account during any correction.

Emerging Markets Shake Off Bearish Pattern

As mentioned above, many markets, including the S&P 500, currently have what is known as a "rising wedge" formation. A rising wedge is a bearish formation. However, in a bull market bearish outcomes do not always occur after bearish formations. Relative to the Emerging Markets Index, the S&P 500 is a laggard. While we are concerned about the S&P 500’s rising wedge, we need to keep in mind that the Emerging Markets have already broken out of their wedge formation. If the leaders continue to lead, and the laggards continue to follow, then it is possible that the S&P 500 will also see a bullish break from its rising wedge.

No Time For Blind Bullishness

Should the breakouts in copper and emerging markets fail to hold, it would be wise for the bulls to pay attention. However, the longer these markets remain in a breakout state, the more bullish these events become. As stated above, when markets move in an unexpected manner, we should pay attention. Therefore, if you have been bearish, it may be worth your time to monitor the sustainability of recent bullish moves in copper and emerging markets. Since we are in a confirmed bull market, the odds favor bullish outcomes until proven otherwise. We will continue to monitor all markets very closely, while continuing to give the bullish trends the benefit of the doubt.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.