Death of Mauldin's Muddle Through Economy?

Economics / Economic Theory Oct 18, 2009 - 07:01 AM GMTBy: Mike_Shedlock

The US government is on an unsustainable path. Deficits are soaring and the Obama administration is planning massive tax hikes.

The US government is on an unsustainable path. Deficits are soaring and the Obama administration is planning massive tax hikes.

Moreover, businesses have little reason to hire already because of massive overcapacity. Add increasing health care costs to the list of reasons for businesses not to hire.

Given that government spending crowds out private investment, these policies all but assures that unemployment is going to remain high for a long time as noted in Structurally High Unemployment For A Decade.

Killing The Goose

Last week in Thoughts on the Economy: Problems and Solutions I listed the problems and some of the solutions facing the economy. It was a discussion between John Mauldin and I about his weekly E-Letter Killing The Goose.

John and I agreed on many, but not all solutions. I would also like to add something I have proposed before, killing the Davis-Bacon prevailing wage act.

Muddle Through Where Art Thou?

Back in 2002, the usually optimistic Mauldin proposed the economy would somehow manage to "Muddle Through".

However, because of the unsustainable path we are on. John has changed his mind. Please consider these excerpts from Muddle Through, R.I.P?

I defined a Muddle Through Economy in the past as one of slow growth (in the area of 1-2%) and a slack employment environment, such as we had in 2002 and the early part of 2003. In early 2007, I suggested we would return at some point to such an environment at the end of the recession I was predicting.

However, gentle reader, never in my wildest dreams did I think we could be

looking at government deficits of $1.5 trillion dollars and actually budgeting future

deficits of over $1 trillion as far as the eye can see. And there is real reason to think that under current plans, $1 trillion deficits are optimistic.

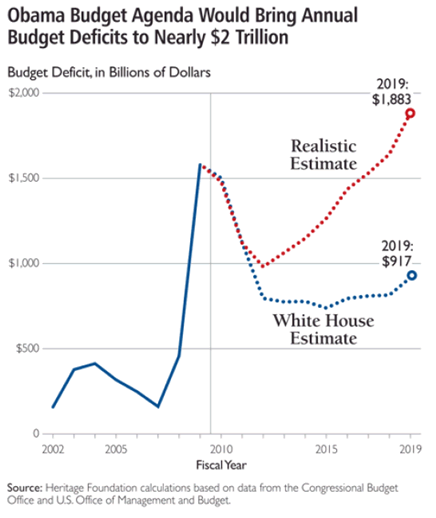

Look at the graph above from the Heritage Foundation. They suggest that current policy would bring us closer to a $2 trillion deficit by 2019. And that assumes nominal growth that is north of 3% and unemployment dropping back below 5% in reasonably short order.

Japanese Disease

Some readers wrote this week telling me I am far too worried about a rising government deficit. Right now we are at roughly 42% of debt to GDP. In 1989, at the

start of the lost decades, Japan had a debt-to-GDP ratio of 51%. Now it is at 178%, and the world has not come to an end for them. In fact, they are running massive government deficits today and plan to do so for a long time. Why, I am asked, can’t we be like Japan?

In 1989, private Japanese debt (businesses and consumers) was at a debt-to-GDP

ratio of 212%. Now it is at 110%. And the total of both government and private debt is roughly the same (within 5%) of where it was 20 years ago. Along with running large trade surpluses, private debt has been exchanged for government debt. Savings have fallen from the mid-teens to about 2% today, as the country is rapidly aging and now using its savings to live on. And how much has all that government spending helped the country?

Before I answer that, read these paragraphs from Hoisington Asset

Management’s latest letter (last week’s Outside the Box):

“The federal government’s promise to extricate the U.S. economy from this

recession involves more spending (increasing public debt) and more subsidies for

consumers, such as car rebates and home buying incentives (more private debt). In other words, more debt is supposed to solve the problem of over-indebtedness. The truth is that this policy merely indentures its citizens further without providing any income for repayment of debt.

“This means there is no long term income benefit from stimulus programs.

According to the latest academic research, the most recent $800 billion stimulus plan will boost economic activity in the short run, but will surely depress economic activity over time. The government problem is complicated by the fact that the tax multiplier is 3, meaning that a 1% change in taxes will change GDP by about 3% over time. More recent research (Barro & Redlick, September 2009, "NBER Working Paper 15369") suggests that a 1% cut in the marginal tax rate would raise GDP in the ensuing year by 0.6%. With the deficit rising due to a zero spending multiplier, the tendency will be to try to raise taxes to pay for this higher level of expenditures, which will further depress aggregate spending and output.”

For all intents and purposes, Japan has had no growth for almost two decades.

Their nominal GDP is where it was 17 years ago, and the number of employed people is at 20-years-ago levels. An aging population has masked their unemployment problems, as older citizens retire. Their savings went to government debt. Taxes were raised numerous times. Since government deficit spending has no long-term multiplier effect, growth has been nonexistent. (By the way, that research about multiplier effects has also been done by Christina Romer, the chairman of the current President’s Council of Economic Advisors, and further explored by European economists. There is general agreement on these facts.)

Large government deficits choke off the very investment that we need to create

jobs. In the name of doing good, the unintended consequence is to make it more difficult for small businesses to start up and create jobs. And we all know that small business is the engine for job creation.

The New Muddle Through Economy

This is not a prescription for a return to normal growth. We are headed for a New

Normal that is less than what the market currently believes. Unless the deficit comes

under control at some point, we face the real prospect of catching Japanese Disease and suffering yet another lost decade. Can we Muddle Through? We have no choice but to do so. But it will not be fun. It will not be long-term 2% growth and employment going back to 6% any time soon. Can we reverse the course? With a different attitude and leadership in Congress, maybe we can. But it won’t happen next year, and it’s unlikely in 2011.

I am afraid we will have to put my old friend Muddle Through, as I previously

defined him, back in his box for a while.Japan Rethinks A Dam

In light of the above discussion of the Japanese Disease (something I have talked about on many occasions as well), please consider Japan Rethinks a Dam, and a Town Protests.

The clatter of construction machinery still fills this forested mountain gorge, where legions of men in hard hats busily pour concrete, clear hillsides and erect a huge, unfinished bridge whose concrete supports tower over the valley floor like crucifixes in an immense graveyard.

It seems an apt analogy. Japan’s new government has suspended the $5.2 billion Yamba Dam being built here and turned this valley four hours north of Tokyo into a symbolic final resting place for the nation’s postwar order, which relied on colossal public works spending.

The Democratic Party government of Prime Minister Yukio Hatoyama has chosen this dam as the first of 48 national government-financed dams that it wants to scrap, worth tens of billions of dollars.

Japan had around 60 large dams under construction in 2005, making it the world’s fourth largest dam-building nation, according to The International Journal on Hydropower and Dams, despite having a land area smaller than California’s.

Decades of pouring concrete have been widely blamed in Japan for cluttering rural areas with needless dams and roads to nowhere. They have also saddled the country with the developed world’s largest national debt — nearly twice its $5 trillion economy. Mr. Hatoyama’s party has vowed to replace Japan’s postwar “construction state” and the jobs it created with something closer to a European-style social welfare system.

That my friends is exactly what public work stimulus projects do on average. Now Obama wants to gut public schools, rewire them, and make them energy efficient. At what cost? At what benefit?

Expect other infracture projects as well. Some may be useful, many won't. The money has to come from somewhere and that somewhere is higher taxes, a cheapening of the US dollar, or both.

Such infrastructure projects did not work in Japan and they will not work here.

Did Muddle Through Ever Work?

For many years it seems like muddle through worked. Indeed on average it did. But averages are deceiving. From 2003 through 2006 if you worked in real estate in any capacity the odds are you did well. If you worked in manufacturing the odds are you didn't.

If you lived in Chicago or Seattle you did better than average. If you lived in Detroit, Toledo, Akron (or Michigan or Ohio in general), things seemed more like a depression.

On average Florida muddled through. But in 2005 people were camping out overnight in lines praying to have the chance to buy a condo. Today it is ground zero of the residential real estate bust.

Factor in the bonuses proposed at Goldman, and other financial institutions. One might conclude on average we are still muddling through.

Yet, there are vast sections of the country where Muddle Through did take place on a more even keel. My hometown of Danville, Illinois muddled through, at least on the surface.

The real estate boom and bust completely passed Danville by. Is that muddling through? I can easily make a case it is. Yet beneath the surface towns like Danville are in slow decay with no source of jobs, homes in general decline, and an aging as well as shrinking population.

In the bubble areas there was a wildly uneven boom, on the back of cheap financing and poor economic policies but that was never the road to a sustainable muddle through. Now the Obama administration, just as happened in Japan, and the Great Depression before that, has taken a bad situation and vowed to make it worse.

In the meantime we have unheard of corruption and influence peddling in DC, hell bent on maintaining policies of the Bush Administration that will make the rich richer, and the middle class poorer.

So muddle through is now on the back burner. The reality is muddle through only worked on average anyway, and the averages were very deceiving.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.