Bernanke Gone Berserk! Bank Reserves Explode! Fed Money Printing Gone Wild!

Interest-Rates / Quantitative Easing Oct 19, 2009 - 08:18 AM GMTBy: Martin_D_Weiss

Martin here with the most shocking new numbers I’ve seen in my lifetime.

Martin here with the most shocking new numbers I’ve seen in my lifetime.

My conclusion: Fed Chairman Bernanke has dumped so much funny money into the U.S. banking system and has done so little to manage how that money is used, the fate of our entire economy has now been cast under a dark shadow of doubt.

This is not conjecture or exaggeration.

This is not conjecture or exaggeration.

Nor are the underlying facts subject to debate.

They are blatant, unambiguous, and fully supported by the Fed’s own data …

Fact #1. Up until the day Lehman Brothers collapsed in September of last year, it took the Fed a total 5,012 days — 13 years and 8 months — to double the cash currency and reserves in the coffers of U.S. banks.

In contrast, after the Lehman Brothers collapse, it took Bernanke’s Fed only 112 days to double the size of U.S. bank reserves. He accelerated the pace of bank reserve expansion by a factor of 45 to 1.

Imagine a crowded interstate highway with a speed limit of 55 miles per hour and with a long tradition of allowing no one to exceed the limit by more than 20 or 25 mph.

Suddenly, a new driver appears on the scene with a jet-powered engine that accelerates to a supersonic speed of 1,350 mph.

That’s the same magnitude of change Fed Chairman Bernanke has presided over.

Fact #2. Even in the most extreme circumstances of recent history, the Fed never pumped in anything close to this much money in such a short period of time. Indeed …

- Before the turn of the millennium, the Fed scrambled to provide liquidity to U.S. banks to ward off a feared Y2K catastrophe, bumping up bank reserves from $557 billion on October 6, 1999 to $630 billion by January 12, 2000. And at the time, that was considered unprecedented — a $73 billion increase in just three months. In contrast, Mr. Bernanke’s recent money infusion is $1.007 trillion or 14 times more!

- Similarly, in the days following the terrorist attacks on the World Trade Center and the Pentagon, the Fed rushed to flood the banks with liquid funds, adding $40 billion in the 14-day period between 9/5/01 and 9/19/01. Mr. Bernanke’s recent trillion-dollar flood of money is twenty five times larger.

Fact #3. After the Y2K and 9-11 crises had passed, the Fed promptly reversed its money infusions and sopped up the extra liquidity in the banking system. But this time, Mr. Bernanke has done precisely the opposite: Since he doubled the currency and reserves at the nation’s banks with his 112-day money-printing frenzy in late 2008, he has thrown still more money into the pot.

Fact #4. With no past historical precedent, no testing, and no clue regarding the likely financial fallout, Mr. Bernanke has invented and deployed more weapons of mass monetary expansion than all prior Fed chairmen combined.

The list itself boggles the imagination: Term Discount Window Program, Term Auction Facility, Primary Dealer Credit Facility, Transitional Credit Extensions, Term Securities Lending Facility, ABCP Money Market Fund Liquidity Facility, Commercial Paper Funding Facility, Money Market Investing Funding Facility, Term Asset-Backed Securities Loan Facility, and Term Securities Lending Facility Options Program.

None of these existed earlier. All are new experiments devised in response to the debt crisis.

Fact #5. The single biggest new facility is the Fed’s purchases of mortgage-backed securities (MBS). This massive operation began on January 7 of this year with only $10.2 billion. Now, just nine months later, the Fed has bought up a cumulative total of $924.9 billion, the largest money infusion by any central bank into any single market sector of all time.

Simply put, the Fed has been buying up virtually all the junk and nonjunk mortgages it can lay its hands on.

Fact #6. Mr. Bernanke would have you believe that he can carefully control how the banks use all this free money, with an eye toward preventing a sudden bout of inflation.

In practice, however, he’s doing nothing of the sort.

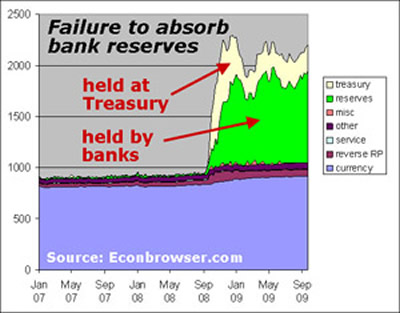

For example, the theory is that if the Fed merely arranges for the U.S. Treasury Department to borrow back most of the excess bank reserves, the Fed could keep the money out of the banks’ hands, prevent them from multiplying it with big lending, and ward off the ultimate inflationary consequences.

|

But, as pointed out by Econbrowser.com, the reality is that the Treasury is absorbing only a small fraction of the banks’ bloated reserve balances (green area in chart).

The bulk of those reserves (green area) are readily available to start multiplying through lending — and to set off an uncontrollable vicious cycle of too much money chasing too few goods.

Fact #7.If the bank lending were mostly to American businesses, it might at least help rebuild the U.S. economy. However, right now, the only big lending we see is to finance a new speculative fever that has swept the globe — the borrowing of cheap dollars to buy high-yield investments. (See Mike Larson’s “Easy-Money Fed Fueling Dollar Carry Trades” and “Getting Inside the Fed’s Head.”)

Fact #8.The nation’s money supply is exploding. In August, money in circulation and in checking accounts (M1) expanded at the breakneck speed of 18.6 percent compared to the year earlier. That was …

- Three times faster than the average M1 growth rate of the 1970s, which helped create the worst inflation of our era;

- Over SIX times faster than theaverage M1 growth rate during the half century prior to September 2008; and

- The single fastest M1 growth rate ever recorded by the Federal Reserve.

The Consequences

This overabundance of high-powered money flooding into the nation’s banking system and money supply can have only one consequence: To cheapen the value of each dollar you own.

Yes, Mr. Bernanke has temporarily tamped down the Wall Street debt crisis. And yes, he has managed to replace fear with greed … convert the flight to safety into the lust for risk … and transform falling markets into rising markets.

But look at the price we are paying:

- The solvency concerns regarding major financial institutions have now been replaced by looming solvency threats to the U.S. government itself.

- The debt crisis of 2007-2008 has been transformed into the dollar crisis of 2009-2010.

Clearly, in this environment, following traditional investment norms with conventional investment vehicles could be dangerous; and evidently, an entirely different approach to investing is now a must.

For specific instructions, stand by for your regular issues or flash alerts.

Good luck and God bless!

Martin

P.S. Here’s the proof of the 45-to-1 acceleration in reserve growth: On December 21, 1994, the cash currency and reserves at U.S. banks was reported by the Fed at $426.6 billion. Subsequently, it took 5,012 days for that figure to double, reaching $849.9 billion on September 10, 2008, the Fed’s last reporting period prior to the failure of Lehman Brothers.

Following that date, however, as the Fed responded with new, unprecedented open market operations, it took a mere 112 days to double, reaching $1,702.2 billion on December 31, 2008.

Fed data series: U.S. aggregate reserves of depository institutions plus the monetary base. To download my spreadsheet showing the Fed data and my calculations, click here.

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.