Sub Prime Mortgage Woes, US Dollar, Gold and Liquidity

Stock-Markets / Liquidity Bubble Jul 03, 2007 - 01:29 PM GMT

As further revelations of sub prime derivative losses emerge after the latest Bear Stearns episode, the USD takes another hit. Indeed, Right after the Bear mess came out in the news, the USD has been falling badly. Obviously, gold eventually is reacting to the continuing decline. We are looking at a rapid test of the approximately 80.5 level of the USDX. Of course, it took gold a while to react to the weakening USD.

As further revelations of sub prime derivative losses emerge after the latest Bear Stearns episode, the USD takes another hit. Indeed, Right after the Bear mess came out in the news, the USD has been falling badly. Obviously, gold eventually is reacting to the continuing decline. We are looking at a rapid test of the approximately 80.5 level of the USDX. Of course, it took gold a while to react to the weakening USD.

In spite of this, the US Dow rallied Monday on news that ISM manufacturing index rose to a 14 month high. A stronger US economy would deter the Fed from lowering interest rates to combat the subprime mess, and gold could normally suffer from this data at this time. However gold rallied as the USD tanked. There are some terror concerns in that as well.

What appears to be happening are concerns that yet unspecified hedge fund losses are going to spill all over the derivatives markets and cause deleveraging. So far, Bear managed to stall a fire sale of its collateral derivatives CDOs by pledging at first about 1.3 billion of its own capital. They had tried to arrange an orderly sale of them, as did the banks who had these as collateral, but found the market was not interested, offering as little as 30% on the dollar. These CDOs, created in the last two years, amount to well over $1trillion dollars – almost 2 trillion. These are very illiquid.

As trouble is now emerging, with the sub prime mortgage market at an incredible 12% delinquency rate thus far, the losses could be as high as $90 billion – SO FAR.

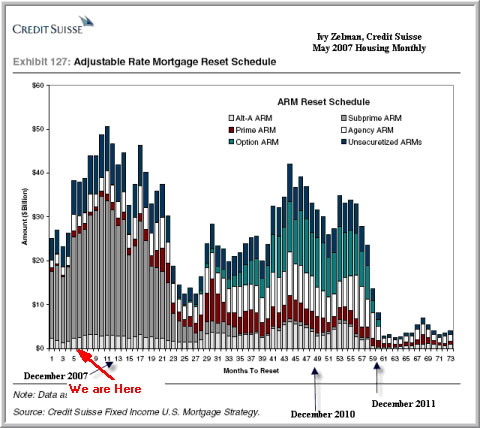

And that is just the beginning. Take a look at this scary chart of ARM mortgages set to reset in the coming years:

With from $1 trillion to $2 trillion dollars of ARMs to reset in the coming year or so, and ongoing pressure all the way out to 2011, the US economy is going to see major pressure on consumers going forward. And, looking at this chart, we have only seen the beginning of the sub prime woes. There are a lot more losses to come.

Mortgage derivative mess cannot be fixed

You might think that bankers could make deals to reset these ARMs into fixed rates to avoid the mess and thus skirt the pending mass of defaults. The trouble is, the originating banks don't hold the debt! The geniuses who created all the mortgage derivatives divided them into tranches (slices of the pie) giving various levels of risk and returns and then sold them in big chucks to varied investors.

The holders of these mortgage derivatives are spread out among many buyers, who buy huge chunks at a set risk and return. There is now way these can be reset to help the defaulting mortgages. If the banks had originated and kept these mortgages themselves, then they would have had the latitude to allow people to shift to fixed mortgages. But, sliced and diced as they are, mortgage derivatives are sliced up and spread around as packaged masses, and how can you get the holders of the CDOs, MBSs, and so on, to accept a total recalculation of all the slices and risk as losses mount, and some slices have preferential treatment and the others don't????

It is quite likely that the trouble with the USD right after the Bear Stearns trouble is being caused by concerns that we have only seen the beginning of market stresses from on going sub prime losses. This will put tremendous pressure on many sources supplying liquidity to markets.

Widespread liquidity problems

It is now emerging that, even as investment banks had made tons of money packaging all manner of mortgage related derivatives (like CDOs), they actually kept some of the most risky segments of these in house, so as to sell the better tranches (slices of the pie) to investors – thereby being able to create an incredible $2 trillion or so of these derivatives- and huge fees. Needless to say, they are highly leveraged at 10 to one (in the case of Bear's hedge funds that were betting on them).

A report just came out that Standard and Poor and Moodys have significantly understated the risk of these $2 trillion mortgage backed derivatives, and only now are being forced to revalue these down as the risk clearly emerges and losses mount. Look for a big investigation about this later on. They get most of their fees from the creators of these instruments! Investors are getting wise to the misrepresentation, and are trying to figure out how to flee from the sector. Bear Stearns and its creditors tried to liquidate the sick derivatives, but they found few takers. A real scare is on. Meaning, Bear and their compatriots are scared stiff they will be unable to sell these, and will have to take gigantic losses. Worse still, the whole sector is afraid that all of these sick derivatives are going to be written down regardless in huge percentages.

Although gold has been benefiting recently from terror fears of late, including Monday's $8 rise, the falling USD is now being quite noticed by gold. I think the real story now is that there are serious concerns about ongoing financial pressures on the USD as much of the hedge fund sub prime mess is centered in the US . Gold has now possibly taken a quite dim view on this emerging sub prime mess – though it took a while to react as the USD weakened.

One of the counter factors of this situation for gold, however, would be from liquidity problems and financial losses emerging from the hedge fund losses, as investors bail out of anything sub prime related, and eventually sock liquidity for all markets. If that becomes the case and markets sell off as they don't need any more reasons to be startled.

(Stock markets have been asking for a decline because there is an almost parabolic world stock and financial boom now).

One way there could be escalating liquidity problems is from investors demanding risk premiums to come back into the bond and derivatives markets, This will have the effect of raising interest rates across the board, put further pressure on the adjusting ARM loans, but maybe more significantly, causing further sub prime derivative losses as interest rates rise. Furthermore, generally rising risk premiums will cause deleveraging pressure across the board too. With financial markets having historically high leverage, we may just be seeing the spark that causes them to finally end their multi year bull markets, as rising interest rates force deleveraging.

Here is an excellent article from Bloomberg Monday about this emerging sub prime mess:

July 2 (Bloomberg) –‘ United Capital Markets Holdings Inc., a brokerage run by John Devaney, halted redemptions on some of its hedge funds that invest in subprime-mortgage bonds.'

The Bloomberg article linked here further discusses emerging sub prime losses elsewhere:

‘Owners of similar securities may face $90 billion in losses, Deutsche Bank AG analysts predicted June 29.

``People are very nervous about how deep the revaluations of these securities will have to go,'' said Virginia Parker, who helps advise about $1.8 billion in client money at Parker Global Strategies LLC in Stamford, Connecticut. ``These positions didn't get marked down until June. Nobody's hand was forced in the market until then.''

Caliber, Queen's Walk

Caliber Global Investment Ltd., a $908 million London-listed fund managed by Cambridge Place Investment Management LLP, said June 28 that it would shut down within a year following subprime losses. Queen's Walk Investments Ltd., a fund investing in the riskiest portions bonds backed by mortgages, reported a $91 million loss from its investments in the year ended March 31.

UBS AG, the world's biggest asset manager, shut down its New York-based Dillon Read Capital Management LLC hedge fund unit in May in part because of losses attributed to U.S. mortgage investments. ‘

It is quite possible that, as hedge funds report end of quarter results, the losses will increasingly come to light. When the news of this Bear Stearns hedge fund subprime mess came out, the US Dow had a very bad day shortly after. It is quite possible that gold is just now realizing that the sub prime and mortgage derivative mess is going to harm the USD, and financial markets.

By Christopher Laird

PrudentSquirrel.com

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.