Dow Hits 10k as Bailed Out Banks Announce Huge Profits and Bonuses

News_Letter / Financial Markets 2009 Oct 19, 2009 - 12:28 AM GMTBy: NewsLetter

The Market Oracle Newsletter

October 18th, 2009 Issue #79 Vol. 3

The Market Oracle Newsletter

October 18th, 2009 Issue #79 Vol. 3

Dow Hits 10k as Bailed Out Banks Announce Huge Profits and BonusesDear Reader Goldman Sachs lived up to expectations of huge profits and "two fingers up to the tax payer" bonuses (no it does not mean V for victory) as a consequence of the funneling of billions of U.S. tax payer cash onto their balance sheet and huge profit margins in the artificial tax payer funded banking system that squeezes retail customers and rewards failure which is not so surprising since the central banks remain firmly at the centre of the parasitic banking sector. In the UK the public sector is rebelling in ever increasing numbers and this is BEFORE deep public sector workforce cuts of 10% have even been enacted which sows the seeds of severe political and economic turmoil in Britain post the 2010 General Election. Postal workers announced an escalation of strike action from regional to national action which will hit small business in the run up their most active pre-Chrismas period. The Labour Government hell bent on committing political suicide declared it would not give in to their demands which would cost some £100 million per year. Though at the same time there were murmurs that the tax payer bailed out bank Lloyds TSB / HBOS is seeking at least another injection of £5 billion of tax payer cash, I wonder how much in bonuses they and other bailed out banks will be announcing next week? Meanwhile the bailed out bank is seeking to transfer £260 billion of bad debts off of its balance sheet and onto the British tax payers. Meanwhile the white wash Legg report on MP expenses was published that required MP's to repay for minor indulgences such as gardening and cleaning costs usually amounting to sums of less than £1,000, which still angered many of the tight fisted fraudsters at Westminster. Though Gordon Brown the walking disaster area still managed to bodge it up by having to cough up £12,000. However the report is a white wash for it FAILED to address the REAL FRAUD of flipping houses which has benefited many MP's to the tune of hundreds of thousands of pounds each! The voters are NOT going to forget the fraudsters at the next general election regardless of the party under who's banner they defrauded the tax payers! Already a record 170 MP's doomed to be rejected by the voters at the next election have decided to step down which means they get to walk away with nearly £160,000 each and an annual pension of £30,000 each, instead of a prison term which would be if any of you committed similar fraud in the workplace. Quick Markets Review. Stock Market - The Dow breached 10k and showed remarkable strength that caught even the bulls by surprise. The perma bears continued to hang on to crash / collapse / bear market resumption hopes despite being on a loser for the past 7 months. Now the mantra is that everyone is hyper bullish and therefore a collapse is imminent. Hyper bullishness does not come THIS early in a bull market ! Looking under the hood you don't see people piling into stocks, on the contrary the rally has been SOLD INTO ! Don't believe me ? Take a look at the volume which is heavier on declines than the rallies. And neither will raising of old charts from 80 years, 50 years, 20 years ago going to make any difference. Where will the market go next is going to require in depth analysis, which I hope to complete either Sunday evening or Monday and email out (subscribe to my always free newsletter). Gold - Stood steady at $1050 ending little changed on the week. The breakout remains intact with silver showing relative strength. I last analysed Gold in January therefore in depth analysis is pending before I attempt to project forward. Crude Oil - Marched higher to $79 and is now showing relative strength against Decembers forecast implying the worlds economies are far stronger then they appear in the data. This now demands an in depth update, though the outperforming oil stocks have always remained a part of the mega-trends portfolio with $200 eventually beckoning stock prices higher. U.S. Dollar - As if out of some CNN report of an Iranian demonstration, "Death to the Dollar" mantra continues near across the board. Meanwhile the USD at 75.77 stubbornly manages cling onto support, therefore the bull market scenario remains intact. British Pound - Early in the week the mainstream press ran with the Centre for Economics and Business Research (CEBR) string of forecasts which included that the British Pound would fall to £/$1.40 in the coming months, sterling abruptly did a u-turn by rising from £/$1.58 to £/$1.63.60 by the end of the week. Other forecasts included UK interest rates to remain below 2% until 2014 - No chance!. Are you hunting for the holy grail of trading ? You may find yesterdays short piece informative. Your analyst thinking forget money, forget gold, time is the most precious resource anyone actually really has, so don't waste it! Source :http://www.marketoracle.co.uk/Article14307.html Nadeem Walayat Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: StocksBuddy Gold has broken out above $1000 and everyone believes that it is headed towards $1500, $1200 being the immediate next target. Technically and otherwise, there has been lot of talk that Gold should be valued @ $2000 - $5000 range based on the real $$$ terms when compared to 1980's. However, if that were so easy, it would have already happened. Here are some of SB comments to the respective articles on the Internet.

By: Captain_Hook At the risk of getting ahead of myself prior to being able to confirm the turn, I am suggesting stock market action over the past week bears the distinct odor of a bull trap, with even informed technicians still waiting for a push to 50% retracements on the indexes. In this respect then, you should realize the context of such a bull trap would be profound in that we are talking about the March lows being tested and violated, meaning for example the S&P 500 (SPX) could be on its way down to test its namesake at 500 before this next sequence is all over. You will remember from previous discussions, and in framing context correctly here, it’s possible we could be looking at a Supercycle Degree Affair lower in global stock markets directly ahead, implying 500 on the SPX would be an optimistic target for a low.

By: Andrew_McKillop In a Yang-Yin world where only two paradigms, models or states are possible - obviously not the real world - commodity boom should replace financial crash, like day follows night. To some, including Jim Rogers, this is already in the works. Speaking from Singapore in interview with the UK Daily Telegraph on 8 October, he forecast a commodities boom able to last 20 years. He said: "Commodities are the best place to be, if you ask me, based on supply and demand". He also believes crude oil will run out in 15 or 20 years "unless something happens", despite quite large recent discoveries and slow growing demand.

By: Ned_W_Schmidt With $Gold now trading firmly above US$1,000, at least on a temporary basis, all are joyous that the Gold Bugs have won. The paper equity charlatans have been vanquished, at least for now. Those fanning emotions with stories about cabals, price suppression, and manipulation may now have to find some other drivel to pedal. GATA, the Gullible and Truly Amateurish, has now firmly been proven a purveyor of fantasy. Those that have opposed Gold and Silver ETFs can now, with knuckles dragging on the ground, return to the back of their caves

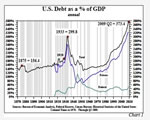

By: Richard_C_Cook It’s too late for anyone to pretend that the U.S. government, whether under President Barack Obama or anyone else, can divert our nation from long-term economic decline. The U.S. is increasingly in a state of political, economic, and moral paralysis, caught as it were between the “rock” of protracted recession and the “hard place” of terminal government debt.

By: John_Mauldin I look forward at the beginning of every quarter to receiving the Quarterly Outlook from Hoisington Investment Management. They have been prominent proponents of the view that deflation is the problem, stemming from a variety of factors, and write about their views in a very clear and concise manner. This quarter's letter is no exception, where they once again delve into the history books to bring up fresh and relevant lessons for today. This is a must read piece.

By: Adam_Brochert If you're not into technical analysis, you're not into it. I understand. Drawing squiggles on a chart seems like reading tea leaves to many. I get it. I personally believe that it increases your odds of success if you have the fundamentals right. In other words, technical analysis in isolation is not attractive to me, but laid over a solid foundation of fundamental analysis makes sense to me.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.