Looking for Potential Sinkers in the S&P 1500 Stocks Index

Companies / Investing 2009 Oct 20, 2009 - 01:08 PM GMTBy: Richard_Shaw

This is a practical follow-up to our recent article on volume as an indicator, and on divergence between volume and price action in particular.

This is a practical follow-up to our recent article on volume as an indicator, and on divergence between volume and price action in particular.

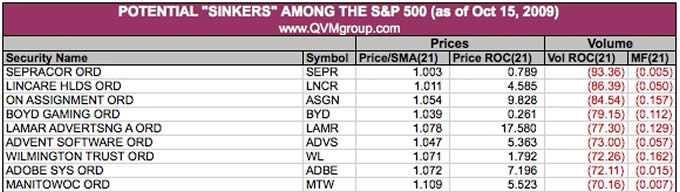

We screened the S&P 1500 for stocks with rising prices and falling volumes. More specifically, we looked for stocks with “sinker” attributes:

- last closing price > 21-day simple moving average price

- positive 21-day price rate of change

- negative 21-day volume rate of change

- negative money flow (more vol. on down days than on up days)

We had the necessary data for 1470 of the 1500 stocks. Of those 104 met the sinker screening criteria as of end-of-day Oct. 15, 2009.

This image shows the 10 companies from that list with the greatest negative 21-day volume rate of change. (download spreadsheet of full list).

If you own any of the stocks on the screened list, look at them again fundamentally and technically to make sure you are OK with holding them. Don’t close a position based solely on these few criteria, but take note and do some more research to see if you should consider closing the position.

Note: We make no representation as to the quality of any company on this list or as to their probability of rising or falling in price. This is simply a screened list to potentially identify stocks for which short-term negative volume trend suggests short-term positive price trend may be heading for a reversal. You need to look further to see if any of those companies are future sinkers or current stinkers. All this list does is tell you that there is a divergence between the behavior of volume and price.

Disclosure: We are neither long nor short any company on this list.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.