U.S. Dollar Attacked by Central Bank Lilliputians Profting From the Carry Trade

Currencies / US Dollar Oct 21, 2009 - 02:40 PM GMTBy: Jim_Willie_CB

The US Federal Reserve continues to talk about their urgent Exit Strategy. My theory is they will be doing mostly talking and almost no doing. The nations that talk the least will be hiking interest rates the most, like Australia. The United States might be dead last in hiking interest rates. The credibility of the USFed will in the process continue to be harmed much more than already, which is rock bottom. The Dollar Carry Trade and the lost Petro-Dollar advantage will work to destroy the USDollar as the global reserve currency. The USFed will have to resort to unusual means to keep the world ‘interested’ and ‘involved’ in the USDollar at all. When they lose interest and involvement, the US$ will descend into the Third World. The USDollar will then be forced to find its true value, based on its own merit.

The US Federal Reserve continues to talk about their urgent Exit Strategy. My theory is they will be doing mostly talking and almost no doing. The nations that talk the least will be hiking interest rates the most, like Australia. The United States might be dead last in hiking interest rates. The credibility of the USFed will in the process continue to be harmed much more than already, which is rock bottom. The Dollar Carry Trade and the lost Petro-Dollar advantage will work to destroy the USDollar as the global reserve currency. The USFed will have to resort to unusual means to keep the world ‘interested’ and ‘involved’ in the USDollar at all. When they lose interest and involvement, the US$ will descend into the Third World. The USDollar will then be forced to find its true value, based on its own merit.

Outsized federal deficits, widespread insolvency, absent industry, refusal to reform the financial sector, bad bank loans festering on balance sheets, Goldman Sachs still in syndicate control of the USGovt finance ministry, the costly drain of endless wars, these are the new fundamentals for the USDollar. It is certain to descend by 30% to 50% in the coming few years. The word on the street has it that with the new IMF role in establishment of a currency basket, the USDollar is isolated sufficiently for a massive devaluation. The maestros have a tough challenge though, as they must halt the move of gold to $2000 and must avert an outright USDollar collapse.

THE SOPHIE CHOICES

In the last few years, three Sophie Choices have been faced. The first was in 2005 and 2006 to cut the credit supply to the housing & mortgage finance bubble, or to support the USEconomy that was dependent on the bubble. They could not do both. They chose continuity of the bubbles and support of growth, even though sick growth. The second was in 2007 and 2008 to cut interest rates and support the housing recovery if possible, or to support the USDollar by keeping rates high. They could not do both. They chose the fatal 0% interest rate path, even though it is a colossal trap. Besides, Wall Street loves free money. They thus migrate from bond fraud to carry trades on home soil with free money. The third was in 2009, to support the USTreasury Bond with federal fiscal restraint and a withdrawn hand from monetization of debt, or to support the USDollar with an official rate hike and control of monetary growth. Remember the promise that the official 0% rate would be a temporary feature? They could not do both. They chose unspeakable hidden monetization of debt and USTBond survival, with an unpublicized plan to let the USDollar fall significantly.

My forecast was for continued funding until the system broke for choice #1 (true). My forecast was for a move to 0% rates since it aids the bank exploitation for choice #2 (true). My forecast was for continued free money, hefty monetization, and amplified credit derivative control for choice #3 (true). It is actually easy to forecast some USFed decisions, since they do whatever is best for bubbles and Wall Street, the concerns and priorities of the nation secondary. We see that in spades with defiance on USFed challenges for disclosure and audits, conducted by the unwashed plebeians.

The situation has grown complicated. The third choice continues to resurface. The underlying threat behind a hike in interest rates is the risk of credit derivative explosion. Something like $500 to $600 trillion in Interest Rate Swaps has kept the out-of-whack cost of money ultra-low for almost two decades. By means of Interest Rate Swaps, the JPMorgan wizards can use short-term dictated Fed Funds rates to control the long-term USTreasury Bond and thus mortgage rates. So a USFed official rate hike would torpedo the IRSwap complex and cause serious collateral damage like the death of JPMorgan itself. Oops! That is a factor the officialdom wishes not even to discuss. Also, much easier for the unwashed to comprehend, an official rate hike would force mortgage rates to rise.

The housing market is nowhere prepared for a recovery or even a true stability for another two years. The hidden housing inventory maintained by banks, burdened by their foreclosure portfolios, assures constant overhang of supply to pressure prices down. Banks have been compelled to make their own Sophie Choice. They can either flood the market with foreclosed homes, thus pushing down home prices by another 30%, or conceal their hidden inventory like just another off balance sheet game, thus perpetuating the housing bear market. My forecast has been for perpetuation of the hidden inventory, since it is based upon government help and false hope. The bankers expect some meaningful home loan modification, but will not receive it. They expect some stability for a housing market generally based upon vaporous historical precedent.

LILLIPUTIANS JOIN ON DOLLAR CARRY TRADE

A new factor expands the powerful forces to keep the USFed at bay, and continue in perpetuity its highly destructive 0% official rate. This story has many sides. Obviously, financial firms worldwide, even some enlightened Wall Street firms who can manage to keep their game offshore, have joined the Dollar Carry Trade enterprise. They borrow USDollars at 0% and expect the US$ exchange rate to continue its trend down. Their object investment is a strong liquid anti-US$ asset like crude oil, gold, or German long-term bonds. The requirement to profit is usage of a non-US$ asset as the investment. The story of carry trades was told in a September 23rd article entitled “New Deadly Dollar Carry Trade” by the Jackass (CLICK HERE). Well, it seems individual central banks have decided that this carry trade is too easy and profitable to pass up. They attack Gulliver (US) himself, much like the Lilliputians. The history of central participation is ripe, as the Bank of Japan and its armada of Tokyo financial firms have a long track record of borrowing their own Yen funds at 0% and investing in US stocks and USTBonds. It was profitable in the hundreds of billion$, every year.

Enter Germany, Austria, Spain, Belgium, and Canada! There is Latin America too! These nations are all issuing debt in US$ denomination and converting to their local currencies. That is more Dollar Carry Trade, folks! It might be in disguise somewhat, but not to those who understand the entire carry trade phenomenon, the gravy train, the trap it creates. Many financial analysts were totally unaware of the Yen Carry Trade that persisted for over a decade. It hides like an acidic river under the fiat financial sector edifices. The broadening of the government practice to issue US$-based bonds will make very difficult any reversal of the 0% policy. In fact, my forecast is that if and when the USFed raises rates, the USDollar will cease to exist and a USTreasury Bond default will occur. The backside to foreign issuance of ‘THEIR DEBT’ in US$ denomination is soon to show itself. Some foreign nations like Japan have announced they will finance ‘US DEBT’ in their local denomination, the Yen currency in the Japanese case. The US candle burns on both ends.

Germany and Austria led governments and companies in Europe to sell $21.7 billion of bonds in US$-based bonds in September to take advantage of the reduced cost of exchanging the proceeds back into Euros. The list included Spain and Belgium in the attraction of a wider range of investors. For Europeans the cost of funds remains advantageous due to the cross-currency basis. Landwirtschaftliche Rentenbank (German agriculture) issued $2.25 billion in US$-based bonds, and another US$ issuance was made by Export Development Canada. The cost of exchanging USDollar floating rate payments into the single European currency as measured by the three-year Euro basis swap is in the neighborhood of 25 basis points below the Euro Interbank Offered Rate, known as Euribor. The important point is that debt is cheaper to issue in US$ terms, even after conversion to the Euro in swaps.

William Pesek penned an article with a catchy title “Hedge Funds ATM Moves From Tokyo to Washington” that further publicizes the new Dollar Carry Trade. A more complete analysis of the Dollar Carry Trade, combined with the commercial threat from lost Petro-Dollar advantages, are covered in the October Gold Report for the Hat Trick Letter. Pesek describes a central point shared by my analysis, the handoff from the Yen Carry Trade. The USDollar will be kept down for both valid fundamental reasons and speculative trade forces. He warns about a trade war further adding burden to the USDollar. He concluded, “The dollar carry trade says nothing good about confidence in the US economy. It is also a reminder that the side effects of this crisis may be setting us up for a bigger one.” All his points are precise, powerful, and poignant. He is a fine analyst. See the Bloomberg article (CLICK HERE).

Enrico Orlandini hails from Peru. He (actual name Eric Bartoli) apparently enjoys the opportunity to hide, especially from investors like a couple Hat Trick Letter subscribers whose money he absconded with. It is not for me to say he strives to become a fraud king like Wall Street elite. But he does issue some occasional great quotes, firm analysis, and newsworthy items. He recently provided this gem from his backyard. Latin American governments are issuing US$-based debt and converting to local currency bonds. Apparently, the nations in South America intend to hold the converted bonds as investments. They are running an active carry trade, whereas the Europeans passed off the risk to the credit derivative market. Orlandini wrote, “Many Latin countries are issuing US dollar denominated bonds and converting those bonds into local currencies, betting the dollar will devalue considerably. Many Latin nations did the opposite back in the late 1980s and early 1990s when the Peruvian, Bolivian, and Ecuadorian currencies collapsed when they made fortunes. I view the new Latin carry trade as very dangerous, since most Latin economies are on the decline and the Latin propensity to print fiat currency is legend. Furthermore success is dependent on finding a good yielding investment, and those are hard to come by right now. Carry trade in other parts of the world simply convert dollar into local currencies, or local AAA bonds, and let nature take its course. The object of the bond emissions in Latin America is for investment, and will not be as easy as everyone thinks. So far Peru, Venezuela, and Brazil are going down this path.”

IMPOSSIBLE EXIT STRATEGY

If the USFed decides in any newfound awakened wisdom to halt the free money parade, it would remove the channel from US speculators operating on domestic soil, but it would cause possible banking system failures in the OTHER NATIONS participating in the Dollar Carry Trade. A policy reversal with rate hike would torpedo the under-structure of Austria, Spain, and Belgium, with serious damage also done to Germany. One can observe more political and systemic pressure for the USFed to merely talk about an Exit Strategy like babbling fools, as spokesman for the failed global central bank franchise system. They cannot hike from 0% and make an exit. In fact, they have painted themselves in the corner, as many analysts have described for two years, with my addition that a Trap Door is being cut by foreign creditors, made worse by the wooden rot on the floorboards from chronic inflation. The Untied States will fall perilously through the trap door into the Third World. In my description of Third World characteristics last week, some important items were omitted. Add puppet leaders, rigged elections, compromised Congress, subservient high court, and the breakdown of law.

The current relentless banking credit crisis will have a second phase. It is kicking into gear right now. Its basis is both the US domestic portfolio losses from mortgages and commercial loans, and the global revolt against the USDollar. The property decline is entering a second arena in the commercials, whose values have dropped by 35% to 40% from peak. Refinance is impossible for commercial mortgages, since Loan/Value ratios went too high with valuation declines. The gradual phase out of the US$ for global crude oil sales assures the next chamber of the banking credit crisis gone global. The financial trade war will soon include far more than just China pitted against the Untied States. It will go global and isolate the pariah. The USFed will be hamstrung unable to hike interest rates. The US has refused to bring any remedy or restructure or prosecution, next be isolated and punished. Those who believe the US banking sector has found firm stable footing again are morons, and are deserving of a strong Darwinist sweep to remove them from the picture financially. Natural selection is rough!

The new Dollar Carry Trade has invited comparisons to Japan. In almost no respect does the Untied States have an advantage over Japan in this dangerous carry trade game. This new version of carry trade will be devastating to the Untied States, while it only subjected Japan to a state of stagnation for over a decade. Given the extreme credit dependence, and global reserve currency soon to be lost, the Untied States is highly vulnerable. That vulnerable state is amplified by the lack of awareness, even arrogance, of an insolvent nation, one that embraces fraud and defies creditors by aggravated financial assault known as monetized debt. The emergence of China as an Asian industrial fledgling power enabled Japan to exit its constipation phase, to follow its lead. The United States will have to face a terminal enema administered by creditor doctors, with complete bowel eruptions and perhaps disembowlment. The patient will die a horrible death. Favorable comparisons to Japan might constitute the most absurd of analytic arguments, with almost no factual basis. The only advantage of the US over Japan is the height of its people. But the Americans manage often to add 100 extra pounds to the taller frames, and sport new problems in obesity and diabetes.

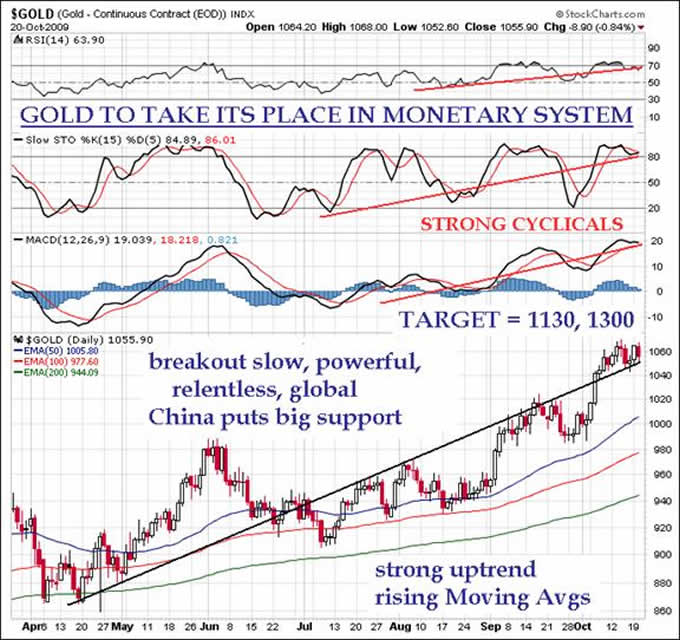

THE ‘BEIJING PUT’ AT WORK IN GOLD

China has begun to show its patterned behavior. They buy gold precisely at weak technical points, thus maximizing accumulation at optimal price. They buy gradually, thus permitting the market to bring more supply at prices as they ratchet higher. The Chinese Govt has become entrenched in an accumulation program of gold, expected to become a part of whatever new global reserve currency evolves. But as they buy in quantity, the price goes up in direct response, frustrating their intention to collect as much as possible, before any collapse of the USDollar. The Chinese are reportedly amplifying their purchases at points of weakness, dictated by technical analysis. In effect, the Chinese could be using a reverse strategy from technical analysis methods, dictated by chart patterns, by pressuring the bid harder with more purchases when the technical indicators say they should be selling. They would thus position themselves opposite to the USGovt, which routinely smacks gold down prior to USTreasury auctions, or when the USDollar threatens to break below support. They would also position themselves opposite to professional traders, who tend to follow the technicals and USGovt official control banter. The Chinese will continue to obstruct the gold interventions, as the US-UK fascist tagteam loses control.

Another Chinese market factor will work to put more money in gold investors hands. Their A-shares for mining firms have jumped 150% to 200% in recent months. So investors in certain stocks can redeem some profits to accumulate the real thing, gold bars. Qin Weihuan is a researcher at China Gold Assn. He told China Daily, “In the past, gold prices dropped back after it hit over $1000 per ounce. But I believe this time the price has really breached the $1000 ceiling and will stay at these levels for some time.” Qin believe gold has entered a new ‘Era’ as inflation fears and uncertainly over the world financial system will prompt investors to look for safe havens in bullion. China will soon take full control of the gold market, and render the global monetary crisis centered upon the USDollar ballistic.

THE COMPLETED PICTURE OF E.T.F. GOLD FRAUD

Fraudulent games have expanded in the gold market. In the last few months, much publicity has come (except to mainstream media) of how the COMEX can legally use Street Tracks GLD shares from their Exchange Traded Fund to satisfy short futures contracts in need of a buyer. Instead of rolling over the short contract, they ‘close it out’ by placing a GLD share in offset. So the corrupt pyramid of short gold futures contracts has been co-mingled with GLD shares from the ETFund. Challenges will soon come. The COMEX players and controllers do not locate and purchase gold bullion in order to satisfy the short contracts. They essentially infect the GLD shares instead. So would the real gold depository of the Street Tracks GLD fund please stand up???

In the last couple weeks, the London CME officials have had a terrible time avoiding a default. Some large players want the gold from their long futures contracts, in gold bullion from physical delivery. The Bank of England and one other unidentified central bank from the European Union have tried desperately to supply the delivery demand. In the process, they have provided and handed over more than a little ancient substandard gold bars. The London CME officials even offered a 25% dividend bonus if the gold contracts were satisfied in cash, rather than gold delivery in physical form. This entire incident centered on very high volume for gold also, not a trifling amount. Sounds like gold is worth $1300 per ounce to me!

This story grows worse, and again involves the Street Tracks GLD fund. Likely accounting fraud accompanies other efforts to confiscate their GLD backing of deposits held in gold.

The counter-parties in deep trouble are JPMorgan and Deutsche Bank, each heavily short gold and unable to produce it in the face of delivery demands. Central banks are probably aiding the plunder of private gold accounts. All integrity is at risk of being lost. Simultaneous irregularities have taken place during the LBMA ‘gold delivery incidents’ and official Gold Bar Lists maintained by the Street Tracks GLD exchange traded fund. Evidence points to the GLD gold bullion inventory taken to satisfy the London demand for gold delivery. Independent audits have begun in earnest by large private interests (mostly Arabs). Word came today the JPMorgan is accepting gold bullion in order to establish margin foundation for commodity futures trading accounts. They are indeed desperate, since a margin failure for clients would produce to JPM the gold.

So one might conclude that GLD shares are corrupted by virtue of satisfying the COMEX gold futures short contracts. So one might conclude that GLD deposits of gold as backing for the fund are corrupted by virtue of selling their gold bullion to the Gold Cartel in satisfaction of futures contract delivery demands. That seems to undermine the entire GLD fund, and to expose it as an Exchange Traded FRAUD. Fraud in physical gold deposit management is not the sole province of the Untied States and the Untied Kingdom. An Asian Depository has found ‘Good Delivery’ gold bricks to be gutted and filled with tungsten, another heavy metal. See Rob Kirby’s article entitled “Central Banking: A Blight on Humanity” (CLICK HERE) and also “Blight on Humanity Addendum” (CLICK HERE). What great financial forensic analysis work!

GET OUT OF THE 'GLD’ AND ‘SLV’ FUNDS, WHICH ARE IN ALL LIKELIHOOD DEEP FRAUDS THAT HOLD SHRINKING BULLION IN DEPOSITS. In time the GLD might be exposed as having little or no gold, and certainty inadequate amounts to back their fund for legitimacy. In time, my forecast is that the GLD fund will eventually sell at a 25% discount to the gold spot price, due to suspicion of fraud in its gold deposit management. Later, my forecast is that the GLD fund will eventually sell at a 50% discount when the investor lawsuits pile up and formal challenges are lodged. The weapon to pry open the vaults will be discovery and ordered independent audits with teeth. The final chapter of the GLD in my view will be its liquidation, with extreme discounts paid to angry investors. Their laziness and stupidity will be worthy of a footnote in history. The managers of the GLD fund and that for the SLV silver fund, are both main members in the Gold Cartel. JPMorgan is custodian to the GLD fund. Barclays manages the SLV fund. Those who believe the tactics and activity behind the curtains are different are indescribably naïve. They too deserve a meat cleaver outing with Sir Darwin on personal wealth.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.